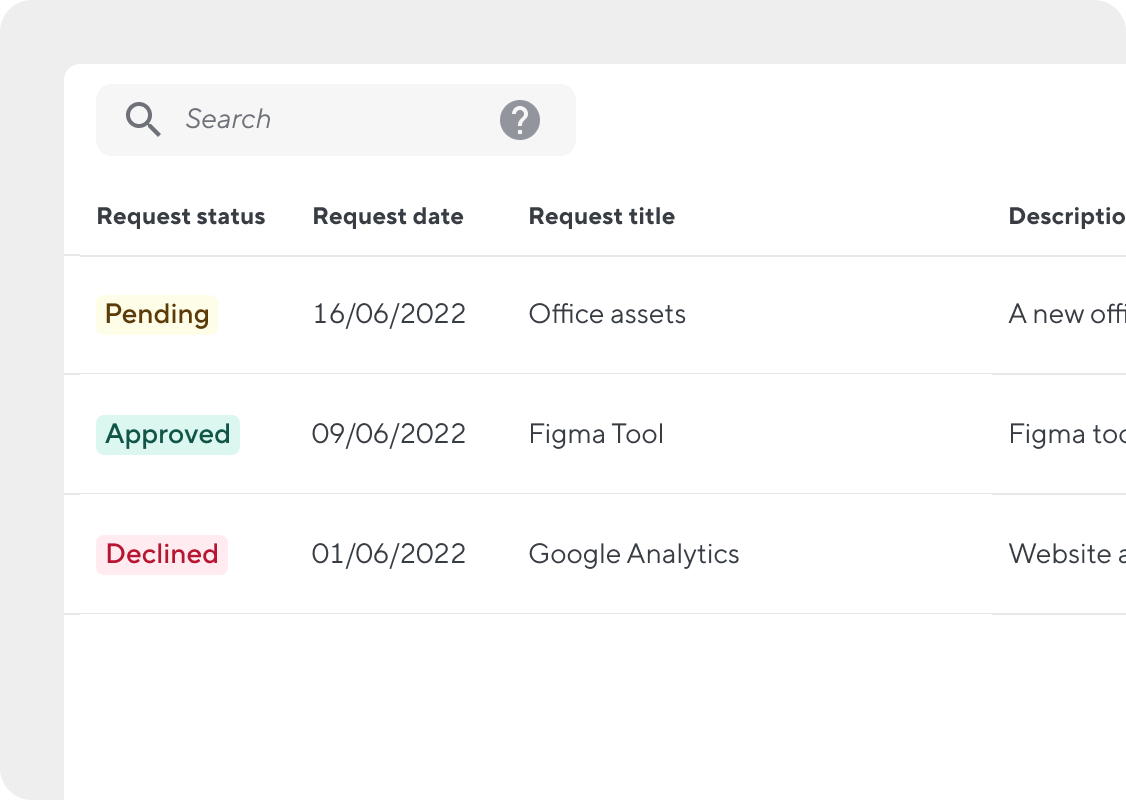

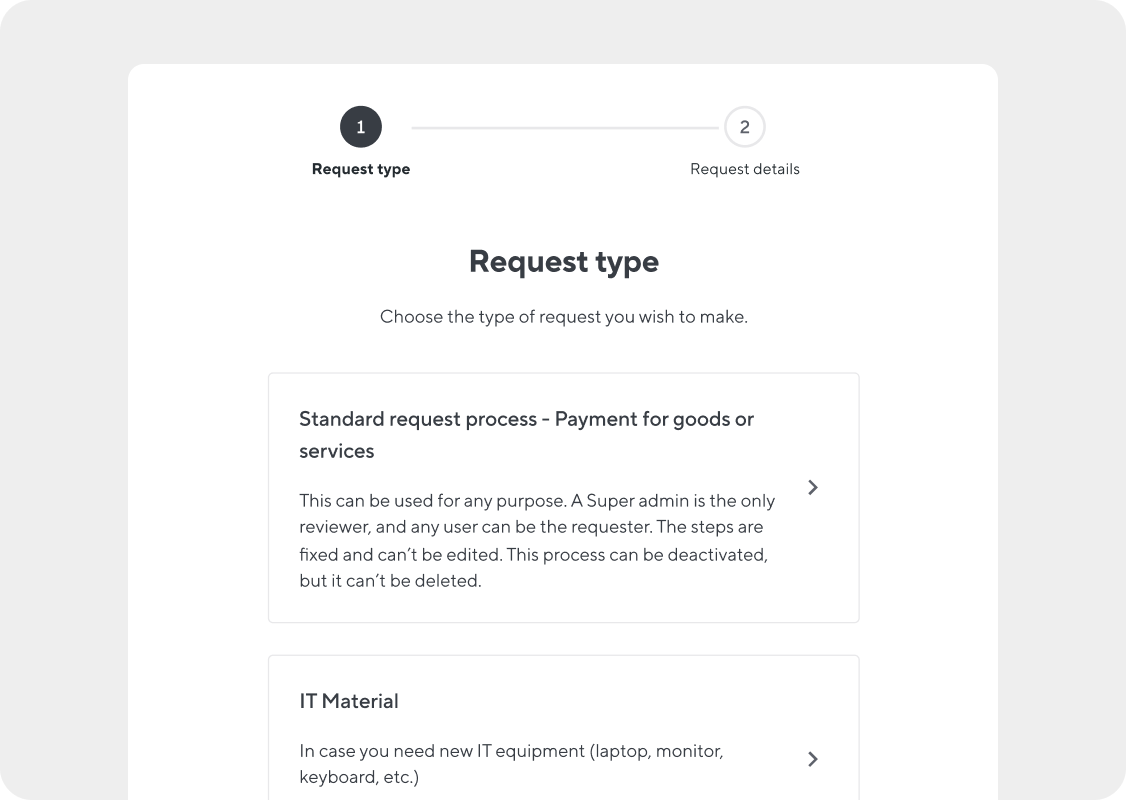

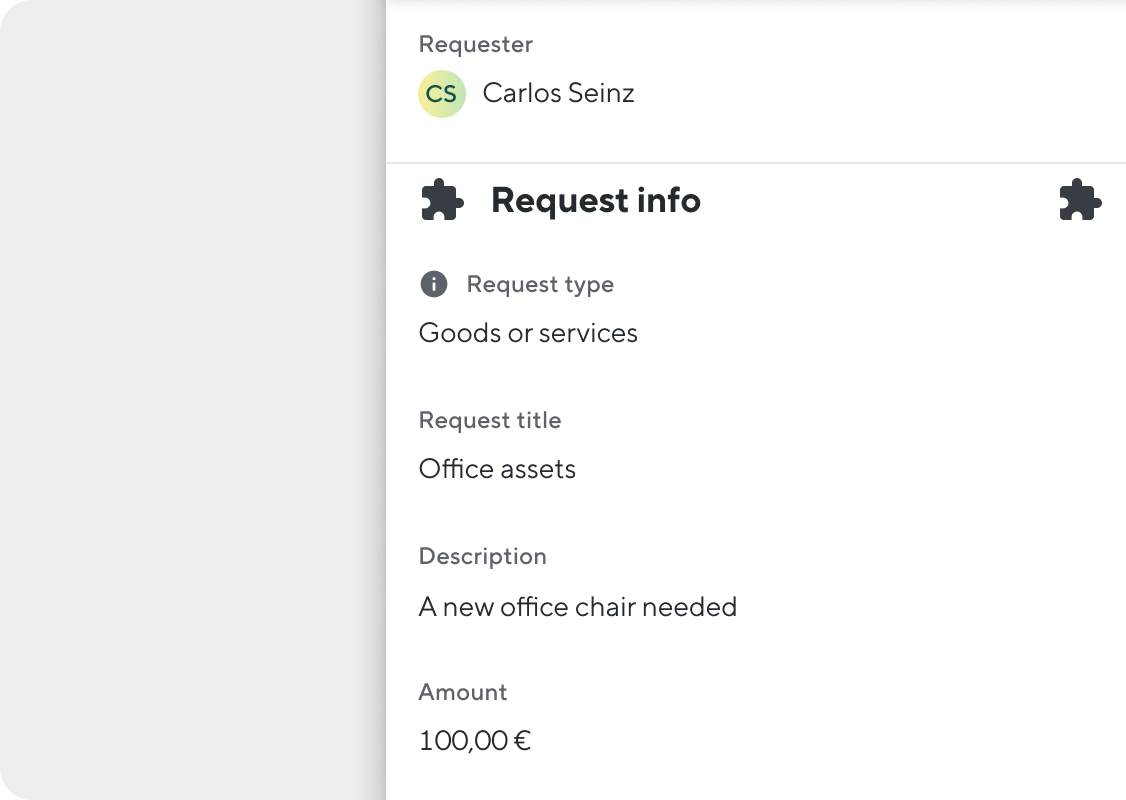

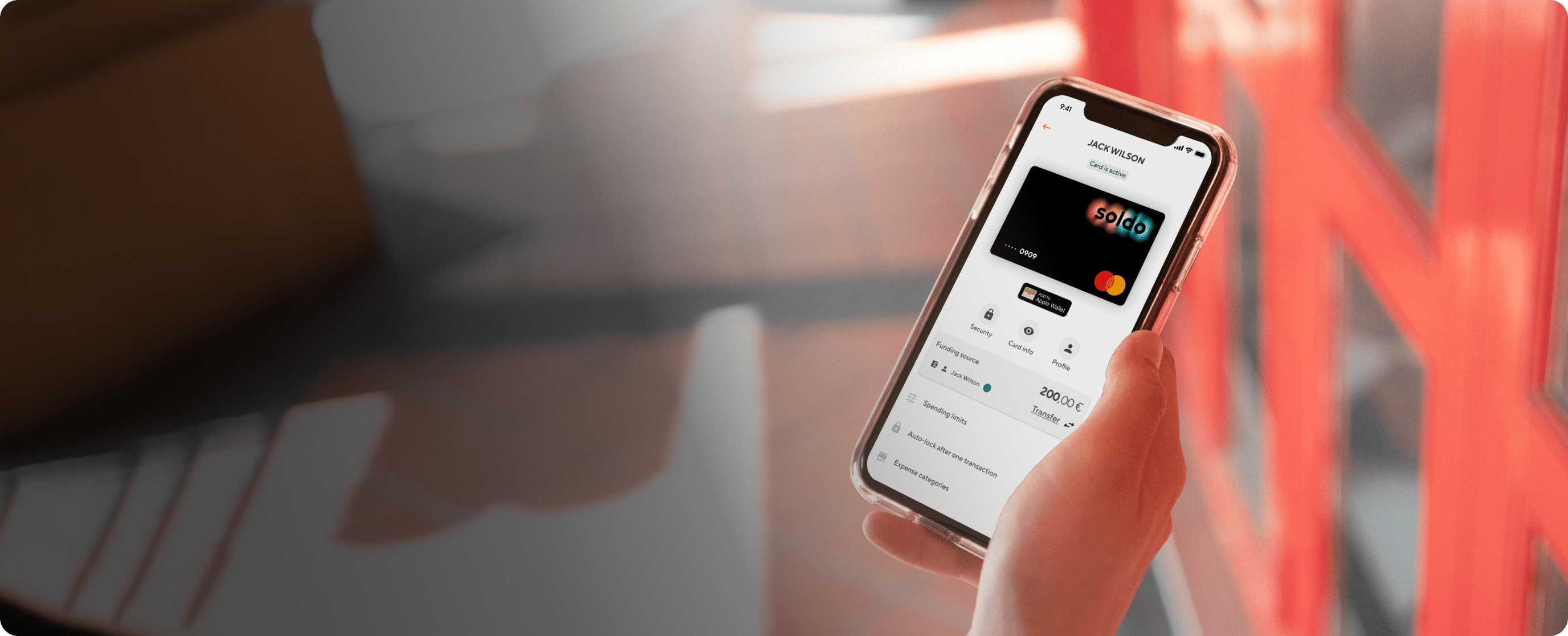

Users can make short-term spend requests (for expenses like short business trips, online events, or courses) at any time. Email notifications route these seamlessly to approvers, to avoid frustrating delays.

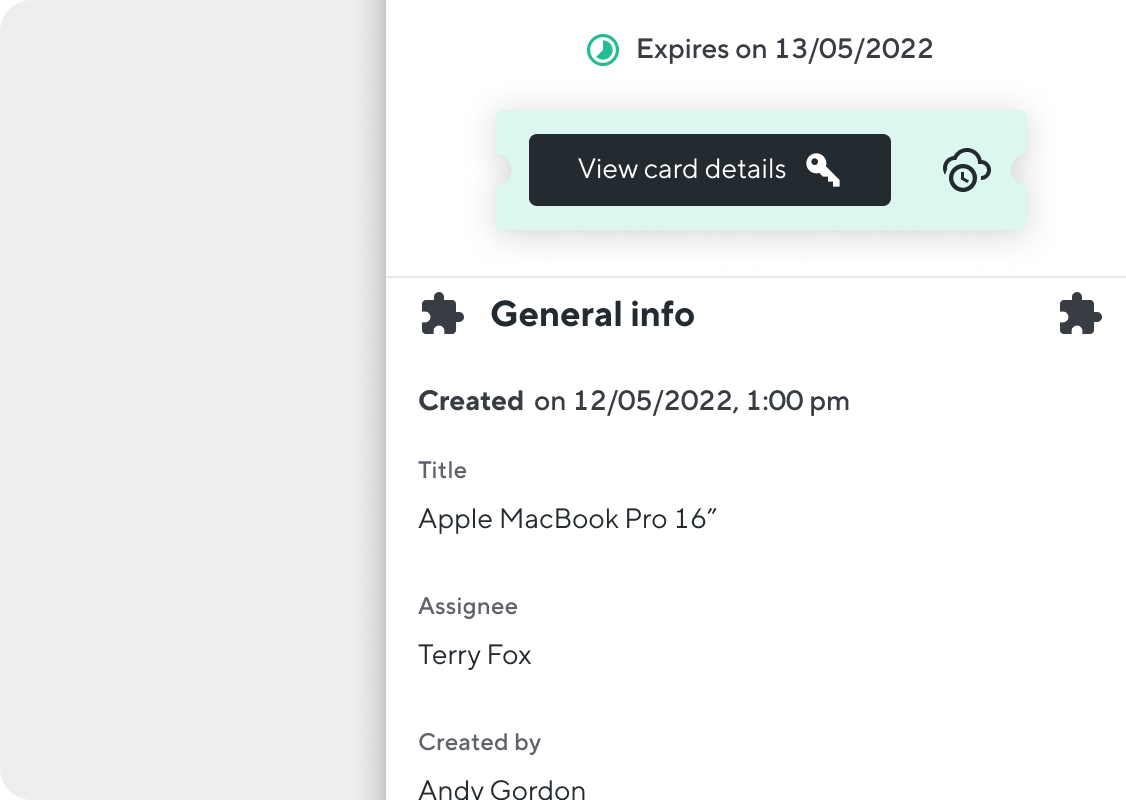

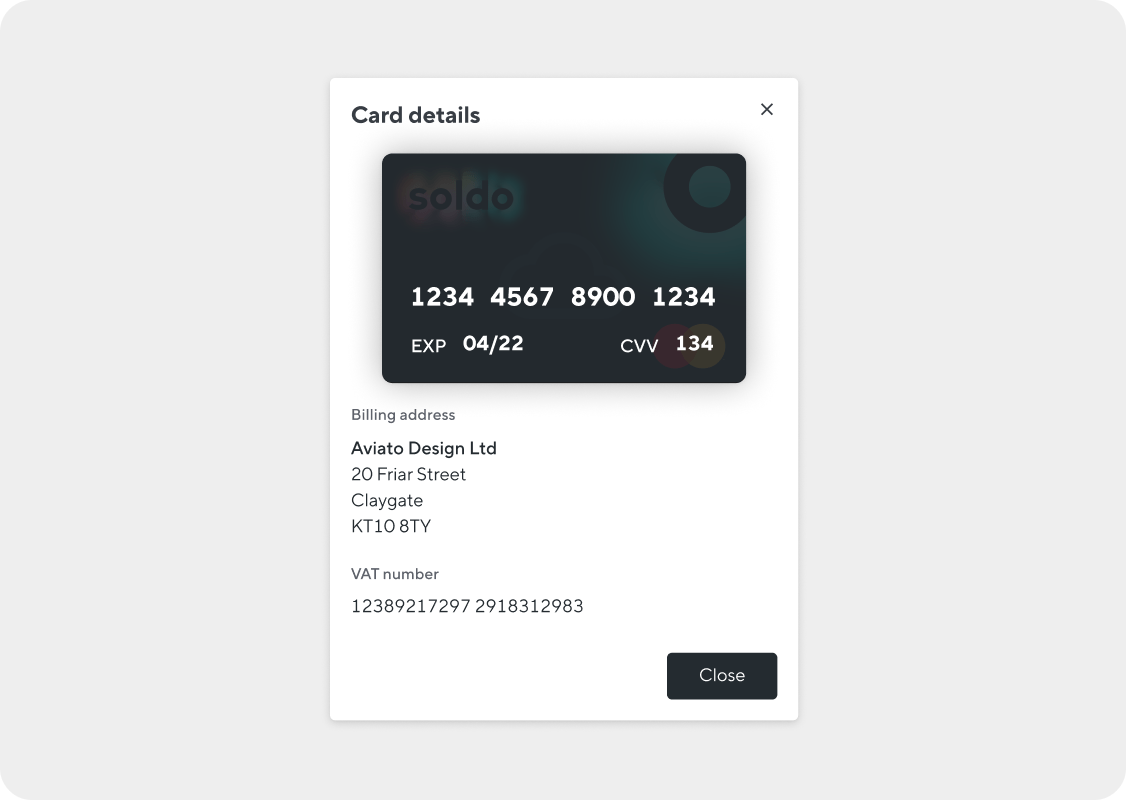

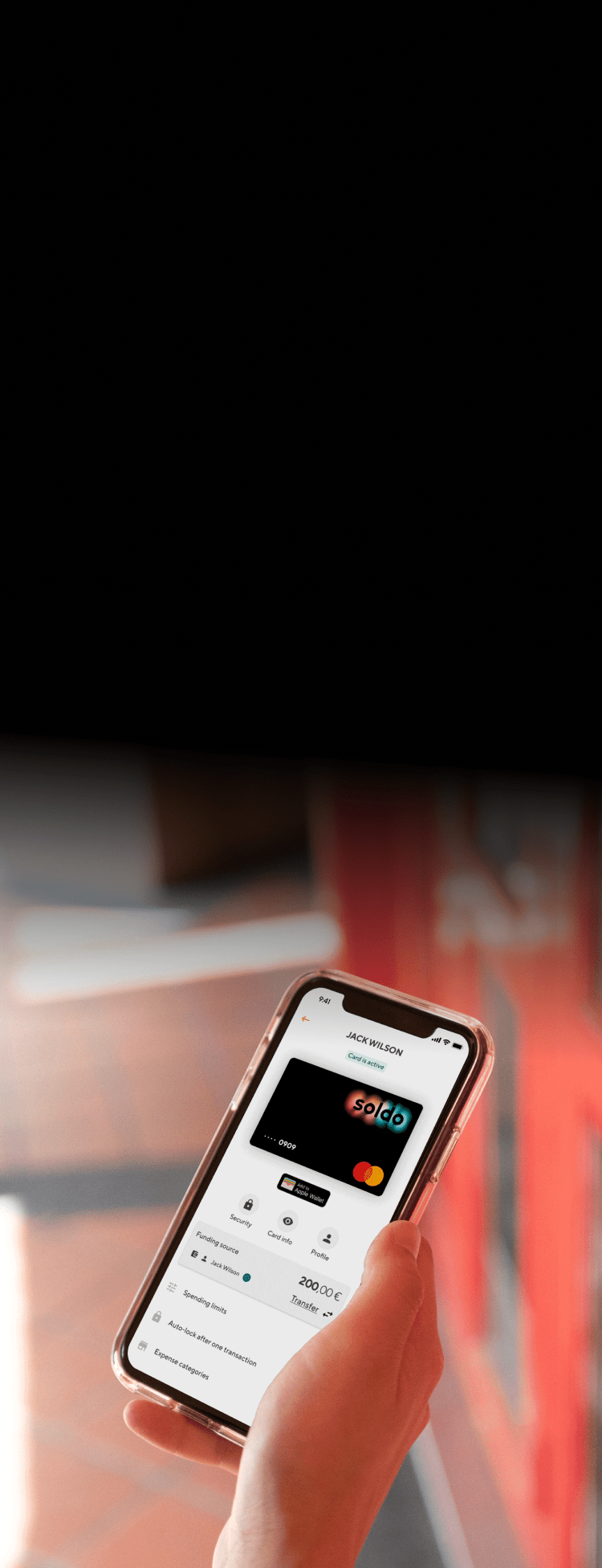

Manage ad-hoc spending with temporary virtual cards

Forget reimbursements. Issue temporary virtual cards in seconds so individuals can make purchases for 7 days while you keep control of the budget. Set a purchase limit between 1 and 10 transactions for complete flexibility.