If your business is growing, there’s a good chance your financial admin is too.

With new people and new products comes greater spend management responsibilities. And when separate departments, teams, and employees are dipping into the pot, keeping up with your finances is no small task.

At this stage, businesses usually have two choices: hire more staff to handle the increasing workload, or choose scalable software that frees your teams from the administrative burden.

Growing your business doesn’t have to feel like a double-edged sword. This short guide will help you select financial software that lets you sustain your growth without adding to your workload.

We’ll explain how to:

Assess your needs

The first step towards finding financial software that works for your business is assessing your needs.

Accounting and spend management software is particularly good at handling data. Think automated bank feeds and reconciliation, receipt matching, and generating visually appealing reports, charts and forecasts. Before choosing software, you should consider the activities in your business that lend themselves to automation.

You could ask yourself the following questions:

- What jobs are taking the most time, are the most frustrating, or involve a lot of hard work?

- What jobs are manual -admin intensive? Does software exist that can take care of them instead?

Perhaps you’re spending too much time on expense claims, reconciling accounts, or sourcing receipts from team members. Maybe your approvals process is slow and lacks standardisation. Adopting software that takes care of these time-intensive tasks will free you up to think about other efficiencies and opportunities in your business.

Next, you’ll want to consider how your needs will change over the coming months and years.

To make software a worthwhile investment, you need a solution that’ is adaptable and scalable. That way, you won’t suffer the rigmarole of a complex software migration every time your business has a growth spurt.

Consider what your business will need in the next six months’,year, or five years:

- Will your payroll responsibilities increase as you add new recruits to the team?

- Will you need a more comprehensive view of spending as your team goes global?

- Will you need to meet new regulatory requirements as your business grows?

Upcoming regulatory changes such as Making Tax Digital for Income Tax and Companies House software filing will require businesses to have appropriate software in place. Software that meets these requirements already exists – so by adopting it now, you won’t need to change your operations ahead of the deadlines.

The last thing to think about is who’ll be using the software. Perhaps it’s just you and a colleague for now. But if entire departments need to be proficient in your chosen solution, you’ll want to make sure it has great usability, customisable levels of access, and permissions that allow the right people to access the right stuff.

While you may have an idea of where your business is headed, it’s difficult to know exactly what’s coming up in the future. This makes it all the more important to have software with room for growth. Tailored solutions that allow you to integrate other tools and apps are your best bet for delivering all the functionality your scaling business needs.

Focus on time-saving features

The ideal software solution should reduce your employees’ administrative workload – not add to it.

Financial software can ease the burden on teams through automations, live dashboards, and in-platform workflows that make managing spending less time consuming. Without convoluted processes and inefficient systems getting in the way, your teams have more time for strategic and fulfilling work.

Features like live bank feeds and receipt capture tools mean your teams don’t need to type up the numbers themselves; software automatically extracts the transaction data and recommends matches in your accounting records. Soldo spend management software syncs up with Xero, so company spending is automatically carried into your accounting system. Instead of duplicating data entry, you can manage everything in one place.

Features like these save you the hassle of having to correct inaccuracies. Manual data entry puts companies at risk of human error. Accidentally mistyping a figure or failing to complete bank reconciliations correctly can lead to inaccurate reports and tax returns, which end up costing you more in the long run. Businesses that use Soldo spent 62% less time processing expense claims and 80% less time reviewing reports.

You should also look out for software that has customisable permissions and access levels. By delegating responsibilities by department – such as budget setting, monitoring, allocating funds, and approving spending – you can keep projects moving without blowing your budgets.

Approvals can be a lengthy process, but with software, this couldn’t be further from the truth. You can set up designated approvers who are automatically notified when a purchase is awaiting the green light. There’s no convoluted email chain to sift through, and approvers can access all the information they need about a purchase within your spend management software.

Legacy software often tied businesses to specific devices – financial data could only be accessed in a certain place, on a certain device. Modern cloud-based software maintains data security, while allowing businesses and their teams to manage the financials from anywhere.

You don’t need to worry about local storage, and you’re not tied to a single device. Your team can work from anywhere with an internet connection – so if you’re expanding into new locations or embracing remote working practices, you won’t be disrupted.

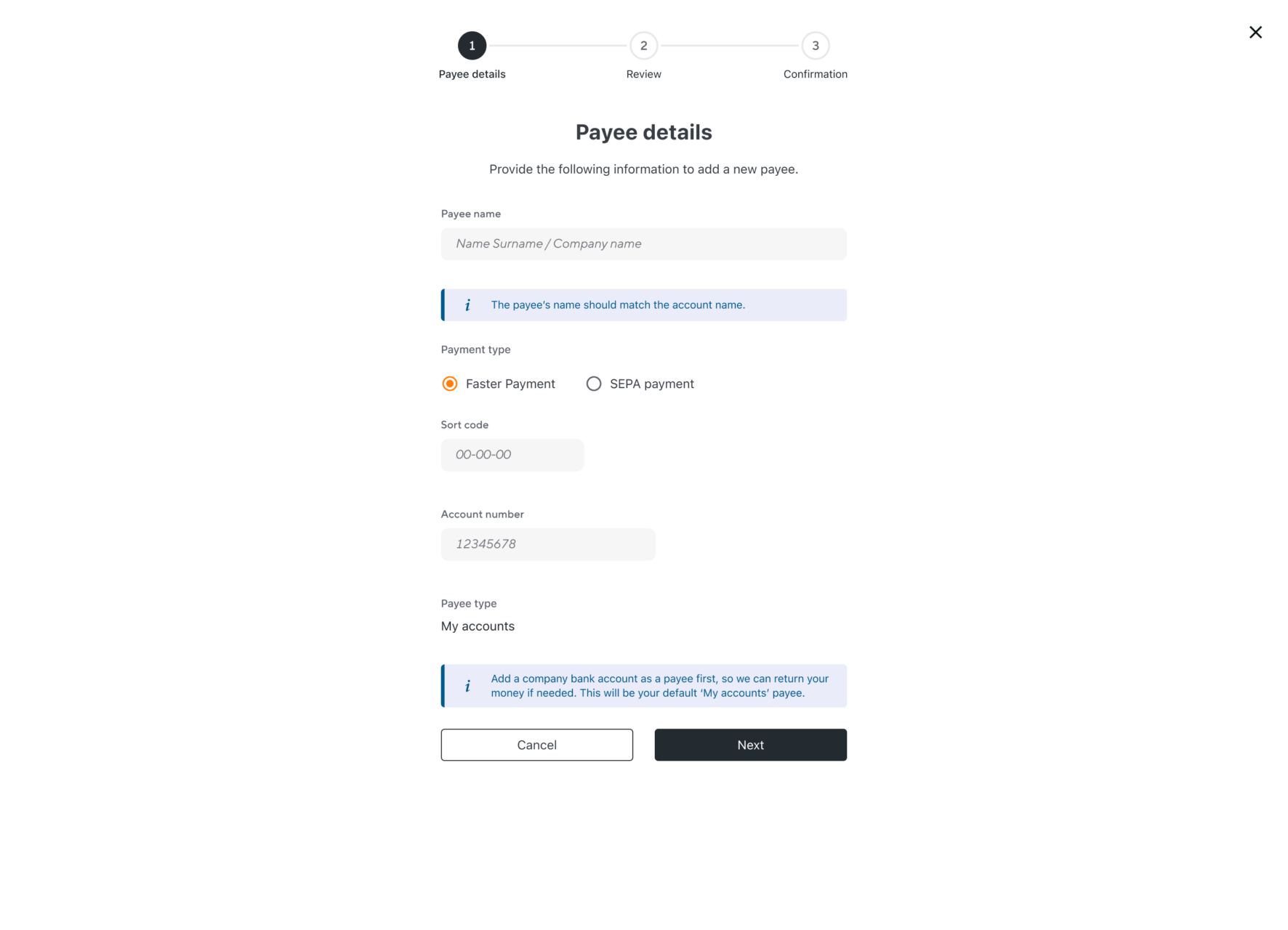

Importantly, expenses can be dealt with on the spot with a mobile app. Employees simply snap a picture of their expense receipt with their smartphone, and upload it via the app along with any relevant notes.

Get better as you grow with analytics

To grow sustainably, business owners need a clear view of what has and hasn’t worked so far.

The right software package for your scaling business will come complete with reporting, forecasting, and analytics functionality that helps you understand your past and plan for the future.

Using cash flow forecasts, you can identify the right time to pay your bills or make investments without disrupting operating cash flow. Or you can use expense reports to figure out which departments and teams spend the most, whether that spending is justified, and where to divert additional budget.

Forecasting and reporting can help you improve how you operate over time. For example, expense reports could highlight areas of wasted spend – like unused subscriptions or programme fees. You can also compare month- on- month reports to see how much you’re spending with specific suppliers – and may be able to negotiate better deals or secure a better deal with a competitor.

With all the information at your fingertips, you can make decisions backed up by data. For every forecast, report and analysis, you can reveal new details about your business finances and use these insights to fuel your continued growth.

Pull up a cash flow report to see whether you should pay a bill upfront, or delay it until your next invoice is paid. Decide whether now is the right time to invest in equipment, or whether cutting expenses should be your next focus.

Flexible financial software is the perfect partner for scaling businesses. Teams are freed from the constraints of outdated systems and convoluted processes – they can forward their projects and file their expenses in a few clicks. What’s more, you get a clear overview of the financials, and don’t need to tackle a complex software migration as your business grows.

Try Soldo today.