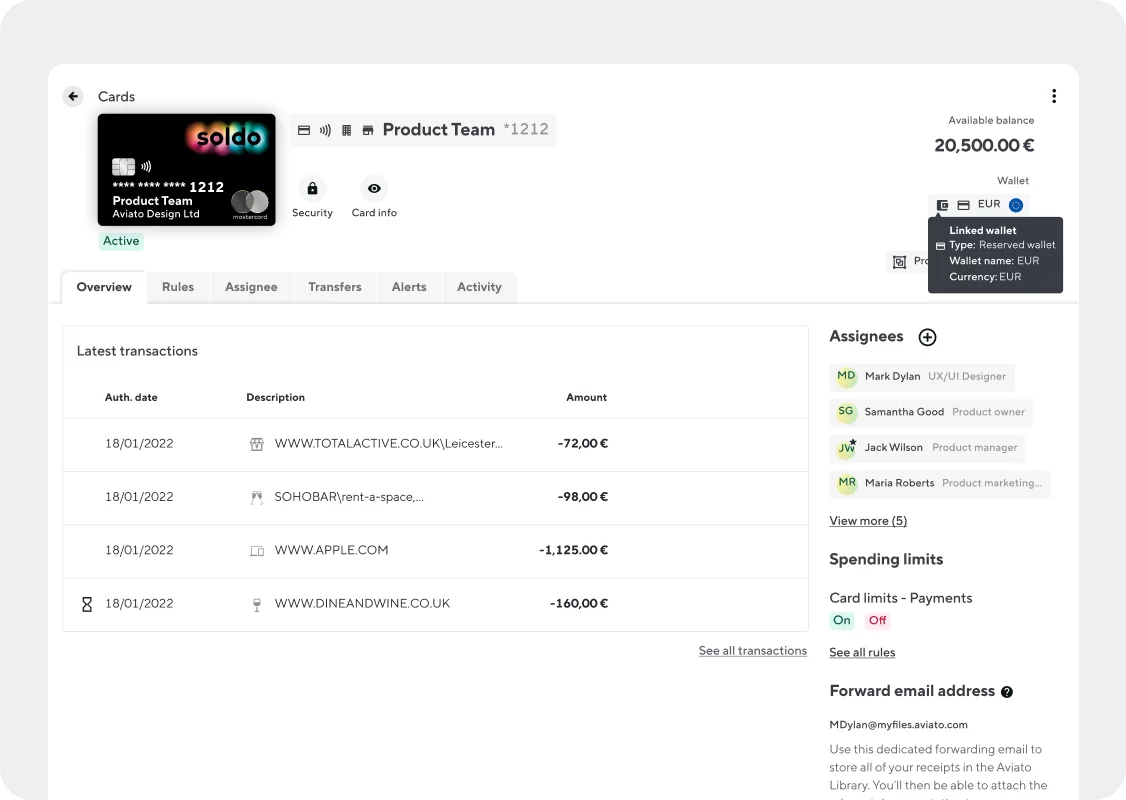

With Soldo company cards, you control who spends company money, how much, on what, and which budget they use.

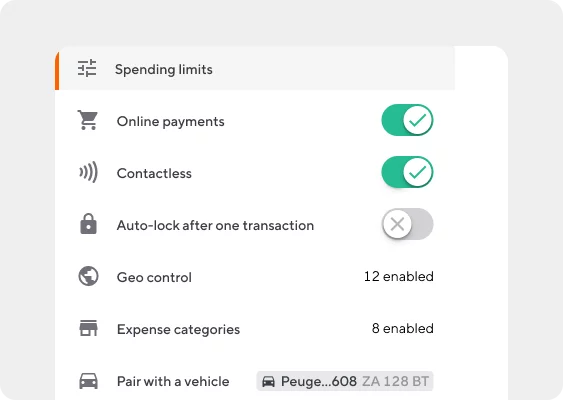

Set custom rules and limits for each card in a few clicks to prevent overspending , without micromanaging every transaction.

- Why Soldo

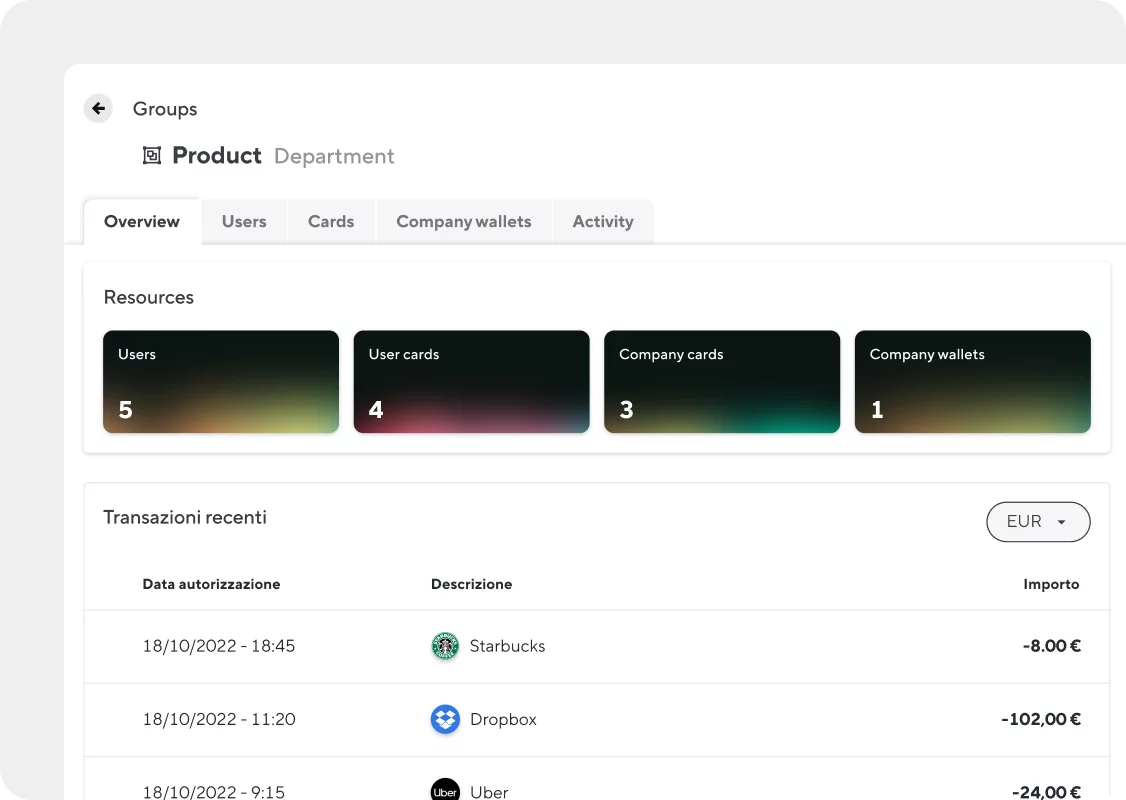

- Decentralised SpendControl company spending in one place

- Liberate Finance Accomplish MoreReduce admin, focus on strategy

- Progressive Finance ApproachSmarter, more agile financial management

- The Soldo DifferenceBuilt for flexibility and scalability

- Soldo Financial ServicesNot reliant on 3rd party financial solutions

- Security & PrivacyEnterprise grade protection and compliance

-

- Progressive Solutions

- Business NeedsHow Soldo can benefit your business.

- Centralise Decentralised SpendControl all spending in one place

- Business & Finance AgilityFaster, smarter financial control

- More Accurate ForecastingSmarter insights, better planning

- Easier Month-endsClose books faster, stress-free

- Increase ProductivitySpend less time on admin

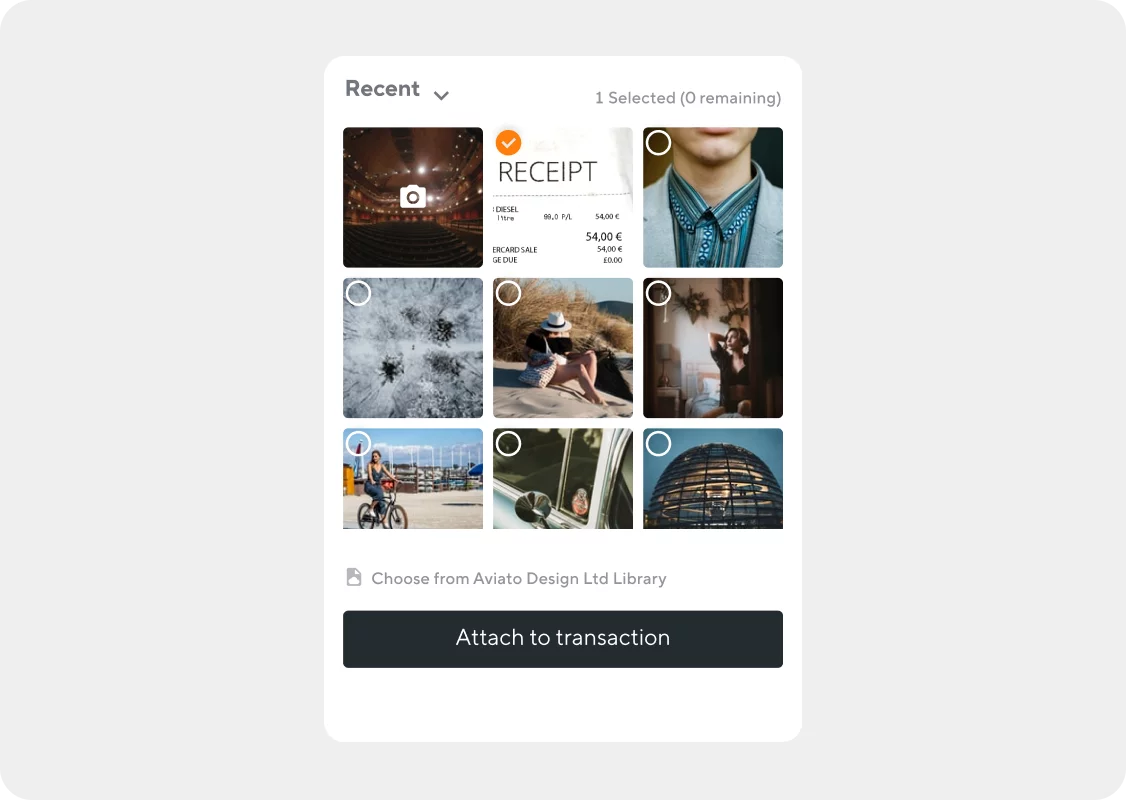

- Ensure ComplianceStay audit-ready, effortlessly

- Track Sustainability GoalsMonitor and manage ESG impact

- Expense & Company CardsFlexible, controlled business spend

-

- Latest resources

Managing Business Spend For Dummies:...Spend management can make the...

Managing Business Spend For Dummies:...Spend management can make the... Spend Index: How businesses like...Discover the trends shaping decentralised...

Spend Index: How businesses like...Discover the trends shaping decentralised... Spend Health Assessment ToolTake our short assessment to...

Spend Health Assessment ToolTake our short assessment to...

- IndustrySome key industries we are in.

- Fashion RetailTrack budgets across stores

- Food & BeverageMaintain budgets at every branch

- Property & Facilities ManagementSee property expenses live

- Machinery ManufacturingHandle unplanned repairs fast

- Media ProductionManage on-set expenses smoothly

- Social Care GroupsProvide funds for service users

- ConstructionGain cost visibility per site

- EducationSupport daily teaching costs

-

- Latest resources

Managing Business Spend For Dummies:...Spend management can make the...

Managing Business Spend For Dummies:...Spend management can make the... Spend Index: How businesses like...Discover the trends shaping decentralised...

Spend Index: How businesses like...Discover the trends shaping decentralised... Spend Health Assessment ToolTake our short assessment to...

Spend Health Assessment ToolTake our short assessment to...

- Company SizeWhich represents your company size?

- Role or FunctionWhat do you do for work?

- CFO & Finance LeadersStrategic control of company spend

- Finance TeamsSimplify spend management

- Finance TransformationModernise and automate finance

- Operations & ProductionOptimise costs and efficiency

- ProcurementSmarter purchasing decisions

- Human ResourcesManage team expenses easily

- MarketingTrack and control campaign spend

-

- Latest resources

Managing Business Spend For Dummies:...Spend management can make the...

Managing Business Spend For Dummies:...Spend management can make the... Spend Index: How businesses like...Discover the trends shaping decentralised...

Spend Index: How businesses like...Discover the trends shaping decentralised... Spend Health Assessment ToolTake our short assessment to...

Spend Health Assessment ToolTake our short assessment to...

- Latest resources

Managing Business Spend For Dummies:...Spend management can make the...

Managing Business Spend For Dummies:...Spend management can make the... Spend Index: How businesses like...Discover the trends shaping decentralised...

Spend Index: How businesses like...Discover the trends shaping decentralised... Spend Health Assessment ToolTake our short assessment to...

Spend Health Assessment ToolTake our short assessment to...

-

- Product & Ecosystem

- One Ecosystem forHow Soldo can transform your business

- Management PlatformHow Soldo’s management platform helps you

- Spend ControlsEnforce policies & limits

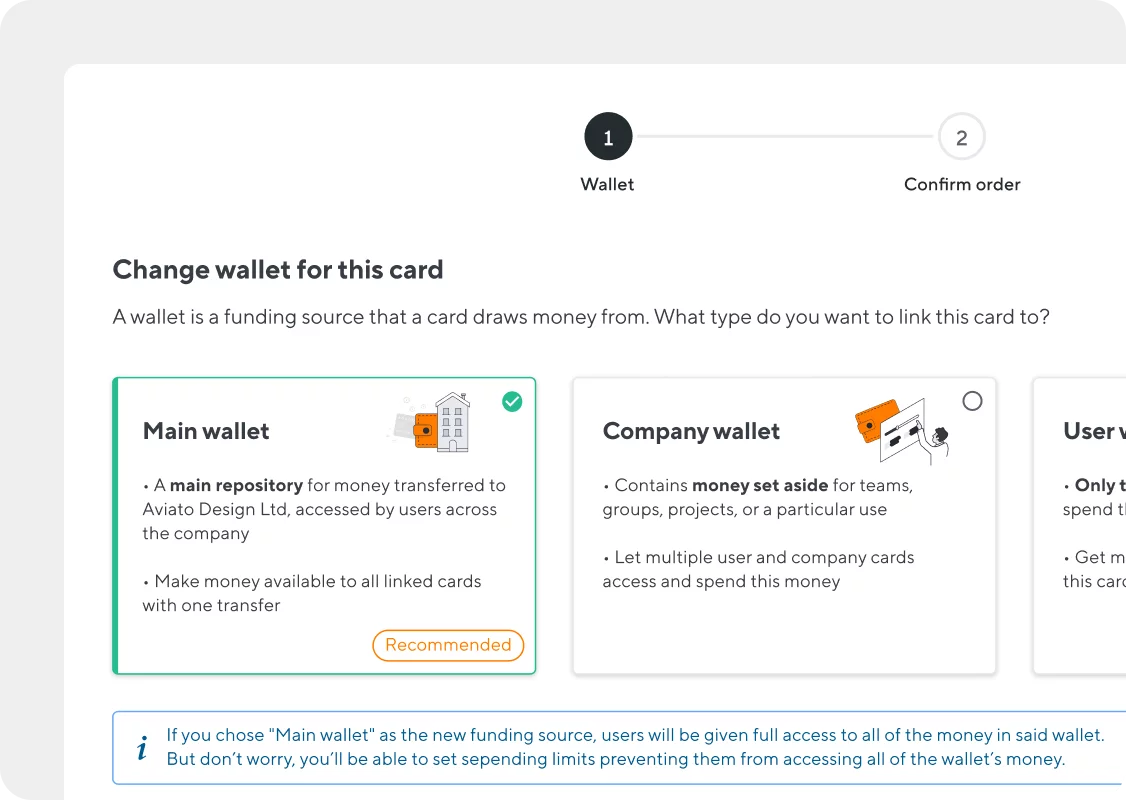

- BudgetsAllocate ring-fenced funds

- Teams & EntitiesAlign spend with hierarchy

- Requests & ApprovalsEmpower teams to request funds

- Expense ReviewAutomate approvals & expenses

- Accounting AutomationSync spend with accounting

- Reporting & AnalyticsGet clear spend insights

-

- Latest resources

Spring LaunchDigital innovation is reshaping every...

Spring LaunchDigital innovation is reshaping every... Bank Transfer AccessSoldo’s new feature gives you...

Bank Transfer AccessSoldo’s new feature gives you... Product TourSee how Soldo simplifies spend...

Product TourSee how Soldo simplifies spend...

- Payments & CardsWe cover a variety of payment methods

- Mobile AppOn-the-go solutions

- Integrations & APIsConnect spend data across your systems

- IntegrationsConnect your financial system

- Accounting IntegrationsSpeed up reconciliation and reporting

- ERP IntegrationsConnect business systems for one source of truth

- HR IntegrationsSync employee and spend data

- T&E IntegrationsSimplify business travel expenses

- eCommerce IntegrationsTrack and reconcile your eCommerce spending

- Custom IntegrationsFlexible options for any system

-

- Latest resources

Spring LaunchDigital innovation is reshaping every...

Spring LaunchDigital innovation is reshaping every... Bank Transfer AccessSoldo’s new feature gives you...

Bank Transfer AccessSoldo’s new feature gives you... Product TourSee how Soldo simplifies spend...

Product TourSee how Soldo simplifies spend...

- Professional ServicesUnlock the power of Soldo

- Latest resources

Spring LaunchDigital innovation is reshaping every...

Spring LaunchDigital innovation is reshaping every... Bank Transfer AccessSoldo’s new feature gives you...

Bank Transfer AccessSoldo’s new feature gives you... Product TourSee how Soldo simplifies spend...

Product TourSee how Soldo simplifies spend...

-

- Pricing

- Resources

- ResourcesFind guides, tips & insights

- SupportGet help when you need it

- CompanyContact, learn and join

- Latest resources

The Hidden Cost of Admin...Outdated spend processes cost care...

The Hidden Cost of Admin...Outdated spend processes cost care... What mid-year spend trends reveal...Global transformation lead Monica Proothi...

What mid-year spend trends reveal...Global transformation lead Monica Proothi... What mid-year spend trends reveal...Explore what the latest spend...

What mid-year spend trends reveal...Explore what the latest spend...

-