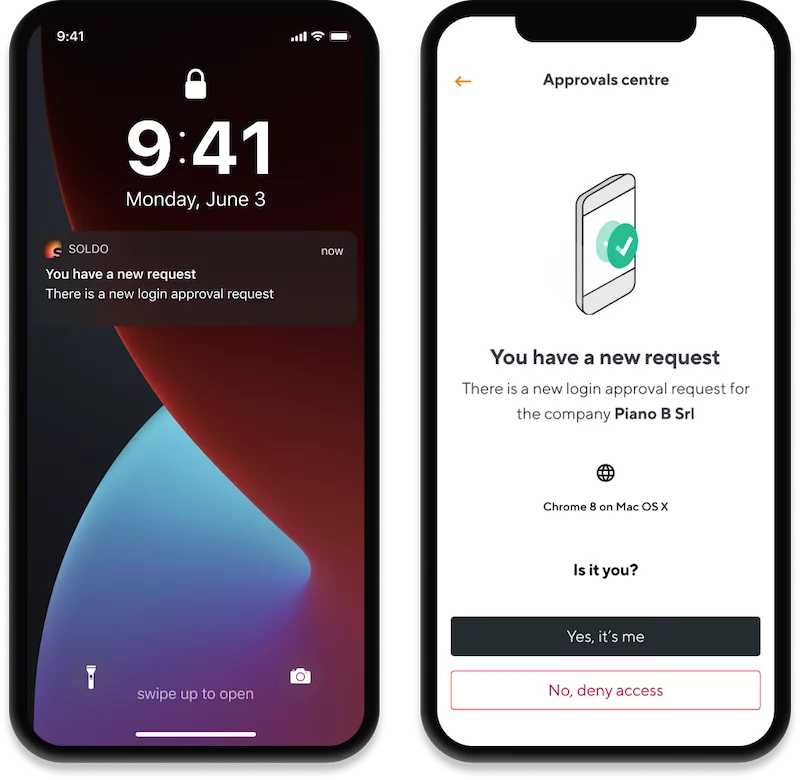

Soldo works alongside your company account to give you much more control and oversight over day-to-day spending. Using Soldo’s prepaid cards, integrated apps and web payments console, you can manage expenses with ease.

Easy application

You can apply online, and get started the same day.

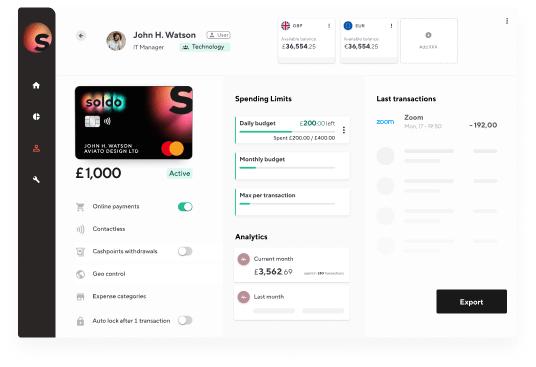

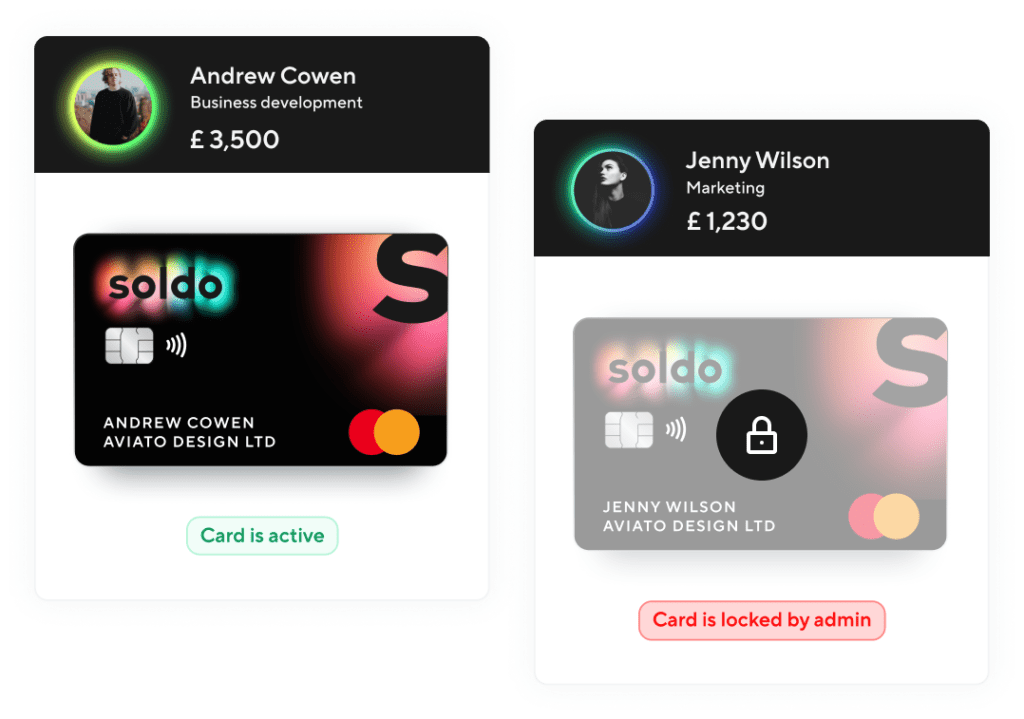

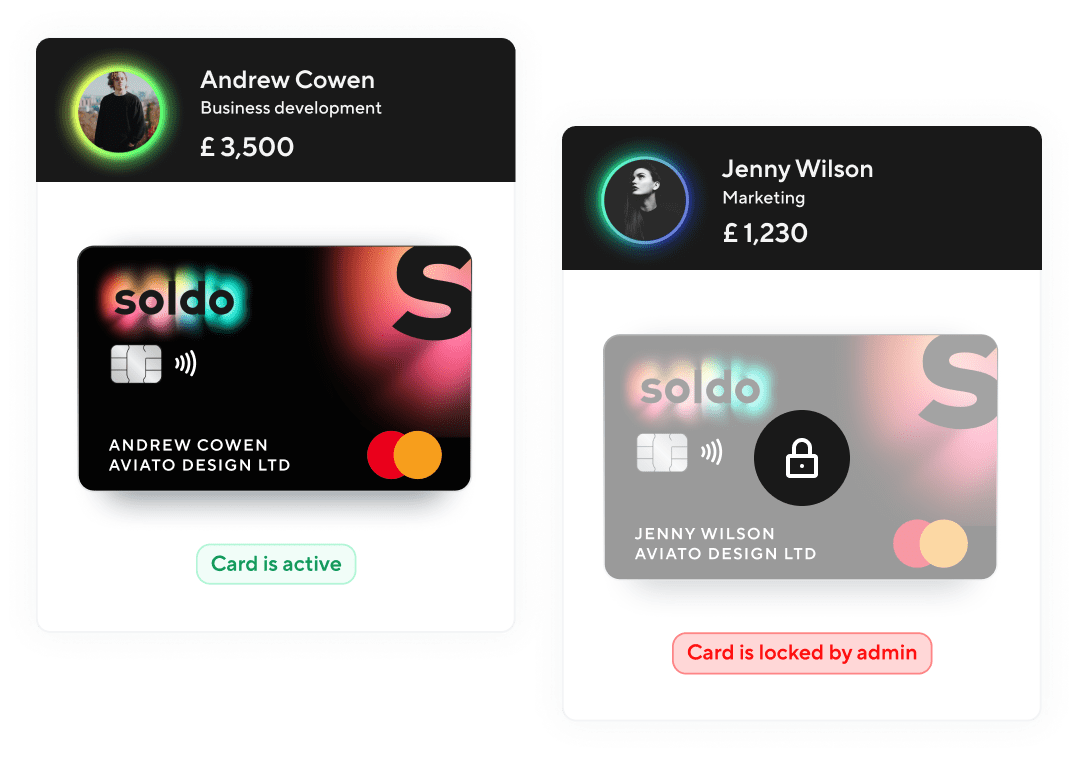

Silo staff spending

With Soldo prepaid cards, employees get their own separate spending accounts – that you control.

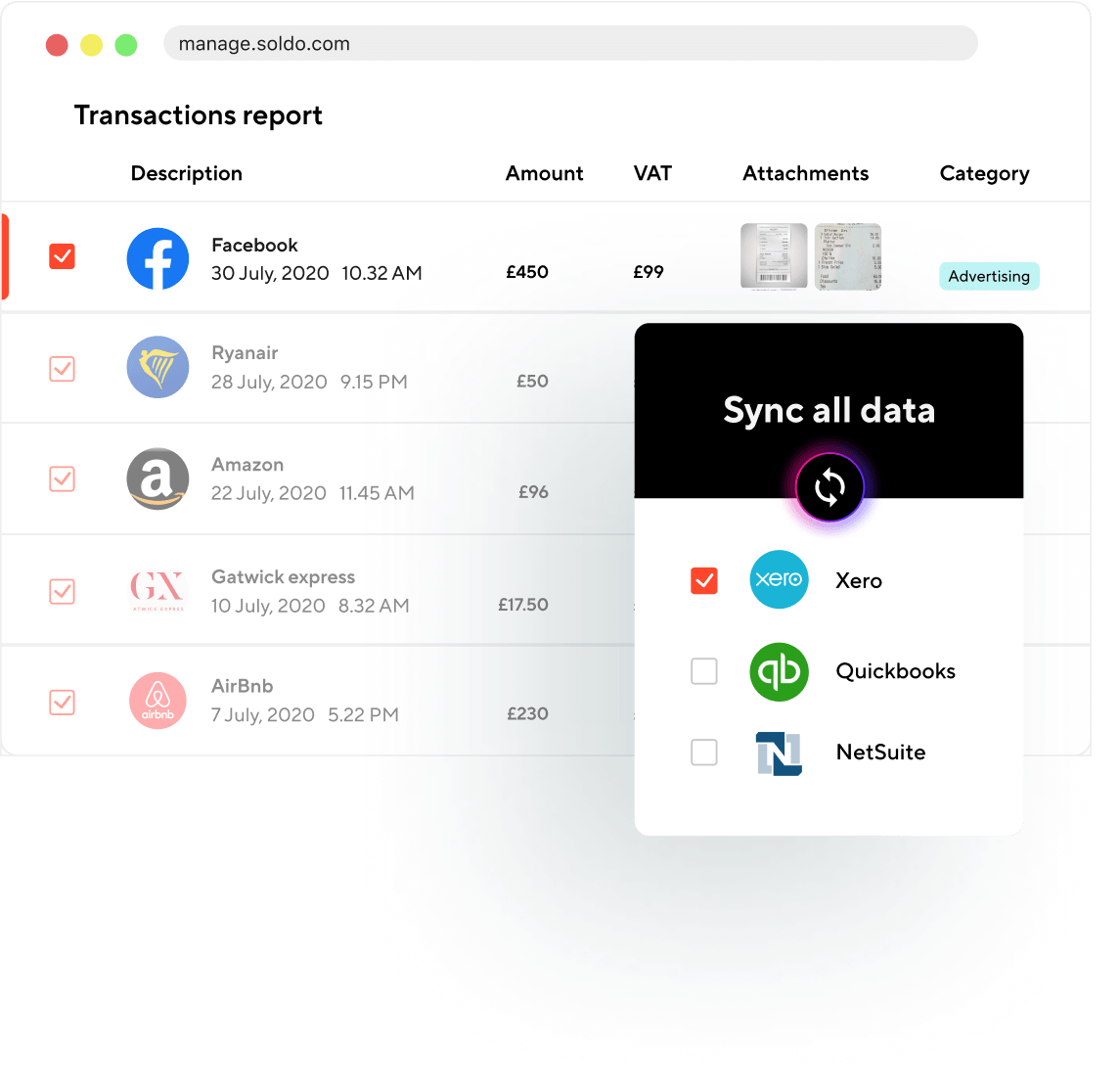

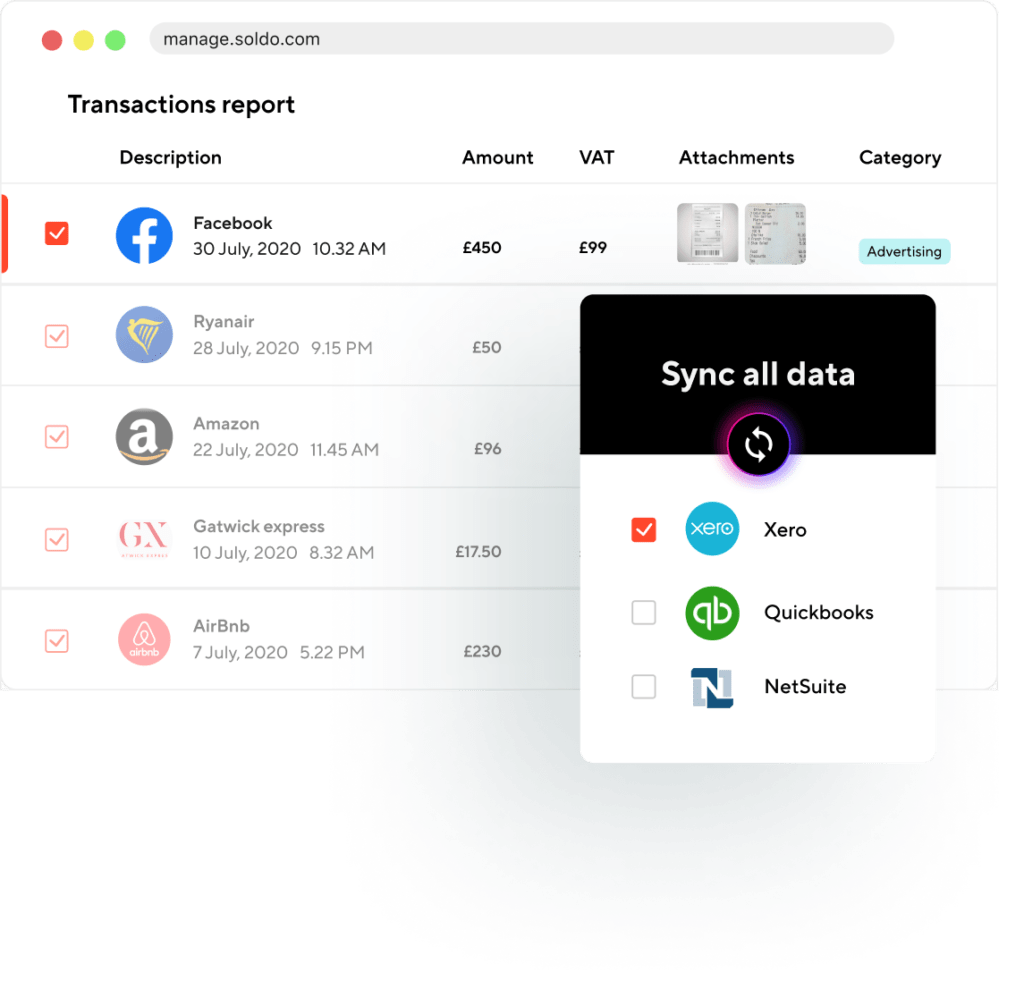

Simplify expenses

Online bank accounts can reduce admin in lots of ways, but expense management is still an arduous process. With Soldo, it’s entirely automated.