On average, it takes 60 minutes for a single expense report to go from submission to payment. 45 minutes for an employee to create it, and 15 minutes for finance to process it.

Think of it this way: ordinarily, a company creates 135 expense reports each month.

Expense management could be taking up 8,100 minutes a month of your staff’s time – enough to play 90 consecutive football matches. (Of course, your staff probably shouldn’t be on the football pitch during working hours.)

At the end of the day, time spent expensing is time not spent on business-critical and revenue-generating tasks.

How much could you save on employee expenses?

Find out how much you could save using our expenses calculator

Find out how much you could save using our expenses calculator

Slashing the time (and money) you spend on expense management doesn’t require huge changes.

You could make significant savings simply by ditching spreadsheets, reconciliations, and other manual processes – and by investing in an expense management platform like Soldo.

Here’s an in-depth look at how an expense management platform can help you save time, free up your staff, and beef up your bottom line.

Expense reports that do themselves

Expense reports that do themselves

In a 2015 survey, 53% of participants famously said they’d rather do their taxes than create an expense report. But no matter how much they dislike expensing, most employees can’t seem to escape it.

A study on expense management we commissioned in 2018 found that 10% of employees submit expense reports most days, 20% submit most weeks, and a further 20% submit most months.

Every time, employees have to go through a soul-destroying and bureaucratic process: they have to save receipts, collate expenses in a spreadsheet, get the report approved by a manager, and send it over to you. Here, your staff check each transaction, reconcile it, and process reimbursements.

It’s also incredibly time-consuming. An expense management platform like Soldo cuts that process in half:

- Each employee has a prepaid card with a set spending limit

- When they pay for a purchase, they get a notification on their phone, snap a pic of the receipt, and upload it

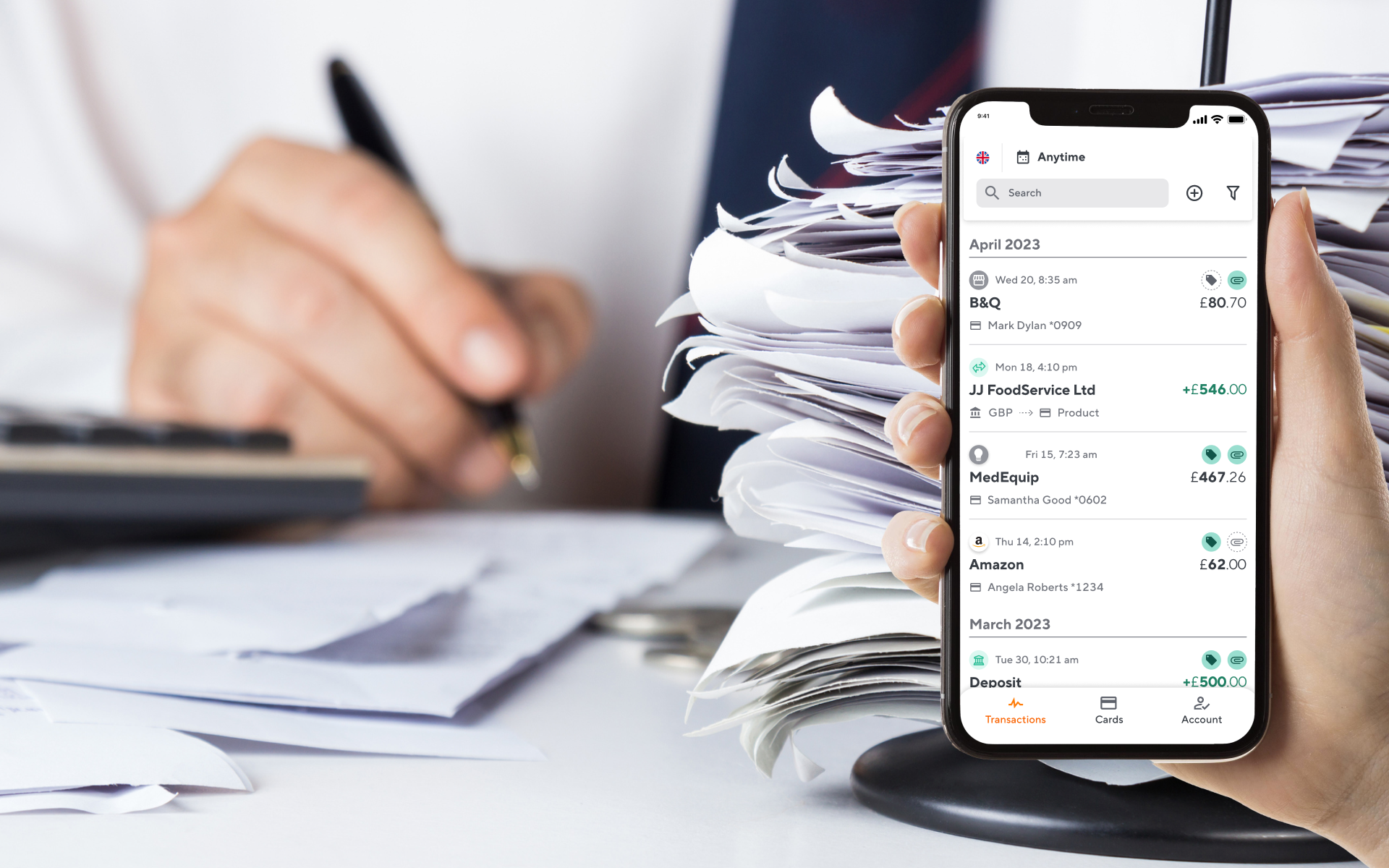

- The expense report is ready immediately. No spreadsheets, crumpled invoices to sift through, or rounds of approvals. Your finance team can log on to Soldo’s dashboard and see each employee’s spending at a glance.

You can see how this process makes expense management much simpler. More importantly, though, it saves time. And time is money.

Let’s say your company employs 100 staff and makes £1 million in annual revenue.

According to our ROI calculator, using Soldo would save your staff 15 hours a month – that’s two working days. The average UK hourly wage in 2019 was £14.80. That’s a saving of £222 per employee per month.

And the savings grow with your business.

If your company has 200 staff and £3 million in annual revenue, Soldo would save 30 hours a month, or four working days – £444 per employee per month.

And if you have 300 staff and £50 million in revenue, Soldo would free up 45 hours a month – more than a full work-week – at a saving of £666 per employee, per month.

But that’s only the start.

Keeping employee spending in check

It’s not just time spent creating and processing expense reports that costs money. Manual processes are prone to human error, which inevitably leads to abuse.

38% of employees admit claiming for things they shouldn’t. Claims range from subtle (such as inflated mileage or taxi fares) to blatantly egregious, including cigarettes, cat litter, and even family holidays.

As astonishing as it seems, it’s easy for such expenses to fall through the cracks, because manual processes lack visibility.

Case in point, our research found that only 17% of those who falsely claim expenses are caught.

Worse, the majority of those who are caught (30%) are undone by their social media posts, not by the auditing process. Odd receipts and unusually high claims caught people out only 24% of the time.

You’re less likely to mistakenly approve dubious claims if you use an expense management platform, because you’ll have complete, real-time visibility.

With Soldo, for instance, you can log on to the dashboard and instantly see what a specific employee has bought with their card.

The Soldo dashboard also lets you implement restrictions. Which means you can make it so the card is rejected when someone tries to buy an item your expense policy doesn’t cover.

According to our ROI Calculator, an expense management platform’s increased visibility and control could save over £2,000 a year for a business with 100 employees and £1 million in annual revenue.

Again, the savings grow with your business. So:

- A company with 200 staff and £3 million in revenue saves £6,000 a year

- A company with 300 staff and £50 million in revenue saves a whopping £100,000 a year

These savings are on top of the hours saved from not having to file expense reports. And your team will also save time and money, because the reconciliation process will be much simpler.

Which brings us to the next point:

Less process, more productivity

It goes without saying but, ultimately, the pressure is on finance. It’s up to your team to:

- Sift through every expense report line by line

- Confirm each line item is within your company’s expense policy

- Update your accounting system (Not all accounting systems can import spreadsheets, so someone might have to input every single transaction manually)

- Figure out how best to reimburse expenses – one-off bank transfer? Cash payment? Through payroll? Some other way?

The biggest change to this process an expense management platform like Soldo makes is eliminating the need for payment runs. Each employee card is pre-loaded with company money. And this means staff are never out of pocket, so they don’t have to be reimbursed.

But expense management platforms also reduce admin. Soldo integrates natively with Xero and has an API you can use to integrate it with your company’s accounting software. The upshot is that transaction data gets imported automatically, so there’s no need for manual input.

Best of all, you don’t have to wait for staff to submit their expense reports (often a whole batch of them at one go). You can log on to the Soldo dashboard at any time of the month and review transactions in real time.

Time is money: spend it on what matters

Time is money: spend it on what matters

Is your expense management process still mostly manual? Switching to an expense management platform can save you grief, time, and money.

Our ROI calculator reckons Soldo could save the finance team at a company with 300 employees and £50 million in revenue a total of 67 hours a month. And that’s on top of 45 hours saved from employees not having to file expense claims, and money saved thanks to increased visibility and control.

All in all, you could be looking at £119,930 a year in savings (or much more if your company is bigger).

Why not invest that money in growing your business and keeping your staff happy and motivated, instead of burdening them with hours of mind-numbing admin?

With these benefits, it’s certainly worth a shot.

Keeping employee spending in check

Stop expense management from taking over your workday and hurting your bottom line. Find out how much time and money Soldo could save you.