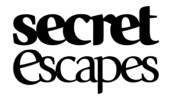

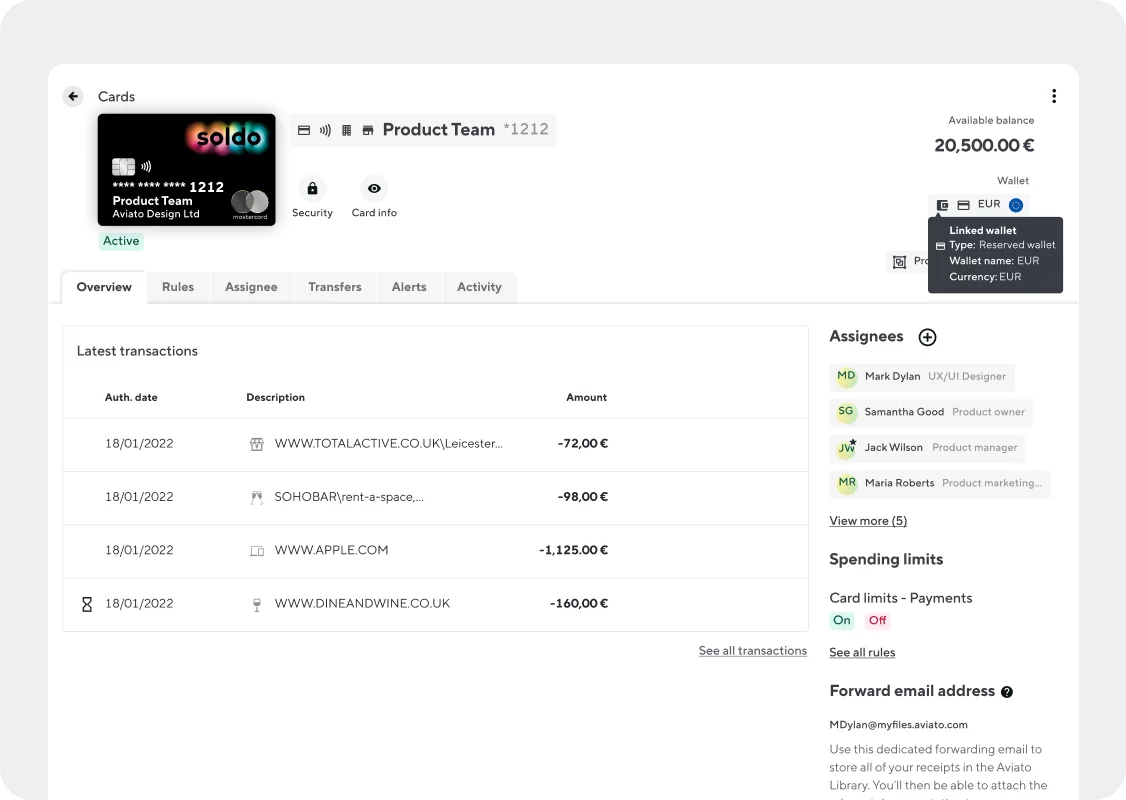

With Soldo company cards, you control who spends company money, how much, on what, and which budget they use.

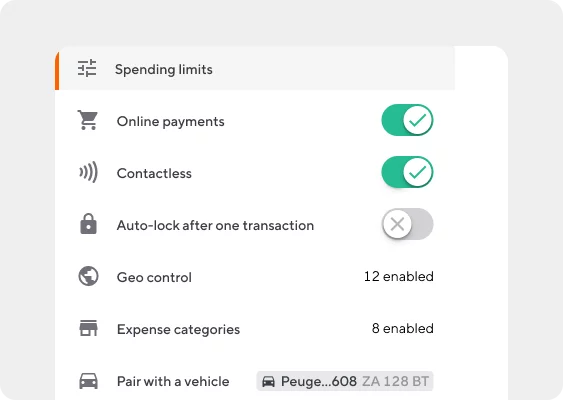

Set custom rules and limits for each card in a few clicks to prevent overspending , without micromanaging every transaction.

Business Expense Cards that empower your employees.

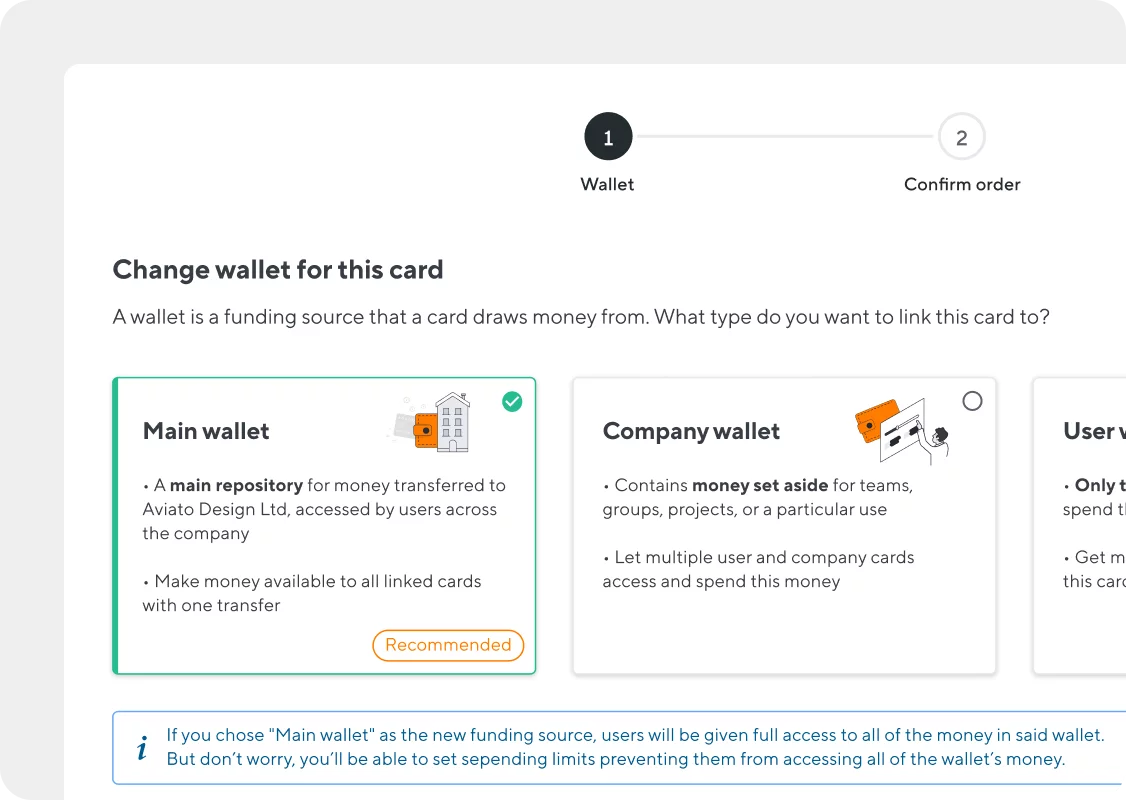

Prevent overspending: keep budgets seperate, set custom limits and freeze cards instantly

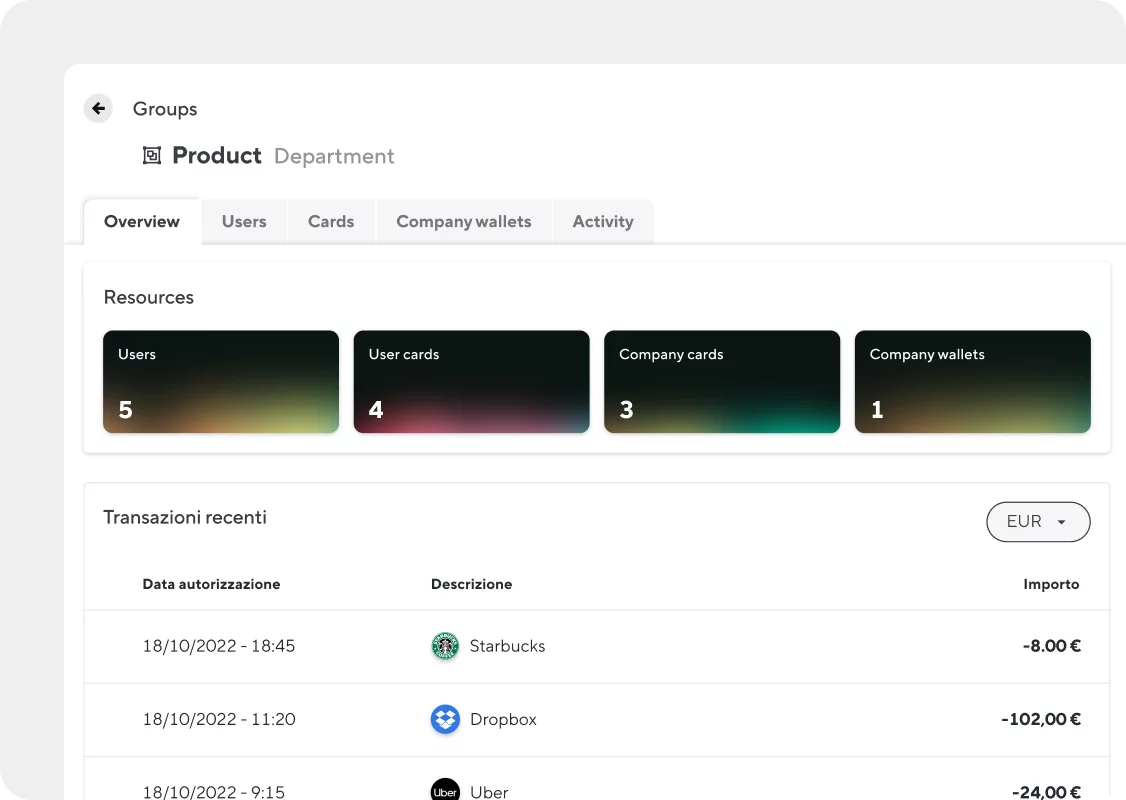

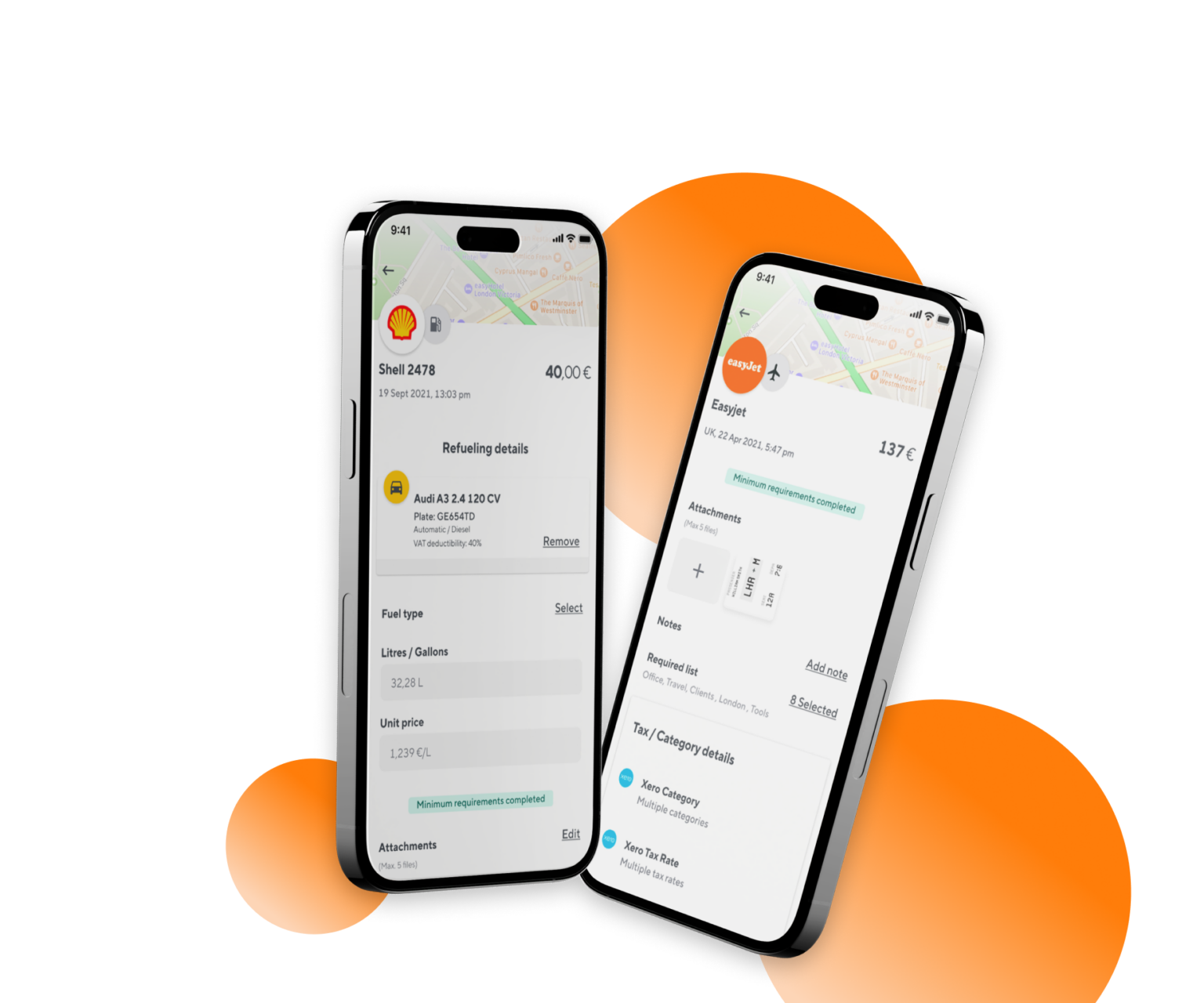

Make expenses easy – no more paying out of pocket, chasing receipts or need for reimbursement

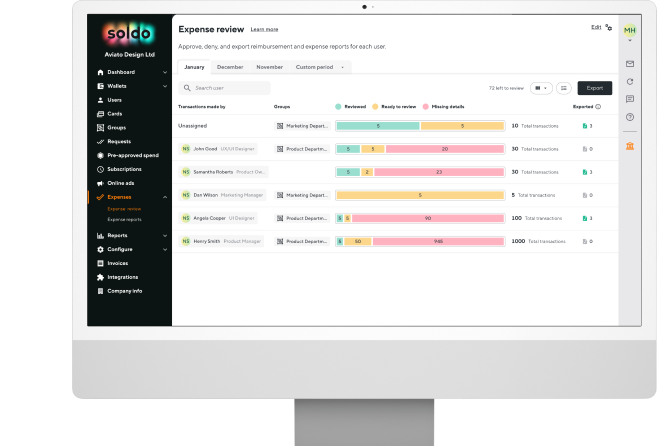

Save hours with real-time expense tracking, automated reporting and accounting software integrations