What are the biggest financial risks that companies face?

The inevitability of risk

Starting a business is always a risky venture, and every company is subject to a degree of financial risk. Even though it’s possible to plan for certain issues, not all financial risks are able to be controlled. For example, stock market disruption, changes in interest rates, and even currency movements can affect your business in ways you don’t anticipate.

Since it’s impossible to predict financial markets accurately, risk management is a crucial aspect of any company’s long-term plans. Business owners must try to anticipate potential risks by preparing strategies to cope with any adverse events; for example, constructing a reliable financial plan or using a prepaid card system rather than credit cards.

Learn More: Soldo is better than a business credit card

Below we have categorised and discussed financial risks in six different ways. These are credit risk, market risk, operational risk, liquidity risk, legal risk, and equity risk.

Financial risks in business examples

Credit risk

Sometimes referred to as default risk, credit risk arises from borrowing money. This is something that almost every company will need to do at some point, whether that’s to fund start-up costs or to enable the business to expand and grow. Companies must ensure that they can meet the repayments, because a failure to comply with the terms of the loan carries severe penalties.

However, credit risk can also refer to customers being unable to pay for their goods or services. Most businesses need to extend credit to their clients at one point or another, which comes with its own pitfalls. Customers defaulting on their payments will have a knock-on effect far beyond the time and costs associated with debt recovery.

Where a business has investors or shareholders, they will be adversely affected by credit risk, which can cost them highly in interest or loan payments. Debt collection costs merely exacerbate this effect.

Using prepaid cards rather than a business credit card is one way of mitigating credit risk.

Market risk

With the increasing dominance of the internet, the way a business operates has changed almost beyond recognition in a very short time. As an ever-growing number of consumers head online to source products and services, brick-and-mortar stores are feeling the pinch. This is a perfect example of market risk. A business market is subject to changing conditions, and this can affect its profitability.

For example, businesses that prepared in advance for this digital shift, known as early adopters, have thrived and grown throughout the online evolution. But companies that failed to plan well in advance for these changes have struggled to stay afloat.

Market risk is what’s known as a systematic risk. This is a risk that affects an entire market, rather than just one specific business or industry.

Operational risk

Operational risk refers to the dangers faced during the day-to-day management of a business. The term covers a broad spectrum of potential risk factors, including abuse or neglect of expense management cards, HR issues, and ineffective management. Even the failure of technical equipment can have an impact on a company’s finances, so it’s essential to have plans in place to cover all eventualities.

Generally speaking, operational risk is split into two separate categories: model risk and fraud risk. Model risk covers the company’s plans for growth and marketing, which, if not thought through very carefully, can lead to financial calamity.

Fraud risk, as the name suggests, is concerned with any fraudulent or incompetent economic behaviour within an organisation that comprises its integrity. One way of avoiding fraud risk is to make your employee expense process as secure as possible. Soldo’s prepaid cards can help your business with this by offering a watertight payment method that gives you total control whilst still affording employees autonomy to spend.

Liquidity risk

Robust cash flow management is essential if a business is to avoid liquidity risk. The term refers to the level of risk involved in ensuring that company assets can quickly transform into available cash. This is of particular concern for seasonal businesses which are subject to regular downturns in trade during lean periods.

When a business finds itself unable to pay its staff or source more stock, it can very quickly lead to significant problems. In extreme circumstances, this may result in the closure of an otherwise viable business, reinforcing the need to keep a close watch on cash flow.

Liquidity risk is often broken down further into two separate classifications. Asset liquidity risk can arise from either an insufficient number of buyers or an inadequate number of sellers. But it also refers to the risk involved in buying an asset that has little or no resale value. Funding liquidity risk, on the other hand, applies to the business’ daily cash flow operations.

Legal risk

Legal risk for a company refers to any financial losses that arise as a result of legal proceedings, as well as any other consequences faced by your business due to a failure to comply with the law. Legal matters of course require the assistance of trained lawyers, as well as their associated costs.

One of the most prominent examples of legal risk in recent times has been the focus on data and data breaches. If you store any of your customers’ data, and it’s highly likely that you do, then it’s imperative that you’re following all data protection laws, otherwise you’re putting your business – and your customers – at great risk. A data breach comes not only with a financial cost but also reputational damage.

A more practical concern associated with legal risk that you should consider is your responsibility as a business-owner to protect employees from harm. This requirement has been put into stark focus over the past couple of years by the emergence of Coronavirus, and there are specific guidelines for risk assessing during the COVID-19 pandemic. Failing to account for these risks could put your business in hot water legally.

Equity risk

Equity risk refers to the level of risk involved for businesses trading on the stock market. A volatile market can make it almost impossible for a company to value any equity stocks that it holds accurately. In particular, a falling market can spell disaster for a business that hasn’t undertaken the necessary degree of financial planning.

While some financial risk may be out of your control, make sure when you are opening a bank account for a business that your chosen bank provides a high level of cover and support for certain financial risks.

Security with Soldo

Although we can’t mitigate every type of risk (there is no service that can), Soldo’s smart prepaid system does offer a robust and secure way of expense management.

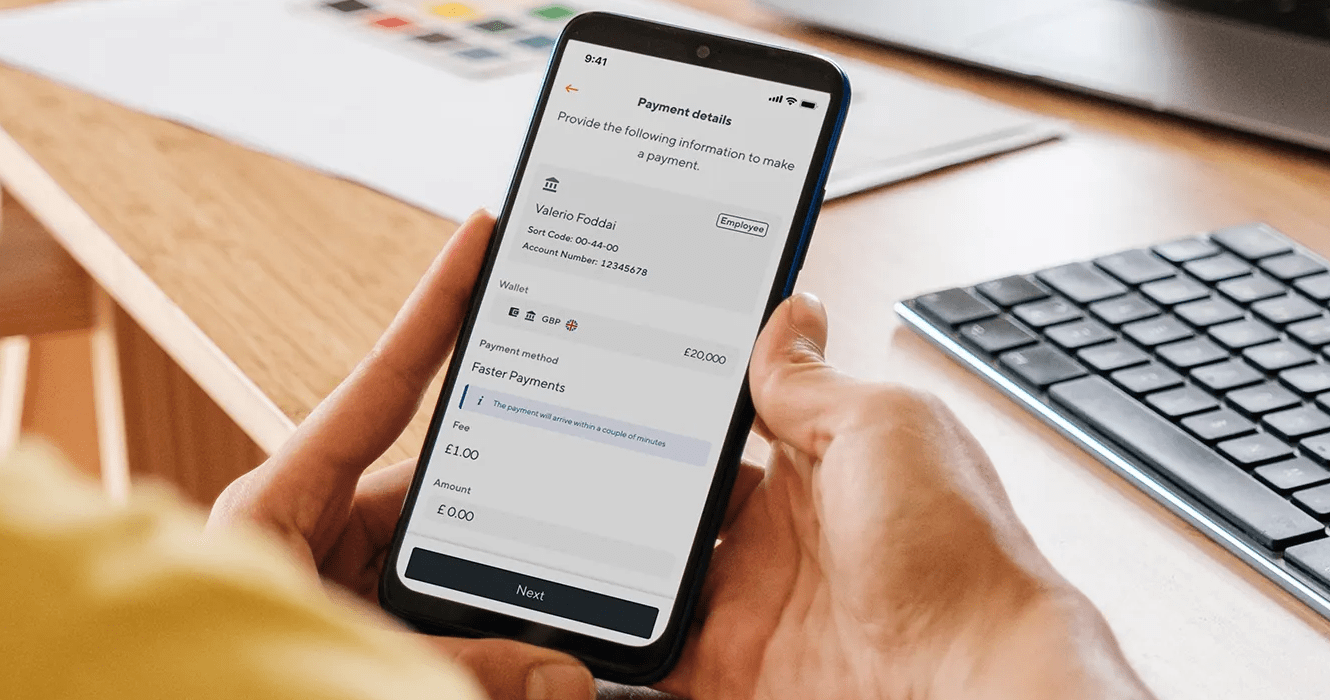

Simply preload Soldo prepaid cards with cash, set budgets and rules that limit spending. Not only does this mean you know exactly how much is being spent and by whom, but because Soldo cards aren’t connected to a bank account, your company’s funds are safe.

With the freedom to assign cards to as many individuals as you deem necessary, your Soldo plan is customisable according to your preferred way of doing business. This is a great way of preventing fraud and minimising operational risk. And because Soldo’s cards don’t rely on credit, you won’t be increasing your credit risk, either.

Getting started is easy and you can be up and running the very next day. Take control of your expense management and give yourself greater peace of mind by switching to Soldo.

Simplify your spending with prepaid cards

Access lower fees and save time spent on accounting by joining Soldo today.

Mitigate operational risk

Soldo’s numerous safeguards mean our payment cards can’t be abused or neglected, giving you peace of mind.

Risk-free spending

With Soldo’s prepaid cards, there’s no link to the company bank account, so your funds are safe and secure.

See transactions in real-time

As soon as an employee makes a purchase you can see all the spend data in the Soldo console for desktop or mobile.