Discover smarter spending

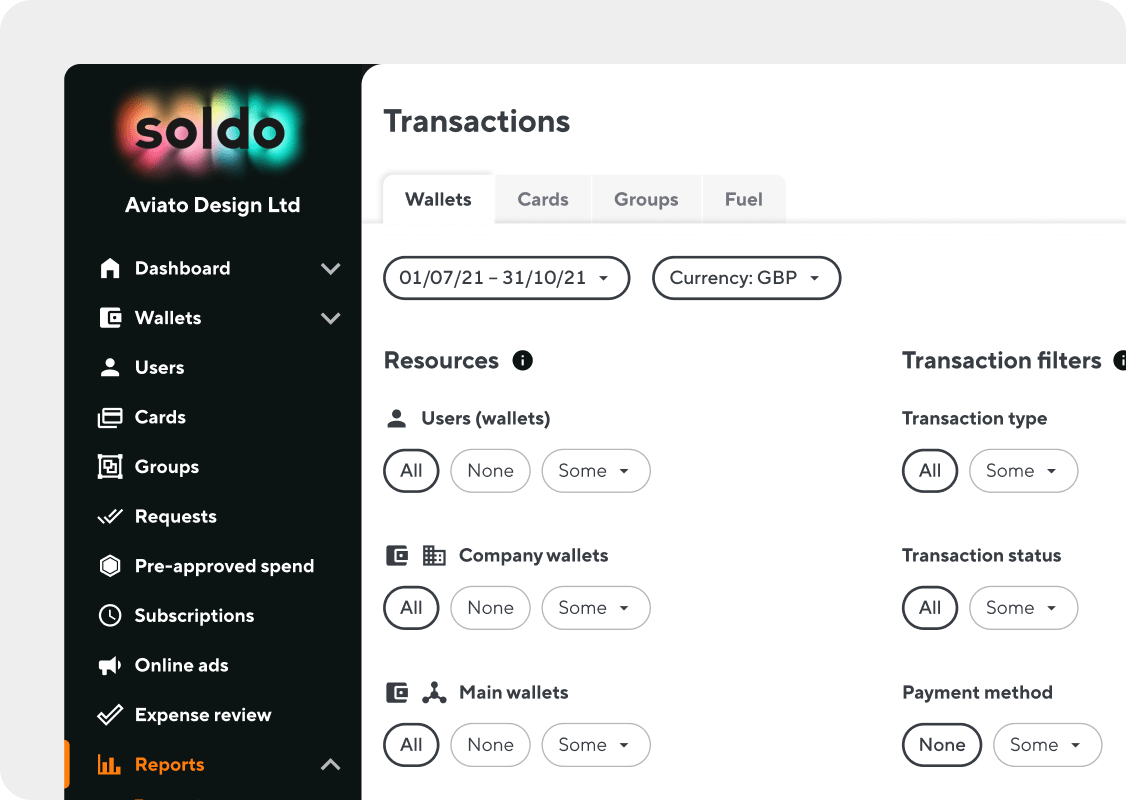

Organisations need to spend on subscriptions, online advertising, office supplies and more every day to stay in business. But banks were never built for business spending. So, managing company spend is challenging, creates unnecessary paperwork, and increases risk.

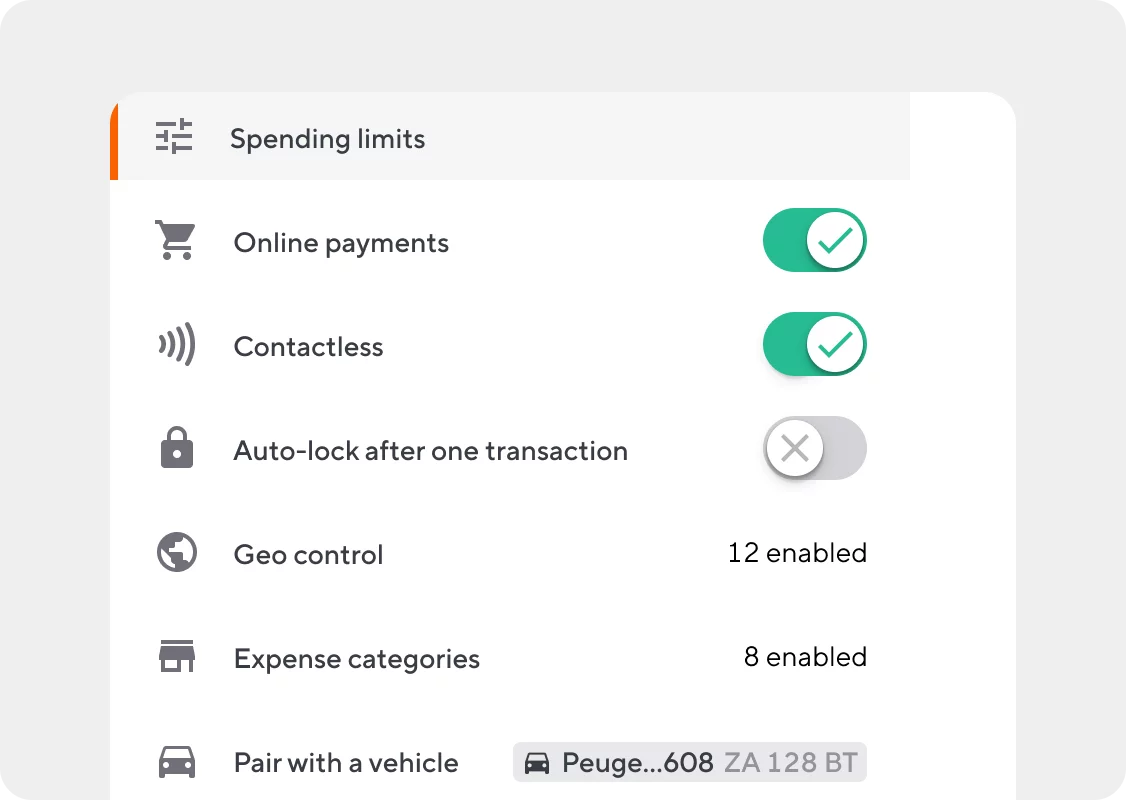

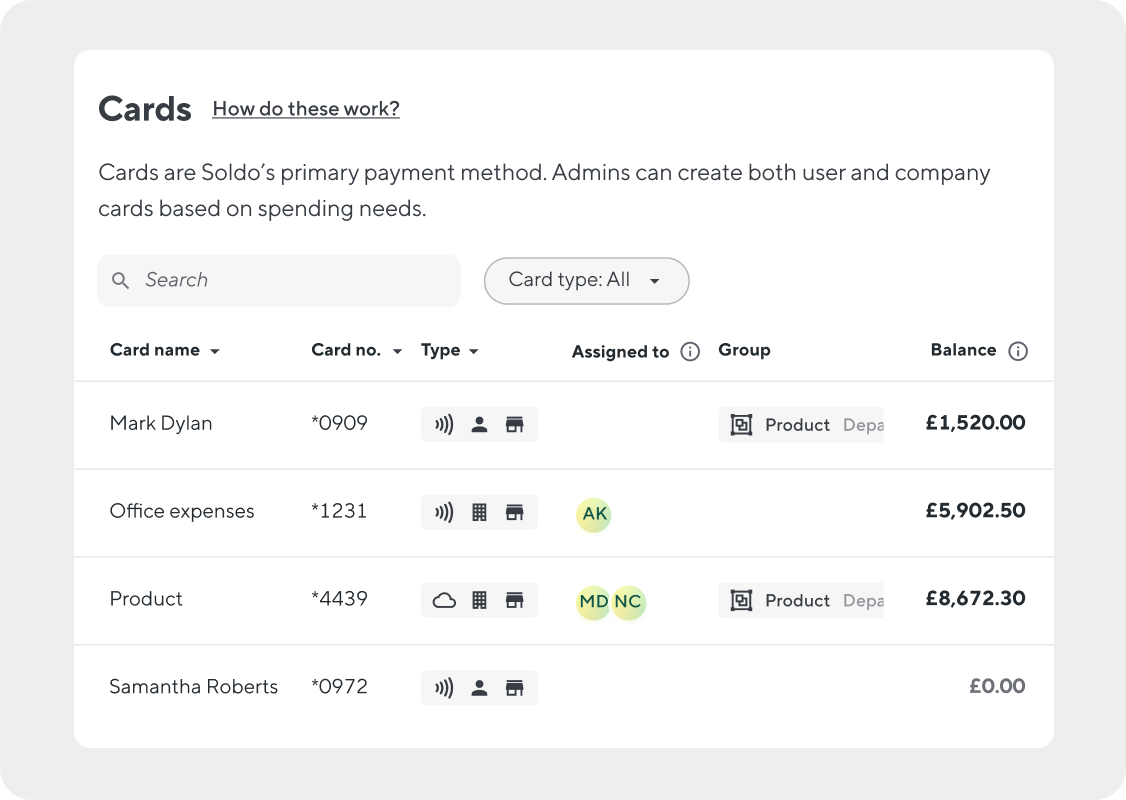

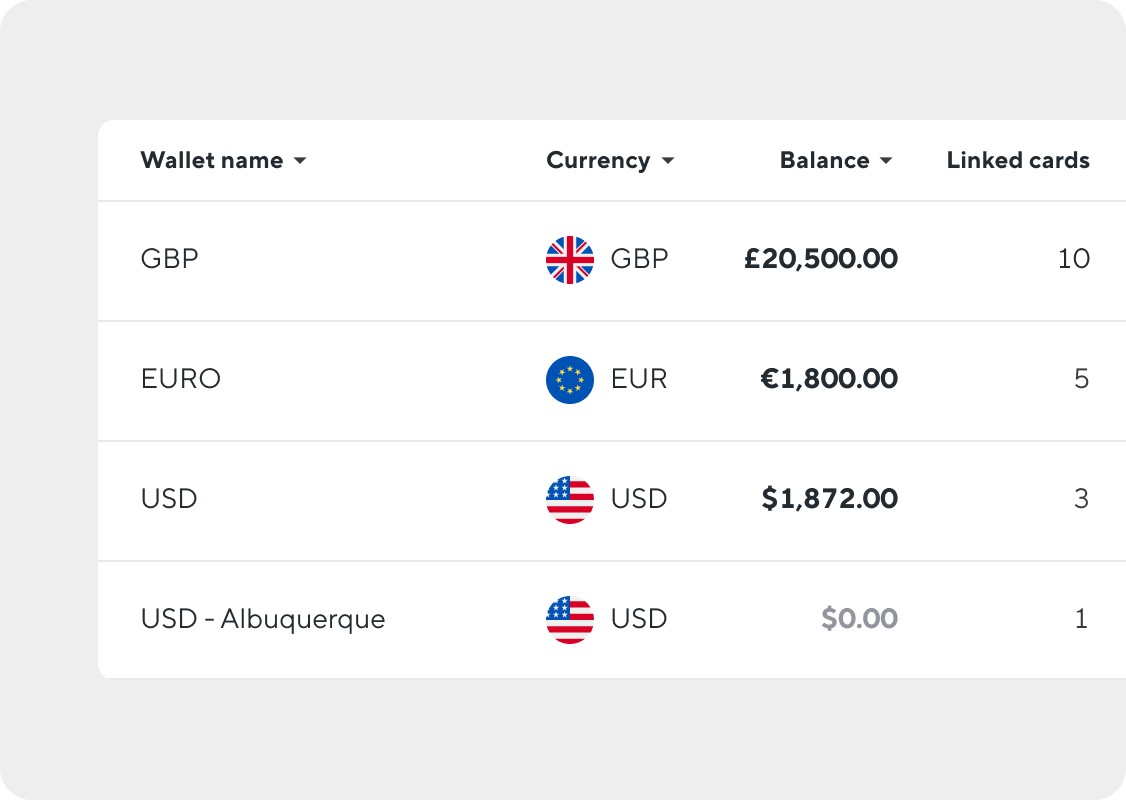

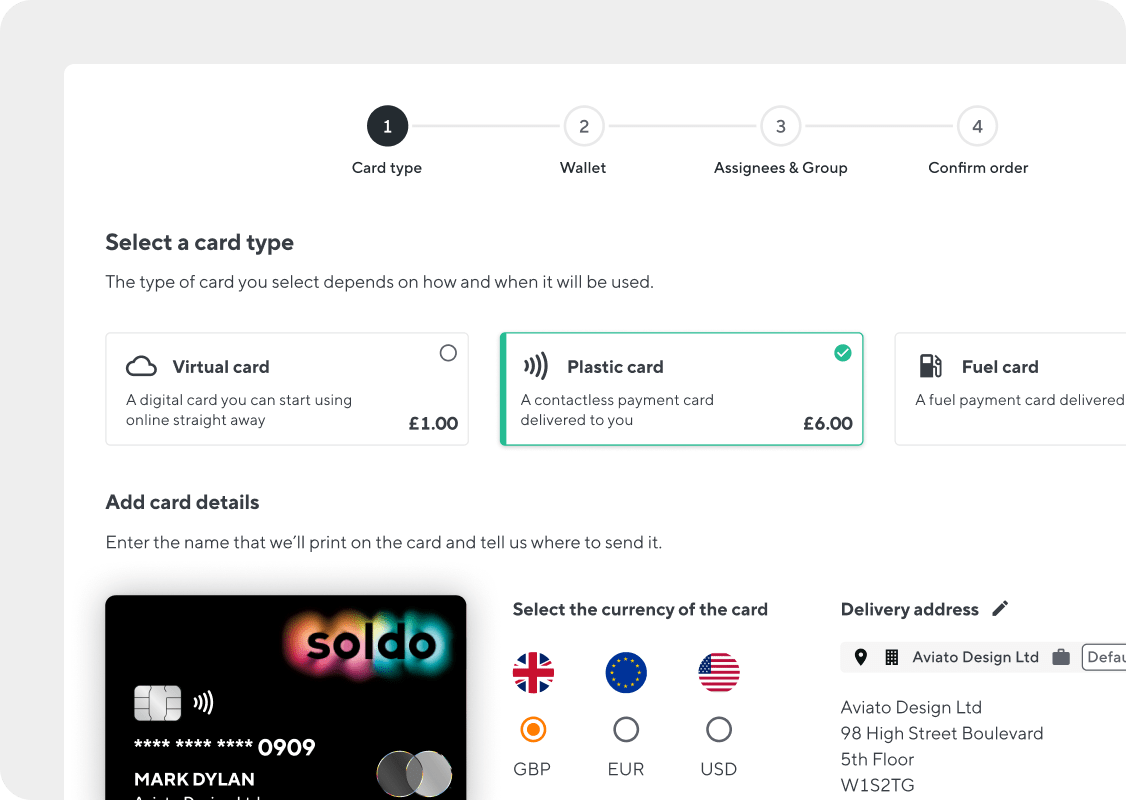

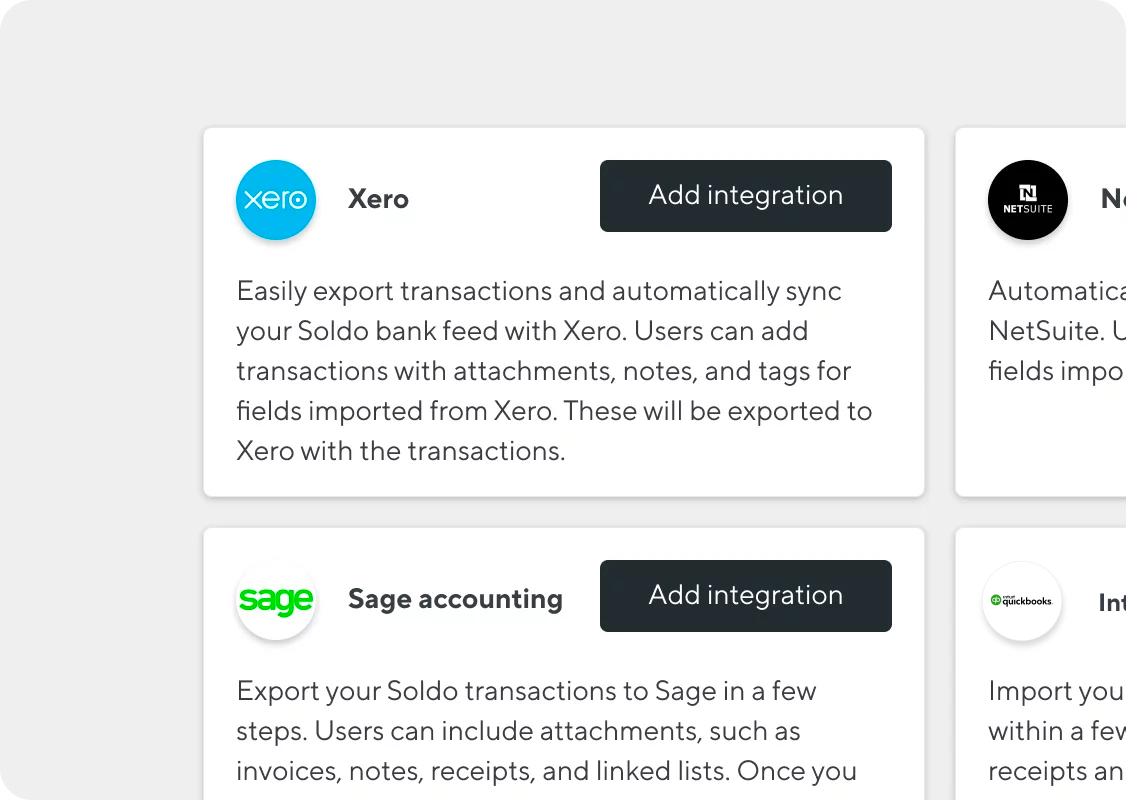

Thankfully, Soldo’s automated system offers a flexible alternative, that gives you everything you need to manage business spending in a smarter way.