Petty cash books are useful when it comes to keeping track of small payments, but there is a brighter way to manage expenses

Your business has to manage small expenses somehow, and you may have decided that petty cash is the method for you. However, for the uninitiated, a quick explainer of petty cash is that it’s a physical fund that employees can dip into to pay for everyday expenses, such as staples or printer paper. It’s for, as the name suggests, petty expenses.

This amount is separate from other company funds and the person responsible for it is known as the petty cashier.

Our petty cash hub gets into a lot more depth about this particular expense management system, so if you want to dig into it further you can head over there. For now though, we’ll be getting into everything you need to know about petty cash books.

A petty cash book is a way of tracking the comings and goings of your petty cash. If you’re not already, it’s a good idea to start using one. A petty cash book is a ledger in which you detail the particulars of each transaction so that when it comes to reconciling your expenses, your finance team already has much of the information they need, and hopefully the remaining petty cash fund matches the numbers recorded in the book.

Keeping track of petty cash in this way certainly helps when it comes to financial visibility. You want to know exactly where all of your cash is going, especially if employees have free rein to take from the petty cash box at their discretion.

A breakdown of expenditure also means you can see how much is being spent on particular expense-categories, so you can implement reductions in spending in these areas should you deem it necessary.

Okay, so you’re going to implement a petty cash book, but what exactly does one look like? And how do you format them?

These books can be as simple or detailed as you want. Of course, the more detail you record, the more accurate a picture you’ll get of your finances, but it also means more time spent on admin. You may prefer to just record what’s come in and what’s gone out. With that in mind, let’s look at the two main formats of petty cash books.

Simple Cash Book

The simple petty cash book is the most basic, consisting of a column for the date of a transaction, as well as two columns for the value of the transaction, detailing whether the amount is incoming or outgoing. You could also include a column for remaining balance.

At the end of a period – often monthly – you check that your records match the petty cash left in the fund. This is an easy way of seeing a net figure for a period, but it isn’t particularly detailed.

Analytical Ledger

An analytical ledger is divided into two main sections: credit and debit.

The debit section is a single column where you list cash received by the petty cashier. The credit section is split into several columns, with one for each type of expense. Basically, instead of having a random list of transactions, each petty cash expense is categorised under an umbrella term such as ‘stationery’ or ‘food & drink’.

The benefit of an analytical petty cash log is that it explains each transaction, giving you more depth than the simple petty cash book. And because each payment is categorised, you can get an idea not just of spend, but of spend distribution.

Imprest Fund

There’s also something known as imprest. This is less a type of book and more a method of funding your petty cash transactions. An imprest is a fixed sum of money that’s allocated for a specific period. So, for example, you may allocate £1,000 for petty cash each month.

At the end of the month, staff submit expense reports plus receipts. You or your petty cashier then carry out a petty cash reconciliation to confirm that the reporting matches the leftover sum, and top up the petty cash balance so it’s back at £1,000.

A benefit of the imprest system is that you always know the absolute maximum that can be spent each month, so it’s impossible to overspend.

We have a petty cash book template here that you can use if you’re wanting to get a better handle on your petty cash expenditure.

Unfortunately, even if you have a scrupulously kept log and a strict receipt-reconciliation process, a petty cash book will never be the best option for your business. Manual data-entry is incredibly error-prone and it leaves you vulnerable to theft or fraud. Not to mention the unpopularity of cash as a format.

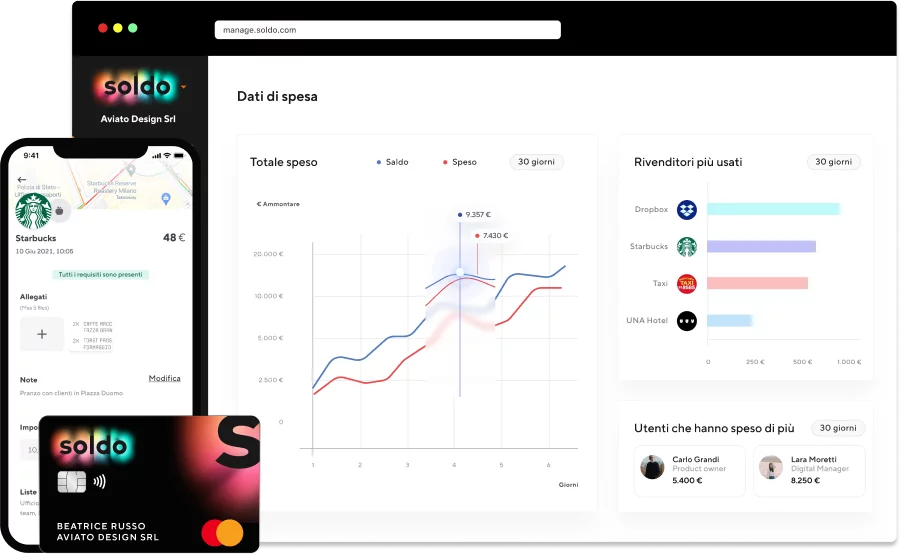

Thankfully, there is a brighter way. With Soldo’s smart prepaid system, you won’t have to handle a physical receipt again. We offer prepaid cards that you can distribute to as many team-members as you like. You simply pre-load them with cash, so there’s no direct access to the company bank account, and every transaction is automatically reported in our app or desktop console.

Soldo eliminates the inconsistencies inherent to petty cash payments, as employees just have to snap a photo of their receipt when they carry out a purchase, and all the spend-data is collated by Soldo. Then, when it’s reconciliation time, you can utilise our seamless integrations to transfer this data to accounting software such as QuickBooks, Xero, and NetSuite in no time at all.

The customisable nature of Soldo’s cards means you can tailor them to your business’ specific needs. You can make them into Petty Cash Cards if you like, using them for petty expenses in the same way you used your petty cash fund. This way, a switch to Soldo doesn’t require a huge overhaul of your processes, but it does bring you complete security and visibility.

Say goodbye to tedious petty cash books full of mystery payments and supercharge your business by joining Soldo today.

Soldo helps you simplify the management of business expenses by making administrative processes faster and more transparent.