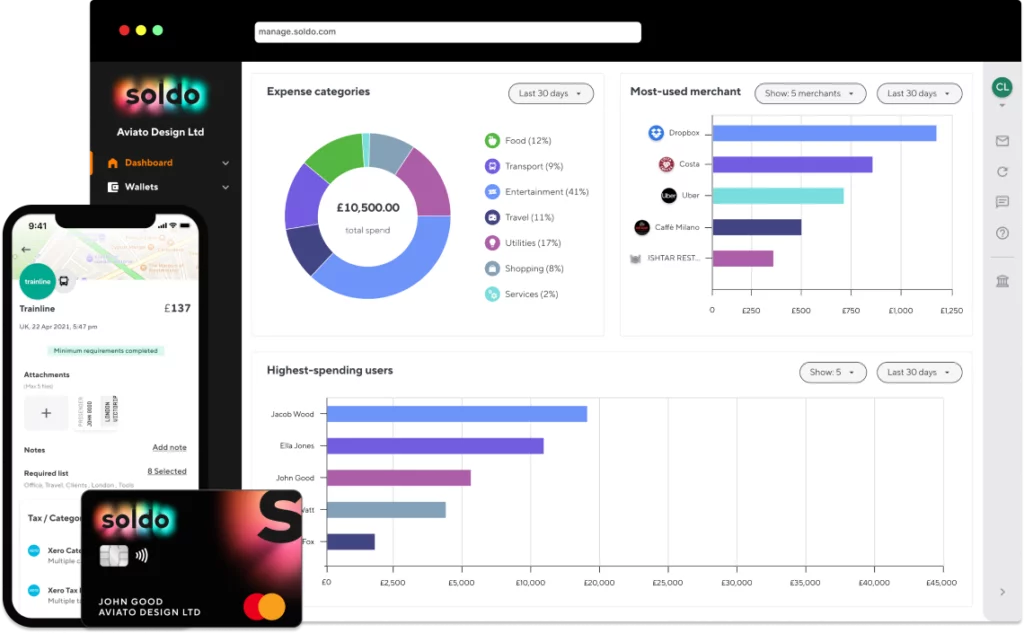

In this article we’re going to tell you exactly why Soldo’s app is the best choice when it comes to tracking expenses, but if you don’t want details and you’re just here for the headlines, then here they are.

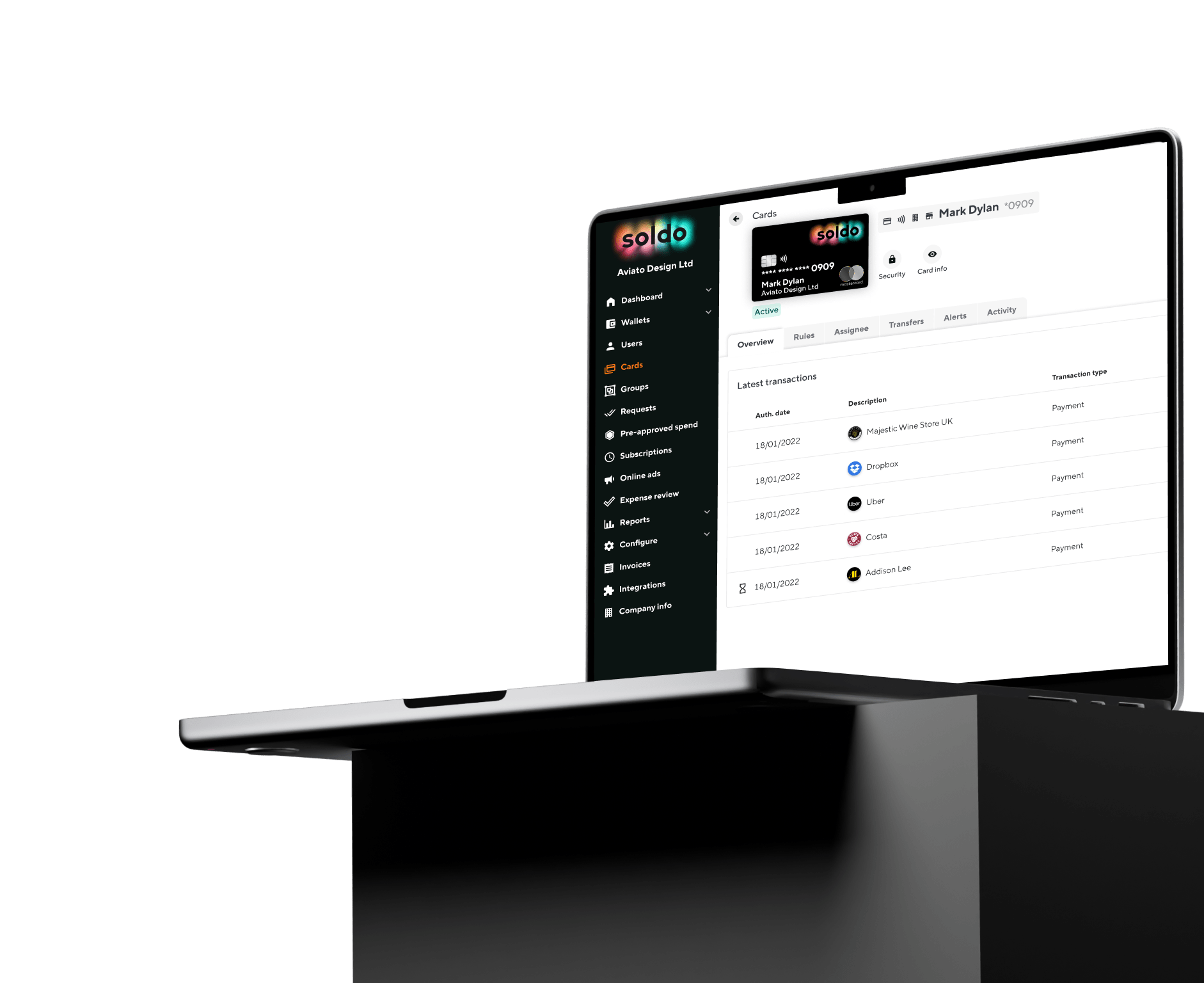

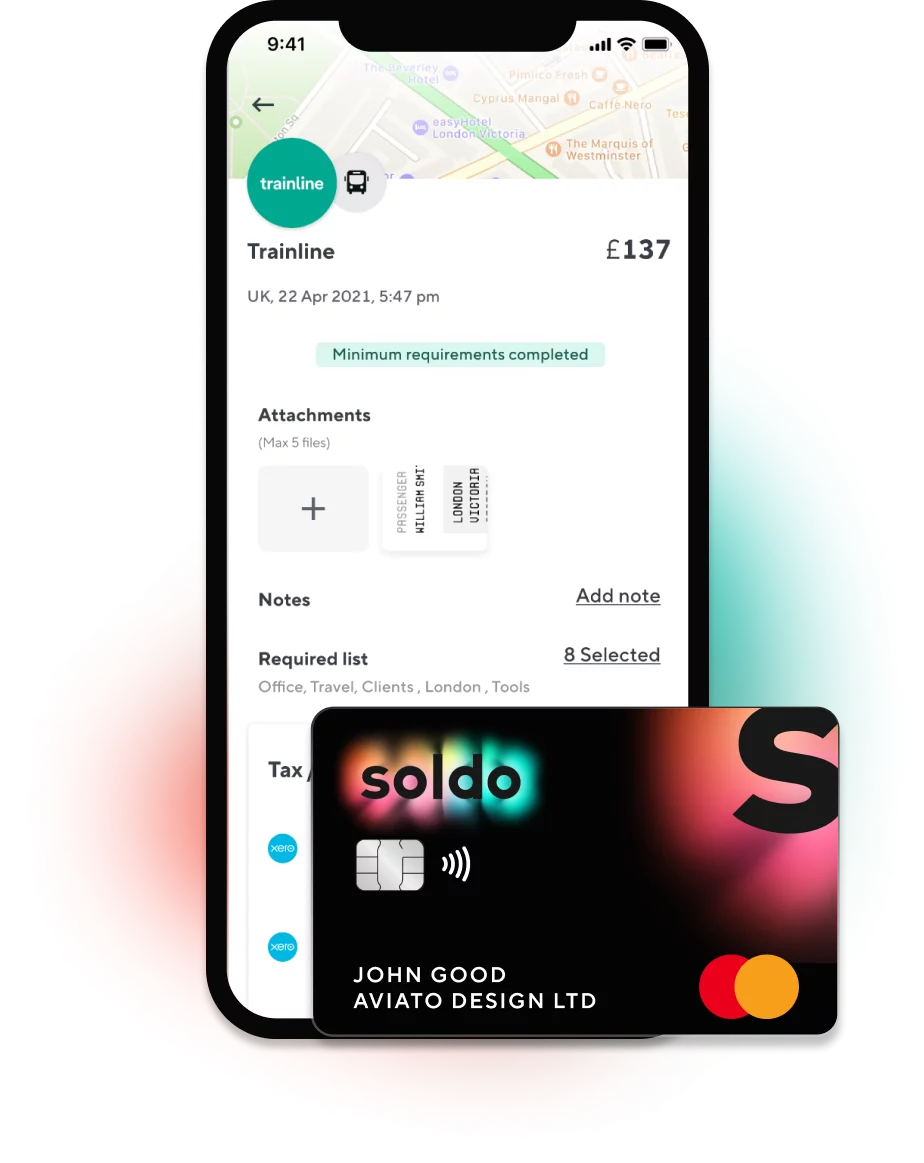

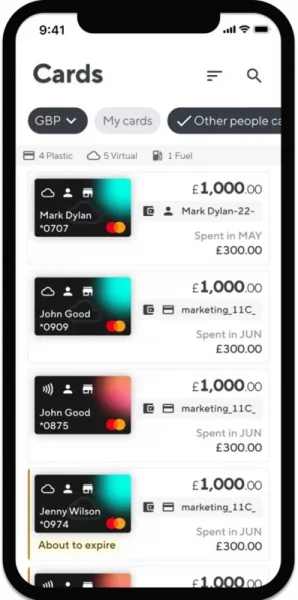

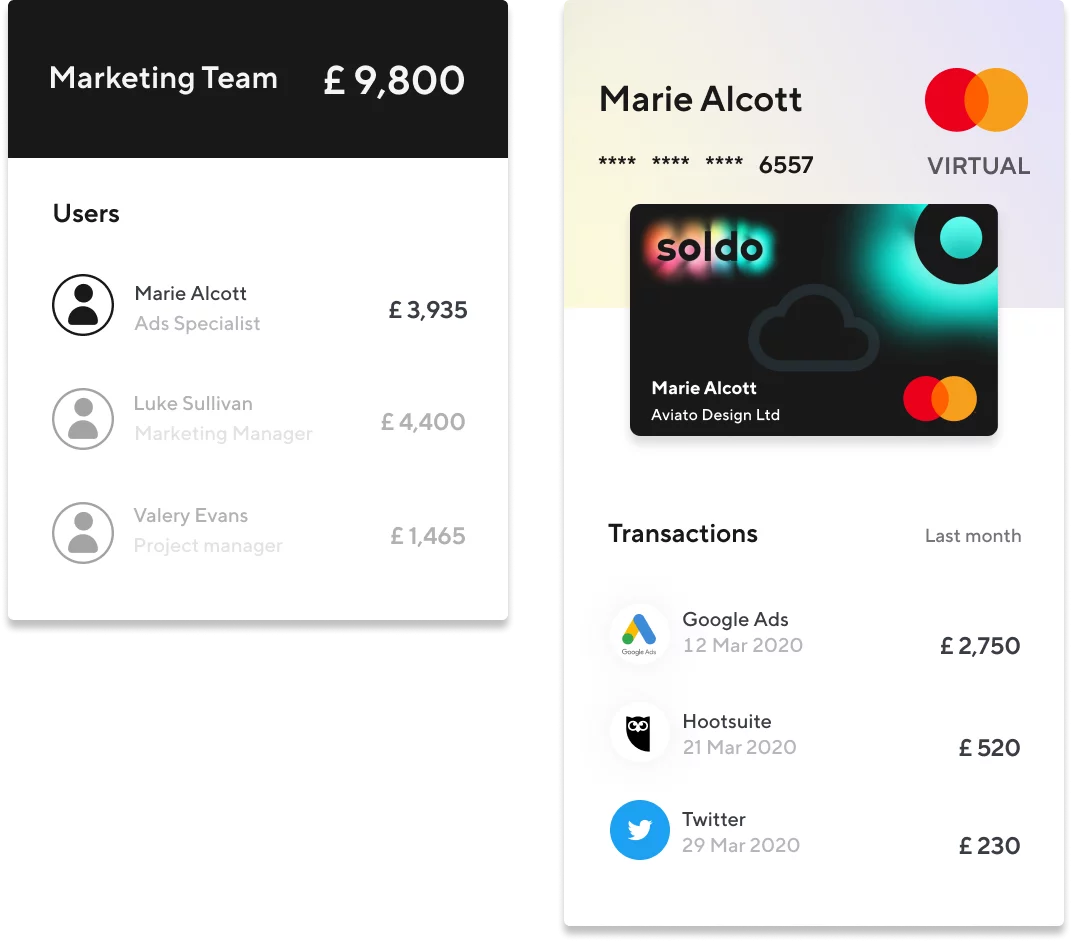

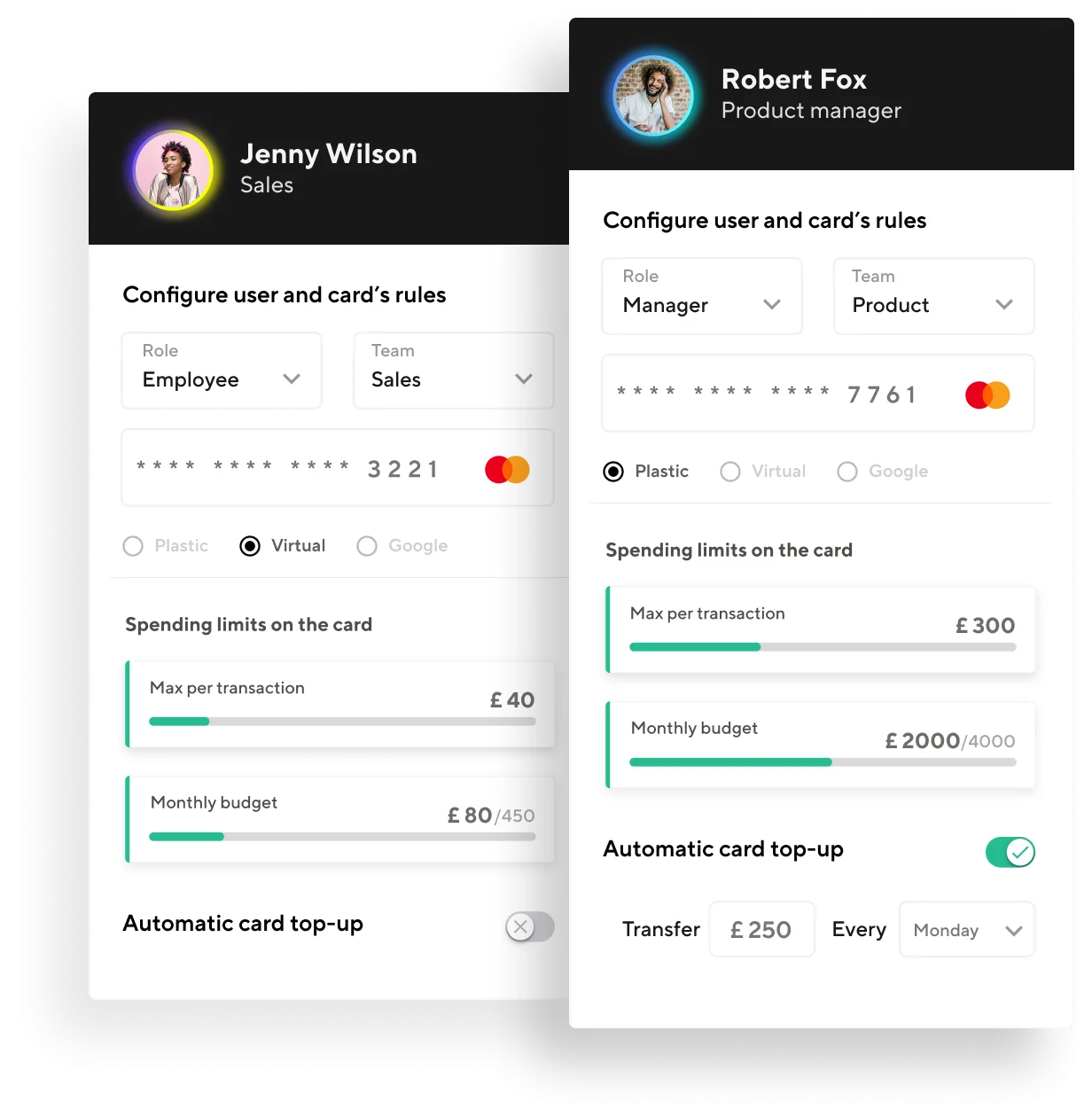

- Soldo is a prepaid system that is designed to simplify the expense management process at every turn. We combine an intuitive app (for mobile or desktop) with physical prepaid business card or virtual prepaid cards. As many cards as needed can be assigned, and they have no direct link to a bank account.

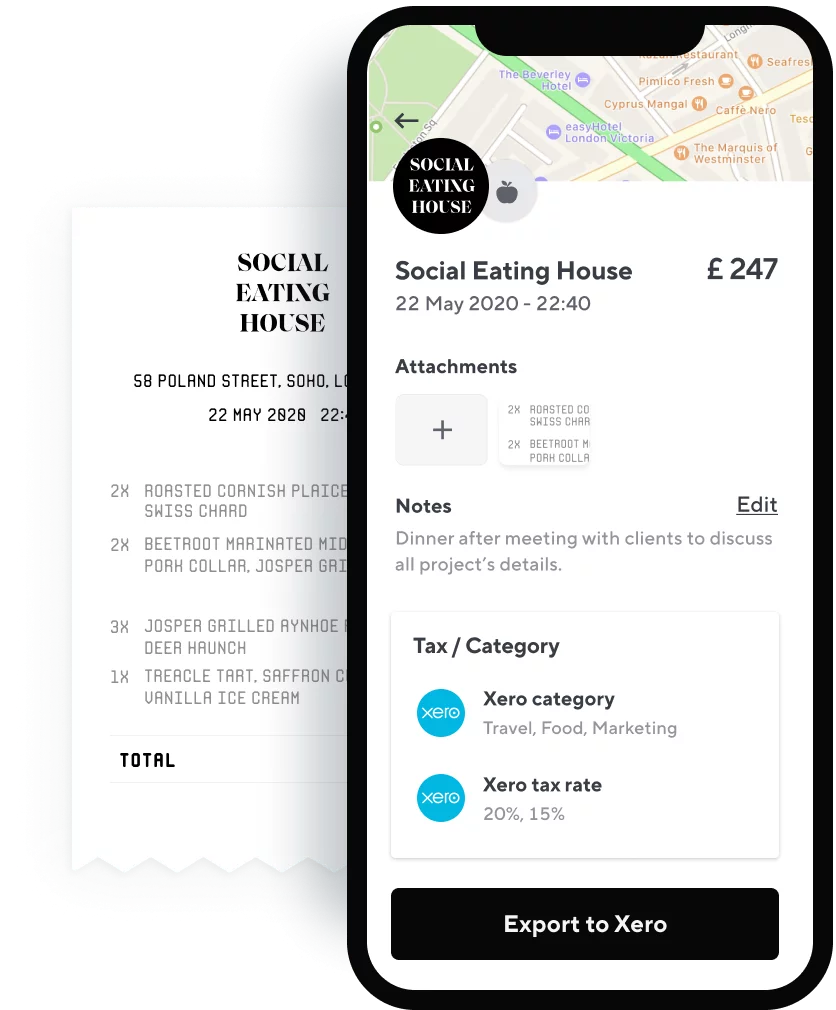

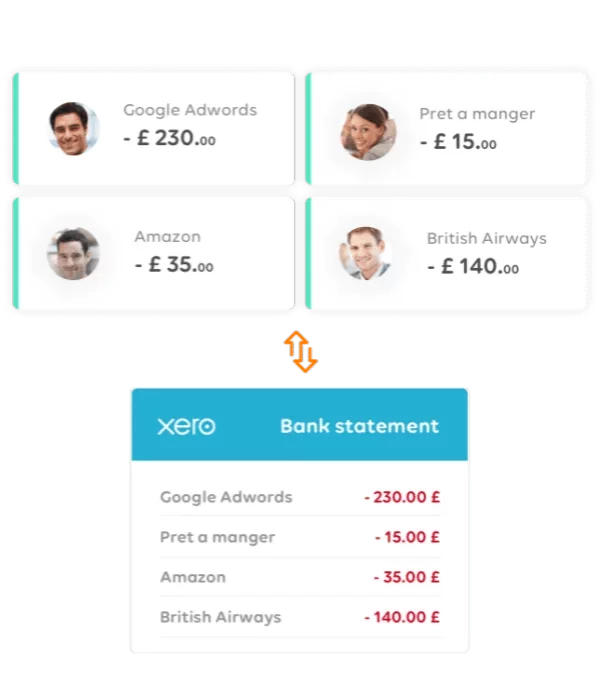

- The cards are topped up, you go out and spend, and every transaction is logged by Soldo. All you need to do is take a photo of your receipt, and Soldo collates all the spend data

- Then when it’s time for the bookkeeping, Soldo’s integrations with accounting software like QuickBooks and Xero make the process easy. With the click of a button, data can be transferred from Soldo to your preferred software. This saves businesses time and money.

So those are the basics of what Soldo does. It’s simple, secure, and efficient. Soldo’s business expense app makes things easier not only for business owners, but for employees too. To find out more about how Soldo can help you, read on for a comprehensive rundown of features.