A typical day was full of manual admin and reconciliations. Hours were lost making sure there was enough petty cash to hand out to staff in need. And making sure much-needed donations went to the right places felt like trying to pull together seemingly endless threads.

Money had always been tight; almost 48% of charities saw a decrease in income in the 2018 financial year. Larger charities, representing just 1.3% of all bodies, receive 72.2% of all income raised, according to the Charity Commission.

And then the pandemic arrived, bringing with it new complications:

Petty cash is a no-go, with staff working remotely and shops refusing cash

Staff often need quick access to funds to respond to urgent needs like purchasing PPE and other necessities

And it’s tough to trust a large number of new temporary staff and volunteers with cash or credit cards

These challenges are in addition to the loss of income resulting from the lockdown; Oxfam has already warned of a £5 million loss from the closure of its shops alone.

Then and now, budgeting has always been an issue. Charities have lots of staff who need access to funds, and traditional methods like corporate cards and petty cash are just not practical anymore.

It’s difficult to pin down what’s been spent where and by whom, and, the month-end period is fuelled by headaches and stress.

Corporate credit cards are not always the answer. For starters, they need to be in someone’s name. Then you have to physically get each card to someone for use. And sharing card details by email or chat is a big no-no – imagine the cybersecurity implications.

Sandra Curran from charity Making Space, says they’d been using credit cards for years, which brought its own set of challenges.

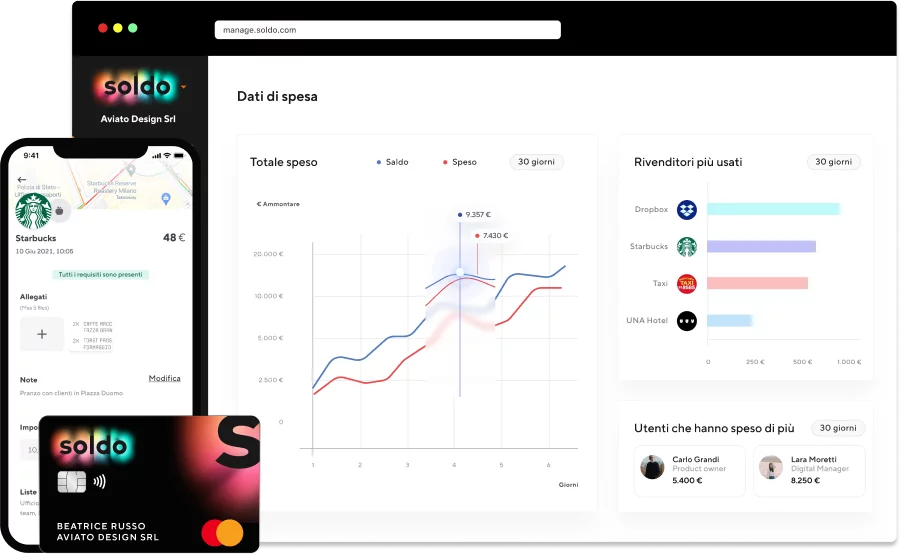

Making Space chose Soldo’s spend management platform to simplify their spend management processes.

Soldo can help charities to:

Soldo requires no technical implementation and can be up and running in less than a day. It complements your traditional business bank account, so you get all of the benefits of your established bank plus access to more innovative services. And you decide who can access company money, as well as the rules they follow to spend it.

Give your people smart payment cards with built-in budgets that don’t leave them out of pocket in their time of need.

Soldo Mastercard cards, both plastic and virtual, can be set up quickly from the central web console, acting as a replacement for petty cash or team corporate credit cards.

You could, for example, mark a specific card as ‘petty cash’ and set an automatic top-up so that when funds drop below a certain limit, it gets replenished. Or, in the case of a new temp worker – normally desk-bound – needs to drive for a site visit; you could add a temporary permission to their card that allows spending on fuel.

Sandra at Making Space says new staff were always amazed they were still using cheques to distribute petty cash: ‘We had petty cash at each service, so they would have to send us a return as their floats were going down, and we’d send them out a cheque.

‘They’d have to then go to the bank to cash the cheque. Sometimes they get lost in the post, or the bank won’t cash them as they don’t recognise the signature.’

Each card you issue – whether virtual or physical – connects to a central web console. You can see what’s being spent on each card, and how much, in real time. Set up spend categories, and control which cards can be used for which categories.

Have a fundraising drive coming up? Set up a virtual card to be used for all related spending.

Staff can upload receipts using the Soldo app, cutting paperwork and simplifying reconciliations. The app also captures VAT, spend categories and more, while the finance team can export data to your accounting software in a couple of clicks.

“Petty cash and reconciling credit cards took a total of 6 days a month. Now it takes me half a day. It’s saving us time!”

Sandra Curran, Purchase Ledger Coordinator at Making Space charity

Automated reporting from the web console can save hours of admin – which means you can spend more time making a difference.

COVID-19 may have thrown a spanner in the charity funding works, but it’s also provided an opportunity to review how you handle spend and expense management.

Soldo helps not-for-profits streamline spending and get better control over what’s going where, both now and in the new normal. That dream of going cashless is now a reality.

Soldo helps you simplify the management of business expenses by making administrative processes faster and more transparent.