What is a virtual prepaid card?

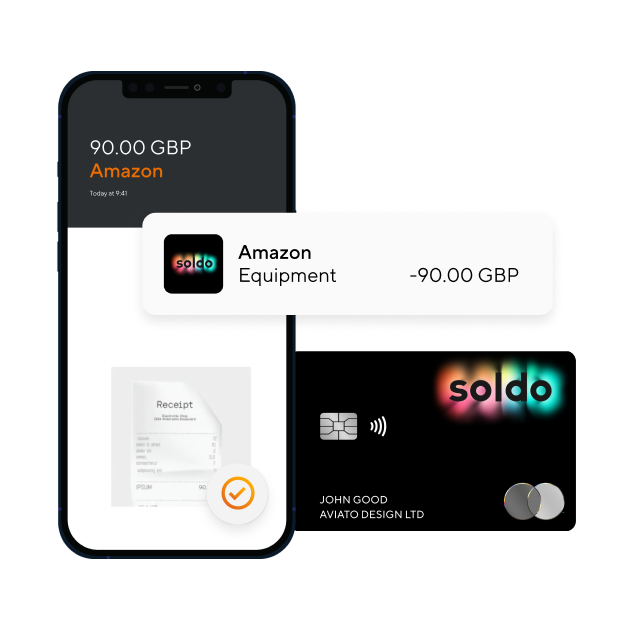

This digital payment card functions similarly to a regular prepaid card but exists only online. You won’t receive a physical card but you’ll still have a card number, expiry date and CCV number that you can view on a screen.

Your virtual card is preloaded with a specific amount of funds and can be used for purchases or payments anywhere – basically, wherever you would be able to use a regular card.

Virtual prepaid debit cards help you manage corporate expenses, team budgets, vendor payments or employee incentives. They also include enhanced security features to prevent fraud or misuse.

How are prepaid virtual credit cards online issued?

Prepaid virtual credit cards are issued instantly via our online management platform. You can create and distribute cards in just a few clicks, removing the need for physical manufacturing or shipping.

Simply select the card type, assign a cardholder, set spending limits and load the card with funds. Once generated, it can be immediately sent to the designated user via email or another secure method.

This process allows for speedy issuance and makes it easy to allocate funds to employees, departments or projects in real time.

Are virtual prepaid credit cards secure?

Virtual prepaid cards are highly secure. They offer enhanced protection compared to traditional cards as there is no physical card that can be lost or stolen.

Additionally, you can set spending limits, restrict specific merchants or categories and control the usage of each card, reducing the risk of unauthorised transactions. If a card is compromised, it can be instantly frozen or cancelled through our management platform.

With Soldo, you can rest assured that any sensitive financial information is secure and protected. We use advanced encryption and security protocols, and we’re authorised and regulated by the Financial Conduct Authority (FCA).

Your funds are kept separate from our business bank accounts and safeguarded under the UK Payment Services and Electronic Money Regulations. Learn more about security with Soldo.

Are virtual prepaid cards reloadable?

Yes, our reloadable cards allow you to add funds as needed, providing flexibility for ongoing use. This is beneficial for those managing recurring expenses, project budgets or employee funds – and it removes the need to issue a new card each time additional funds are required.

Soldo allows you to reload funds as and when, ensuring that spending continues smoothly without interruptions.

What fees are associated with using virtual prepaid cards?

Get started with your virtual prepaid debit card by signing up to our Soldo Pro plan. Gain access to all core features, including our mobile app and desktop platform. We never charge hidden fees for deposits or transactions.

For advanced features like reporting and additional controls, sign up for Soldo Premium. Learn more about pricing or request a call back for more information about our range of prepaid cards.

Who can I issue virtual prepaid cards to?

Choose to issue virtual prepaid cards to a wide range of recipients depending on your business needs. Examples include:

- Employees: For managing corporate expenses.

- Contractors: To simplify payments for freelance workers or consultants.

- Suppliers and vendors: For streamlined payments without the need for complex invoicing.

- Customers: As part of loyalty programmes or to issue refunds and rewards.

- Partners: For distributing incentives or bonuses to business partners.

- The flexibility of virtual prepaid cards makes them ideal for securely sending funds to anyone in your network, with control over how those funds are spent.

How many virtual prepaid cards can I issue?

Regardless of the size of your business, all Soldo plans include access to as many cards as you need for your employees and departments. Whether you want to distribute cards to a handful of people or the entire organisation, everyone will be spending within your limits.

Can virtual prepaid cards UK be used internationally?

You can easily use our cards for global payments. It’s ideal if your business works with international vendors, contractors or employees. Cross-border payments are simplified.

Set up company wallets in GBP, EUR or USD to manage your operations worldwide. Each card will be issued in these currencies with a small and fixed foreign exchange fee.

How can I monitor expenses made with virtual prepaid cards?

Our expense management platform allows you to set rules and limits on expenses before reviewing and tracking them in real time. This gives you full visibility over who is spending, how much and on what.

Tracking monthly expenses through a single platform is easier than switching between spreadsheets. Download reports, gain useful insights and remove the risk of human error.

What if I need help with my online virtual prepaid card?

If you need support with your prepaid card, you can email us at [email protected]. We also have a list of helpful topics and information on all things Soldo on our support page.