Volunteers give up so much of their own time, it’s only fair they’re properly compensated. Read on for the best ways to handle charity expenses.

Expense management for charities

Volunteering is, by definition, unpaid. But, as a charity, it’s good practice to reimburse volunteers’ travel and other expenses.

Volunteers are the backbone of the charity sector, giving up billions of hours each year. In the course of their duties, volunteers can incur various costs, from train fares to lunches on the go. Making sure they aren’t out-of-pocket acknowledges their immense contribution. Plus, it encourages those who might not have considered volunteering for financial reasons to join in as well.

But what counts as a travel expense for volunteers? How do you go about reimbursing expenses? And what’s the best way to manage the process without getting bogged down in admin?

What are HMRC’s rules around charity travel expenses?

HMRC says that, as a rule, volunteers’ expenses don’t have tax implications. This is because there can only be a tax liability if a person holds an office or is employed and earns money from that office or employment. And of course, volunteers aren’t employees.

The upshot is that you can reimburse your volunteers without having to worry about reporting to HMRC or deducting income tax and National Insurance contributions. That said, reimbursement amounts may become taxable, and you’d have to report them if:

- You reimburse more than what the volunteer spent

- You use scale rates and HMRC thinks what you’ve paid isn’t reasonable. Scale rates are flat rates that reimburse expenses which are ‘widely incurred in broadly similar amounts’. Travel expenses fall under this category.

What is reasonable when reimbursing charity travel expenses?

According to HMRC’s guidelines, scale rates:

…should be set at a fairly modest level which, taking one day with another, will be enough to cover the relevant expenses. They should not be pitched at a level to cover the highest amount that an employee [or volunteer] might spend.

A simpler but, unfortunately, less clear answer is that what a ‘reasonable expense’ is often depends on the circumstances. With this in mind, it’s usually a good idea to use HMRC’s own scale rates.

Because they’ve issued them, HMRC accepts that they’re reasonable. So using them to pay back your volunteers’ travel expenses is unlikely to create issues.

What are HMRC’s scale rates?

Charity travel expenses: mileage

HMRC publishes a scale rate for mileage travelled in an employee’s or, in this case, a volunteer’s personal vehicle. These mileage scale rates are called Approved Mileage Allowance Payments (AMAP). They apply when a volunteer uses their personal vehicle on charity business. It doesn’t apply to the use of company cars, because HMRC considers a company car to be a benefit in kind, which means you’d have to tax the volunteer on it.

The AMAP rates cover a proportion of:

- Fuel

- Maintenance

- Insurance

- Wear and tear

The AMAP rates don’t cover parking, tolls, congestion charges, or other travel expenses. You’ll have to reimburse these separately.

The current mileage allowance payments are:

- For cars and vans, 45p per mile for the first 10,000 miles and 25p per mile for every mile over 10,000

- Motorcycles, 24p per mile

- For bicycles, 20p per mile

You can also pay an additional 5p per mile for every passenger.

Charity travel expenses: subsistence

If a volunteer has to travel away from the location they usually volunteer, you can pay a flat rate to cover the cost of food and drink.

HMRC’s subsistence scale rates are:

- A £5 breakfast rate where the volunteer has to leave home before 6am and doesn’t have time for breakfast

- £5 for a meal if they’ve been away for at least 5 hours

- £10 for two meals if they’re going to be away for 10 hours or more

- A £15 late evening meal rate if they’ll finish after 8pm

HMRC says the breakfast rate and late evening meal rate are exceptional, so they wouldn’t apply if the volunteer regularly starts before 6am or works past 8pm.

How to create an effective expense policy as a charity

The most efficient way to manage your expense policy as a charity is to split volunteers’ expenses into categories; not to increase admin, but just so you and your volunteers are on the same page. Once you have your policy up and running, it’ll make things a lot more streamlined.

It makes sense to categorise based on the scale rates provided by HMRC, because as we’ve mentioned, this is the most stress-free way to handle expenses where you can. Make your volunteers aware of these rates and what they can be expected to be reimbursed, and you won’t have to file an expense claim form with HMRC.

You can base another category on HMRC’s subsistence scale rates. This should cover any meals your volunteers purchase in the performance of their duties. Again, make your volunteers aware of these guidelines, have them keep hold of their receipts, and the reporting will be done in no time.

The third category would apply to anything not covered by these scale rates. As to what these expenses could be, it depends on the nature of your charity, but it could be train fares, industry-specific equipment, or other purchases necessary to fulfil their role as a volunteer.

This is the key point for expenses not specifically covered by HMRC: as long as the expense incurred was necessary for the volunteer to carry out their work, and as long as you don’t reimburse them for a larger amount than what they spent, then tax shouldn’t come into it at all.

How to manage charity travel expenses effectively with a spend management platform

If you establish a policy and remain strict about reimbursements, then you don’t need to worry about tax deductions, National Insurance, or forms.

That said, if you rely on manual processes, the admin will still be a nightmare.

Volunteers will have to produce physical receipts as proof of their travel expenses. And, in the case of mileage, you’ll need to work out how much of it was for charity business. Which means volunteers will need to keep mileage logs.

Aside from potentially putting volunteers off, all this admin puts a strain on your finance team’s limited resources. There’ll be endless hours sifting through spreadsheets, matching transactions to receipts, crunching numbers, and figuring out the best way to process payments.

Sandra Curran, Purchase Ledger Coordinator at Making Space, a charity that provides social care across the UK, calls the process:

… monotonous, [and] quite messy. Some of our sites would have three-and-four-page statements. So the number of receipts that would come through was a nightmare.

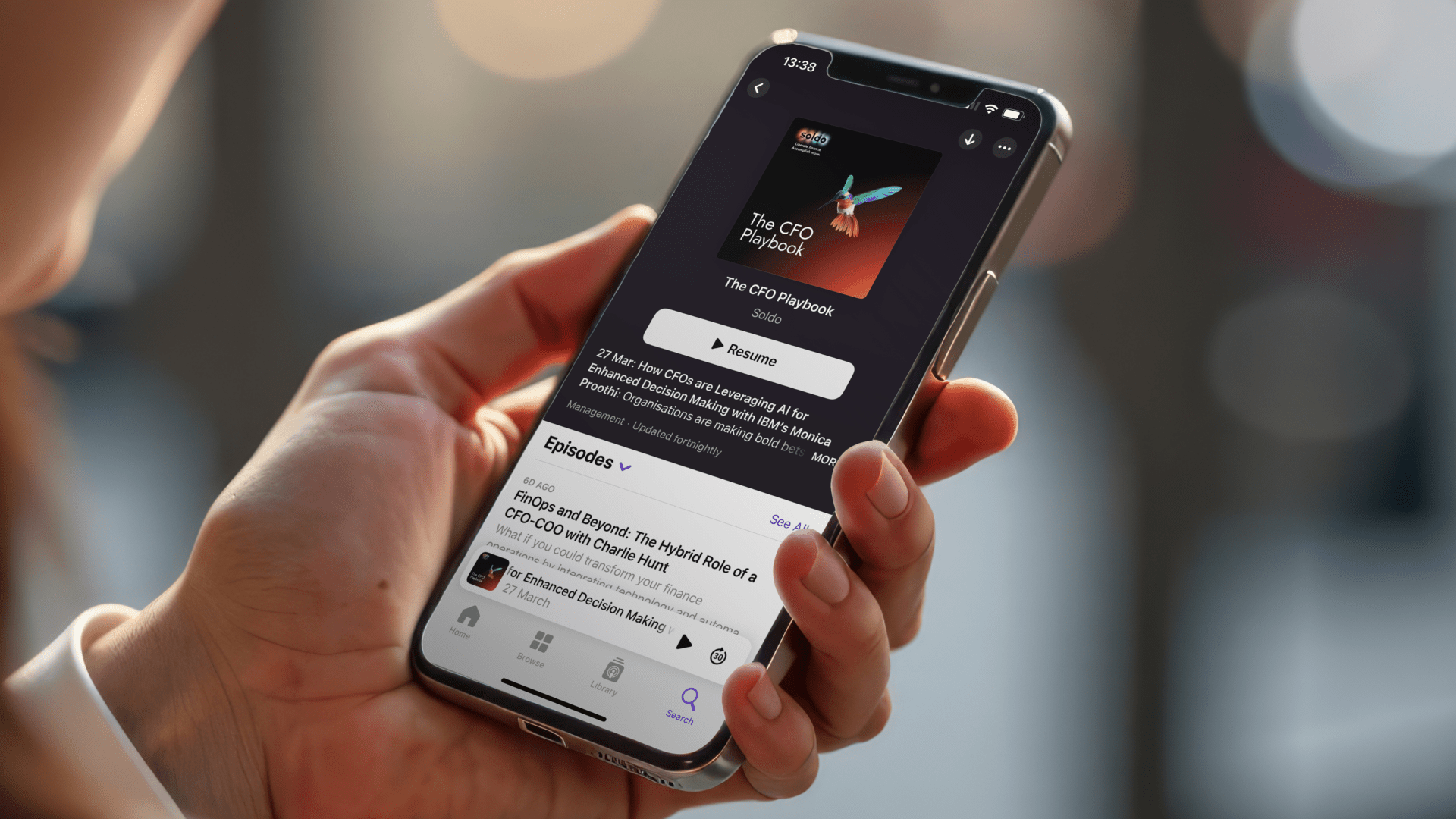

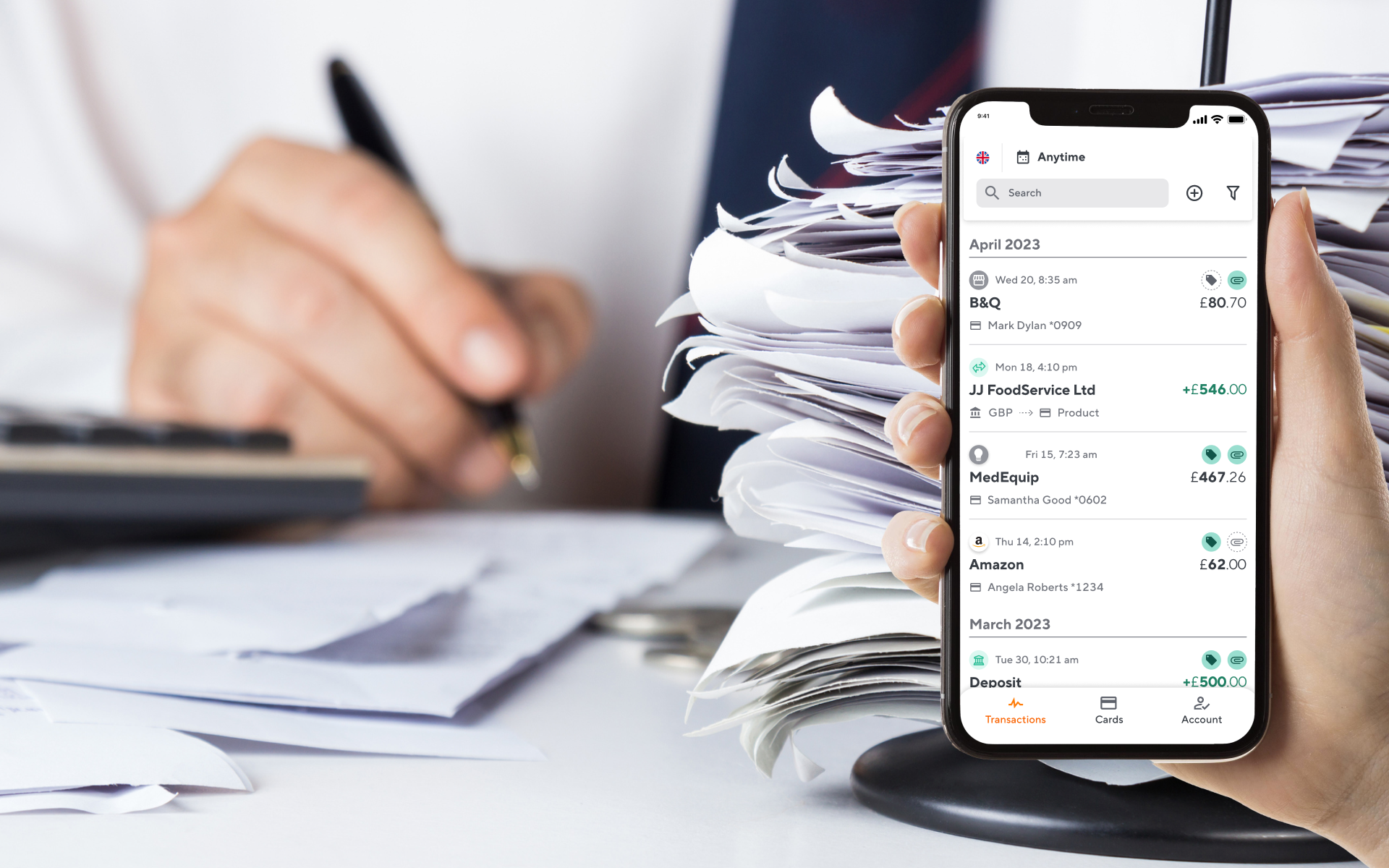

Thankfully, there’s another way. With Soldo, you can give your volunteers a prepaid card (as well as a virtual card) they can use to pay for expenses. This means they’re not out of pocket, so you don’t need to reimburse them. And because you can set transaction limits and restrict what kinds of purchases they can use the card for, you can make sure all expenditure is compliant with HMRC.

Curran says that using Soldo has cut the time Making Space spent on admin from six days a month to half a day each month.

Soldo also lets you issue non-nominative cards. In other words, a card doesn’t have to be in someone’s name, so you can assign it to a volunteer and then switch to another volunteer if needs be.

Best of all, volunteers can upload receipts onto the Soldo app. And you can view transactions in real time and link everything to your accounting system, so there’s no need for manual data input.

In 2018/19, 19.4 million Brits volunteered their time, at an estimated value of £23.9 billion. Soldo can help you show your appreciation by making sure they’re not losing out. All while giving you more flexibility and freeing you up to crack on with your important work.

Slash admin and focus on what matters by upgrading to Soldo today.