Six essential business software integrations

Being a digital business is now the norm, rather than the exception. Business software solutions sit at the heart of many business operations, streamlining manual processes and carrying out smart analysis of your data.

But for your business software to deliver the best return, it’s important for your apps and solutions to be fully integrated and connected. Having the right integrations helps you share data, automate manual tasks and improve the breadth and depth of your management information.

So, which integrations should your business software have? And what are the benefits of having these integrations as part of your app stack?

We’ll give you the lowdown on:

- Seamless accounting integrations

- Making the most of your CRM data

- How expense management integrations help

- Improving inventory management

- The benefits of a cloud storage integration

- Scaling operations with sales automation

Seamless accounting integrations

The importance of being in control of accounting is a given. So, it’s crucial that your accounting software seamlessly integrates with your business platform. This gives the company accurate financial reporting and tracking to work from. It also helps senior leadership make informed decisions – based on solid financial data from across the business.

When you integrate your accounting software with the company’s other business software, you can pool the financial data from every part of your operations.

For example, you have the ability to track:

- Cash flow – track your cash flow position in real-time to understand your cash inflows and outflows. And use this data to generate essential forecasts.

- Revenue targets – set targets for sales revenues and follow how the business tracks against these goals. Run revenue forecasts too.

- Payroll costs – understand how labour costs are impacting on your overall financial health. Track costs, tax payments and benefits to drill down into your payroll spending.

With all your systems integrated with accounting software – like Exact Online, for example – there’s no need for time-consuming data entry and management information is there at your fingertips.

Making the most of your CRM data

Customer Relationship Management (CRM) software is not just an essential tool for managing sales and marketing. It’s also a goldmine of insightful customer data and information.

Integrating your CRM with your business software gives you cross-platform access to this invaluable customer data. That means better data when targeting your marketing campaigns. Improved understanding of customer needs when developing your product. And a better grasp of who your ideal customer is when running sales initiatives.

An integration like this makes it easier to track the customer journey and your brand’s customer experience (CX). Understand your customer relationships and get key insights that keep these customers engaged, happy and advocates for your brand.

How expense management integrations help

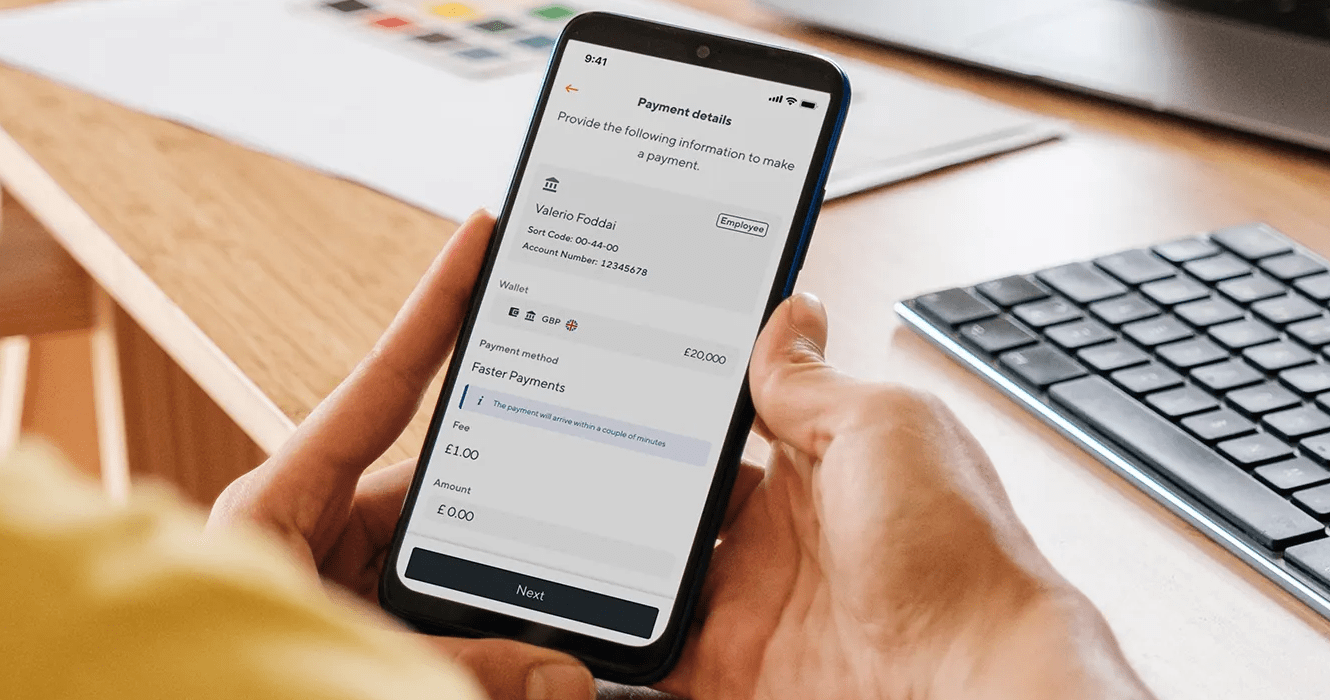

An expense management platform, like Soldo, gives you complete visibility and control over both employee expenses and company spend. By integrating this with your business software, you can automatically export receipts and invoices with other relevant information such as spend categories and notes about individual purchases.

This kind of integration helps by:

- Saving time and effort on chasing down receipts, so the books close faster at month-end

- Improving book accuracy by automatically syncing detailed and error-free spend data

- Providing a single, real-time view of all incomings and outgoings to make reporting, analysing and forecasting that much easier

Improving inventory management

For companies that sell physical products, inventory management is essential for staying in control of your stock levels. An inventory management system integrates with your business software to ensure that all customer orders are accurately tracked and fulfilled on time.

Whether you’re a smaller manufacturing business or a bigger retail operation, inventory management is a vital link in the business process. With a central, integrated system you can see current stock levels, restock products at the best time and ensure that orders are fulfilled. It’s the proactive way to keep your stock, shipping and logistics function in check.

This kind of integration is especially helpful if you have multiple warehouses or locations that require different levels of stock at any given time.

The benefits of a cloud storage integration

With so much data now being generated by the average business, having somewhere safe and secure to store all this information is a must.

Cloud storage has become an increasingly popular option for securely backing up data, documentation and customer information. The convenience factor of having 24/7 online access to your data, from any location, is a massive bonus.

Signing up to a cloud storage solution is generally far cheaper than building and upkeeping your own servers and IT infrastructure. And with tight security protocols and encryption of data sent over your integrations, you can be confident of the safety of the company’s information.

Sharing information between teams and collaborating with other departments is also easier. You have one central ‘point of truth’ for all business and management information, giving you an advantage when working on business plans and strategy.

Scaling operations with sales automation

Software automation is one of the main benefits of having an integrated business system.

Where manual processes can be automated, the business gains the advantages of improved efficiency, productivity and accuracy. Automating the major stages in the sales process doesn’t just help the company become more efficient. Automation also adds the ability to scale your sales operations at pace, helping you grow and become more profitable.

With a sales automation integration in place, you can:

- Remove the manual data-entry of customer details

- Improve the quality and depth of your customer information

- Automatically generate and send out sales invoices

- Use software automation to chase up invoice payment

- Send automated sales email cadences to your chosen audiences

Software automation can do much of the heavy lifting, giving your sales team the chance to focus on higher-value tasks. For example, they’ll have more time for meeting prospects, phoning warm leads and interacting with your existing customers. That’s time well spent when your goal is to ramp up sales, bring in more customers and meet your ambitious sales targets.

Get integrated and start reaping the rewards

With these six core integrations built into your business software, you’re turbo-charged and ready to do business! Embracing the benefits of software integration, data-sharing and automation keeps the business fast, agile and ready for whatever the market throws at you.

Visit our blog for more articles like this one or subscribe to get them direct to your inbox. Find the right Soldo plan for your business here.