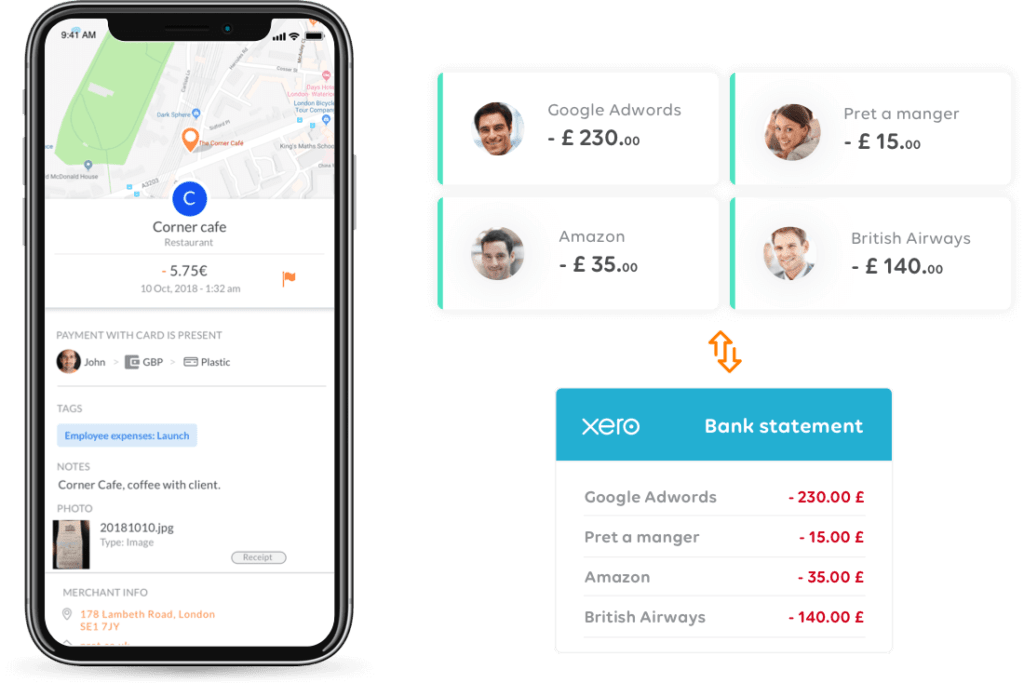

Because we connect to Xero, expenses are reconciled seamlessly.

Start using expenses software that integrates seamlessly with Xero.

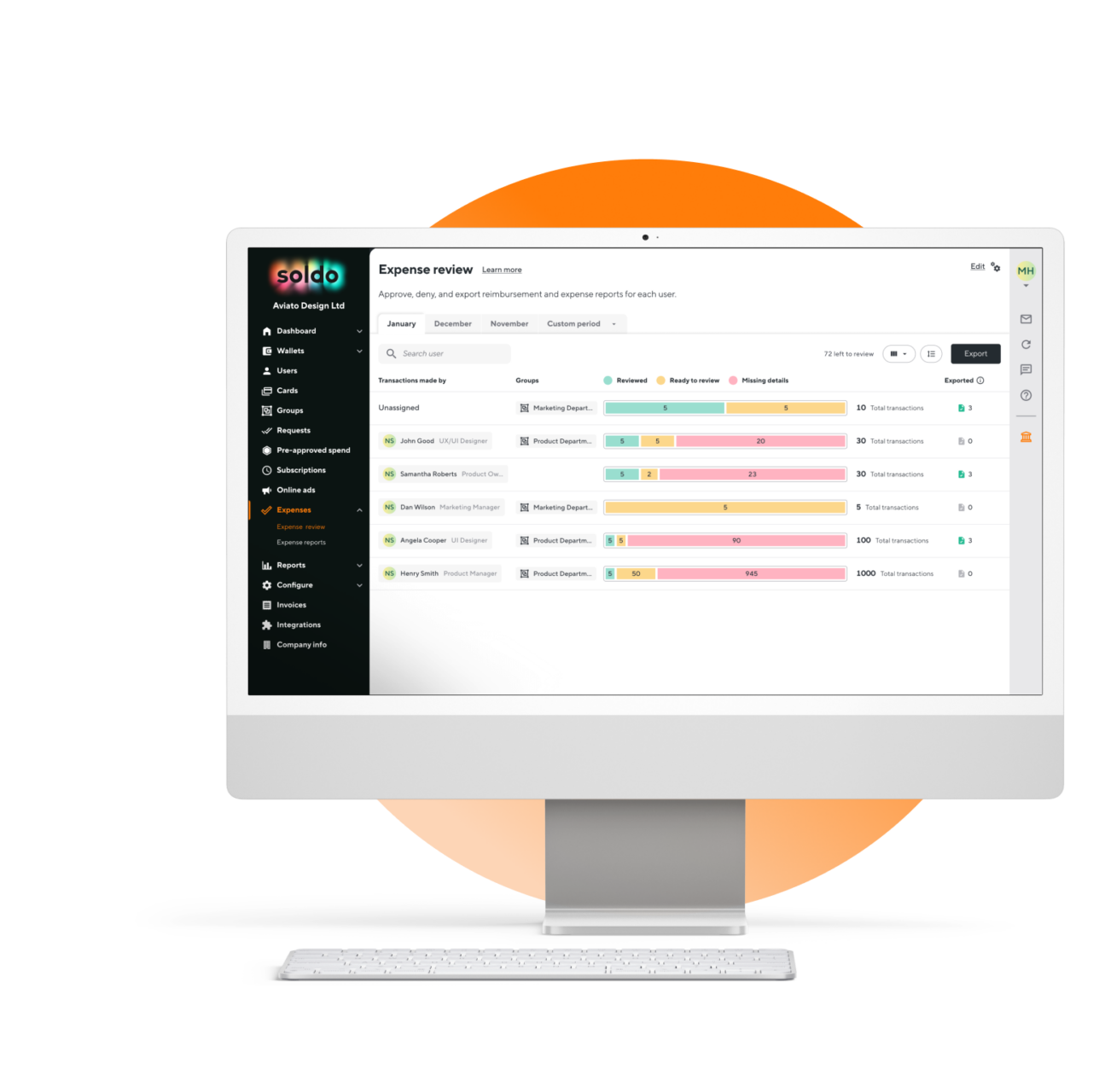

Spend less time on manual expense management

Good news: you don’t have to manage expenses manually anymore. With Soldo, you can automate 80% of your financial processes, which means more time for impactful work. And less risk of input errors.

With approvals, reimbursements and expense reporting taken care of, the only question is what to do with all those extra hours.

A simple way to prevent overspending

Imagine knowing where every penny of company money is being spent in real-time. Or, better yet, putting spending policy profiles, daily allowances, and separate budgets in place – so you know where it’s going before it even gets there.

We’re bringing together Soldo company cards and our expense management platform to make this kind of visibility and control over company spend an everyday reality.

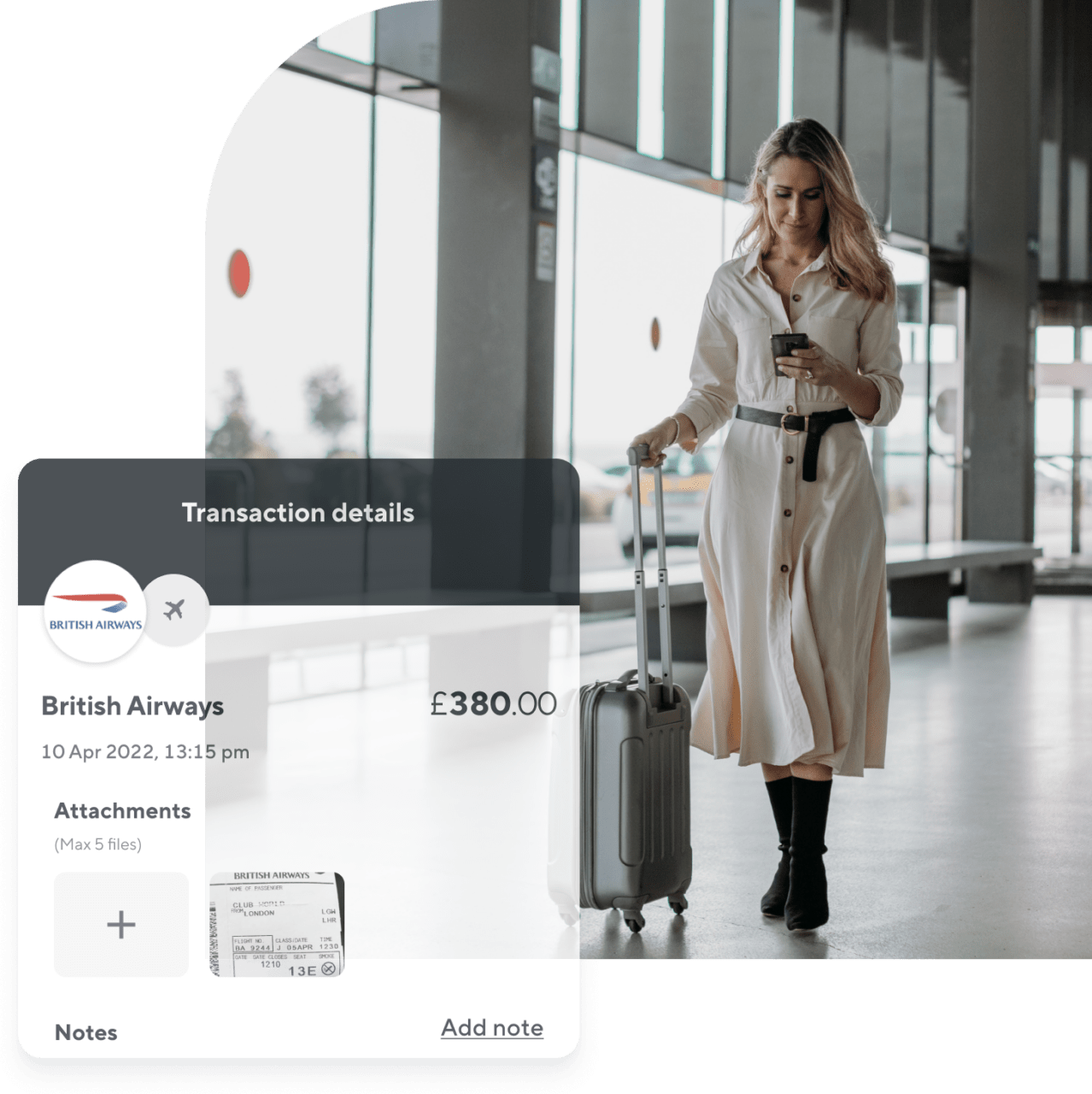

Manage expenses on-the-go

Our mobile app makes expense management easy for finance teams and employees, wherever they are. Top up an employee’s Soldo company card with the company money they need – from anywhere – or approve out-of-pocket expenses in seconds. See every transaction as it happens.

And because employees use the app to capture receipts at point of purchase, everyone avoids the hassle of chasing bits of paper.

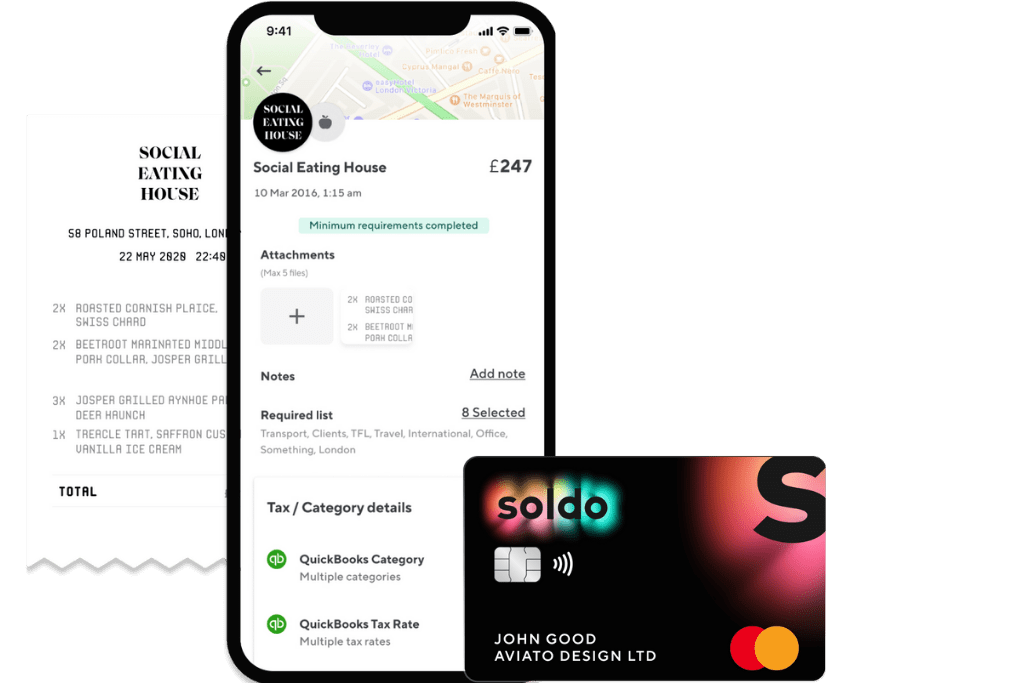

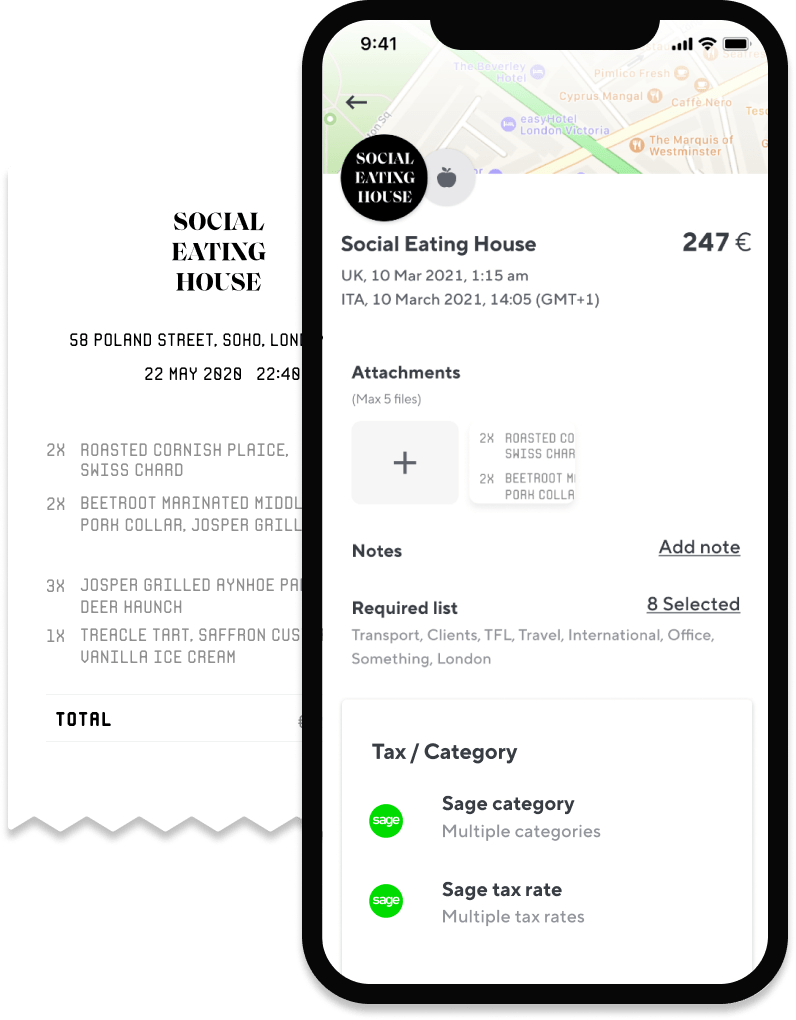

Soldo integrates with your accounting software

Copying data between multiple systems isn’t just annoying – it wastes time and increases the likelihood of manual input errors. Soldo connects with your accounting software so you can track, manage, and report on employee expenses and company spending. All in one place.

Reconcile in a single click, manage month-end faster. Rely on real-time, accurate spend and expense data.

Keep company money safe and secure

Soldo company cards are issued by Mastercard® and can be frozen or cancelled instantly from the web or mobile app. Our support team is on hand to answer questions, resolve any issues and talk you through the best way to set up your Soldo account for your specific needs.

Soldo is authorized and regulated by the Financial Conduct Authority (FCA) and accredited as a Level 1 Service Provider by the PCI Council. Which means we comply with the highest data security standards.

How Soldo works

Soldo empowers employees and departments to spend company money more responsibly by giving them their own plastic or virtual Mastercard® cards. While an intuitive web console makes it easy to manage spending using customisable budgets and rules. The mobile app prompts staff to snap receipts at the point of purchase – so late, inaccurate expense reports are history. And Soldo automatically sends payments to Xero, sharing receipts (and much more) in just one click. See an overview of how it works.