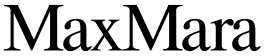

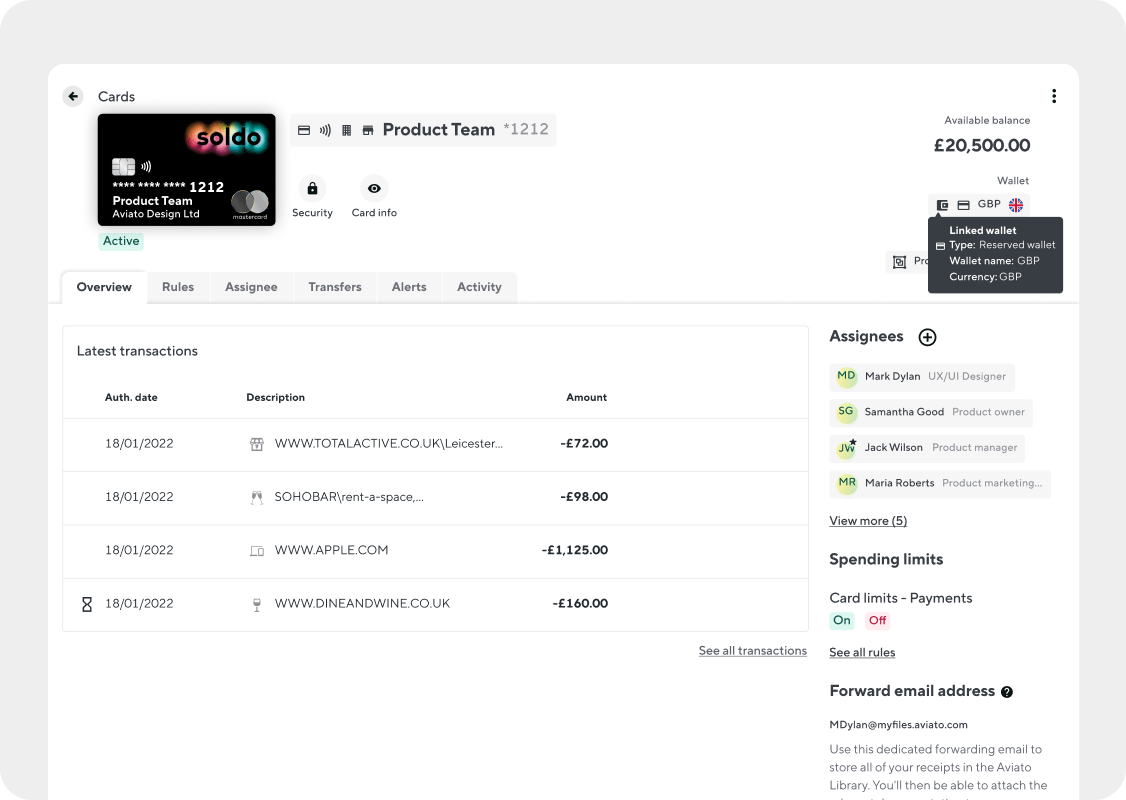

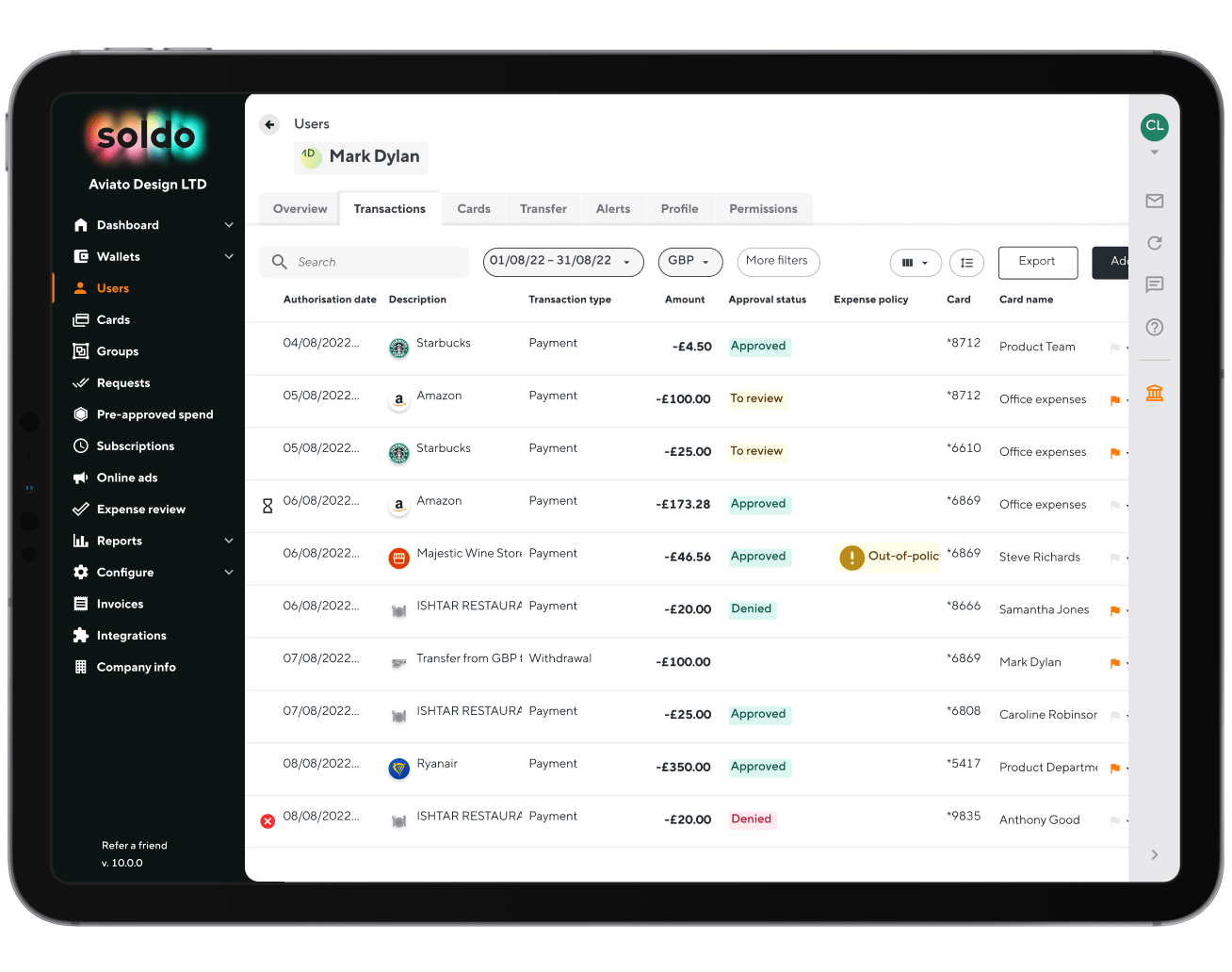

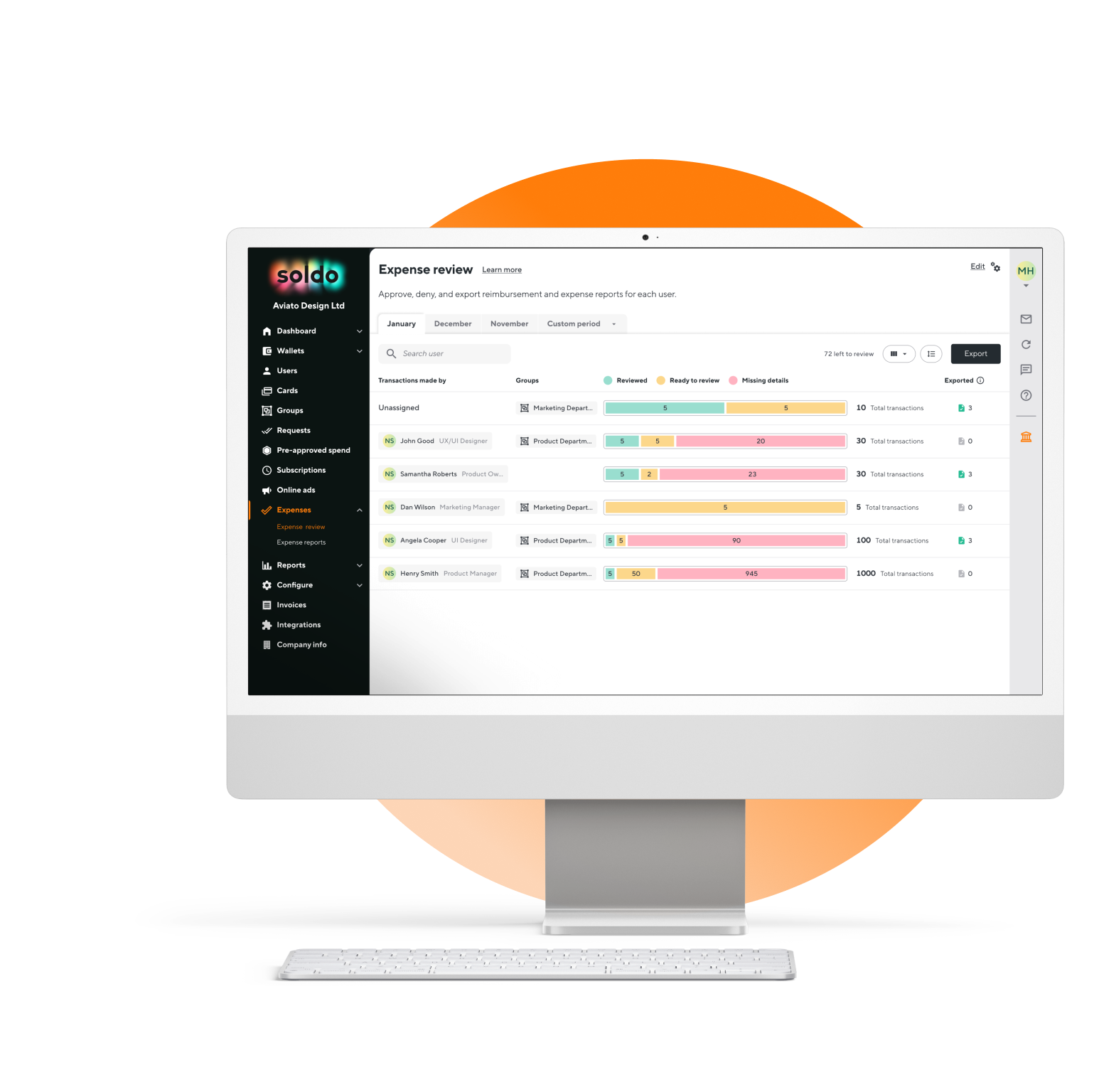

With Soldo company cards, you control your business expenses and who spends company money, how much, on what, and which budget they use.

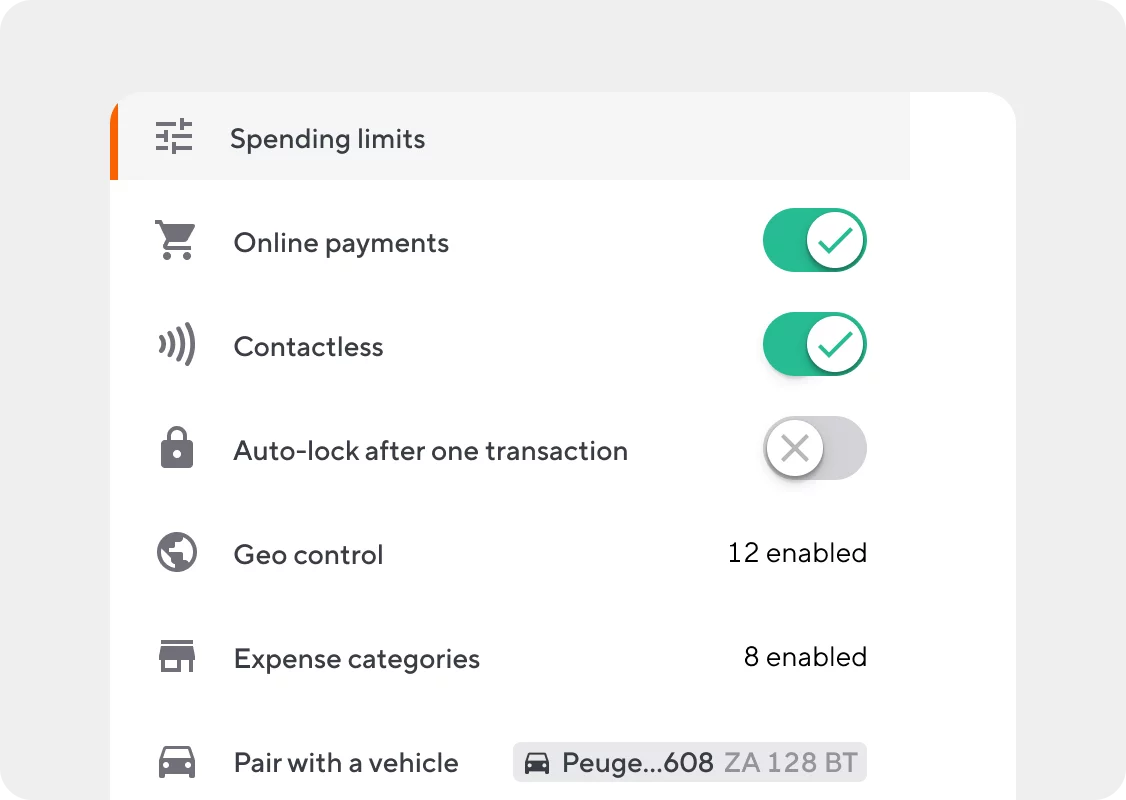

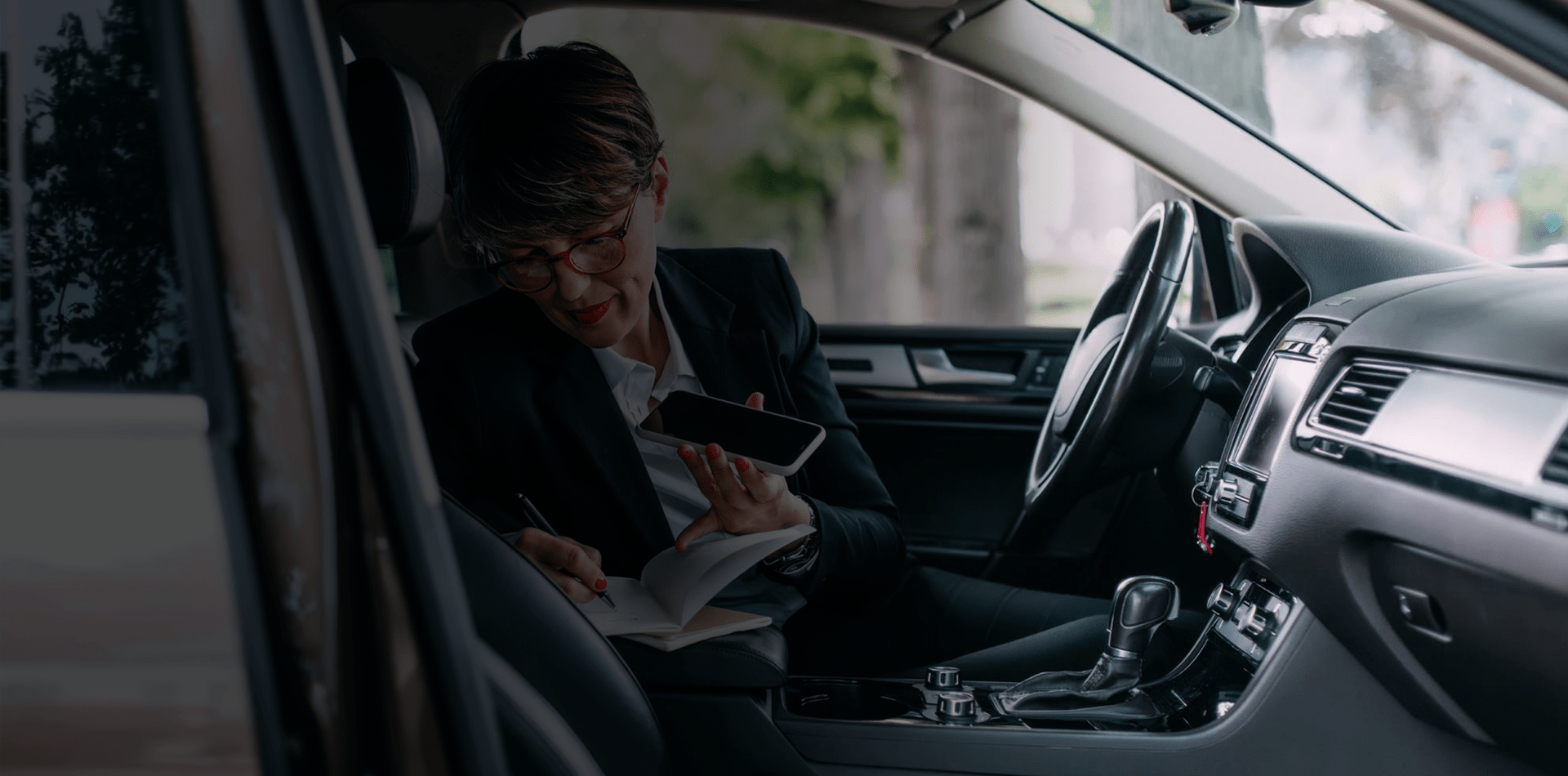

Set custom rules and limits for each card in a few clicks to prevent overspending , without micromanaging every transaction.

Business expense cards that make controlling company spend effortless.

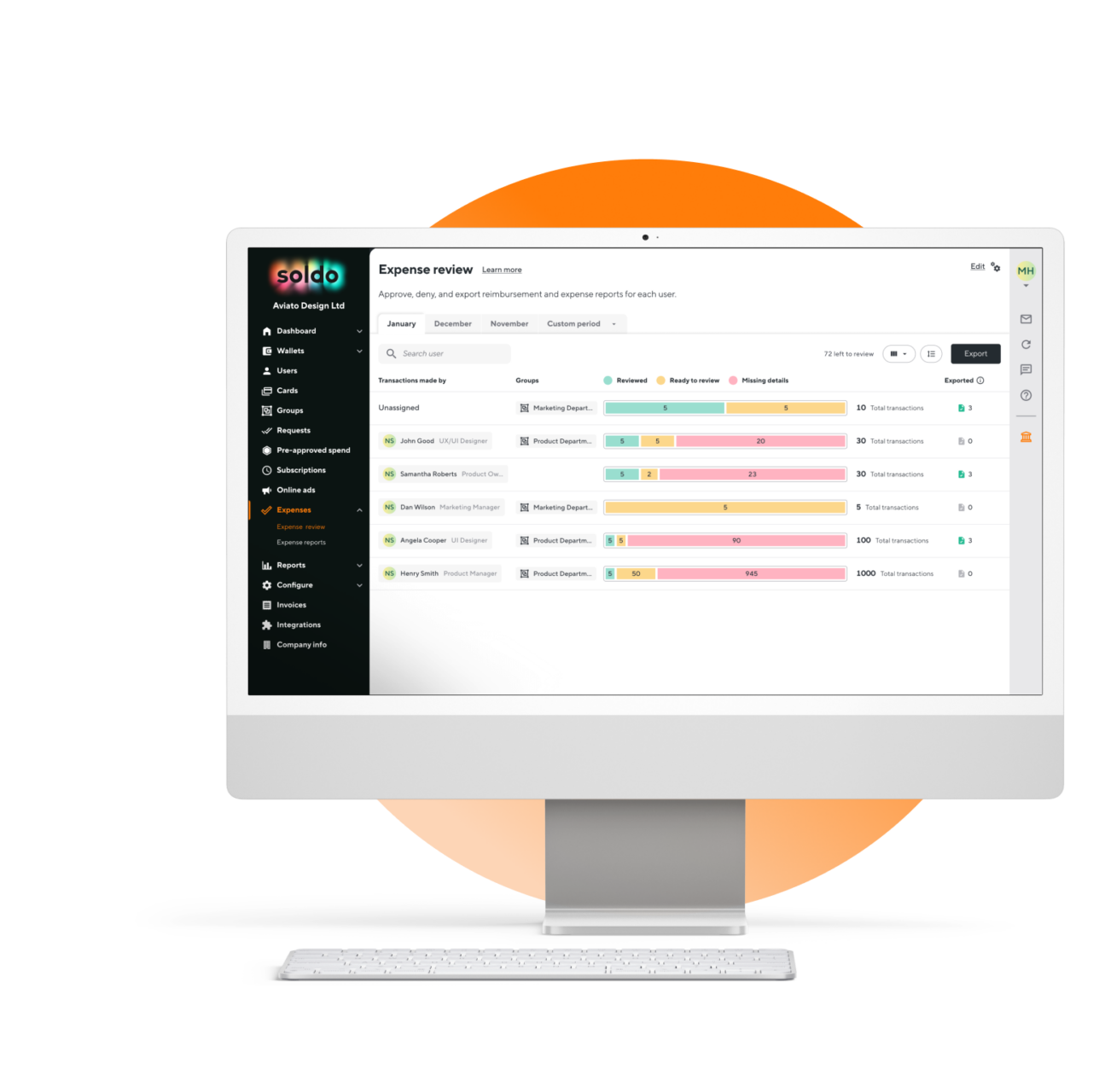

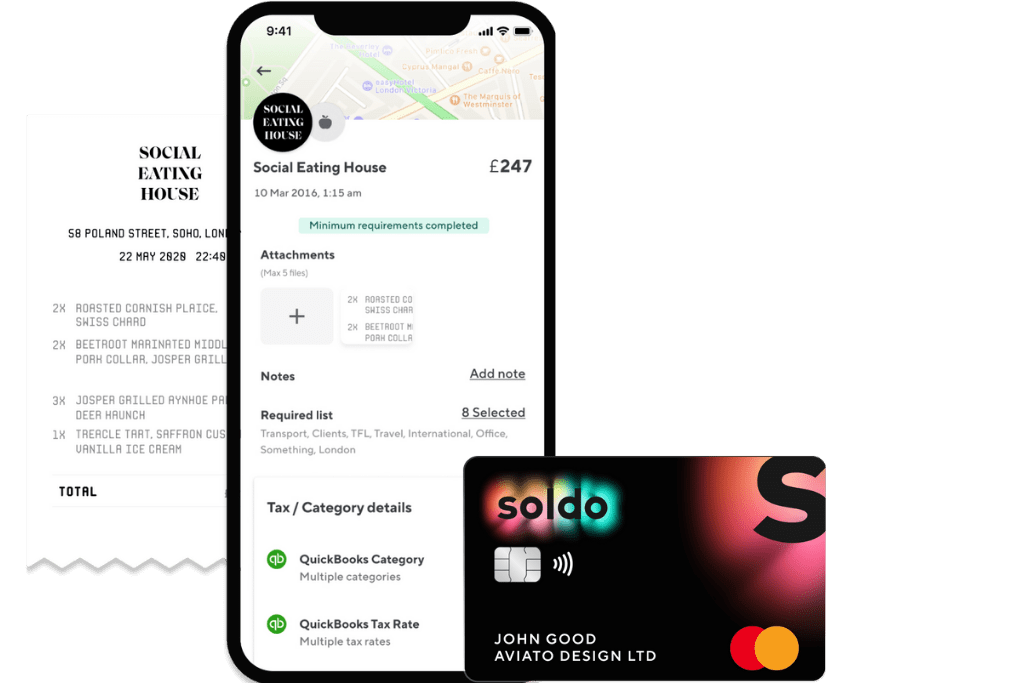

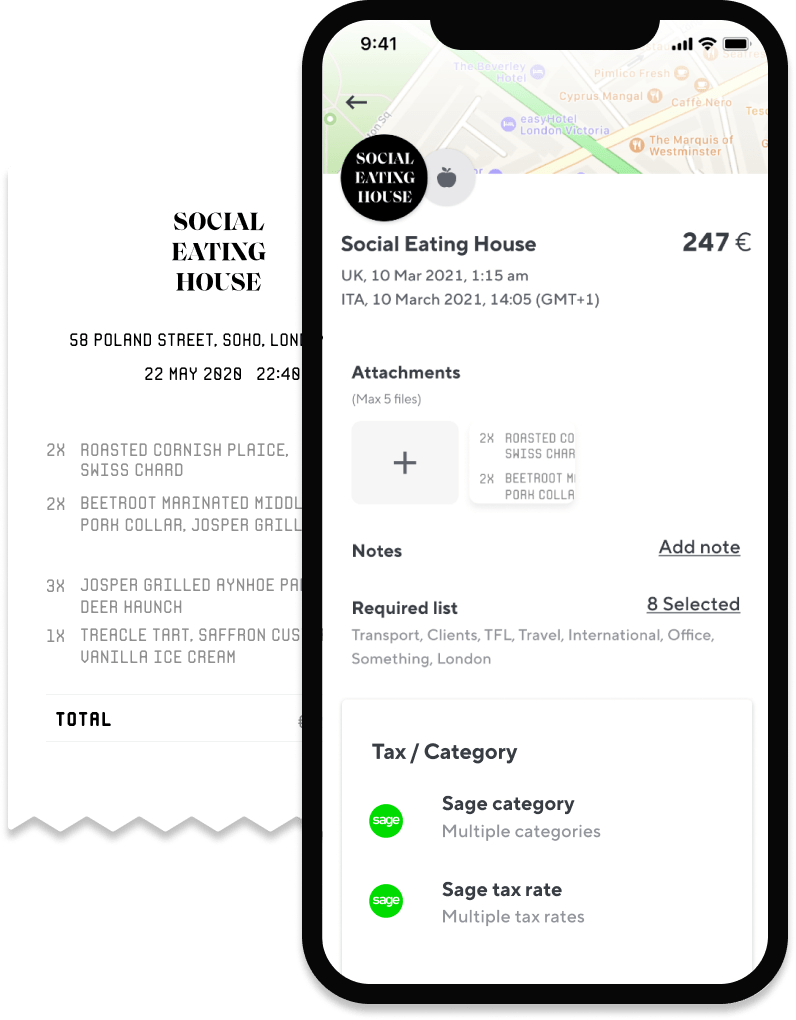

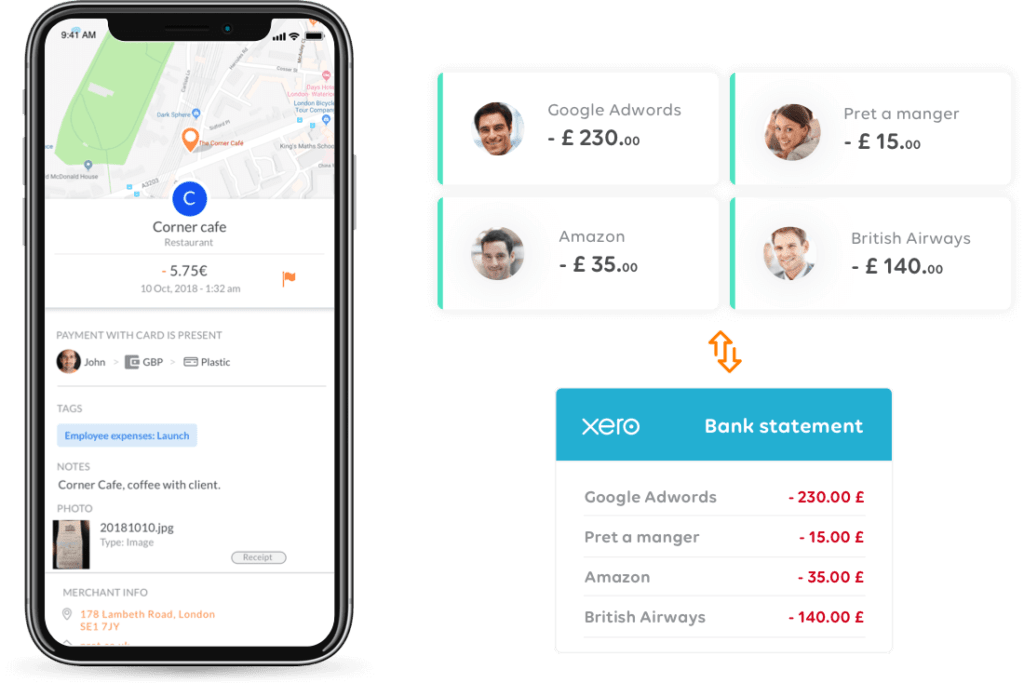

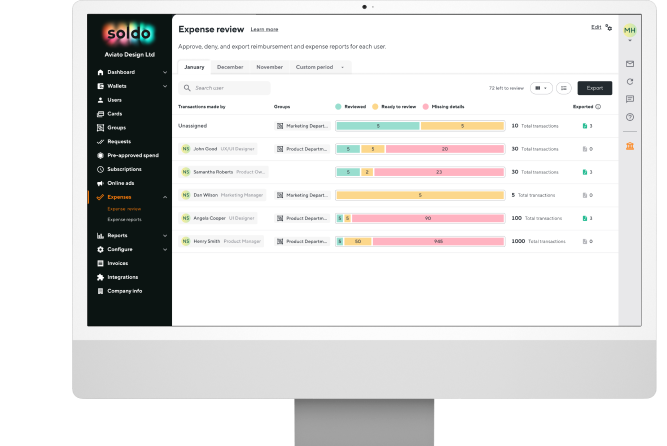

Soldo business expense cards connects to intuitive expense management tools. Control, track, and report spending – all in one place.

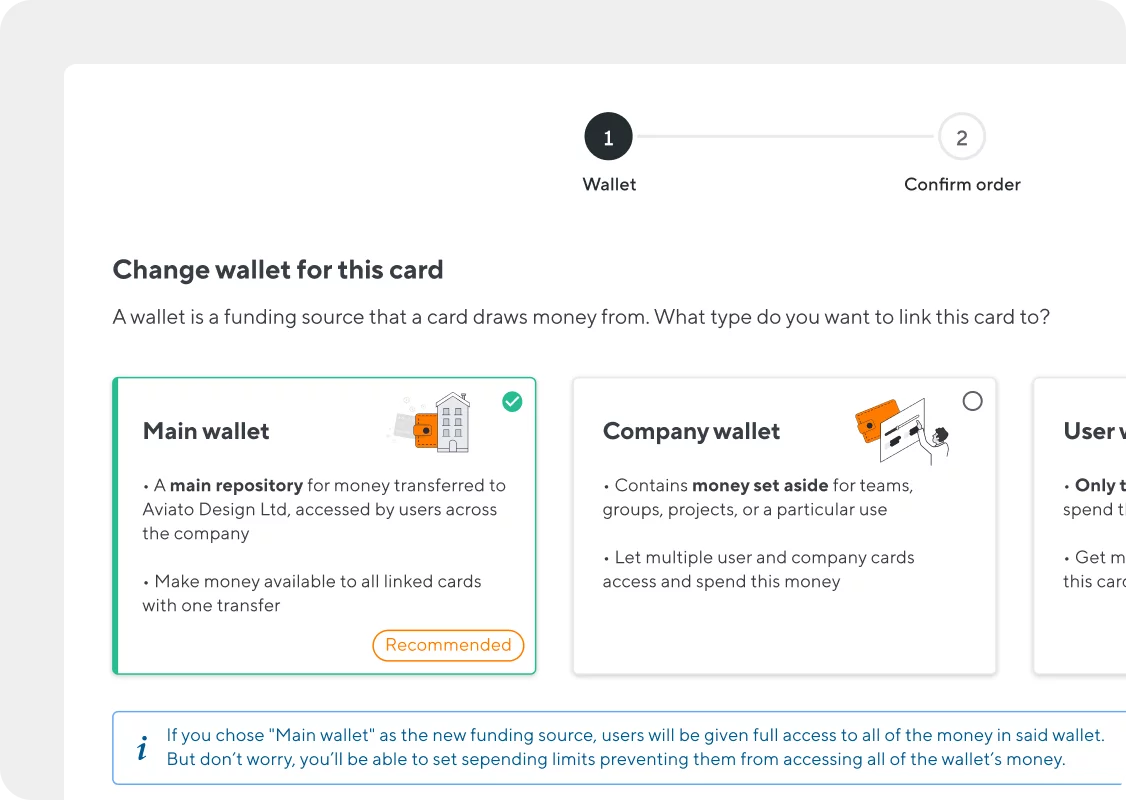

Prevent overspending: keep budgets seperate, set custom limits and freeze cards instantly

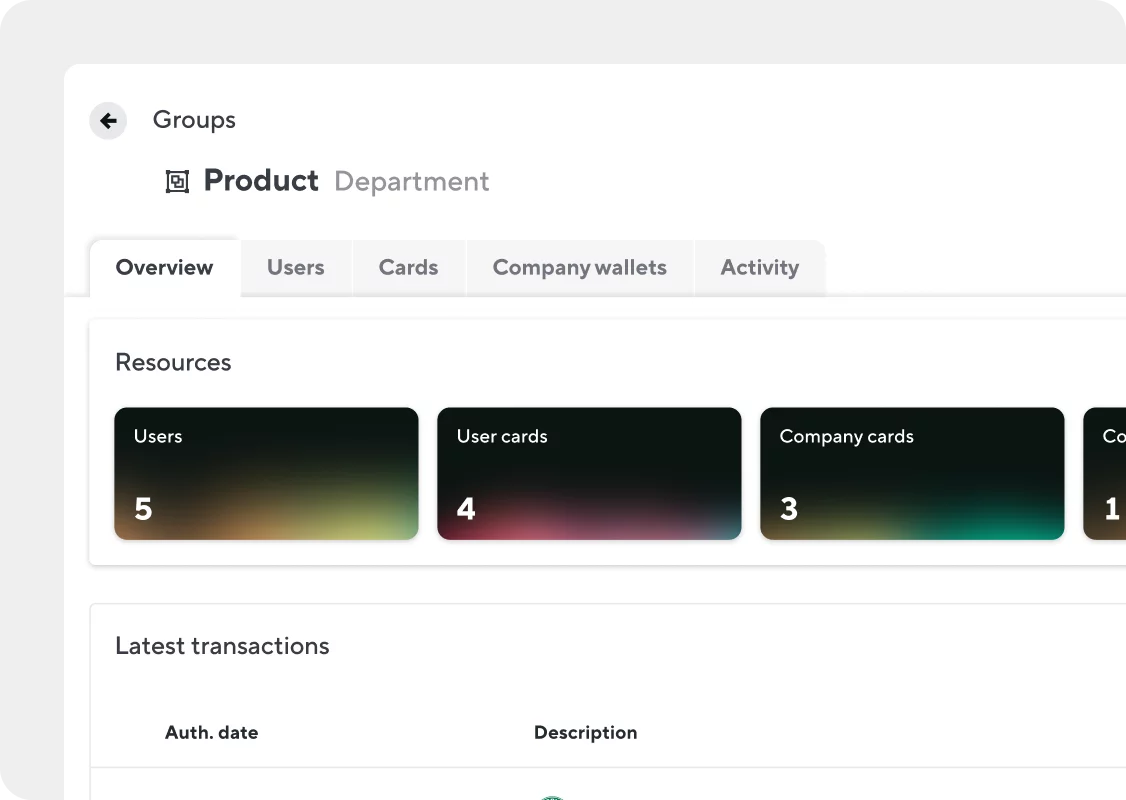

Make expenses easy – no more paying out of pocket, chasing receipts or need for reimbursement

Save hours with real-time expense tracking, automated reporting and accounting software integrations