What is a fuel card?

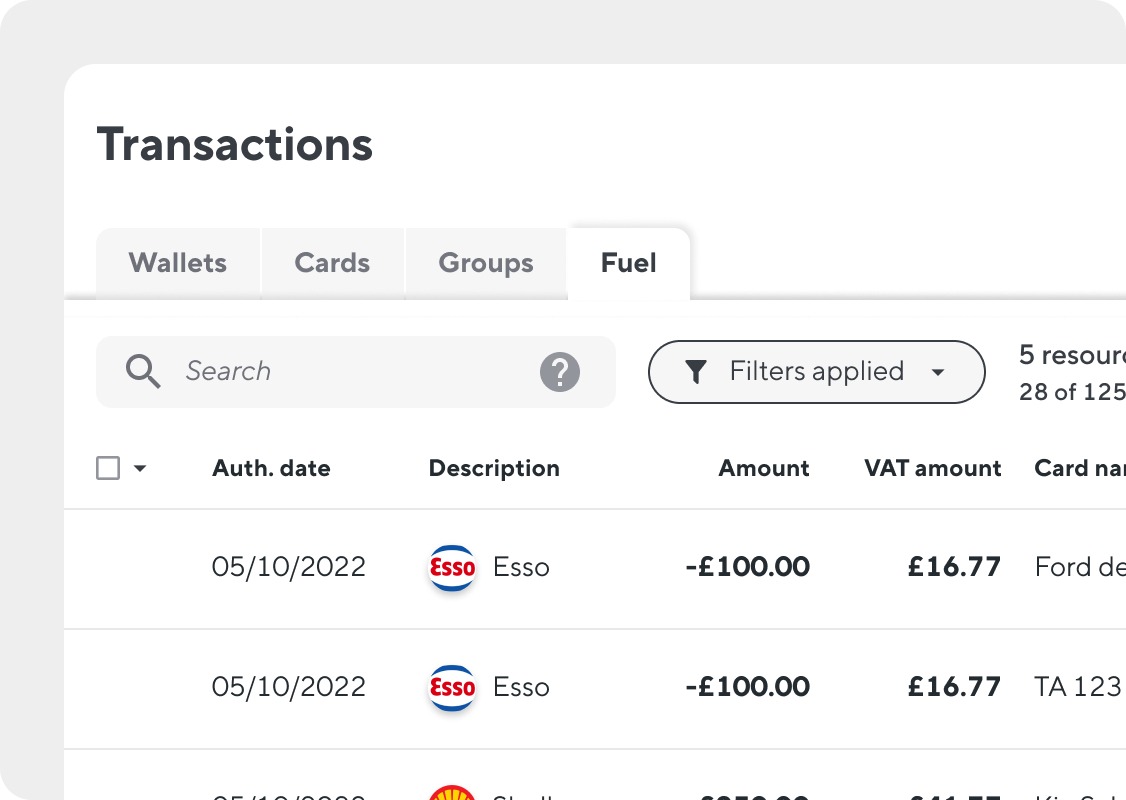

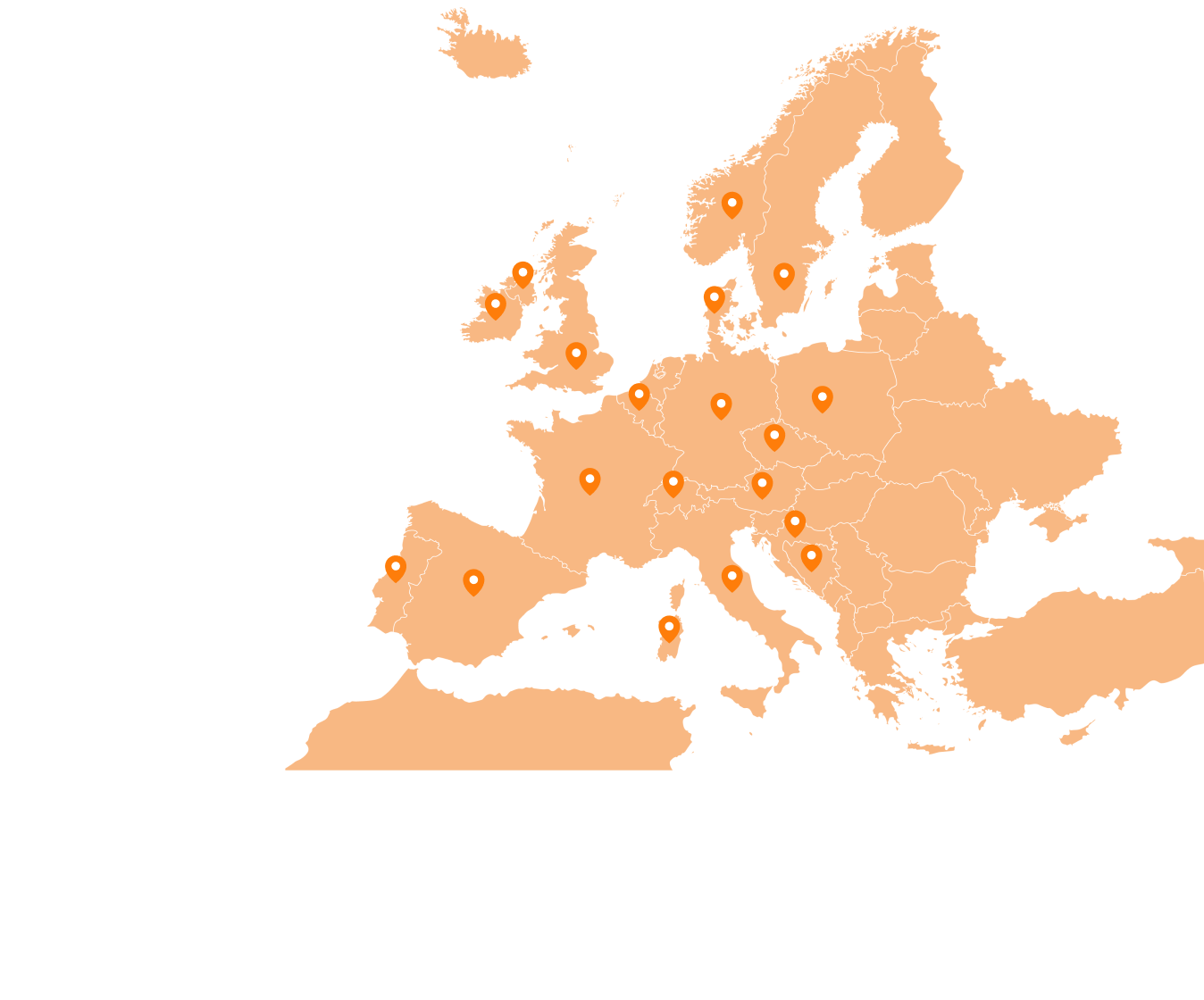

Instead of paying for the cost of fuel using cash, credit or debit cards, employees can use a fuel card. The cards can be affiliated with a major fuel brand, or operate across specific fuel stations, such as supermarket forecourts. Soldo fuel cards work at any station where Mastercard® is accepted.

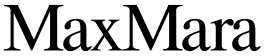

Firstly, transactions are logged against the car, and businesses will then receive regular invoices in a format that is compliant with HMRC. The use of dedicated cards for fuel frees business managers from the burden of collecting receipts and calculating VAT manually.

How do fuel cards work?

Soldo fuel cards give employees controlled access to company money to pay for fuel, tolls, parking and electric charging at any station.

With Soldo, you can allocate fuel cards to specific employees or vehicles with a pre-approved and allocated budget.

What are the benefits of fuel cards?

The main benefit of using Soldo fuel cards is the opportunity to purchase fuel at the most convenient station, or where petrol prices are lowest. The price difference from station to station may only be a few pence per litre but over a year that can represent huge savings, particularly for companies operating a large fleet.

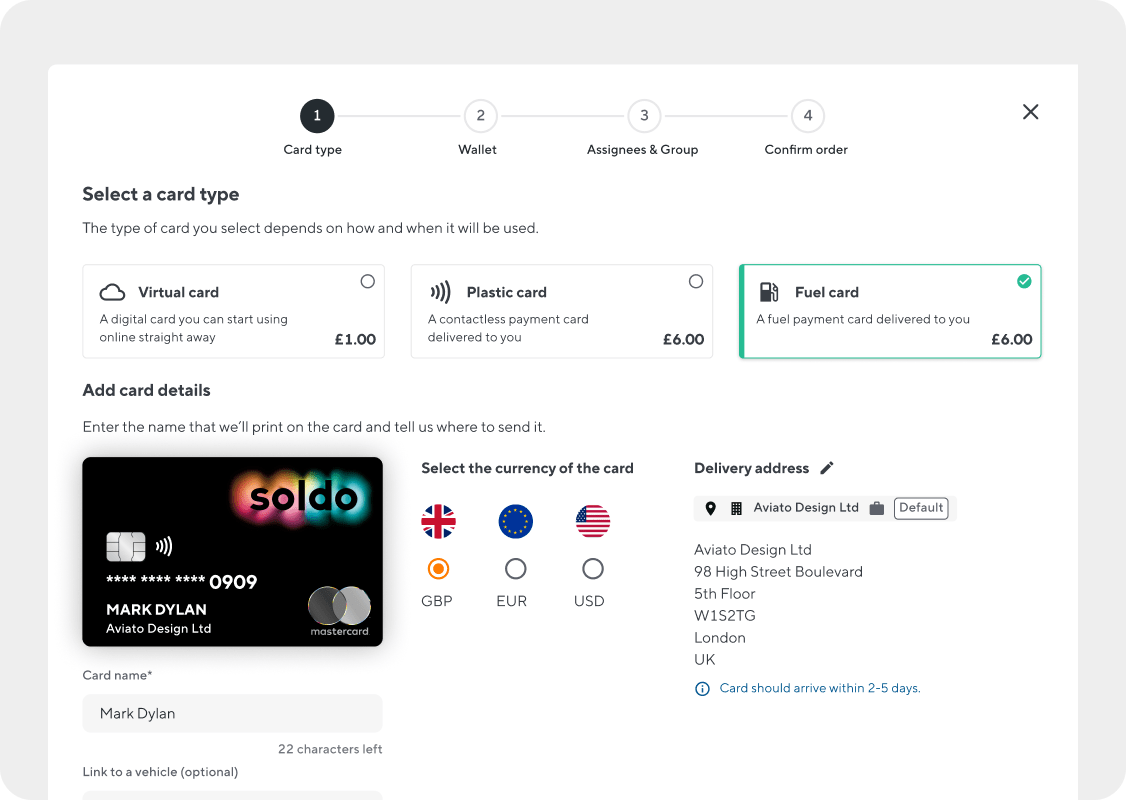

Employees appreciate them, as they enable them to fill up company vehicles without any need to use their own money. Expense management can be a long-winded and frustrating process, usually involving bundles of damaged receipts which tend to go astray. Lost receipts might leave your employees out of pocket, which in the long run could cause resentment. Learn more about how the Soldo mobile app helps with receipt capture.

Unlike credit cards, which can pay for various business expenses, fuel cards tend to be exclusively for fuel and motoring expenses, so there’s no confusion as to the amounts spent and where. Invoices contain all the information that a business needs to complete its accounts, making light work of administrative tasks.

The majority of fuel cards come with controls that fleet managers can tailor according to the needs of the business. For example, it’s possible to set specific spending limits on each card issued, which significantly limits any potential for fraudulent use.

Additionally, the information displayed on the invoices allows business managers to assess the mileage and running costs of their vehicles with high accuracy, which can speed up your mileage claim processes. It’s also possible to identify drivers who could benefit from further training to encourage more efficient fuel consumption.

Where can fuel cards be used?

There are a variety of cards available, some affiliated with particular fuel brands such as Shell and Esso and some giving access to supermarket forecourts, for example. The cards can also be associated with specific types of fuel. Businesses can choose diesel cards, petrol cards, or combination cards which allow access to all fuel types.

Soldo fuel cards can be used at any station for any kind of fuel, tolls, parking or electric charging.

Businesses that own several vehicles may find that a dedicated card for fuel can help to save time and money. In addition to providing businesses with HMRC-approved invoices, the data collected allows business managers to keep a close eye on the activities of their vehicles and their drivers to ensure optimum efficiency.