Learn how integrating a few of the best accounting tools can keep your bookkeeping straightforward with our comprehensive guide.

Manage your expense accounting in one place

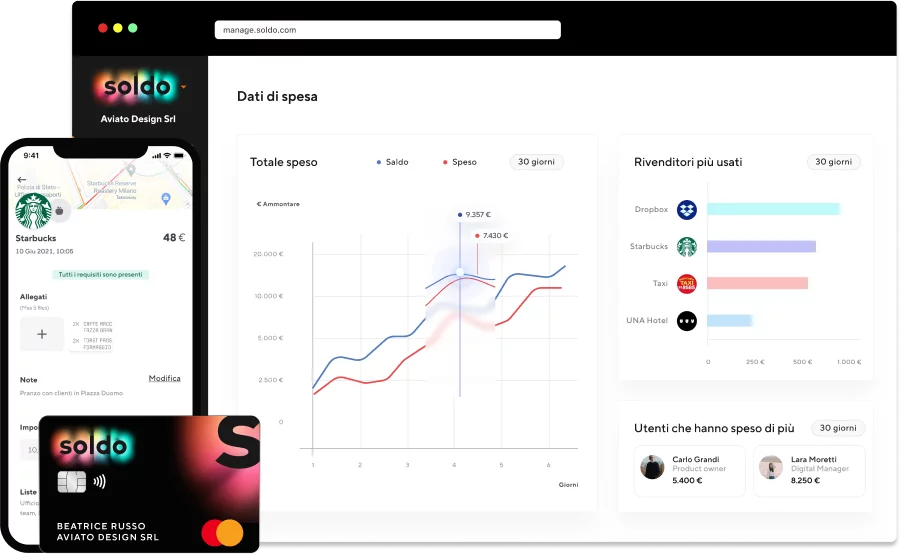

Prepaid business cards can be used anywhere – and they give you much more control and oversight than traditional company cards. Signing up with a prepaid provider such as Soldo, will make managing all your spending simple.

Here are a few common ways our customers utilise their prepaid accounts.

Software subscription management

Most workers today rely on a few software subscriptions to get their job done. Chances are, the different teams in your business each require a unique stack of tools – which can make managing all the subscriptions tricky.

With prepaid cards, you can delegate the task of choosing and paying for subscriptions to each department, increasing autonomy and encouraging responsible spending.

There are a few ways to achieve this. For example, you could allocate extra budget to department leaders’ cards, with rules that restrict transactions to software subscriptions. Or you could create a single shared account for online payments, keeping everything in one place.

Online advertising

If you’re running a sophisticated online advertising strategy, then tracking your expenditure across various platforms can be almost impossible, which often leads to accounting issues later on.

One solution is to allocate specific accounts for media buying using prepaid cards which automatically track and record every transaction. With Soldo’s virtual cards, you don’t even need to worry about a piece of plastic – everything is handled online.

Plus, Soldo’s comprehensive reporting tools make it simple to analyse your media spend, identifying trends and areas for operational improvement.

Petty cash

Petty cash is a poor way to manage company expenses, dragging on efficiency and transparency. Prepaid cards enable you to run a completely cashless office, so you’ll never have to puzzle over miscounted coins – or hunt down missing receipts – again.

You could set up an account that’s purely for occasional purchases, or give each employee additional funds for milk runs and more. Either way, every purchase will be tracked automatically, so there’s no extra work required.

Travel expenses

Business trips can be great for building relationships and growing sales – but all too often, they create an accounting headache. Trawling through a mass of receipts, calculating mileage and sorting personal from allowable transactions is time intensive and morale draining.

The rules and budgets that come with prepaid solutions make managing travel spend much more straightforward. You can limit the usage of each card to what’s permitted within your policy, so there’s no chance of misuse. And with Soldo’s real-time monitoring, reconciling travel transactions takes seconds.

Entertainment expenses

Traditional company cards lack the functionality and clarity required to properly track entertainment expenses. You can’t sort between VAT-exempt transactions, or limit spending when you’re not around.

With prepaid cards, you can use rules to separate VAT-exempt spending, saving your accountant time. Plus, with limits and budgets, you control spending before it happens. So there are no more surprise entertainment claims.

Employee benefits

The flexibility that prepaid cards bring enables you to choose your preferred strategy for managing employee benefits. For instance, you could give every single employee in your company a virtual account for purchasing gym memberships or development opportunities. Or, allocate additional budget to senior staff to spend as they see fit.

However you choose to handle benefits spending, you’ll get complete transparency over every transaction. There’s no need to manually approve and record every single purchase, so it saves you and your team time – while increasing autonomy and responsibility.

Supercharge your accounting software

What is accounting software?

Accounting software is a type of application that businesses use to handle their financial admin – such as raising and tracking invoices, reconciling transactions, calculating turnover and managing tax obligations.

There’s a huge variety of accounting software available, to suit companies of all types and sizes. Some enable you to meet the basic requirements of the UK government’s Making Tax Digital initiative, while others come with advanced features and tools to help you take complete control of your finances.

Do I need accounting software?

Most UK businesses today will need accounting software of some kind. If you’re over the VAT threshold for taxable income, then you’ll need to keep digital records by law – but even if you aren’t, then using dedicated software instead of maintaining books manually is still recommended.

Managing accounts using spreadsheets requires a lot of time and effort if your company has even slightly complex processes. Software makes the task far more manageable, freeing up your time for the jobs that matter.

Plus, modern accounting apps integrate with other tools to make your life even easier. Xero, for example, has hundreds of integrations listed on its app marketplace. These can eliminate manual data entry, bring powerful additional features and more.

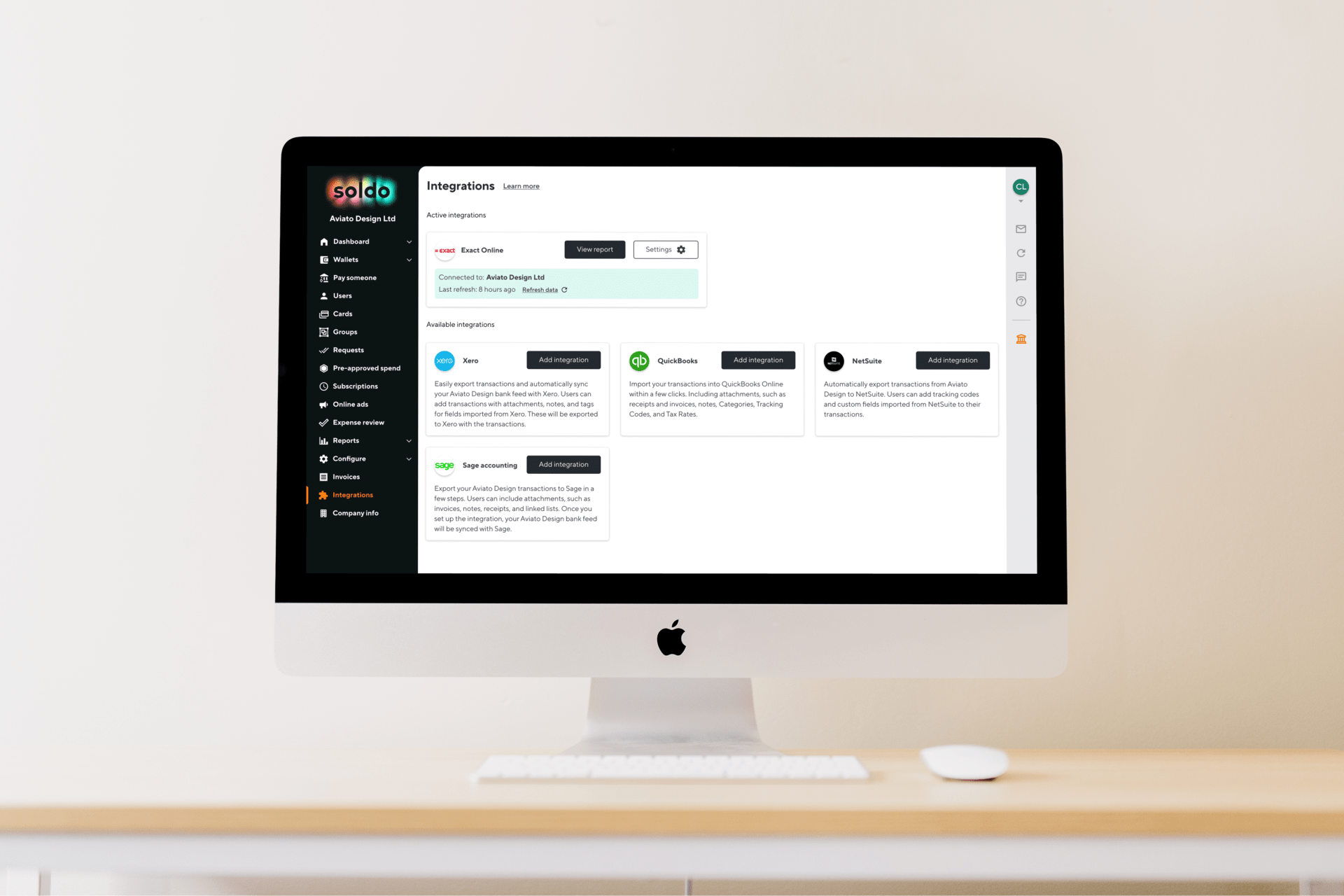

Does Soldo integrate with my accounting software?

Soldo can integrate with any modern accounting solution. Export transactions in a wide selection of formats in just two clicks, putting an end to manual data entry. And if you use Xero or Quickbooks Online, then you get to take advantage of comprehensive native integrations.

Every transaction is shared with Xero automatically, so there’s no need for a manual statement import. All you need to do to reconcile and publish records is click a single button.

Take control of your financial admin with prepaid cards

Prepaid cards offer a complete solution for managing your business expenses – taking the hassle out of monitoring and controlling day-to-day spending. If admin is eating up too much of your or your team’s time, then prepaid cards could be the answer.

- Automate expense accounting Checking and inputting receipts, invoices, mileage reports, petty cash vouchers and expense reports can be a grind. Prepaid cards free your team up for value-adding tasks

- Increase security Prepaid cards come with budgets and limits that put you in total control of spending – and they’re 100% siloed from your primary account

- Capture everyone’s receipts digitally HMRC requires a record of every transaction – but that doesn’t mean you need a messy folder full of receipts. Instead, store everything online with a prepaid card solution

- Reconcile expenses in minutes Say goodbye to the days of expense detective work. Track and record transactions as they occur

- Share information with your accountant Give your accountant or bookkeeper access to your expense data, so they can work faster – and deliver better advice on how to keep spending in check