Smart payments and effortless reporting for media agencies

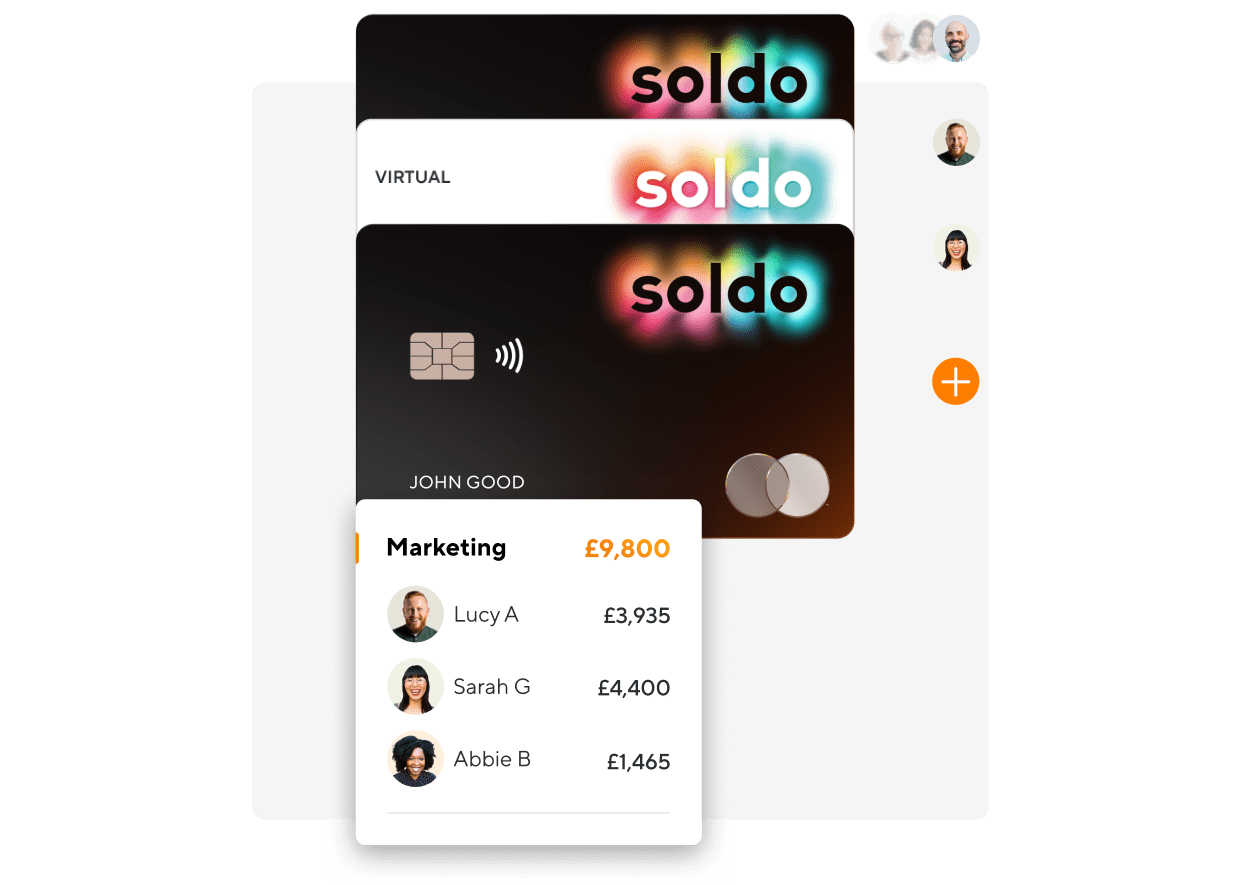

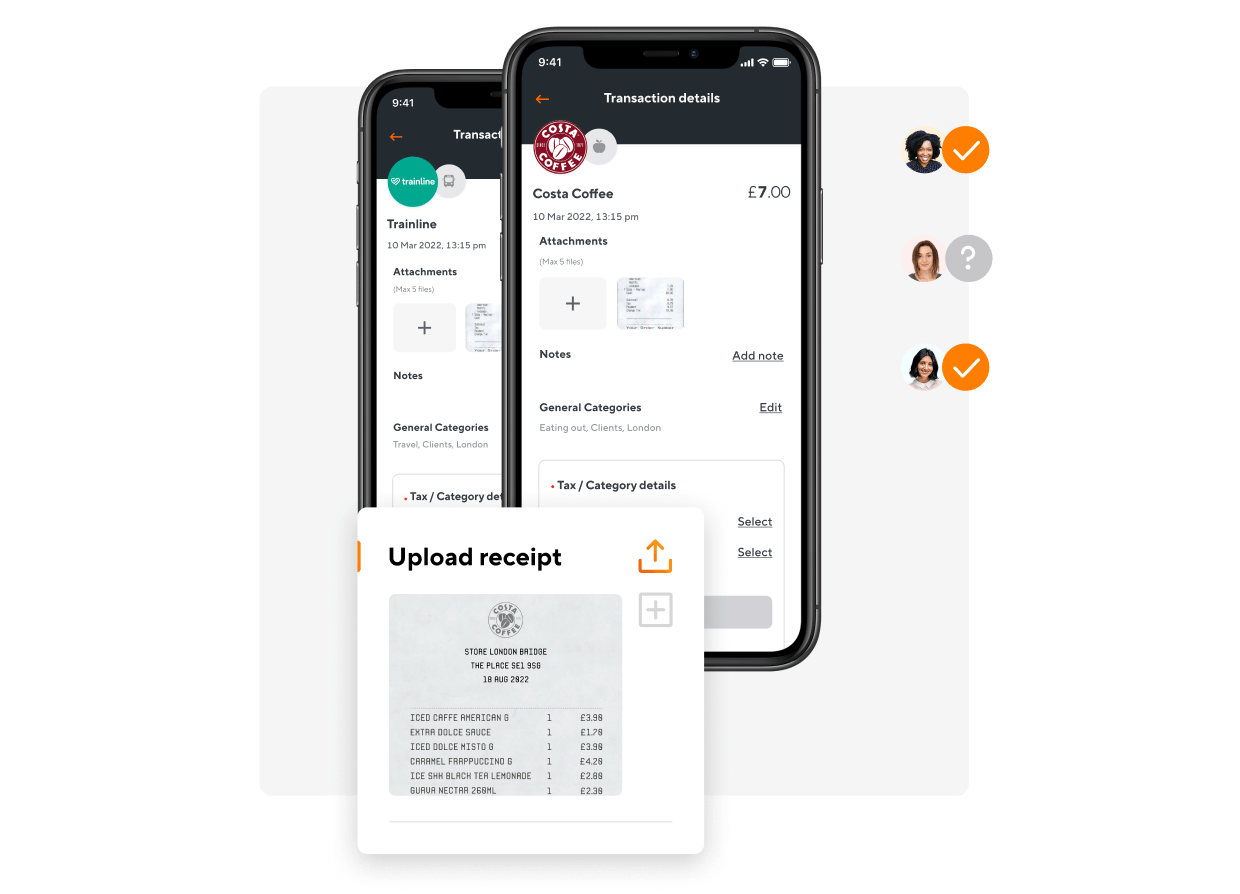

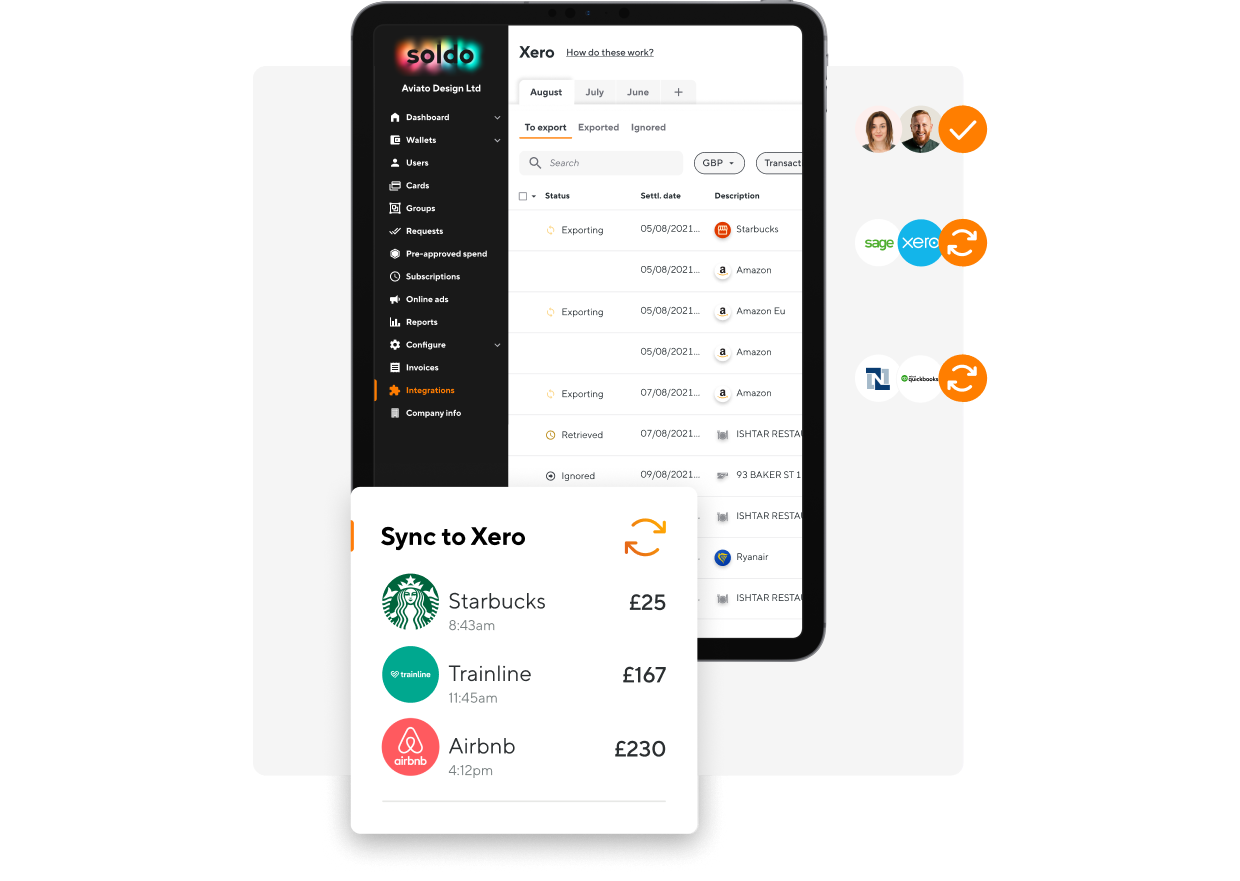

Media agencies face unique challenges when managing spend as they work with multiple clients and across different platforms at any given time. So, keeping tight control over cash flow and budgets is vital. As the number of apps grows, technology becomes increasingly key. With Soldo’s automated platform, fast-paced media agencies can manage spend and expenses seamlessly.