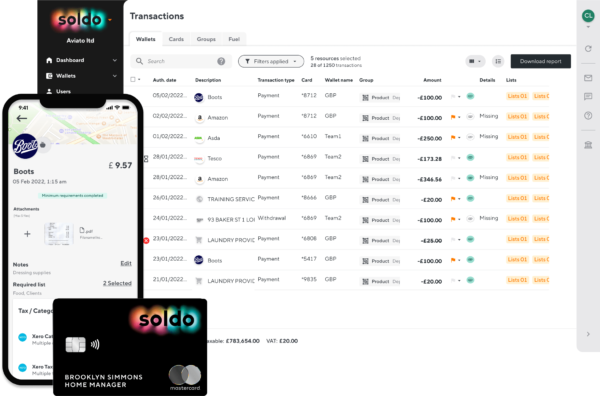

Before the lockdown landed, Soldo took Dough Stories on tour around the UK to speak with founder and investors. Hosted in London, Bristol, Birmingham and Cambridge, the dinners were a chance for founders and investors to lean in, listen, question and be challenged, on the topic of raising and managing money.

We spoke with over 100 founders and investors from across the country, with representatives from Episode 1, Connect Ventures, Borrow a Boat, Feedr, Petalite, Fluence, Bristol Private Equity, Boost & Co., and Tumelo. They all shared one common perspective – starting a company is tough and scaling a company is even tougher.

In a survey of decision-makers at 250 start-ups, commissioned by Soldo, seven-in-10 said they found the funding process easy but 95 percent said they struggle when making spending decisions. For those who struggled to secure investment, one of the biggest challenges was being able to provide investors with a financial forecast (35 percent).

The dinners provided a forum for founders and investors learn from each other when it comes to raising and spending, because sharing knowledge is the only way to succeed and grow. Conversations were centred around financial transparency, burn rates, and diversity and inclusion.

Financial transparency: How much is too much?

There is no blueprint as to how transparent founders should be with their investors post raise, and as a consequence we found a large divergence in transparency levels. Some founders provided financial metrics to their investors by request while others provided investors with 24/7 access to all of their financials.

Reasoning for reduced transparency centred around the fact that that internal north star metrics being worked towards by founders are not necessarily those shared with investors, and can actually be at odds with the metrics investors care about. Increased transparency was championed for allowing investors to provide greater support to founders, negating the need for ‘unexpected, difficult conversations’.

Within teams, there was agreement that financial transparency can build resilience but can also cause unnecessary stress without the potential of significant upside return for non-founding team members. Consequently, there was a large disparity in opinion on how far down financial transparency goes within companies. Some founders only provided financial knowledge on a need to know basis, others were 100% transparent right down to every salary and share option. An interesting conversation was had about the merits and downfalls of the Gravity Payments’ CEO, who recently introduced a $70k minimum salary for all his employees.

Handling burn rate panic

Raising money is a commitment to spend money, but knowing when and what to spend on is a common challenge for founders. With raising funds being a time-consuming process, taking founders away from the day-to-day running of the businesses, it’s important for founders to plan ahead to avoid burn rate panic.

Founders agreed that budgeting at least six months in advance is essential, but also echoed the sentiment that agility is just as crucial when it comes to adjusting spend. In sharing their spending regrets, there was almost unanimous agreement that it is common for founders to overspend on conferences, office space and consultants.

The most significant overspend was bad hires, wasting not just money but also significant time. Unsurprisingly, founders agreed that the best spend is on good hires and on product development. There was a realisation that little is done to support founders, either by investors or by each other with regards to advice on where and where not to spend.

“Diversity is being invited to the party; Inclusion is being asked to dance.”

It has been widely proven that better decisions come from more diverse teams – both within investment and startup teams. However, research from Deloitte also highlights that unless diverse teams also feel included within a firm, they will not perform to their best abilities. An increase in individuals’ feelings of inclusion translates into an increase in perceived team performance (+17%) and decision-making quality (+20%).

There was a consensus that venture capital firms have a responsibility to have clear initiatives to promote diversity in their firms. They also have a unique opportunity to positively impact the companies in which they invest and society at large with regards to diversity and inclusion. It was suggested that VCs should:

- Work harder to look beyond traditional channels for deal sourcing

- Review D&I policies every time they raise a new fund

- Restructure incentives to not discriminate against team members who have been out of work due to paternity leave

- Include a clause in their Term Sheets that says that companies need a diversity and inclusion policy in place within six months of investment

- Guide portfolio companies on building an inclusive culture.

It was suggested that founders of startup/scaleup companies should:

- Appoint a Diversity & Inclusion champion

- Review HR policies including parental leave

- Foster a culture of inclusion for diverse talent

- Provide accessible offices to wheelchair users, lactation rooms for new mothers, and prayer room facilities

- Offer unconscious bias training

- Introduce more flexible working hours

The Soldo team is extremely grateful to all the founders and investors who came together to share their experiences of raising and spending money to grow their game changing businesses. There’s was lots of food, lots of laughs and lots of learnings.

Watch founders get into the nitty gritty, the ups and downs of raising and spending dough in Soldo’s new video series Dough Stories live now.