Soldo’s Summer Update: Helping you accomplish more with new platform updates

For us, 2024 is about ensuring that finance teams are liberated from the laborious admin of spend management – freeing them and their business to focus on strategic activities that drive competitiveness. Our latest updates continue to listen to you and your needs – so we’ve gone back to basics to ensure more productivity and reduce inconveniences when managing your spend.

Maximising your productivity, putting you in control:

Make all forms of payments through one solution

We’ve introduced more options to make payments via Soldo than ever before. Teams can now handle different types of payments under one roof, without having to seek different methods elsewhere. ‘Pay Someone’ brings the flexibility to make outbound bank transfers to employees or suppliers directly from the Soldo platform. So for moments when using your Soldo card isn’t an option, Pay Someone acts as the alternative to ensure you can pay supplier invoices or make one-off external payments from the Soldo platform.

Reach new levels of efficiency by setting card rules in bulk

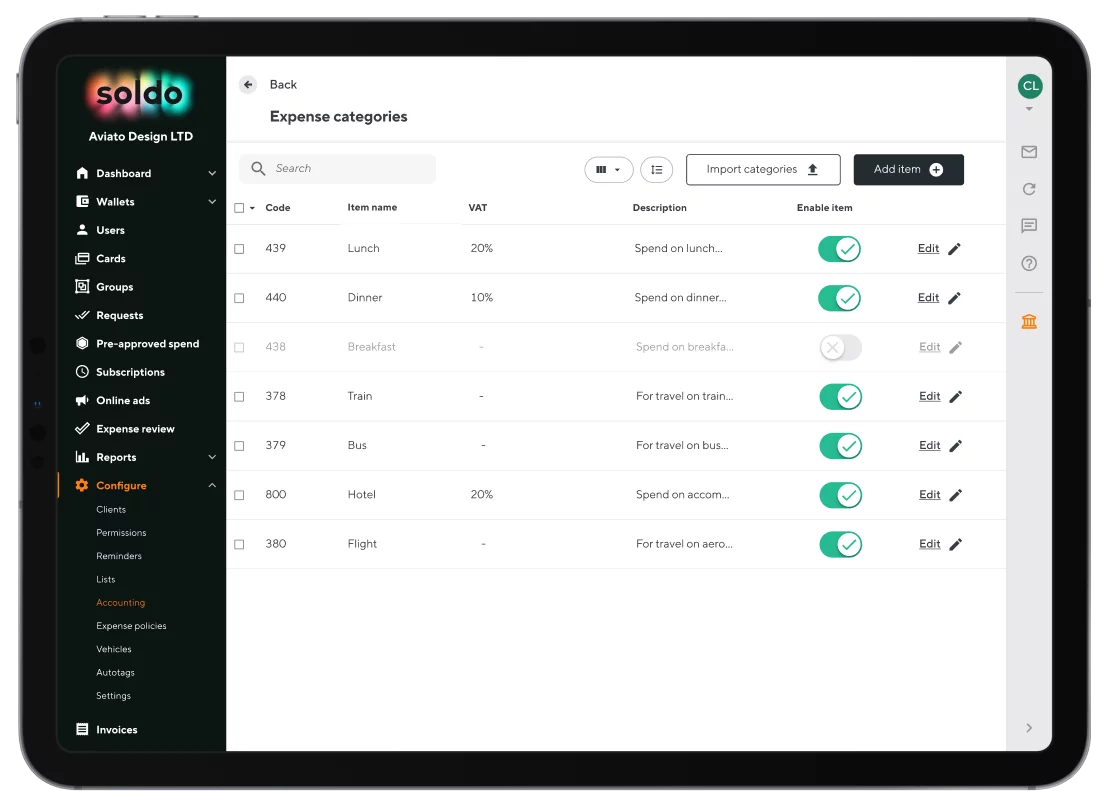

For organisations with a large volume of cards to manage – setting spend rules for these cards is now a smooth and seamless task. Whether it’s setting spending limits or specifying how and when Soldo cards can be used (e.g. limiting use by geo-location or merchant category), these rules can now be set in bulk via ‘Card Rules Presets’. Not only does this reduce any manual effort but it means that different presets can be configured and applied to specific groups or teams – the result – full control of spend based on your business needs.

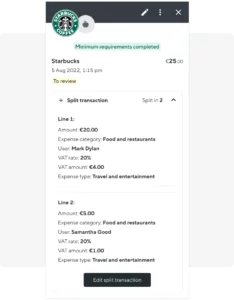

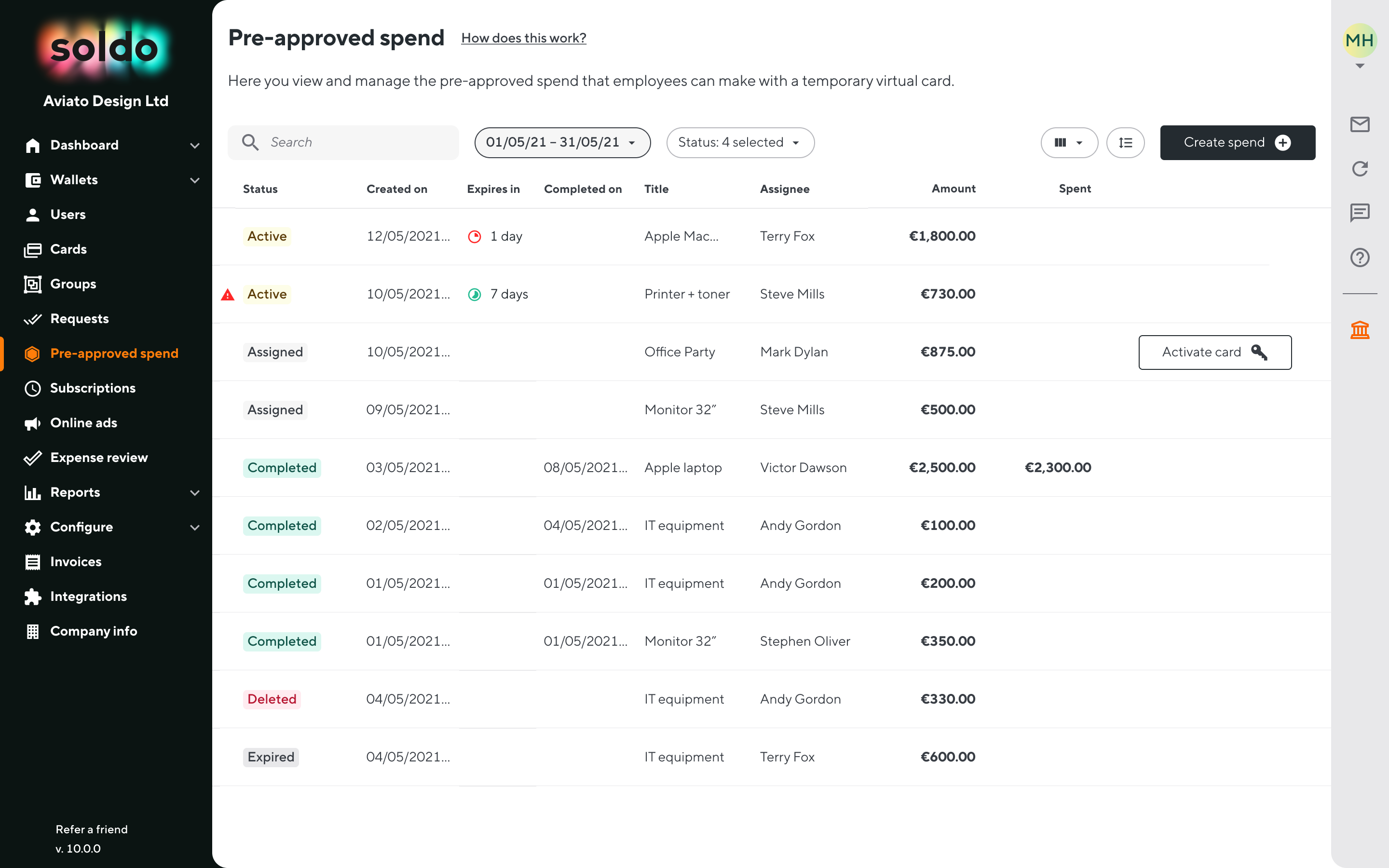

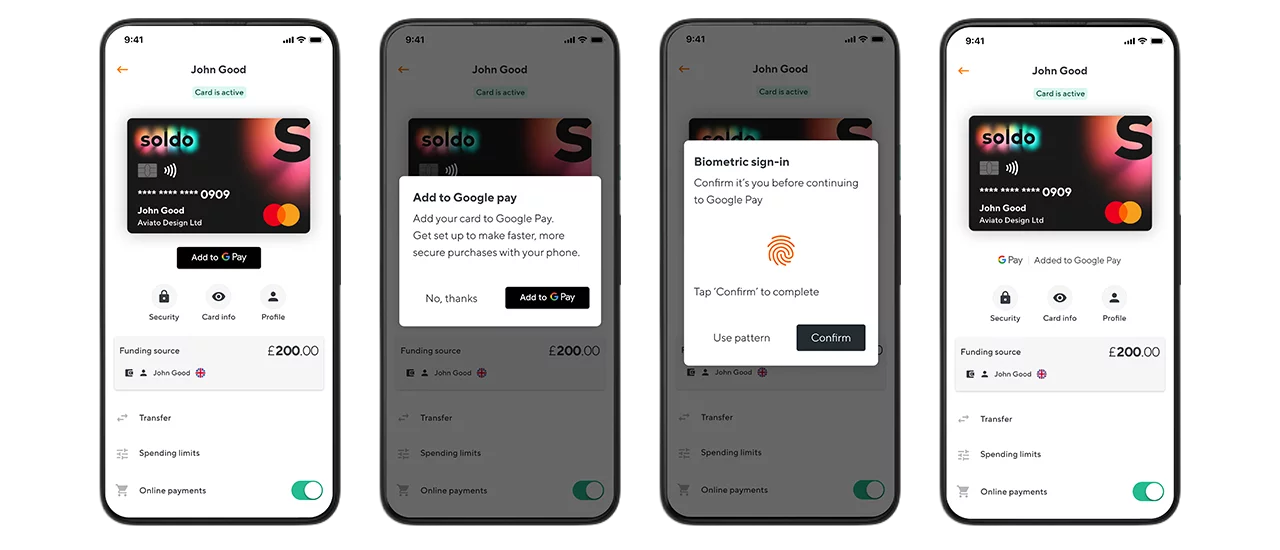

Enjoy greater flexibility with temporary virtual cards available via mobile

We want to ensure that anyone using Soldo is empowered to make a purchase as and when they need to, wherever they are. We’ve brought our ‘Pre-approved spend’ capabilities over to mobile to enable exactly that – giving admins and users the flexibility to request, approve and access Temporary virtual cards on the go.

Reducing those inconveniences:

Fewer disruptions when you’re in the zone

We’ve all been there, being logged-out of an app when working across different tools and trying to get things done. Our updated inactivity timer, means that you can be inactive for 15 minutes without having to log-in again, giving you more time to focus on the tasks at hand.

Want to maximise Soldo’s capabilities? Explore our new Business API portal

Our Business API Portal is a one-stop resource for teams seeking to automate financial processes. User-friendly, and comprehensive – our documentation covers how our APIs facilitate everything from transaction exports to virtual card management, driving productivity across the board.

Continuously building around your needs

Our Soldo team is on the ground listening out for your challenges and needs. Our platform improvements and feature releases aim to push you to greater levels of productivity.

If you want to learn more about these features and Soldo’s Amazon Business integration, check out our latest product update webinar.