Save hours on admin by connecting your expense claim system to Soldo

Simplify your expense claim system by connecting pre-loaded company cards to intuitive management tools. Control, track and report spending – all in one place.

We’ve helped thousands of businesses get more

from an expense claim system.

Why use an online expense claim system?

Win back valuable time

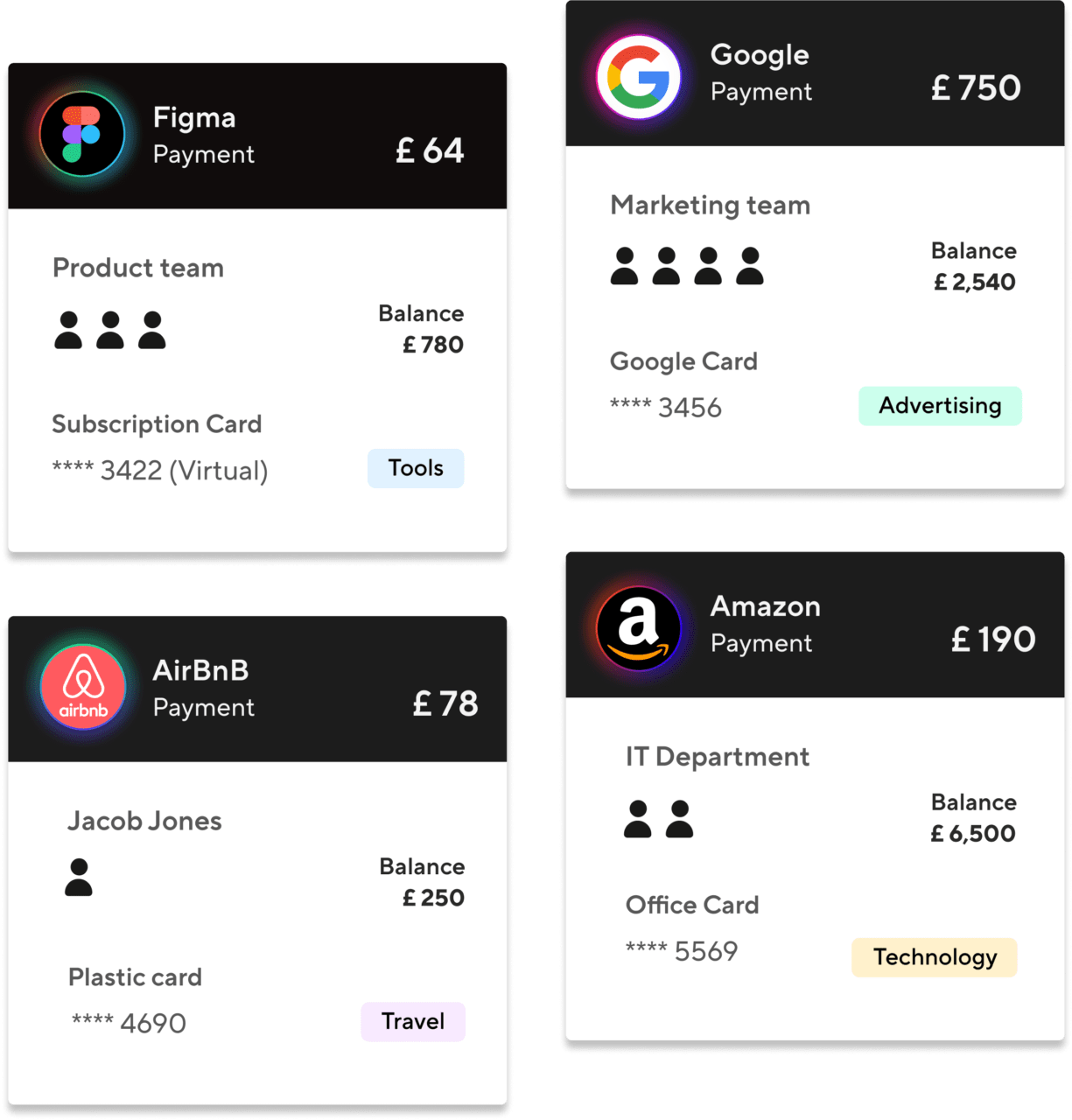

Trust employees to spend company money with prepaid cards that keep you in control

Get accurate transaction data

Separate budgets, custom limits and real-time visibility help prevent overspending

Simplify reconciliation

Save hours on admin and speed up month-end with automated tracking and reporting

Let our expense claim system take the strain

Use prepaid cards to control your cash before anything has been spent. Individual budgets and remote top-ups mean your employees are never out of pocket.

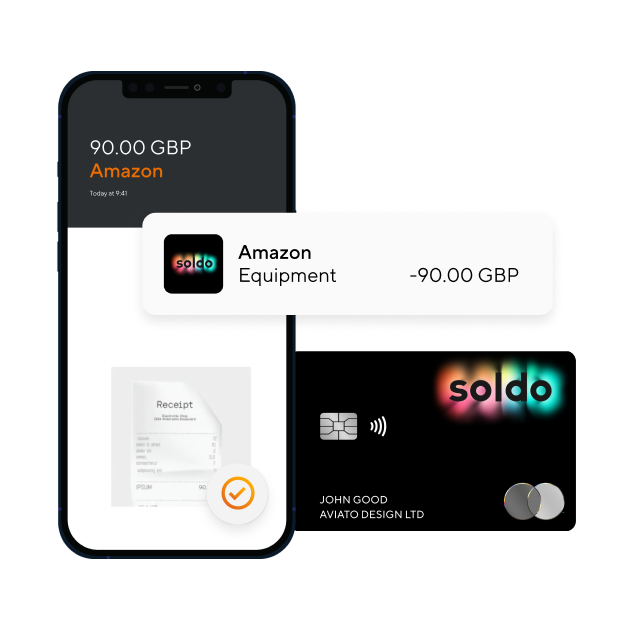

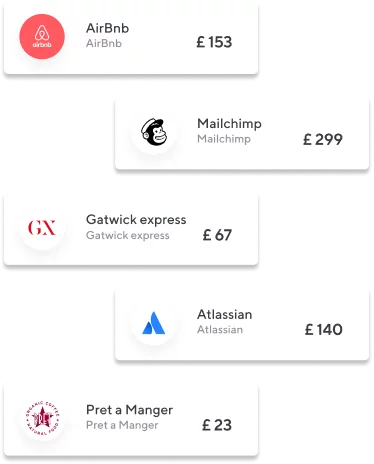

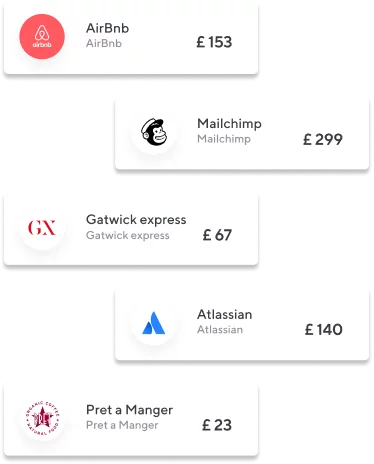

View company-wide spending remotely

Don’t let outdated expense claim systems keep you waiting around for receipts. With Soldo you can see spending information instantly and make data-led decisions.

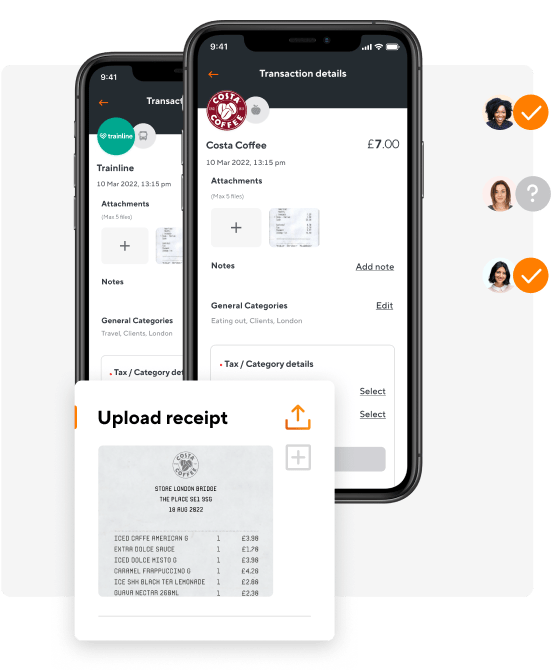

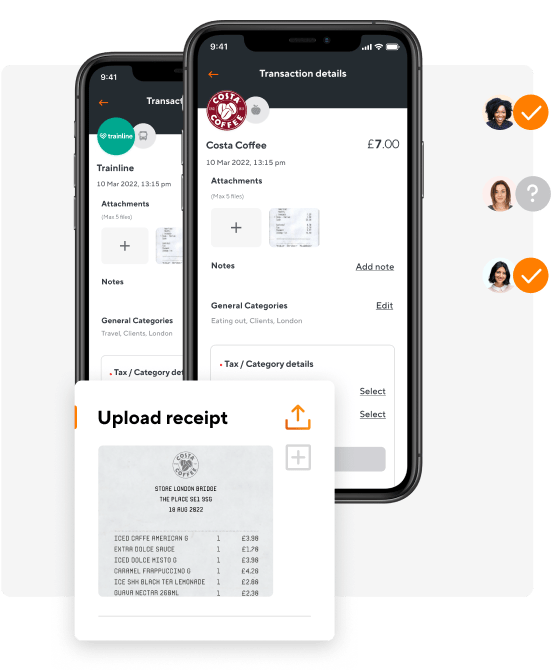

Make expenses easy for your teams

Traditional expense claim systems are slow and inefficient for everyone. Make expenses effortless with prepaid cards and digital receipt capture, with no more waiting for reimbursements.

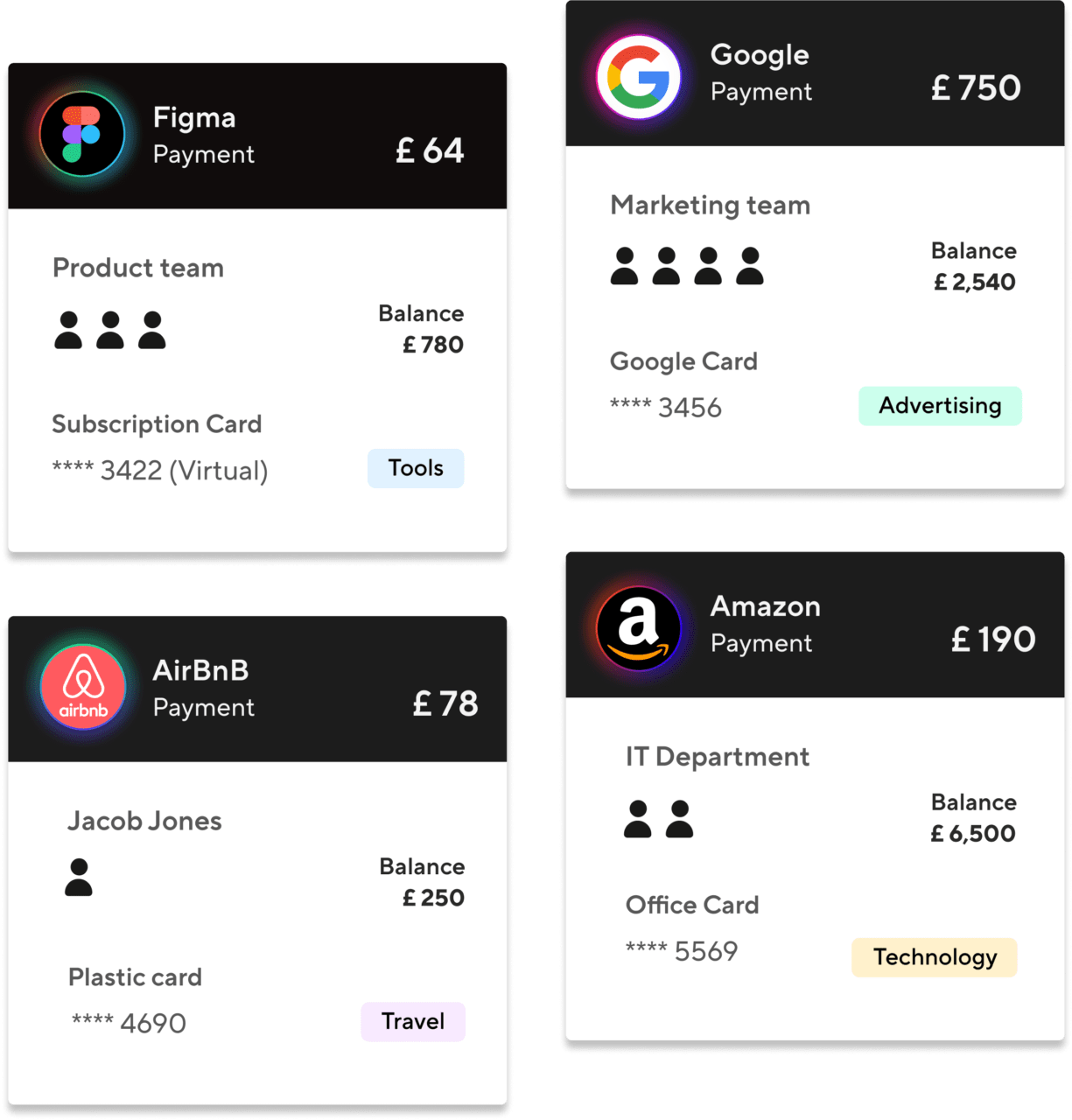

Set custom limits to stop overspending

Soldo’s online expense claim system helps you stop overspending in its tracks. Ring-fence budgets, set custom limits, instantly turn expense categories on or off and more.

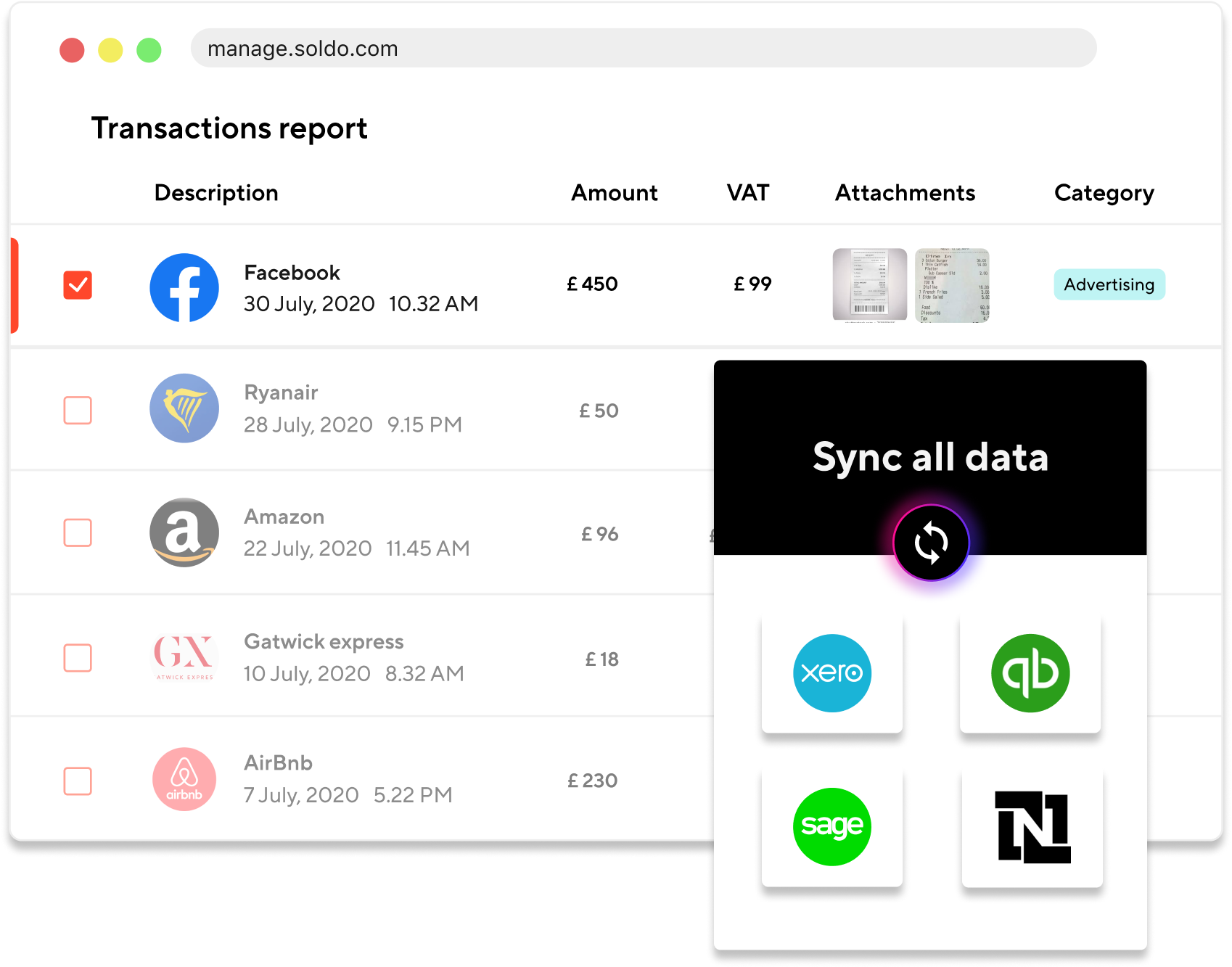

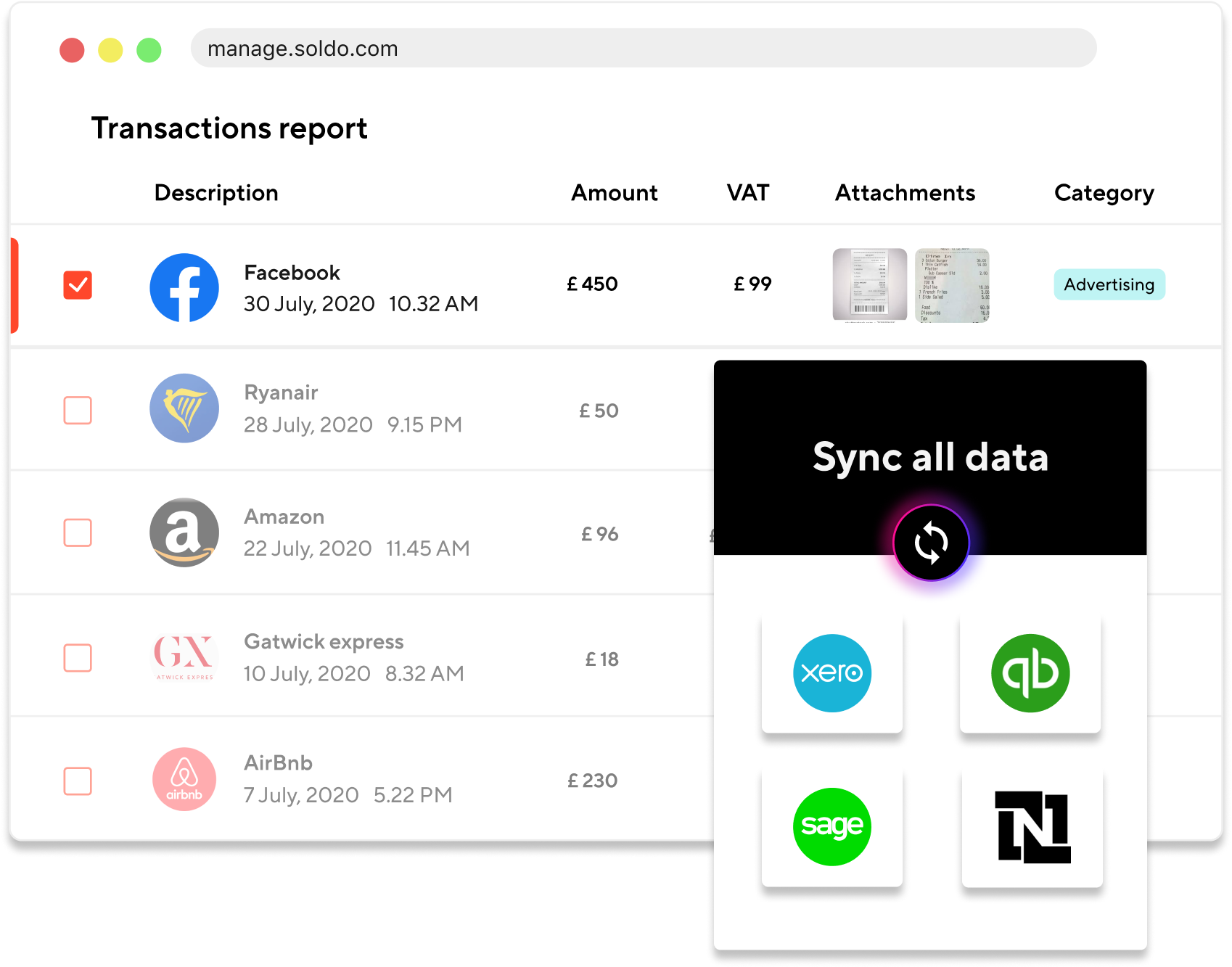

Save hours on bookkeeping

Free yourself from month-end madness. Real-time expense tracking, automated reporting and smart integrations with existing software unlock your time for more strategic work.

View company-wide spending remotely

Don’t let outdated expense claim systems keep you waiting around for receipts. With Soldo you can see spending information instantly and make data-led decisions.

Make expenses easy for your teams

Traditional expense claim systems are slow and inefficient for everyone. Make expenses effortless with prepaid cards and digital receipt capture, with no more waiting for reimbursements.

Set custom limits to stop overspending

Soldo’s online expense claim system helps you stop overspending in its tracks. Ring-fence budgets, set custom limits, instantly turn expense categories on or off and more.

Save hours on bookkeeping

Free yourself from month-end madness. Real-time expense tracking, automated reporting and smart integrations with existing software unlock your time for more strategic work.

How to unlock Soldo’s expense claim system

No credit checks, no hidden fees, no fixed contracts. Cancel anytime.

Complete registration

We need to confirm your identity and address. Upload a few documents and you’ll be done.

Add funds

Load money to your account to order your Soldo card. Receive it in 2 working days.

Start spending

Shop online or instore safely with your contactless card.

excl. 20% VAT

*Subject to eligibility, based on the criteria found

Your Soldo expense claim system plan includes

Everything you need to get started

Soldo Mastercard® cards

Get as many cards as you need for employees and departments. Our contactless cards are accepted by millions of merchants worldwide.

Web console and mobile app

See spending in real time on the online expense claim system. View balances, capture receipts and manage cards on the employee app.

Accounting integration

Export transaction data to every major accounting software, in two clicks. Connect expenses to Xero and QuickBooks.

Free & unlimited transactions

Soldo Mastercard® cards have no fees for domestic transactions and our foreign exchange fee is fixed at just 1%.

No charge for deposits

It’s free to add funds, and money is available to spend instantly. Allocate funds to cards when your team needs it.

Dedicated support

Need a hand? Our friendly customer success team is at your service, providing support whenever you need it.

Empower your team with Soldo’s expense claim system

Get the benefits of a Soldo account now

Get started