Expense reporting should be simple, and with Soldo it is. Read on to learn all about the process and see why Soldo is the best fit for your business.

You started your business because you have a passion for it. What you probably don’t have a passion for is expense reporting. If you do, that’s great, you may already have efficient expense processes in place. However, for the rest of us, expense reporting is a necessary evil. The process can create a lot of difficulties: delayed credit card statements, inaccurate records, disorganised receipts. It’s a minefield. In this article we’ll go through everything you need to know about the expense reporting process, and look into the best ways to manage it.

Let’s start with the basics. If you’re a new business owner, expense reporting can seem extremely daunting, so we’ll dive into the process and understand exactly how it works.

Expense reporting is the process by which you track how much your company is losing to items or services that are necessary for business, such as meals, accommodation, or equipment depreciation. The goal is to make sure all of these expenses are necessary, legitimate, and that no one is overspending.

An expense report is simply a document that details expenses that your business has incurred. It can refer to a reimbursement form filled in by an employee who’s paid for an expense out of pocket, or an account of each business expense over a certain period of time, usually a month, a quarter, or a year.

The report will detail the amount, the vendor, and the card that carried out the transaction. It can also include other information such as the project the purchase relates to or the client for whom the item was bought.

Your expense reports must be accurate in order for your business’ finances to be lawful. Quite simply, your bank account needs to match your books. Fraudulent spending is one of the largest issues when it comes to expense reports, and this is why you must get them right.

Not only this, but expense reporting can benefit you, too. For example, many expenses incurred by employees on business trips are exempt from tax, but you need to keep accurate records in order to prove the purpose of these expenses to HMRC. So how do you go about creating expense reports?

There are numerous ways of creating expense reports, the most traditional of which is the spreadsheet. You can download a template online and then fill it in with the relevant information from the employee expenses. However, this is also the most antiquated method. The problem with a spreadsheet is it has to be filled in manually. This takes up precious time and, as is the case with any manual data entry task, it’s easy to mistakenly input the wrong figure.

An increasingly popular alternative is expense tracking software. There are lots to choose from, but they all share the key purpose of automating your expense processing and making reporting much easier. All you have to do is connect your payment method to the expense management software and it will produce reports for you.

Reports can be itemised and categorised to give you subtotals for each different expense type, making for an even clearer picture of the state of your finances.

Opting for expense management software rather than a spreadsheet is a great solution, but this doesn’t matter if the way you’re paying for expenses and tracking them is inefficient. Let’s consider the best ways to manage expenses.

An increasingly unpopular but still widespread practice is having employees pay for expenses out of pocket with the promise of a future reimbursement. This method is rife with issues. For employees, they may worry about how long it will take to get reimbursed, and it could even put them in financial difficulty.

For employers, your team’s morale will be negatively affected by this expense policy, and the amount of admin required to sort through receipts in order to pay employees back can put a real strain on your finance team.

One expense management solution that avoids many of these problems is the business credit card. Simply put, these are payment cards that offer similar functionalities to personal credit cards, but can only be used for business purposes.

It’s always a good idea to keep your personal and professional finances separate; in fact it’s a legal requirement if your business is registered with Companies House. However, although business credit cards are useful in this regard, they’re not the most efficient way of managing expenses.

For starters, it’s not the easiest process to order multiple business credit cards, so there is often a single card that gets shared amongst employees. This means you can quickly lose track of who’s spending what. Even more problematic, a business credit card gives direct access to the company funds, which means you have to think very carefully about who you trust with the card.

Even if these issues of visibility and security didn’t exist, the process of tracking expenses bought with the card isn’t a smooth one. Employees have to keep hold of physical receipts, with these receipts being filed away somewhere until it’s time for reconciliation. This is a recipe for disaster, or at the very least a headache for your finance team.

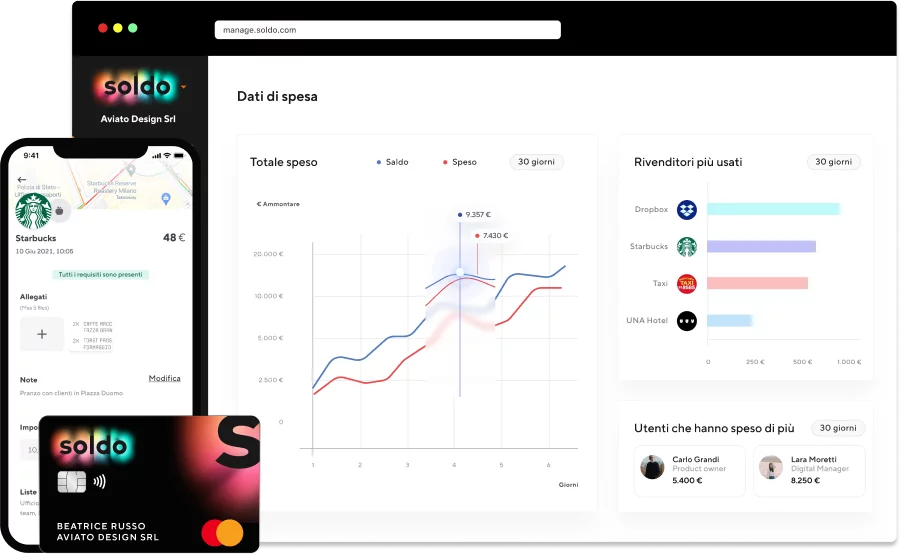

Avoid these issues with Soldo’s smart prepaid solution. Our platform connects prepaid cards to an expense management system, giving you the ability to control spending without sacrificing employee autonomy.

You can order as many cards as you need – virtual or plastic – and assign them to individuals, teams, or whole departments. You decide how much money is on the card, and what it can be spent on. This way there’s no access to the company bank account, just the funds on the card, and should one get lost or misplaced, you can switch it off remotely at the touch of a button.

Rather than having an employee submit an expense report that you can process at a later date before reimbursing the individual, you can empower employees to spend responsibly. Transactions can be tracked in real-time as each one is processed online for you to view, allowing complete visibility.

Customisable categories mean the card can only be used on pre-approved expenses, and the in-built limits mean you can say goodbye to overspending. If this budget then proves to be too limiting, you can top up an employee’s card from anywhere with the Soldo mobile app or desktop console.

And then we come to the reporting. Soldo simplifies this process, too. Once an employee has made a purchase, all they need to do is snap a photo of the receipt, attach any necessary comments, and all this data will be collated in real-time.

And when you’re ready, Soldo’s seamless integrations mean you can transfer this data to accounting software such as Xero and QuickBooks in just a few clicks. No more manually filling in spreadsheets, no more searching through piles of receipts. This is expense reporting as it should be.

Revolutionise your business spending and embrace effortless expense reporting by switching to Soldo today.

Soldo helps you simplify the management of business expenses by making administrative processes faster and more transparent.