What are the pros and cons of e-payment systems?

The rise of e-payment systems

The use of electronic payment systems has skyrocketed in recent years, and this has been further exacerbated by the pandemic. The preference for physical payment methods like cash and cheques is at an all-time low, and it doesn’t look like that trend is going to reverse anytime soon. It’s not just consumers either; business owners are moving away from petty cash and embracing e-payment systems such as prepaid business cards.

So given that we’re all using e-payment systems more often than not, we should know about the advantages and disadvantages of the format, particularly when it comes to small businesses.

Payment processors for small businesses

Before we get into the pros and cons of e-payment systems, it’s useful to know exactly what the process is and what part you as a business owner play in it. At a basic level, there are three parties involved when a customer pays for your product or service using an e-payment system: the customer’s bank account, your business’ bank account, and an intermediary that allows a transfer from the former to the latter. This in-between party is known as a payment processor, and will most likely be a type of card terminal.

For your business to be able to accept e-payments in person, you’ll need to sign up with a payment processor provider so that you have the physical means to process those purchases.

There are a number of service providers on the market, but arguably the most important factor is the number of card brands that they accept. You’ll want your business to accept a range of options, from an American Express credit card to Apple Pay on a customer’s phone. Of course, the more payment options you can accept, the more customers you can serve and the more transactions you can process.

However, another factor you should consider is how much it will cost you to maintain your e-payment processor. Some providers charge a fixed amount for a card reader as well as a certain percentage of each transaction, whereas others offer a monthly rental price. It’s well worth taking the time to research which payment processor will work best for your business.

With that in mind, let’s take a look at the benefits and risks that your business faces when embracing e-payment systems.

Advantages of e-payment systems

Higher customer numbers

In 2018, over 60 per cent of UK transactions used some form of electronic payment, and that figure will only have increased since then. This brings us to perhaps the most obvious benefit to e-payment systems: it means you can serve more customers. People are carrying less and less cash around with them, and cash-only businesses are becoming increasingly rare. You don’t want to be one of them, as you risk alienating potential customers who only carry e-payment methods.

Fast payments

These days most electronic payments just involve a tap of a phone or a card. Of course, this is much faster than a cash payment, which can often be slowed down by the need to give change. The faster you can process transactions, the more sales you can get through per day.

Greater security

E-payments come with multiple levels of security. For starters, unlike cash, there’s no risk of forgery. On top of this, the traditional e-payment methods like credit and debit cards come with a PIN verification for larger purchases. Card-free methods like Apple Pay are even more secure, often requiring biometric verification such as fingerprint or face ID. Not only this, but with Apple Pay, data is encrypted and fluid, so card details can’t be taken from a stolen phone.

Disadvantages of e-payment systems

Merchant charges

The primary downside of using a payment processor is that it will come with a charge. As we’ve said, this could be a monthly rental fee or simply a percentage of each transaction. These additional costs can add up, but thankfully most providers offer a reasonable package that shouldn’t hit the wallet too hard.

Risk of fraud

Although e-payment systems are generally secure, there’s always the risk of their security measures failing. Systems may not come under direct attack, but phishing techniques can be used to obtain IDs and passwords. Once a hacker has these details, e-payments make it possible to process multiple payments before the genuine account holder notices.

Reliance on internet

Of course, as the ‘e’ in ‘e-payment systems’ denotes, these transaction methods are reliant on the Internet. Should you suffer an outage in service, this can grind business activity to a halt, leading to frustrated customers and a lack of income for you.

Although there are downsides to e-payment systems, no method of payment will be perfect, and the pros far outweigh the cons. Whichever way you look at it, modern consumer culture is becoming increasingly cashless, and it pays to keep up with this trend.

E-payments for your employees

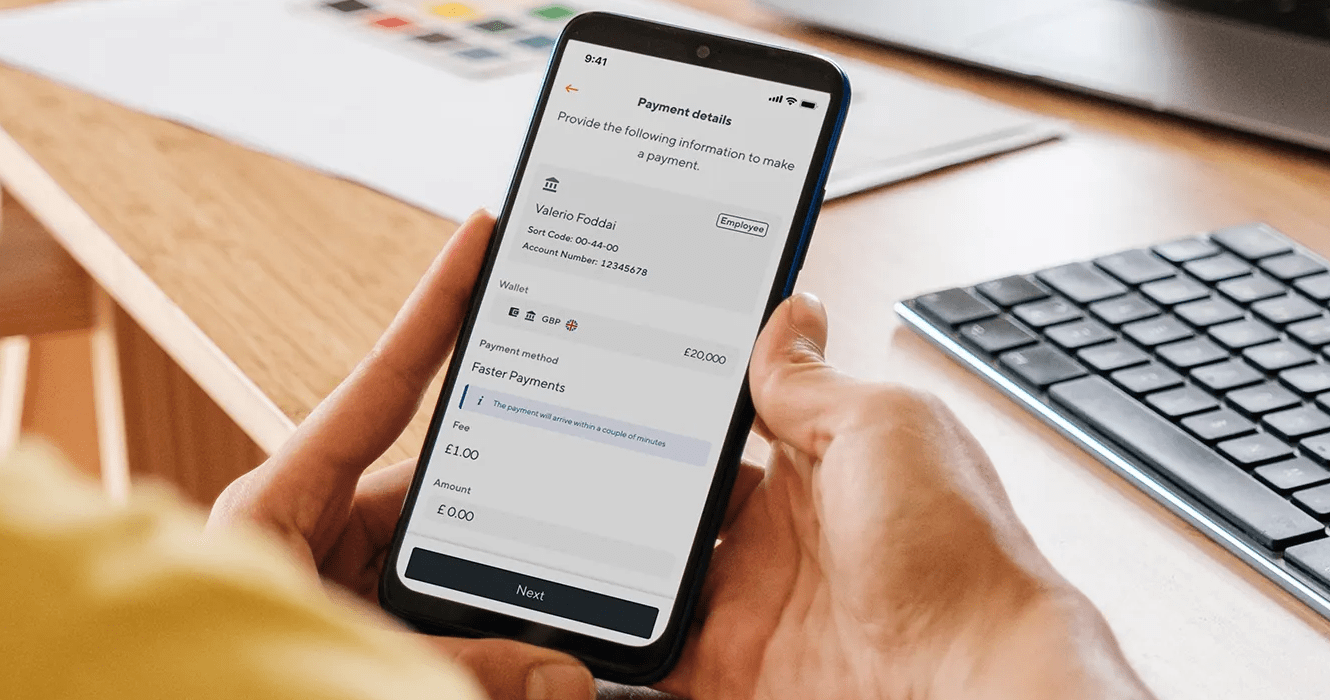

We’ve spoken a lot about electronic payments going from the customer to your business bank account, but what about payments going out of your business bank account? When it comes to necessary outgoings, you want to know that you and your employees are using a secure, reliable e-payment system to purchase business expenses.

One popular method of managing expenses is business expense cards. These will often be provided by a high street bank as a business alternative to personal credit cards. Although these company cards can be useful, their rigidity and lack of visibility means they aren’t ideal for any e-payments you or your employees need to carry out.

Businesses often end up sharing one corporate credit card between a whole team, so spending can easily spiral and it can be difficult to keep track of who’s paid for what. On top of this, the fact that many individuals can access the card makes it vulnerable to theft or fraud. And inflexible spend-limits mean your business bank account is vulnerable to abuse.

But there is a brighter way. With Soldo’s prepaid card from Mastercard®, budgets and limits are customisable, so you decide exactly how much cash is on each card for a certain period. And there’s no need to stick to just one, you can assign a Soldo card to any number of individuals, teams, or departments, depending on how you prefer to track your business expenses.

For a more secure way of handling e-payments, switch to Soldo today and get complete peace of mind.

Simplify your spending with prepaid cards

Access lower fees and save time spent on accounting by joining Soldo today.

Secure payments

Soldo’s prepaid cards offer maximum security and complete visibility, giving you total peace of mind.

Customisable rules

You decide how much cash is on each card, and you can always top them up remotely if needs be.

Assign multiple cards

With Soldo it’s easy to distribute cards amongst your team so that every individual feels empowered to spend.