What are prepaid business cards used for?

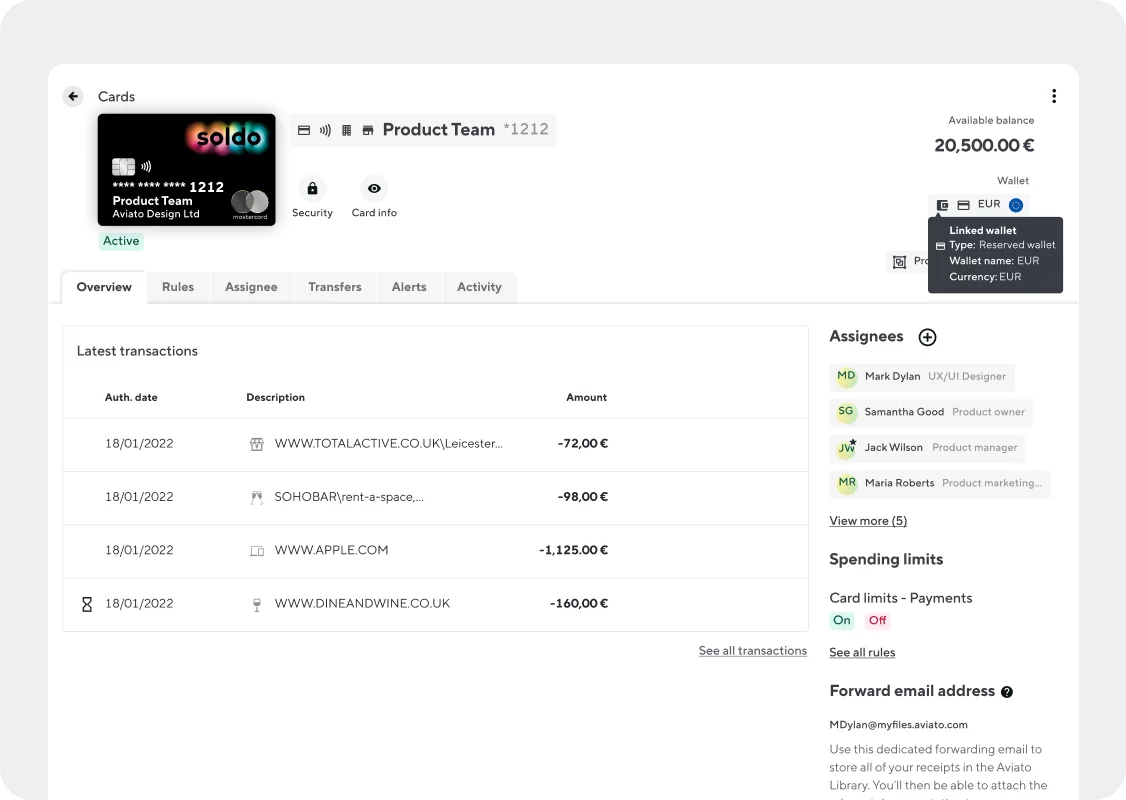

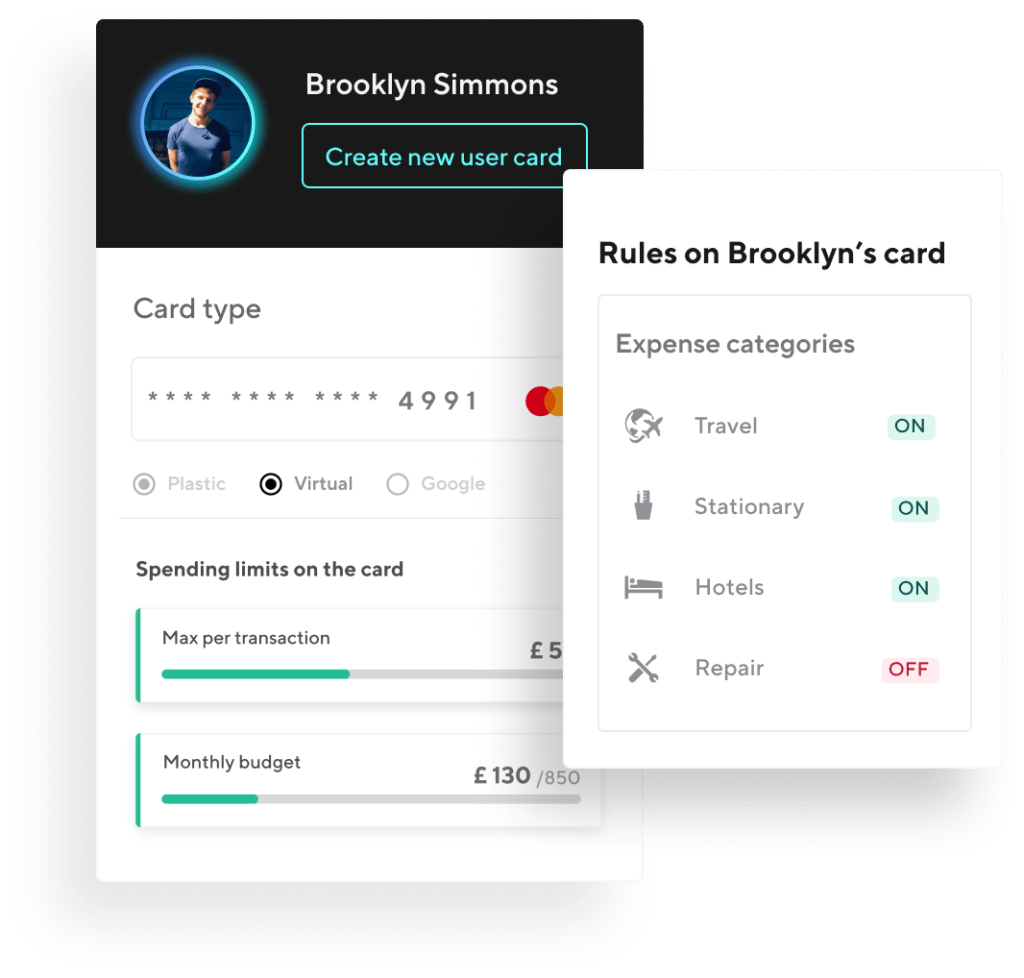

Prepaid business cards are used to give management and finance complete visibility over spending, without taking accountability away from staff. A loaded card can be used in any situation in which you could otherwise use a debit or credit card. You might, for example, use them to give a budget to salespeople on the road, removing the hassle of expenses. Or you could give every employee an individual learning and development fund.

What are prepaid cards?

Prepaid cards look and work just like a traditional credit or debit card. But you need to preload the balance before spending. Prepaid cards have the convenience of a traditional credit card but without the borrowing.

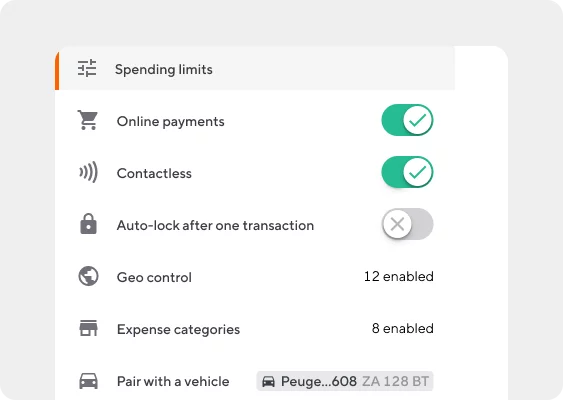

And prepaid cards are just as secure as other cards, if not more so. Soldo builds in features like chip and pin, card freezing, and remote cancellation, and meets the latest strong customer authentication (SCA) standards.

How do business prepaid cards work?

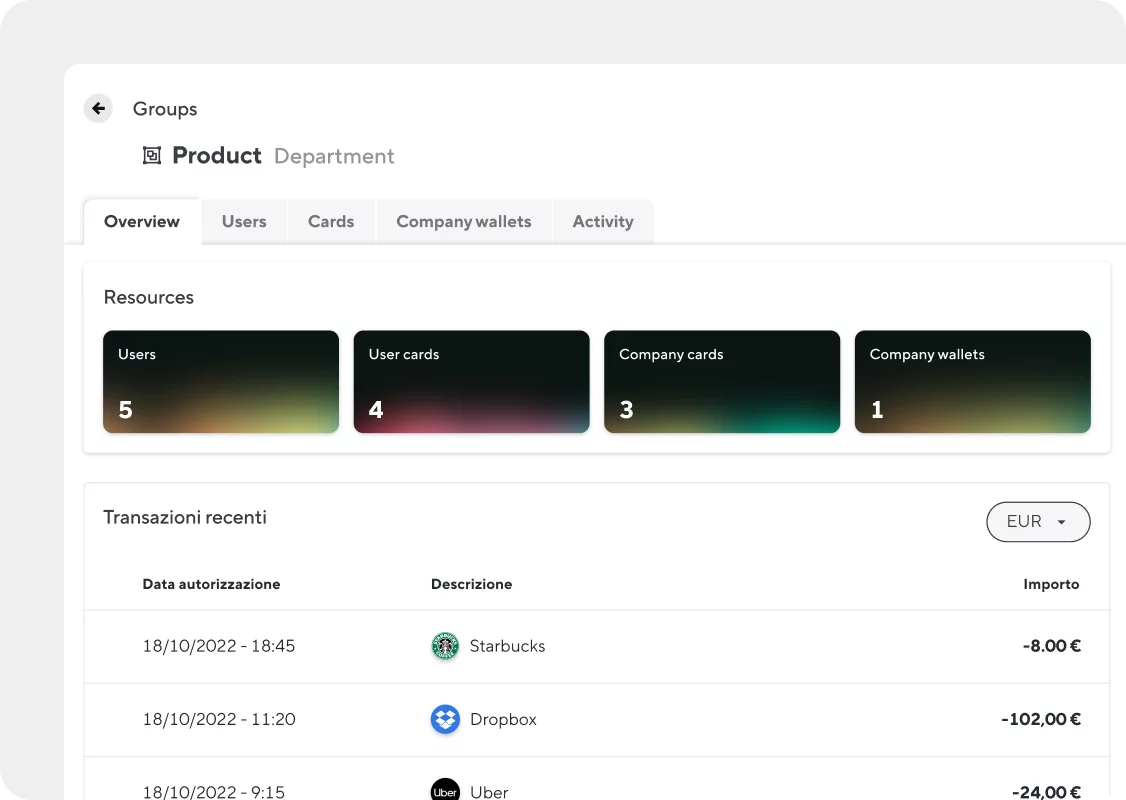

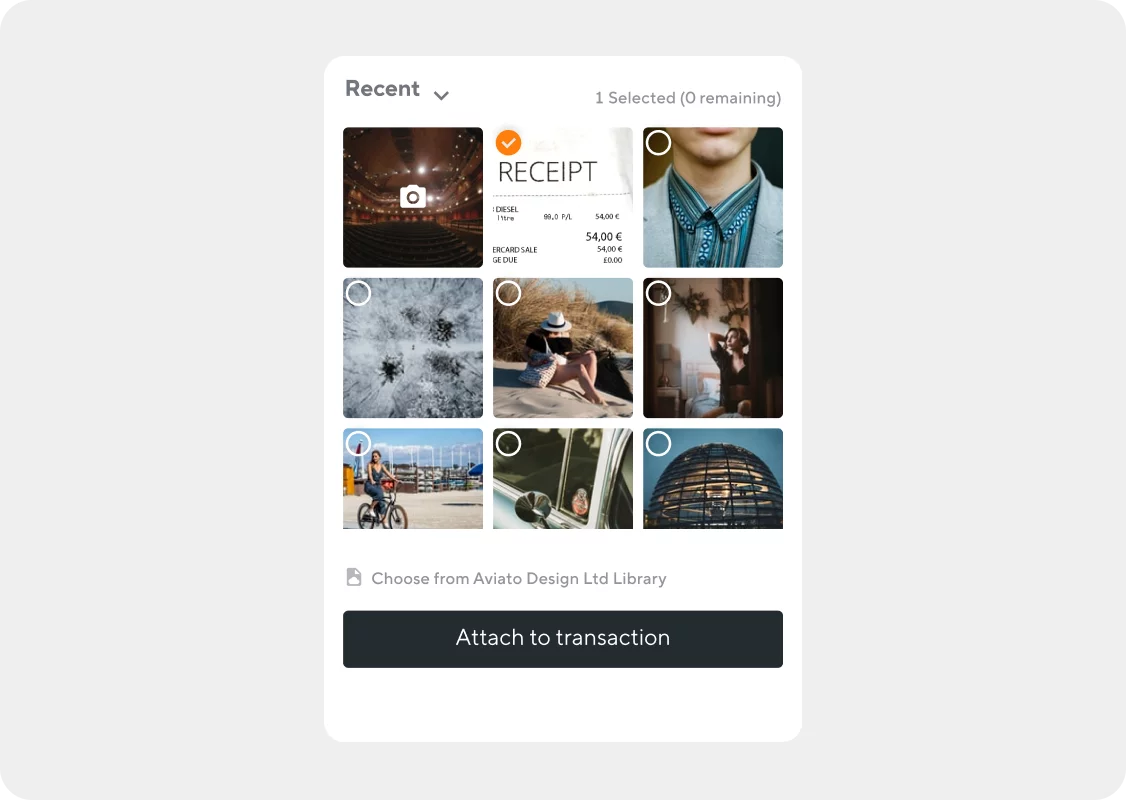

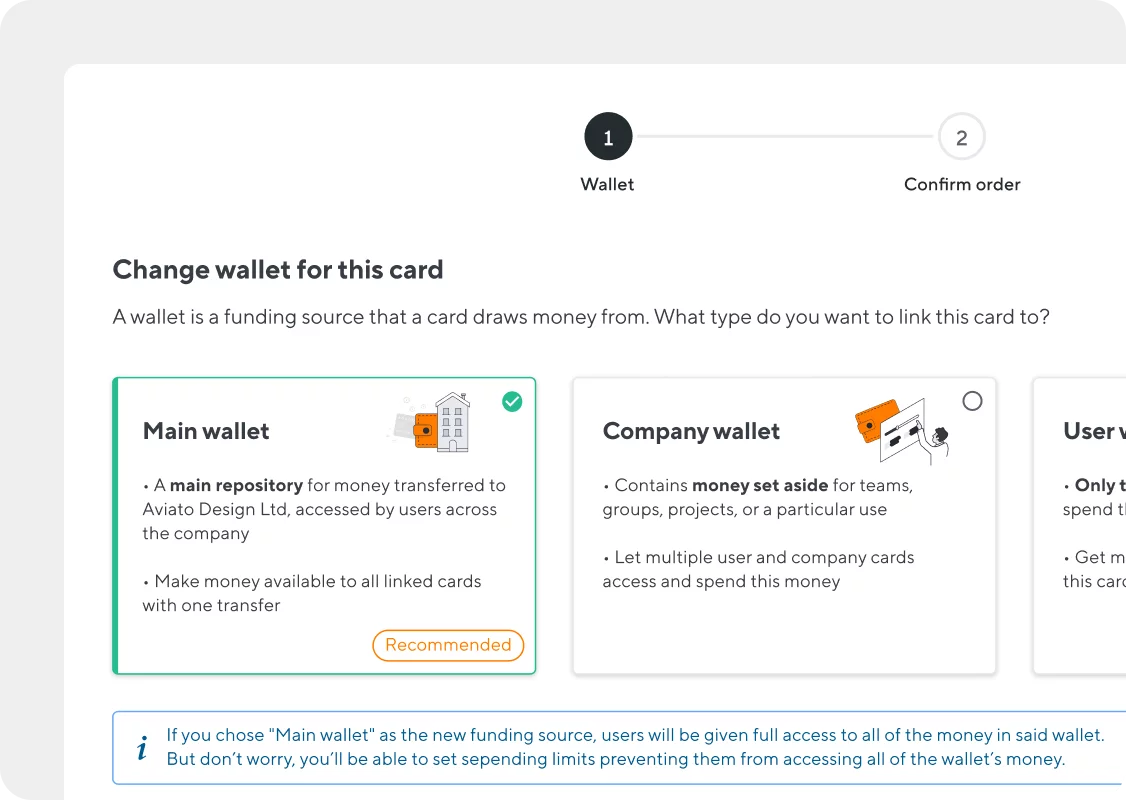

Prepaid cards work a lot like gift cards. Load each Soldo card with a specific sum to set a balance, which you can increase or decrease at any time. Make top ups using mobile or web apps, and you can manage any number of cards.

Make a payment – using exactly the same process as a normal debit or credit card – to see funds immediately deducted from the balance. Spent it all? The card is now out of action until you top it up.

What is the difference between a prepaid card and a credit card?

The biggest difference between a prepaid card and a credit card is that prepaid cards don’t require any credit to function. This brings two significant advantages for prepaid cards: there’s no debt involved, and no restrictions on who can use them – all you need is a registered company name.

Are prepaid business cards safe?

Yes, prepaid business cards are one of the safest ways of managing business spending. Unlike business debit cards, prepaid cards don’t give users access to the main company account, so you have complete control over how much staff spend. And unlike credit cards, there’s no chance of going into debt.

How much does a prepaid business card cost?

You can get started with a Soldo prepaid business card with the Soldo Pro plan. That gets you access to all of Soldo’s core features, including its mobile app and online console. There are no deposit fees or transaction fees to pay. If you need advanced features, you can sign up for Soldo Premium. Find out more about pricing plans.

Can I use a prepaid card for business online?

Yes. You can use prepaid business cards online or in-shop, to make the same purchases you would with a debit or credit card. Soldo offer prepaid cards and virtual company cards. They’re almost identical to traditional prepaid cards – but instead of sending you a physical card, everything is online.

Is Soldo a business bank account?

No. Soldo provides additional spend management features that work alongside your business bank account, instead of replacing it. You can use your Soldo cards to separate staff spending from your main company funds, as well as accessing powerful new features that aren’t available with any banking provider.