Everything you need to know about managing employee travel

How can you manage travel and accommodation expenses in the most financially secure way? We’ll outline what your employees can claim as travel expenses and how to manage and automate employee travel expenses.

Employee travel & tax relief

Many of the expenses that your employees accrue on a work-related excursion qualify for tax relief from the government.

That said, there is no tax relief in regards to ‘ordinary commuting’ or standard travel from home to work. Tax relief only comes into play if a workplace is temporary; a location your employee visits irregularly for a limited period of time. It is not their designated permanent workplace. This is an important detail to grasp and you can learn more by reading HMRC’s detailed employment income manual.

What can employees claim as travel expenses?

In general, employees are entitled to claim tax relief for money spent on:

- Public transport costs

- Hotel accommodation in the event of an overnight stay

- Food and drink

- Congestion charges and tolls

- Parking fees (but not parking fines, speeding tickets or other penalties)

- Business phone calls and printing costs

- Fuel and electricity for use of a company car

- Fuel, electricity, MOTs, road tax and repairs for use of their own vehicle, up to the approved mileage rate

- Professional fees and subscriptions to approved professional organisations if required to be a member of that organisation for work

- Incurred expenses related to working in a home office, if working from home is required rather than voluntary. This excludes things that are for both personal and business use such as rent.

- The cost of substantial equipment needed to complete work, such as a computer

- Certain small items that will last less than 2 years, such as a uniform, work clothing and tools

- If the above relates to business travel or business relations, you should be able to claim tax relief.

Learn which travel expenses can be claimed and which can’t via HRMC’s Tax and National Insurance contributions for employee travel article.

A structured travel expense policy limits overspending

There are nuances as to what employees can claim as a travel expense. You should therefore have a detailed policy to help you to maintain a sense of order and transparency.

For example, it’s not always clear what qualifies as private or personal vs. work-related travel expenses. Let’s say an employee travels from home to a permanent workplace. They then travel from the permanent workplace to a temporary workplace. In this instance, the first leg of their trip is not eligible for tax relief but the second leg is. Grey areas like this should be outlined in your policy.

A structured policy will help limit employee overspending. In a Soldo survey with over 2,500 UK employees, staff expense claims cost UK businesses £1.9 billion a year. Employees spend an average of £117/month on unauthorised expenses.

38% of employees claim expenses for things that they know are off-limits or exaggerated. For example, overstating the number of travel miles they needed or altering taxi receipts to inflate the fare.

A clear-cut policy combined with technology can nip behaviour like this in the bud.

Employee travel expenses policy best practice

Here are some best practices to implement for a successful expenses policy:

- Clearly define the rules, both in terms of spending and reimbursement

- Keep your policy simple and easy to understand

- Make it fair and equal amongst all employees regardless of role

- Ensure it has flexible limits within reason to allow for employees to make easy choices with minimal stress. For example, whether to take a plane or a train

- Distribute it as part of your onboarding process and make it easy to find

- Emphasise why the rules exist to eliminate questions or concerns

- Get buy-in from your team up-front so that everybody is on the same page

- Give your managers the tools they need to properly enforce the rules

- Pay promptly so that employees never have reason to feel aggrieved

- Capture receipts for every expense, every time

Soldo helps manage employee travel expenses

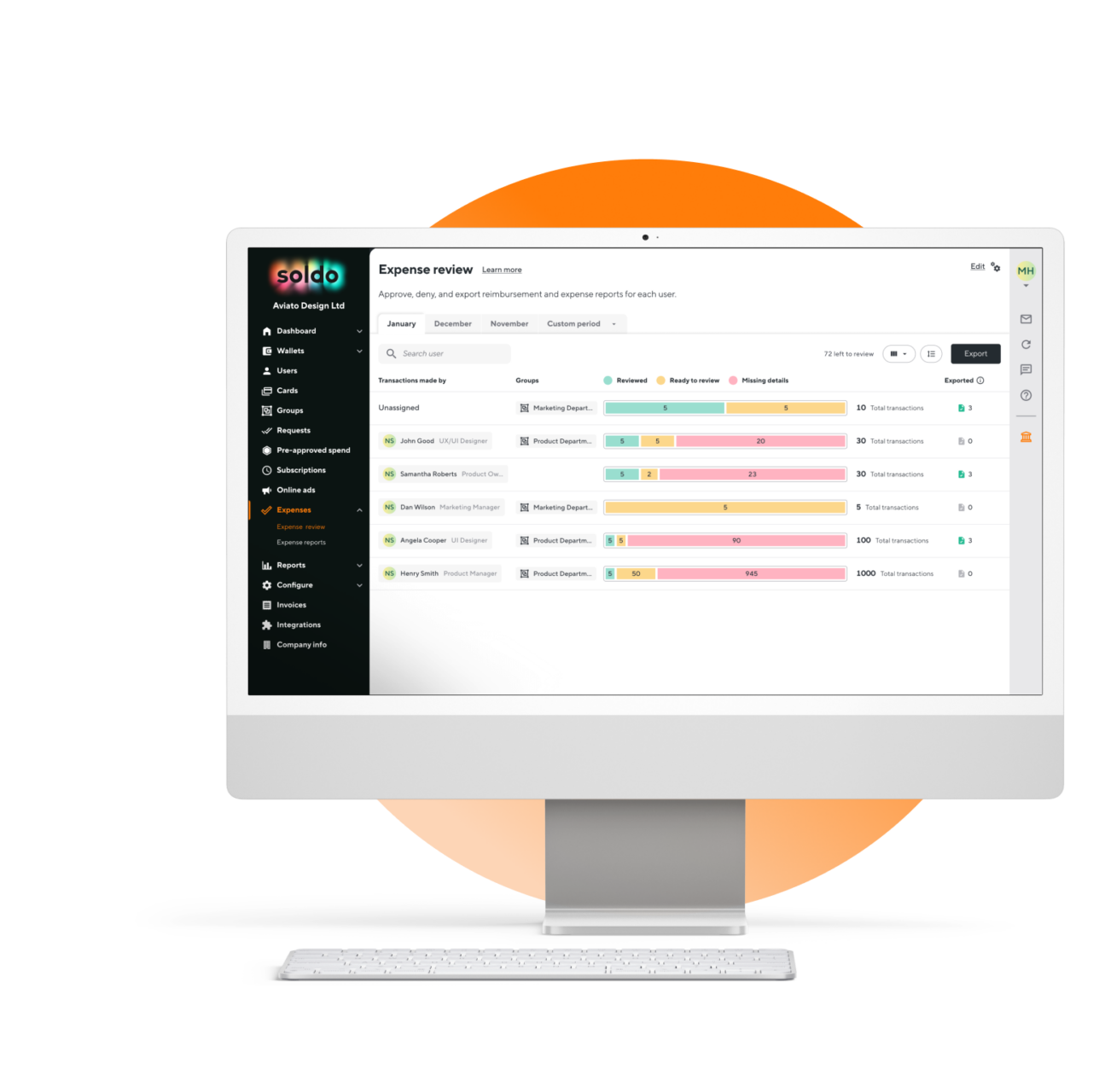

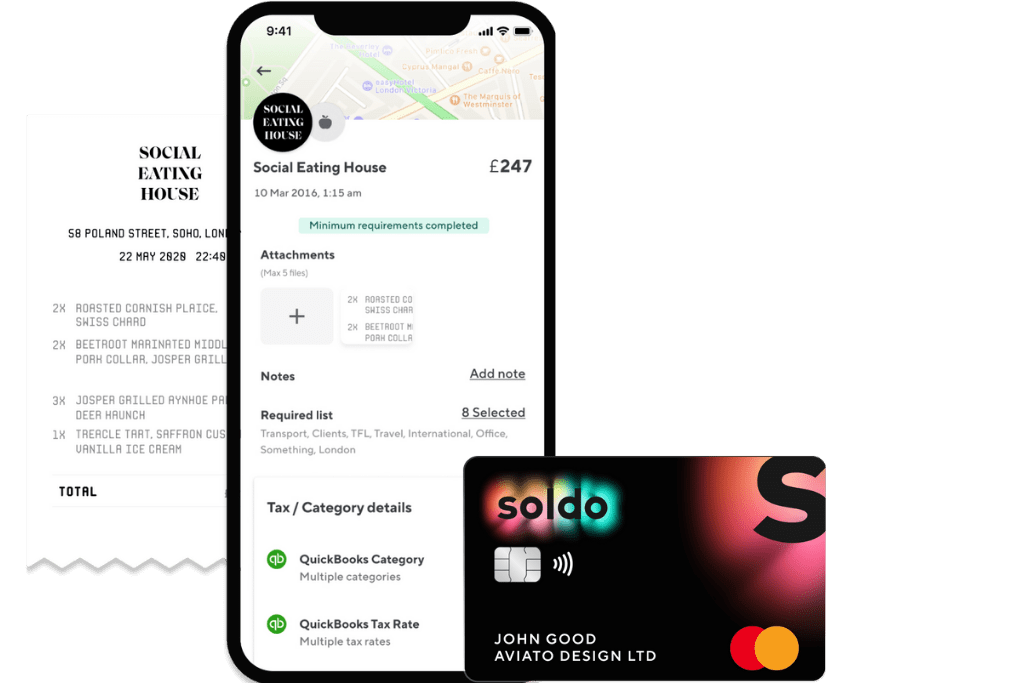

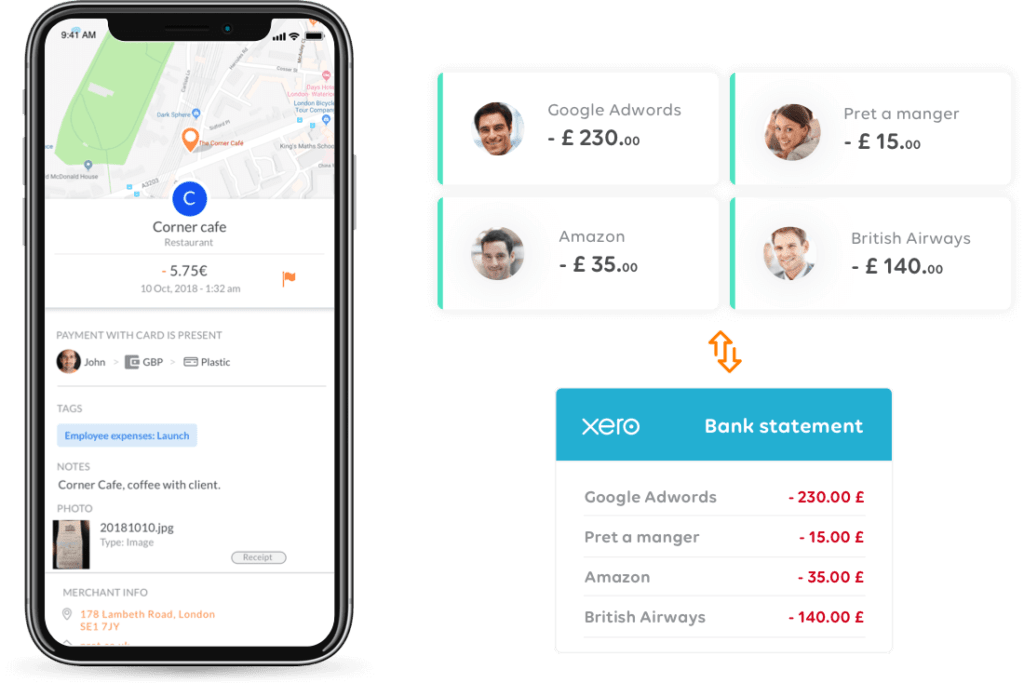

Technology like Soldo makes managing a detailed policy a breeze. With Soldo, you can automate expense management and use prepaid cards to manage employee travel spending.

You can guarantee that your employees don’t overspend with a preset budget for their prepaid and virtual card. You can even set flexible spending limits by category so they don’t go over the preset values. If an employee requests more funds, you can instantly transfer more funds with the click of a button.

Track travel expenses in real-time

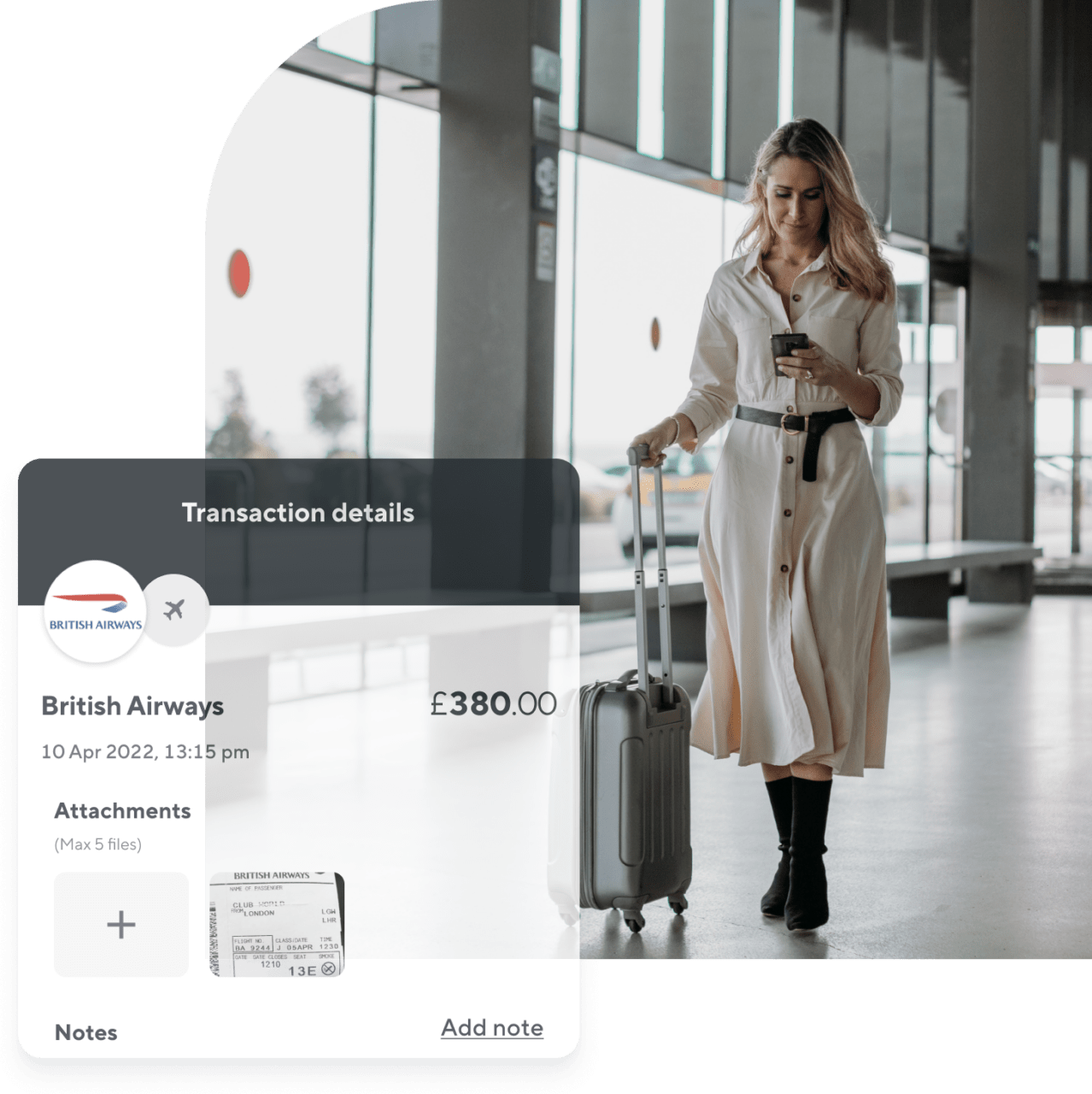

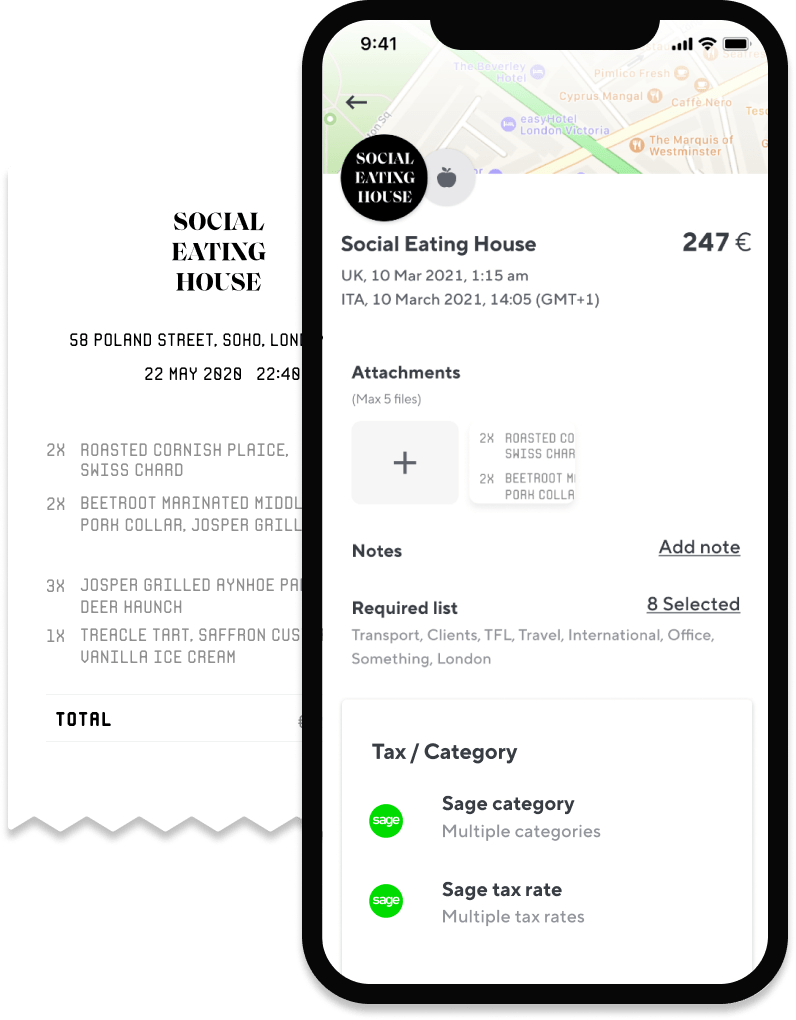

Soldo makes it easy to claim and track travel expenses. Employees can instantly capture receipts with the Soldo mobile app. The don’t need to store paper receipts and complete time-consuming expense forms.

Unlike other prepaid business card providers, Soldo lets you issue separate cards with their own unique numbers. Each travel transaction runs through Soldo and appears in your central admin console so you can see what’s being spent—instantly.

Soldo’s admin console provides a summary of each employee’s transaction history and spending limits. This means you can update their budgets as needed.

Low foreign exchange fees when traveling abroad

Prepaid cards also protect your employees from incurring foreign exchange fees on personal or company credit cards. Soldo’s low fee FX business cards have a fixed 1% foreign exchange fee to keep your travel costs low.

Click here for more information on Soldo’s fees >

Switch to Soldo today

The rules around employee travel expenses can be confusing. It’s important that you familiarise yourself with the government rules and regulations before writing, implementing or updating your travel policy.

Once a policy is in place, managing travel and accommodation expenses shouldn’t be a headache. Ditch outdated paper systems and company credit cards by investing in technology that saves your finance team valuable time.

Soldo is your ticket to smarter travel spending.