Employee expenses: Quick overview

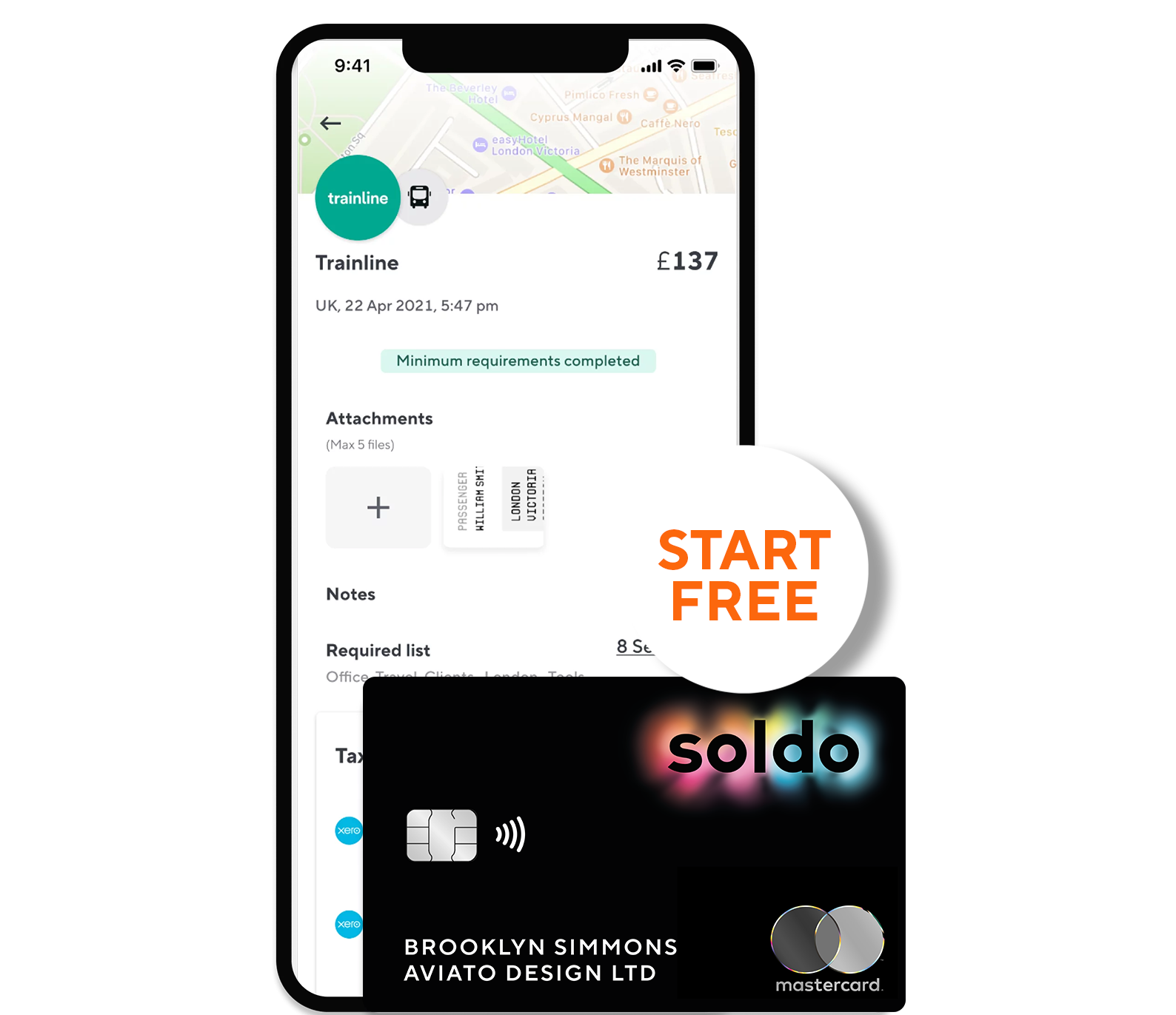

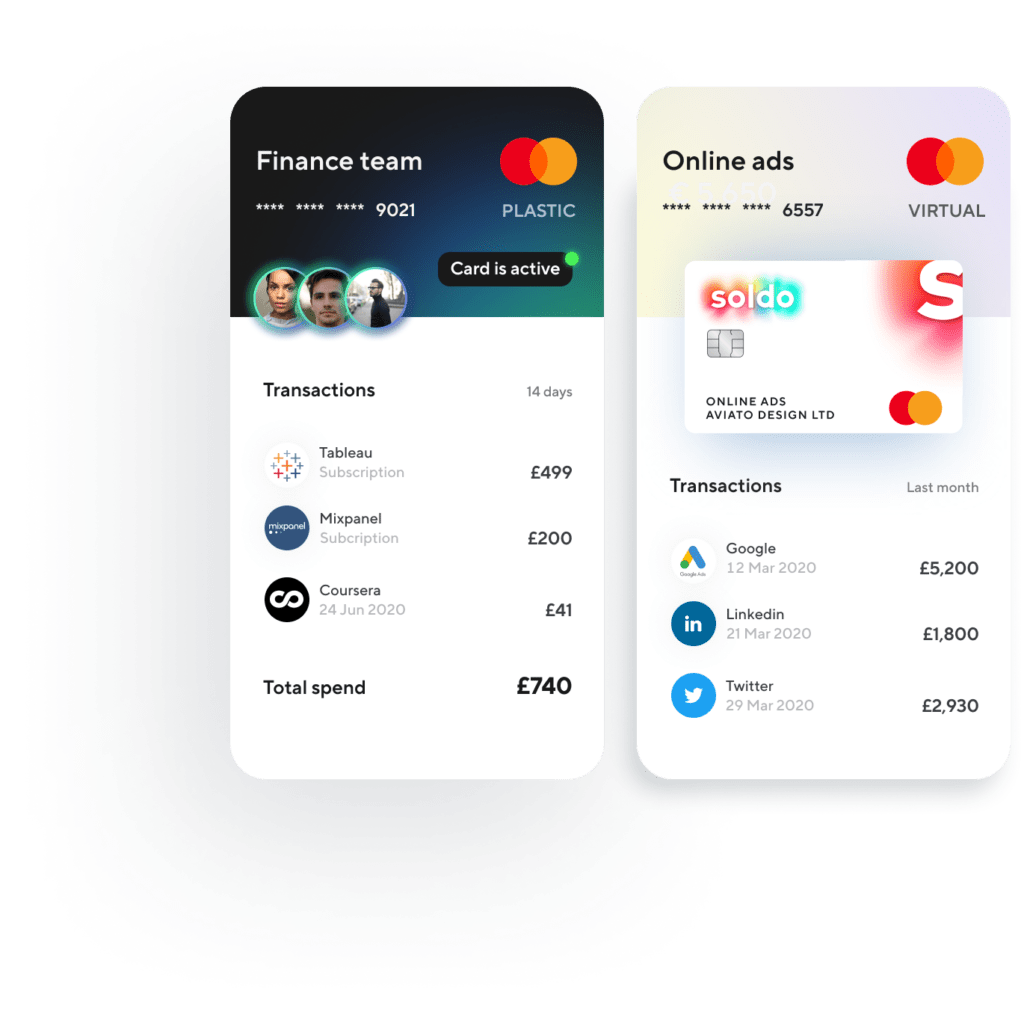

In expense management, reimbursement and business credit cards don’t cut it anymore when it comes to efficient management of employee expenses. The wait time involved in reimbursing employees for expenses can at times reduce the likelihood that they will make critical business decisions with their own money. In rare cases it could leave individuals in some financial difficulty.

Whilst business credit cards avoid this problem, they have some downsides of their own. Sharing one card amongst a whole team can easily lead to overspending and inefficient tracking of who spent what. Not only this, but the fact that these cards are directly connected to your company’s bank account makes them a security risk. Clearly, these traditional processes are quickly becoming outdated.