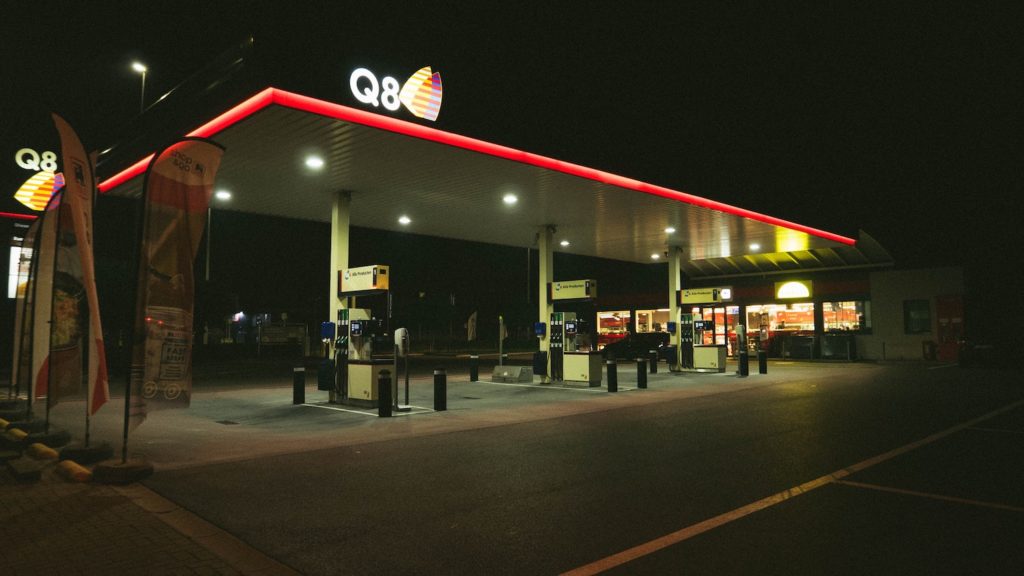

Fuel cards for your company

If you run a business that relies on a fleet of vehicles, your company may benefit from the use of fuel cards. Fuel can be one of the most significant expenses for a business, making discount fuel cards a potentially valuable solution.

Fuel cards operate in much the same way as company credit cards, and they are a fast and efficient way to manage and control company fuel spend. The card allows employees to fill up at one of a network of forecourts, and your company is then billed directly once a month. Some cards even provide HMRC compatible reporting for greater expense integration.

Why choose a fuel card for your company fleet?

There are two principal reasons as to why you should consider using fuel cards in your business:

Reducing your fuel costs

- Setting locations and weekly or monthly spending limits gives you greater control over spending in costly places, such as motorway services

- Reduce the chances of fraud with detailed management reporting

- Encourage more fuel-efficient driving by identifying expensive locations, poor route choices and inefficient drivers which can lead to massive fuel cost reductions

- Encourage awareness of fuel accountability to meet your company’s green targets

Reduce the administrative burden

- Eliminate petty cash to safeguard employees

- Generate HMRC approved invoices that make reclaiming VAT more efficient

- Fuel spend intelligence enables better financial forecasting

- Comprehensive monthly invoicing eliminates the need to store receipts

- Greater transparency when cards are allocated to specific vehicles or drivers

- 24/7 online management gives you greater control of fuel expenditure

The benefits of fuel cards for SMBs

If you’re unsure as to whether or not your business should make the switch to using dedicated fuel cards, here we briefly examine some of the benefits that a fuel card can provide your company.

Save money on your fuel spend

One of the most attractive benefits of using a fuel card is the opportunity to buy discounted fuel. Suppliers of fuel cards work with the largest networks in the country to deliver bulk discount savings or reductions on the price per litre at the pumps.

Your card provider may also offer fixed weekly prices to protect against price fluctuations, preventing company finances from being negatively affected. Fluctuations may be inevitable, but a fuel card allows you to plan and manage your fuel spend efficiently.

Buy fuel efficiently and conveniently

A fuel card works exactly like a chip and pin credit card. Not only are drivers spared the need to carry cash, but they can also pay quickly and efficiently. There’s no need to keep a VAT receipt, and your drivers can go about their job without having to worry about paying for fuel out of their own funds and then reclaiming it.

Increased flexibility for your drivers

A fuel card gives drivers the flexibility of being able to refuel across a broad network. If a route change becomes necessary, employees will still be able to locate a station where the fuel card is accepted. If your chosen fuel cards can be used at supermarket forecourts, drivers may also benefit from the opportunity to collect loyalty card points and receive promotional prices.

Alternatives to fuel cards

There can be drawbacks when it comes to using fuel cards. Remote stations can be hard to find, and some sites can carry a surcharge. If you’re considering fuel cards for your business, why not go a step further and consider a prepaid business card? The prepaid cards can be used for a far more extensive range of expenses and still delivers some of the benefits of a fuel card and more.

Reduce administration

Although a fuel card delivers HMRC approved invoices, with preloaded bank cardsthat have an integrated app, they can enable your employees to manage all of their expenses by simply clicking and tapping to upload. At tax time, all costs are seamlessly integrated with your accounting software.

Controlled access to company money

A prepaid card allows you to set sensible spending limits for individual staff members that can cover a range of expenses, including fuel and won’t leave employees out of pocket waiting for reimbursement.

Business intelligence

Monitor companywide spending in real-time and derive actionable insights on making savings from in-depth reporting.

No credit checks

Fuel cards extend a line of credit to your business and involve credit checks that could pose an issue for some companies, whereas a prepaid business card doesn’t require a credit check.

More than fuel

By carrying just one card, employees can cover all their business expenses, such as client lunches, networking events, business travel and any fuel costs.

Whether you opt for a fuel card or a prepaid business card from a company, such as Soldo, your drivers will always be fully supported. With its ease of integration and greater freedom, a Soldo prepaid business card could be the next step to monitoring finances in real-time and gaining control over company-wide spending.