180m closed for series C

The fundraise was led by Temasek, with the round including new investors Sunley House Capital, Advent International’s crossover fund, Citi Ventures and continued backing from Accel, Battery Ventures, Dawn Capital, and Silicon Valley Bank for debt financing.

As the biggest ever Series C funding round in the spend management category, the impact of Soldo is clear. We’re leading a revolution in spending, delivering control, visibility, and efficiency to businesses.

Carlo Gualandri, CEO and Founder of Soldo, said:

‘We are delighted to welcome Temasek as the lead investor. With a track record of investing in category-leading fintechs, Temasek’s insights will be valuable to us as we scale our platform and offering. Managing business spend is costly and challenging, yet Soldo continues to demonstrate its value and ease to customers of every size and across every industry. It’s clear this category will see exponential growth as more businesses realise the benefits and Soldo is well placed to support them.’

With this funding, we’ll do even more to help businesses, and do it faster. Our goal has always been to flip the script on business payments and spend management processes – making them effortless where they were painful, and transparent where they were opaque.

And we’re going to invest wisely to consolidate our position as market leaders, accelerating development of our category-defining product and attracting the best talent across the UK, Italy, Ireland, France, Germany, and Benelux.

Committed to a brighter way

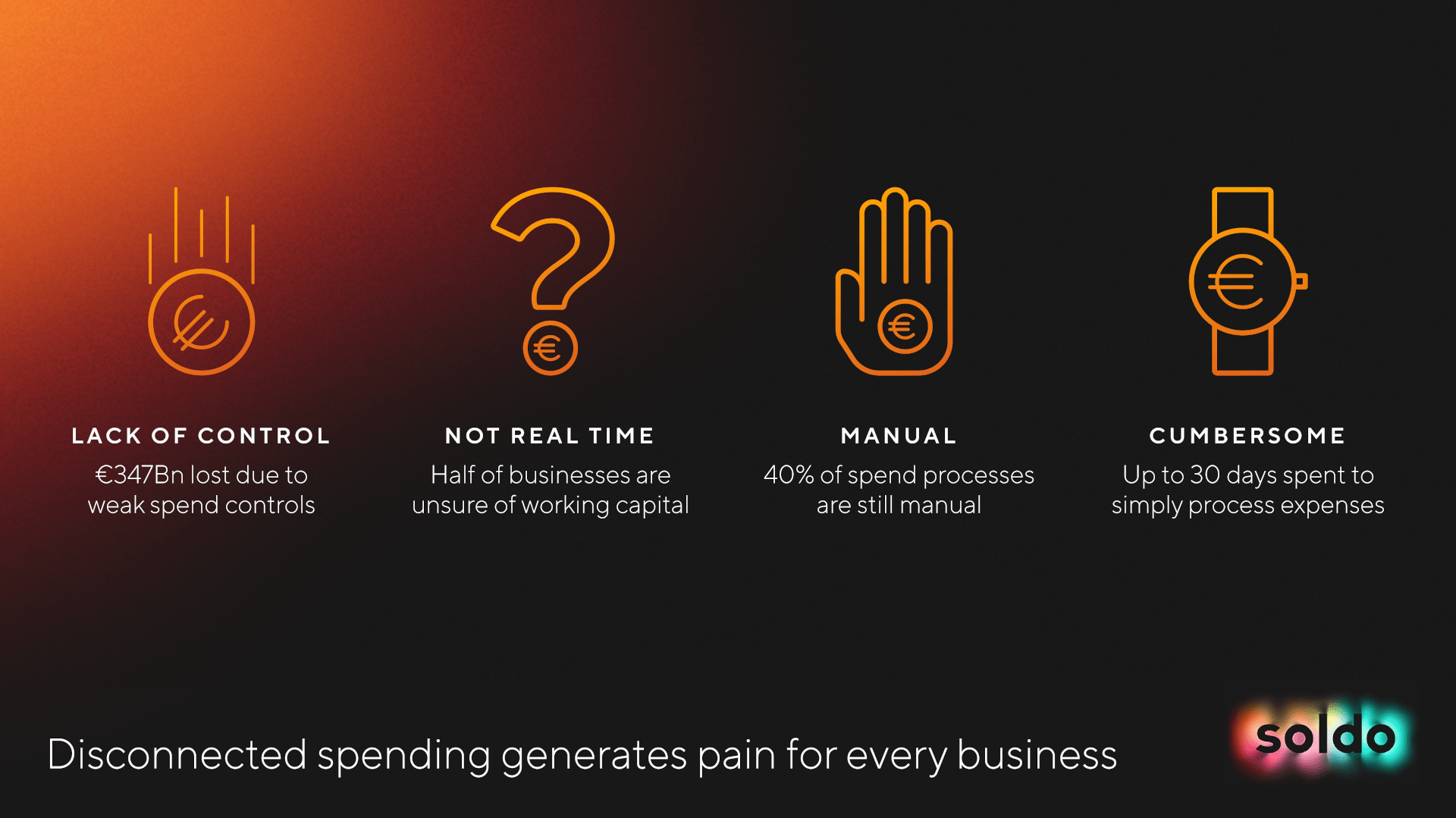

Soldo solves pains across every facet of company spending. Carlo Gualandri underlines the challenges millions of European businesses still face:

‘We know senior finance employees and CFOs currently spend more than half of their time on cumbersome tasks, and the biggest reason for this is due to disconnected payment systems and manual, time-consuming processes.’

From a lack of cost controls to blinkered visibility of working capital, from tedious manual spending processes to admin-heavy reporting and accounting – the status quo keeps businesses in the dark.

So, European companies lose an average of 2% of revenues to poor spend controls, leaving 8% of VAT on the table through processing errors every year. For those businesses, Soldo could be the difference between profit and loss.

Since Soldo was founded in 2015, our product has evolved to add features like Teams, Company Cards, and Flexible Card Funding, and we’ve integrated with Xero, QuickBooks, and NetSuite.

And we’ll keep bringing more services to new and existing customers, without compromising the ease-of-use synonymous with Soldo.

In the future, we’ll take advantage of innovation drivers like Open Banking and PSD2 to streamline even more processes. Today, this allows our customers to initiate a deposit from a business bank account within the Soldo web console, but that’s just the tip of the iceberg.

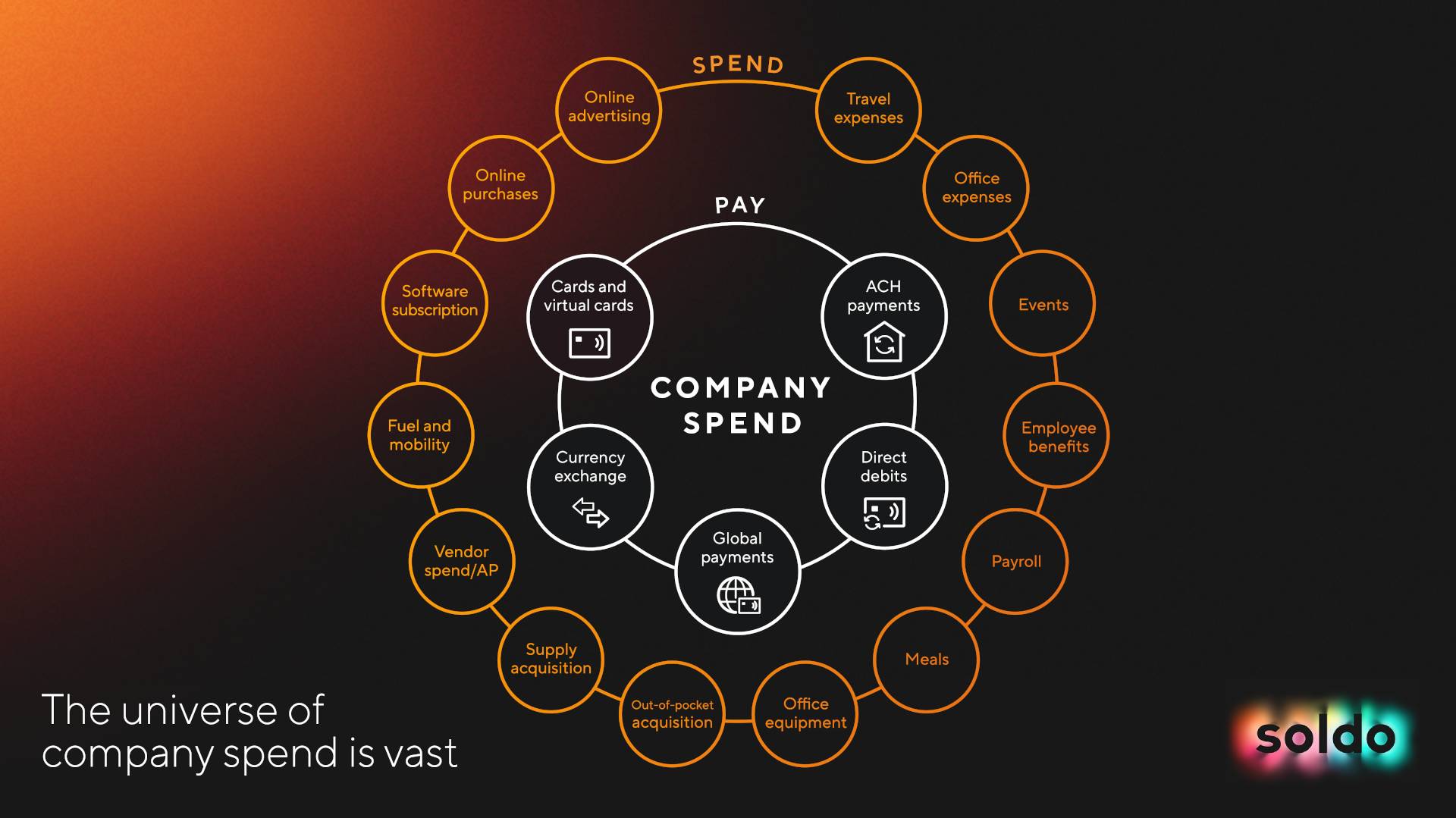

Mapping the universe of company spend

For businesses, payments and spend management encompass a litany of responsibilities and processes. As the Soldo platform evolves, we’ll envelop every relevant business need, bringing solutions to market that make it easier to do better business.

In payments, we’re adding features like Apple Pay and Google Pay, creating flexibility for with features like Apple Pay and Google Pay coming soon. For spend management, our approvals workflow and single-use virtual cards will make it easier to control spending ahead of time.

For our CEO, Carlo, the funding round signals an opportunity to move beyond cards and connect Soldo to a wider world of payments and spending.

‘At Soldo, we are passionate about offering a level of automation, simplicity, and flexibility. With this investment, we are now in a stronger position to deliver against our vision for international expansion and ambitious growth, developing our product offering through new payment types such as Open Banking, global payments, and building out our partner ecosystem.’

Ultimately, we’ll create the clarity and control so many businesses are missing today – connecting the dots between payment and reconciliation. We’ll enable finance teams to manage spend from end to end, helping Europe’s businesses to thrive.

Bringing only the best aboard

In a few short years (and one particularly long one), Soldo has grown from a small core team in London to over 200 employees, representing 21 nationalities and based in four cities and three countries. We know we can only achieve our purpose with stand-out talent – and we’re adding to the bright sparks in our team to make it happen.

The foundation for exceptional hires has been laid, with an excellent employee experience and thriving culture proven by our industry-topping Glassdoor scores. For ambitious and humble candidates, we offer the opportunity to play a starring role as Soldo shapes the future of company spending.

Already picking out your interview outfit? Explore our open job roles here.

Our product has the potential to meet the needs of over 24m businesses across Europe, and we’ll make Soldo more valuable to them as we grow our team and our product’s international footprint.

Over 25,000 businesses made this possible

Our vision is to light the path to brighter business spending. Today, over 25,000 companies in 31 countries use Soldo to get a grip on costs and simplify day-to-day financial tasks – and we want to help many, many more to experience the benefits.

So, to our customers, a massive thank you. Thanks for trusting Soldo with your business spending – we’ll strive to make your experience better through every conversation with our team and interaction with our platform.

As we invest in our people and product, our purpose will always be to help businesses thrive. Thanks for coming along for the journey – we can’t wait to show you what’s next.