Unlock shared spending with Soldo

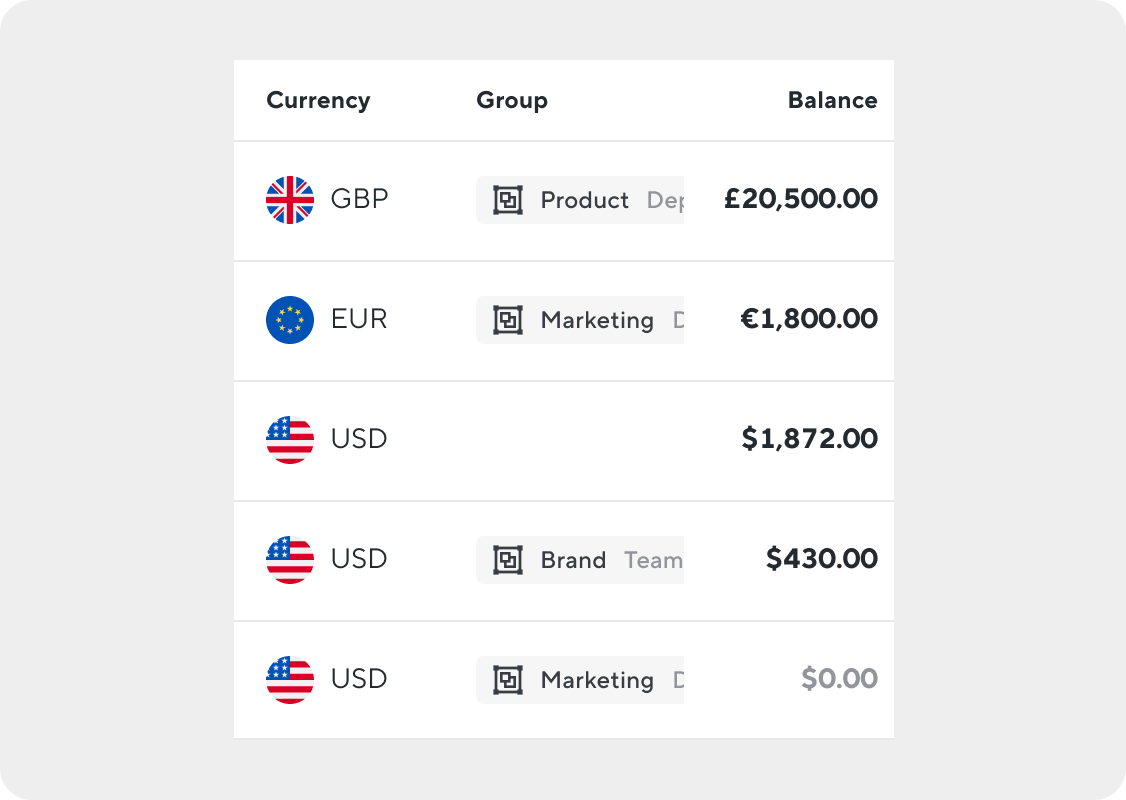

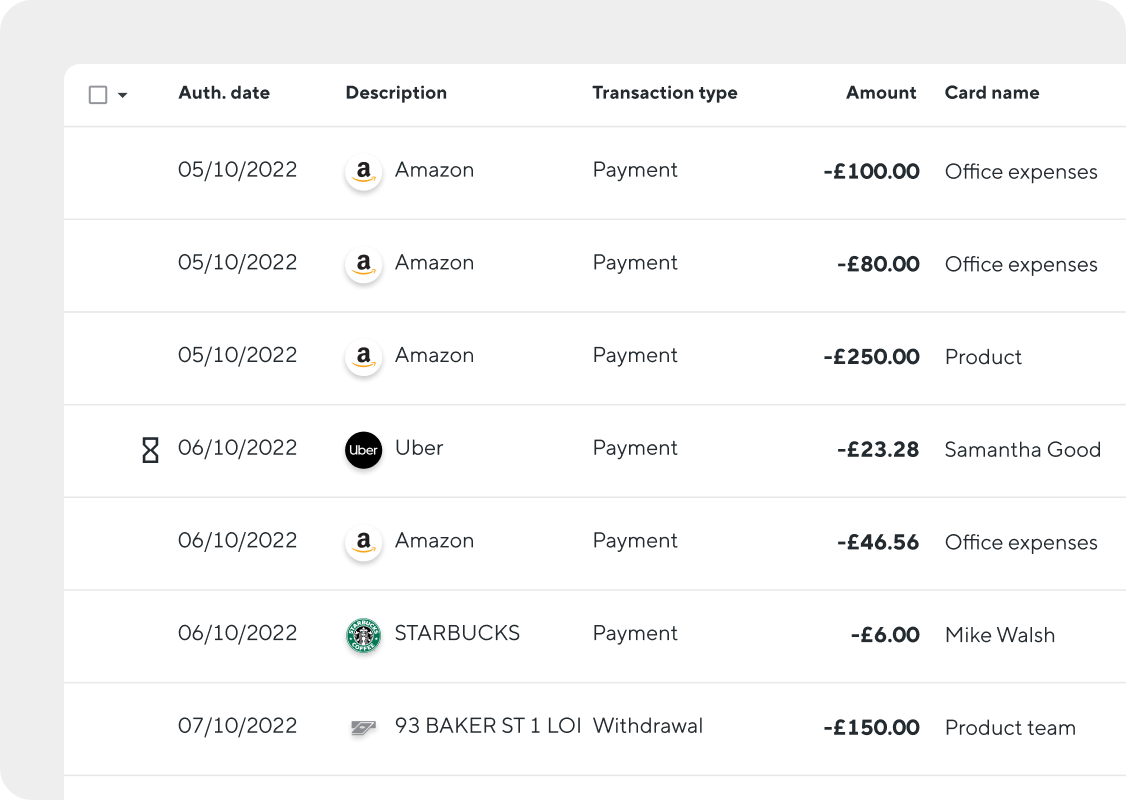

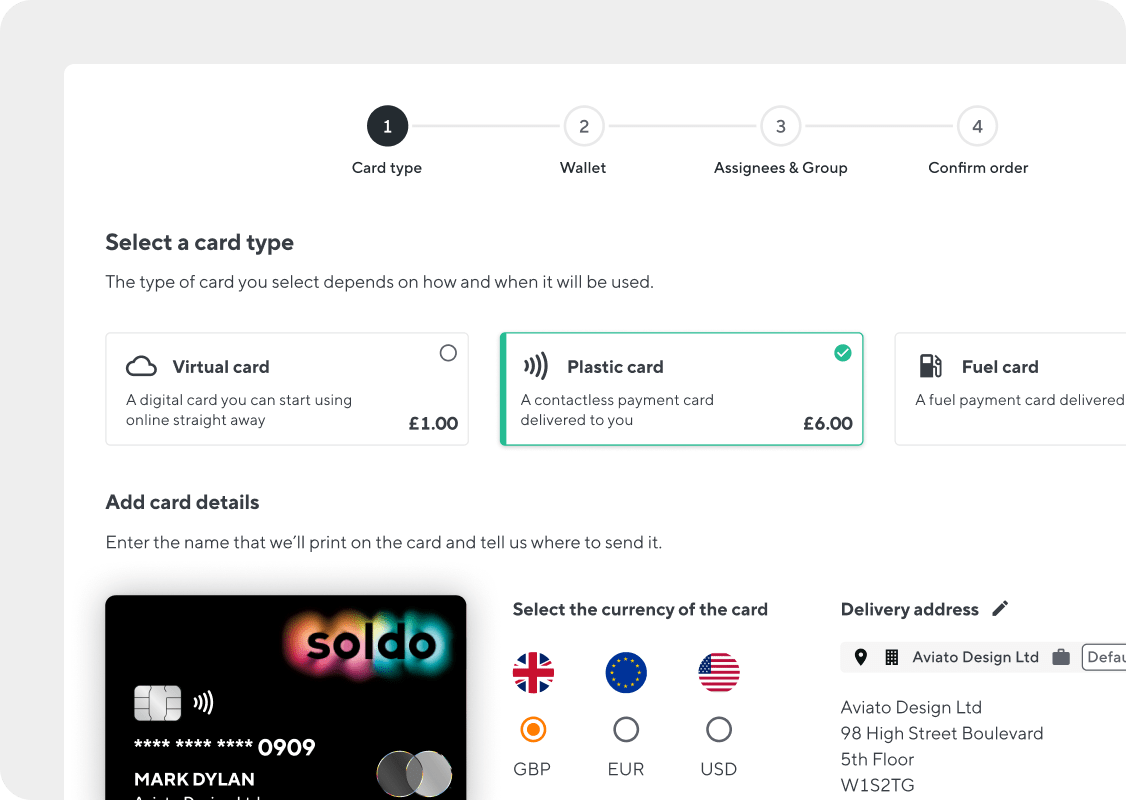

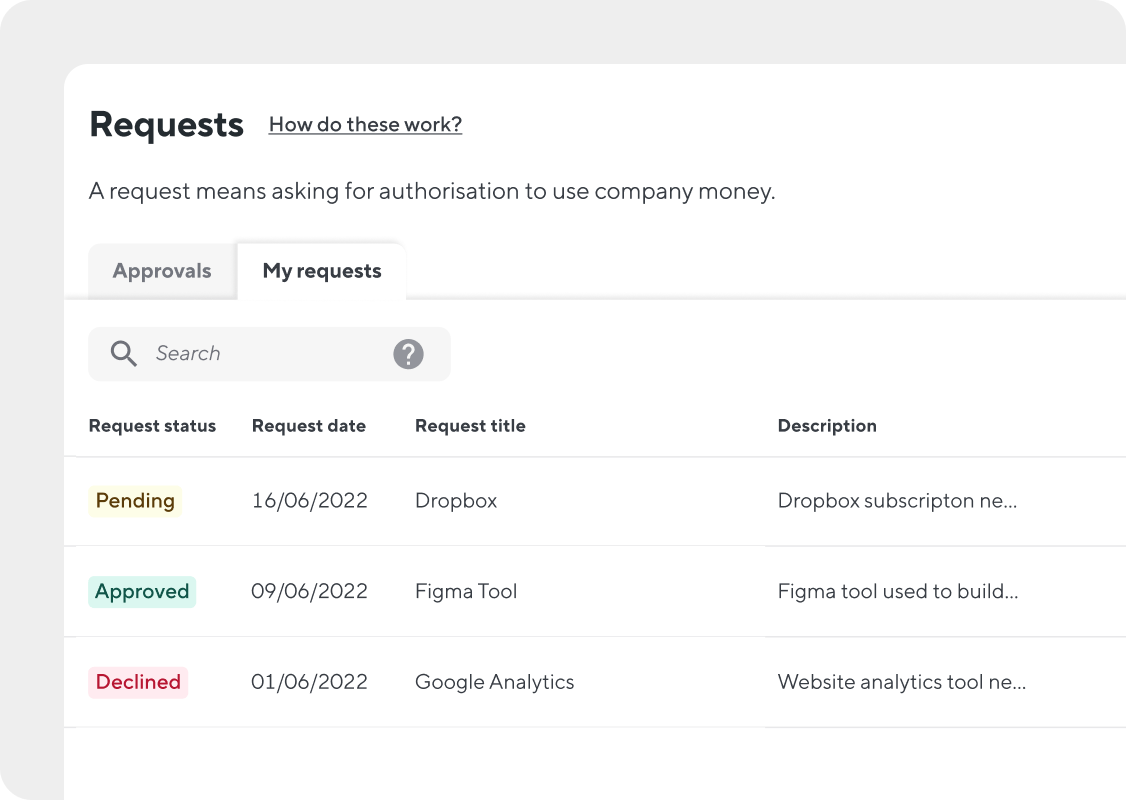

While some spending can easily be assigned to one individual, in many cases groups, teams, or departments need to make shared purchases, even across different locations and currencies. For example, equipment, software subscriptions, marketing spend, or construction projects. These shared purchases can be difficult to manage, categorise, and reconcile without an individual name to attach to them.

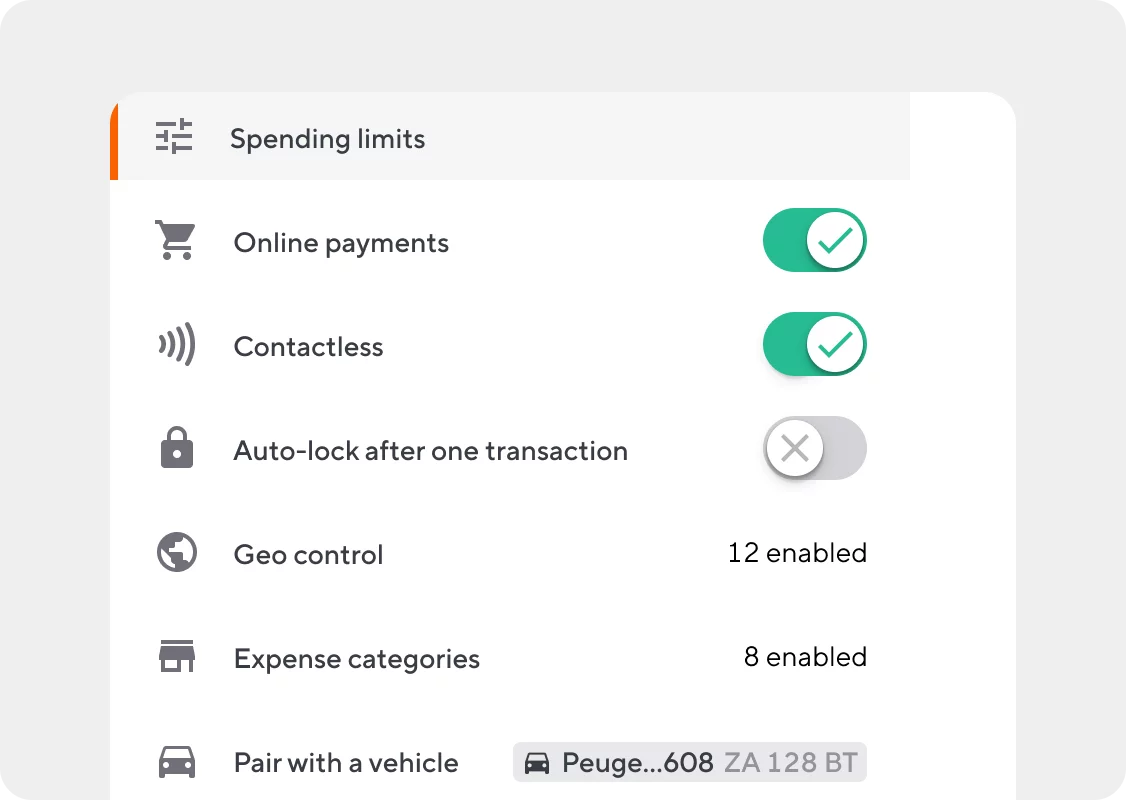

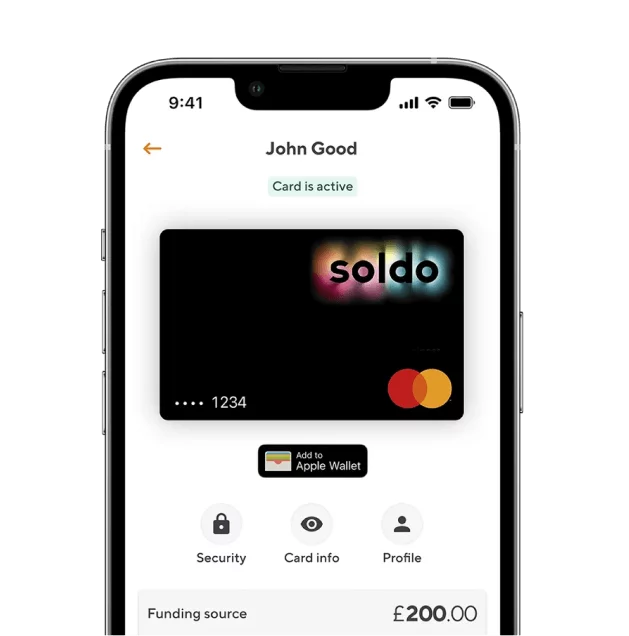

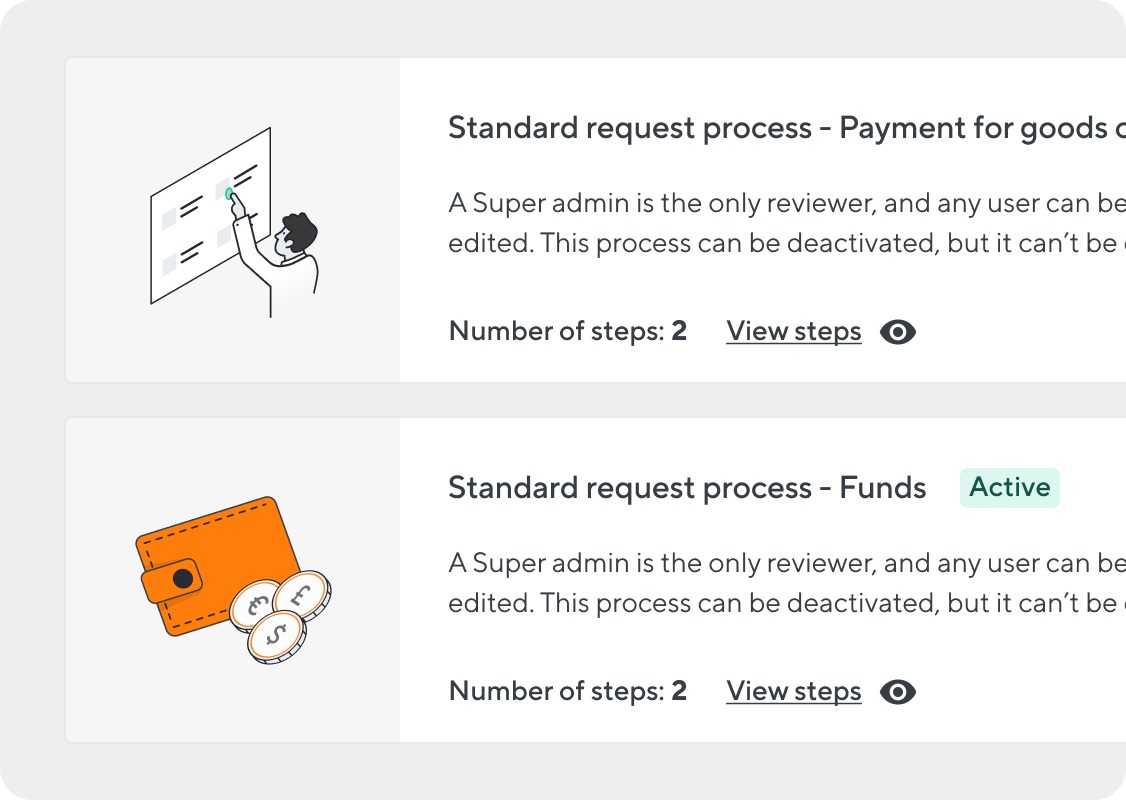

However, Soldo’s unique features ensure that managing complex spending set-ups where multiple employees need to make a variety of payments is quick and easy.