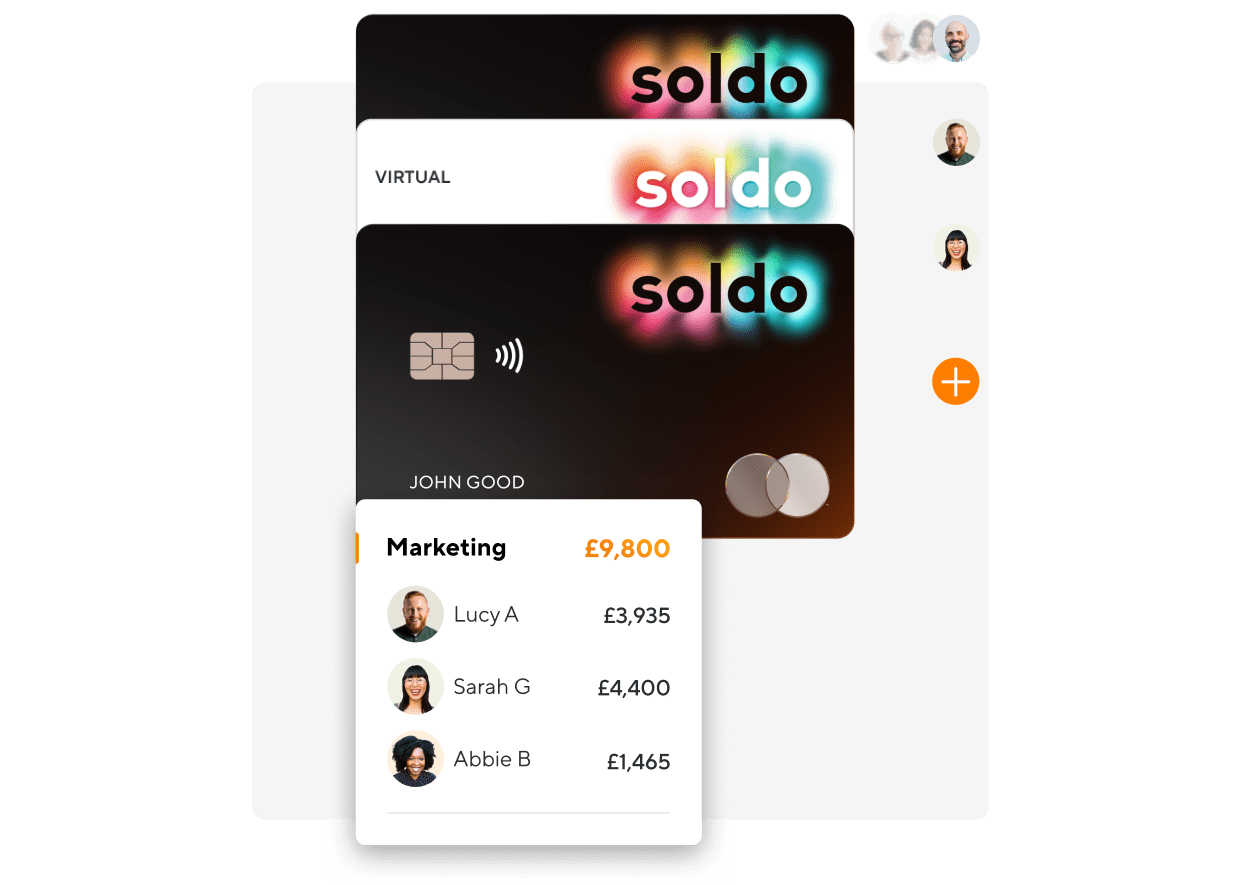

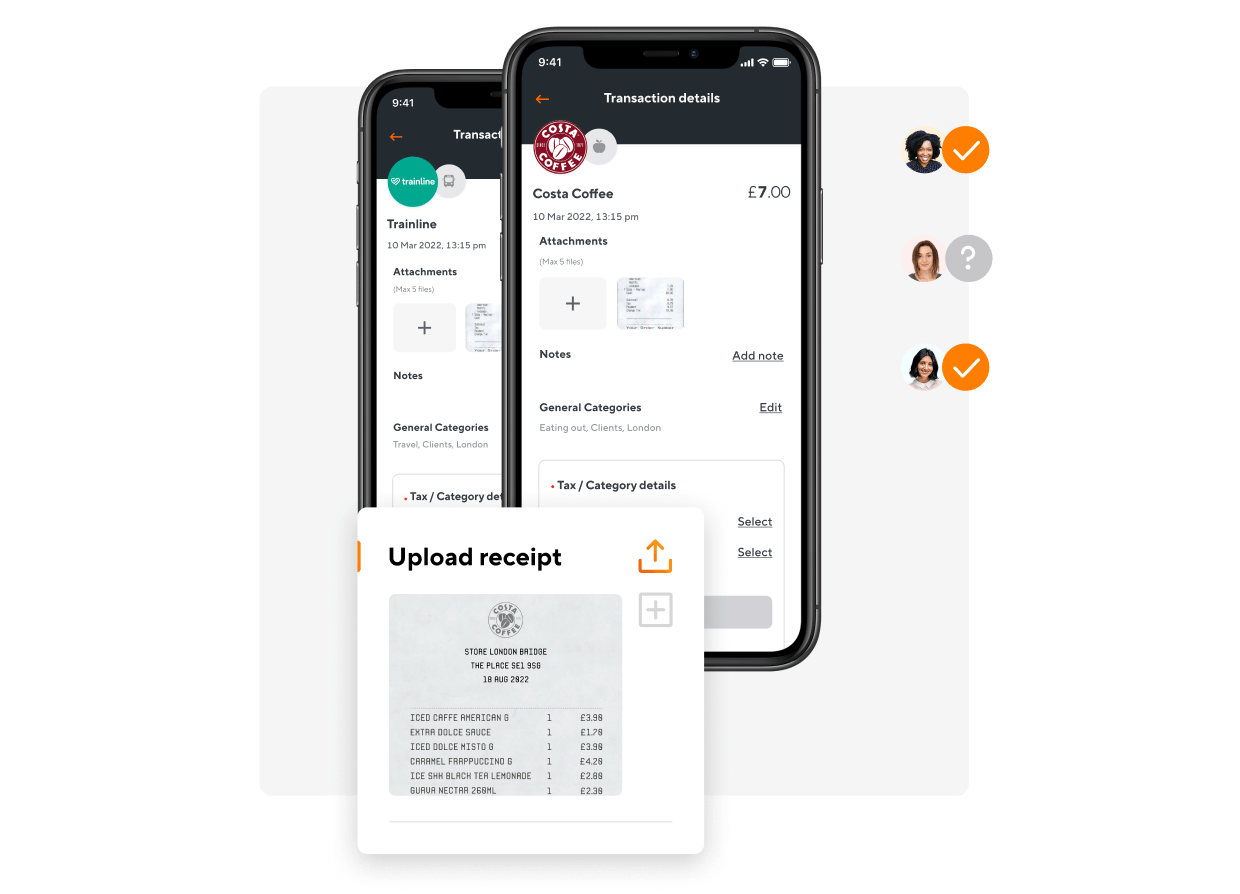

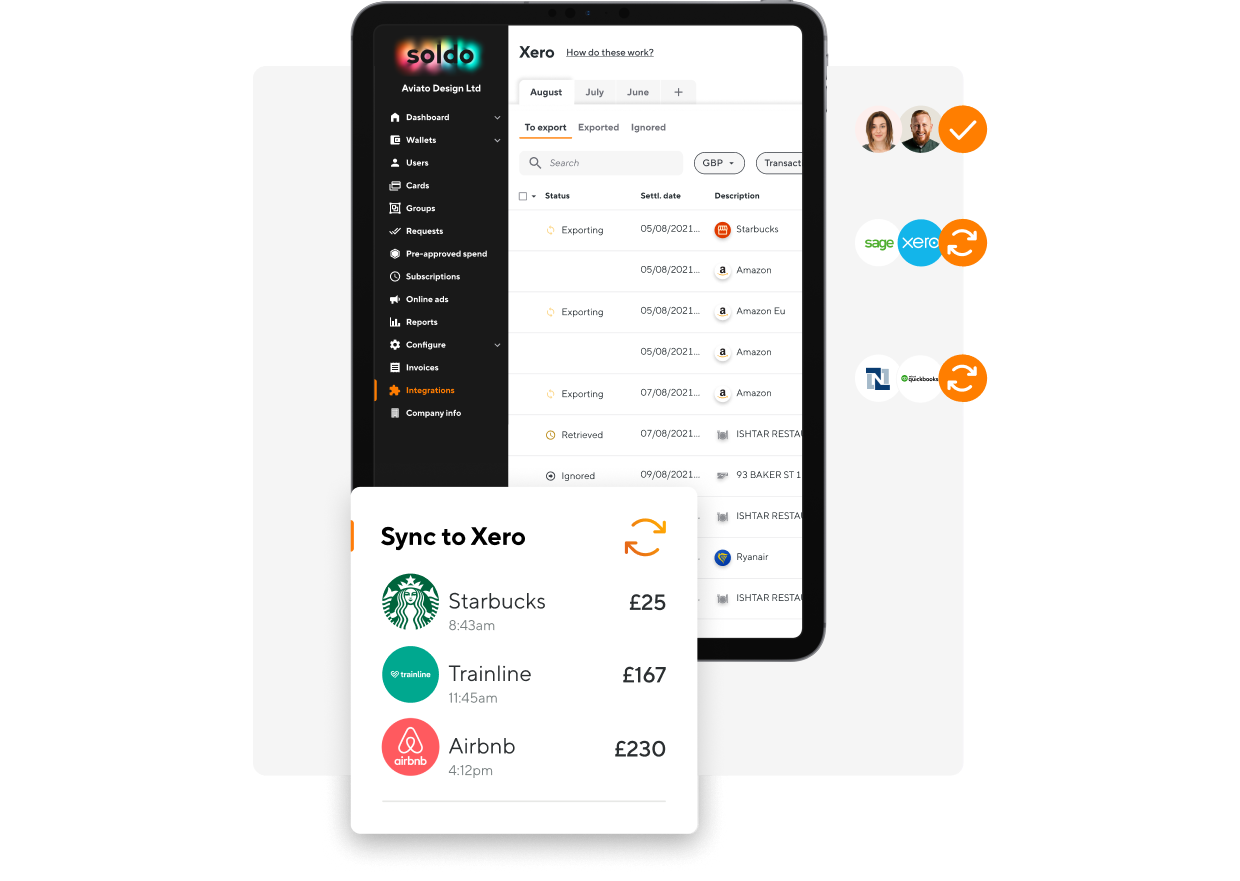

Smart spend management for start-ups and scale-ups

Managing a rapidly growing business is exciting but it comes with unique challenges. Leaders need to find ways to maintain their growth, make quick decisions, and manage tight cash flow. Traditional spend management processes are too slow and admin heavy to support agile working. Soldo’s automated platform is ideal for start-ups and scale-ups, giving them the visibility, control, and flexibility they need to thrive.