Learn about the rules HMRC set for travel expenses and see how Soldo can help you keep track of your travel expenses.

HMRC travel expenses

As a business owner you will likely need to travel to grow your company, and travelling is never free. These business expenses, whether it’s rail fare, bus fare, or fuel costs, can add up. These charges can be significant, too, especially if your business is small and you need to keep costs down. Thankfully, there are ways to claim on these expenses and save quite a bit of money. If an expense qualifies as a business expense, you don’t have to deduct or pay tax and National Insurance on it, but to ensure this, you need to ensure that any expense meets the criteria set by HMRC. It’s quite a complex topic. Read on to find out how HMRC manage travel expenses and how Soldo can simplify the way you manage these costs.

Domestic travel

The most frequent journey you’ll take is of course the one from your home to your place of work. Unfortunately, this daily travel is classed as ‘ordinary commuting’ by HMRC, and it is not eligible for tax relief. This changes, however, if you have to take a business journey somewhere that isn’t your permanent workplace.

Travel expenses are allowable for tax purposes if you have to travel to somewhere outside of your usual workplace to what’s known as a ‘temporary workplace’. A temporary workplace is somewhere you’ll be travelling to for a limited period of time or somewhere you travel to infrequently.

A workplace only counts as temporary if you’ll be working there for less than two years. If you’re there for a period longer than 24 months, it will be classed as a permanent workplace, and you won’t be able to claim expenses on it. This is what’s known as the 24 month rule.

There is a caveat, however, in that this is only the case if you’re performing a substantial amount of duties at this location which, according to HMRC, is 40% or more of your workload. If it’s less than this, you may be able to claim it back.

HMRC also has an Approved Mileage Allowance Payment rate, or AMAP, and you can claim certain amounts depending on how much you travel. This travel of course has to be strictly business related.

6 strategies to fuel growth in 2024

In this short summary, finance and business experts share 6 Growth Strategies from the 2024 Spring Budget to help your business grow.

Download nowOther travel expenses

If you’re travelling for a long period, you’ll naturally incur other expenses that aren’t just related to the travel itself. HMRC allows you to claim business expenses under the term “subsistence allowance”, also known as a per diem or meal allowance; basically, everyday expenses you accrue in the process of running your business.

Although it’s known as a meal allowance, the allowance can stretch beyond food to fees such as business phone calls, congestion charges, and overnight accommodation. This is significant because if they’re designated as a business cost, they don’t need to be taxed, so your business saves money.

Manage travel expenses with Soldo

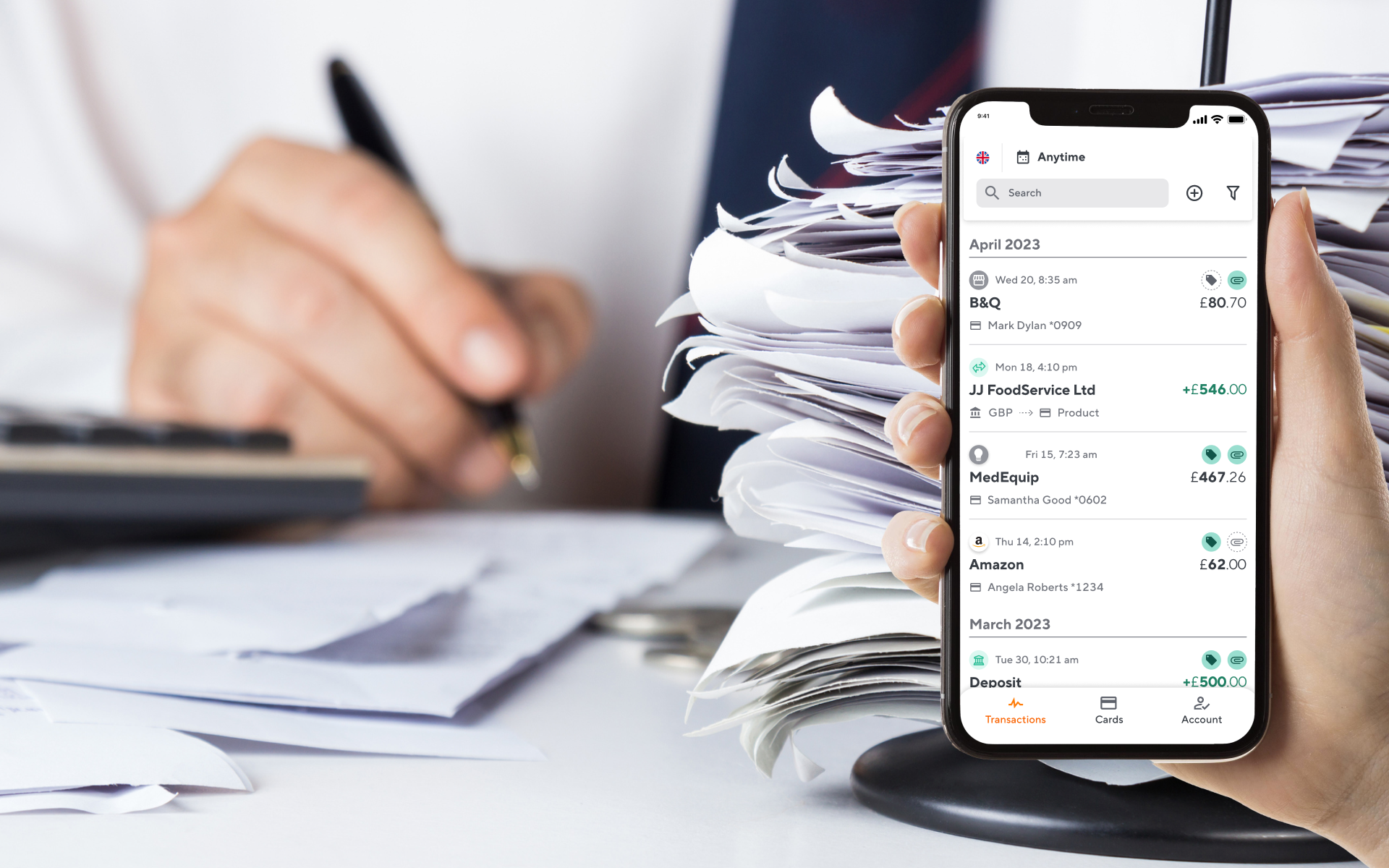

As you can see, there’s a lot to consider when thinking about travel expenses, and it’ll be worth your while to take a look at the HMRC website for details on how your business’ specific needs can be met by the criteria. But whatever expenses you’re able to claim, Soldo’s system of business expense cards can help to streamline your finances and make the process of your expense management much easier.

With Soldo you can set up any number of prepaid cards for individuals, teams, or sites. You then set the budgets for these cards and track how these budgets are being spent on the Soldo app, either on mobile or desktop.

For example, you may want to set up a scale rate payment for your employees. A scale rate payment is a certain budget you allow your employees to spend on subsistence charges, such as meals and travel. You will have to be certain, however, that employees are spending this allowance on necessary business transactions. This has the potential to become a headache for finance teams, as they may have to check through receipts to ensure the expenses are correct.