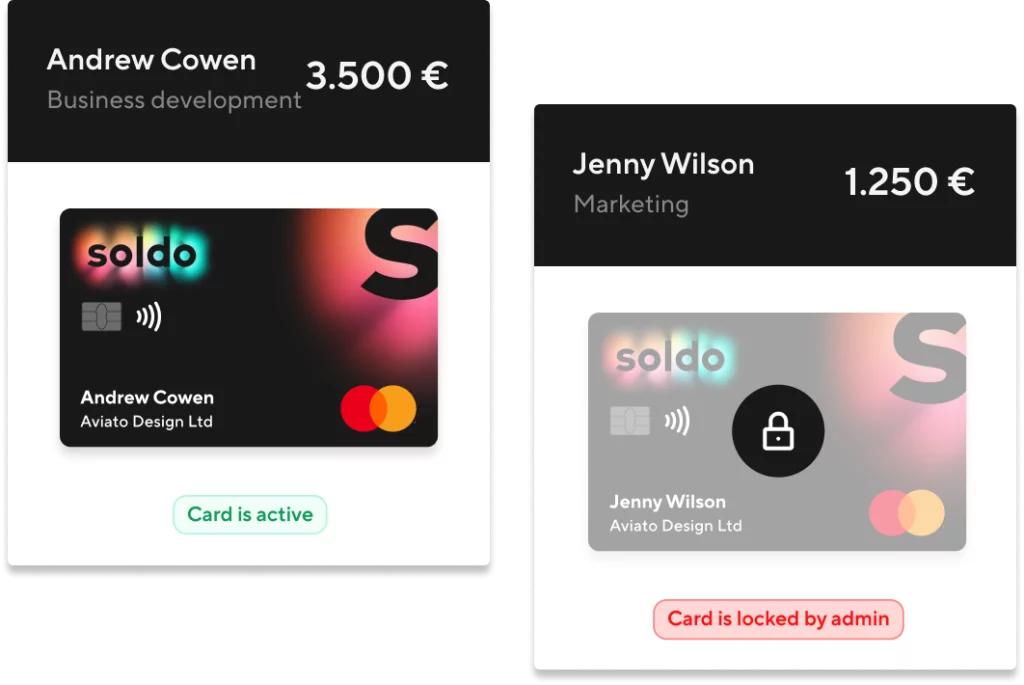

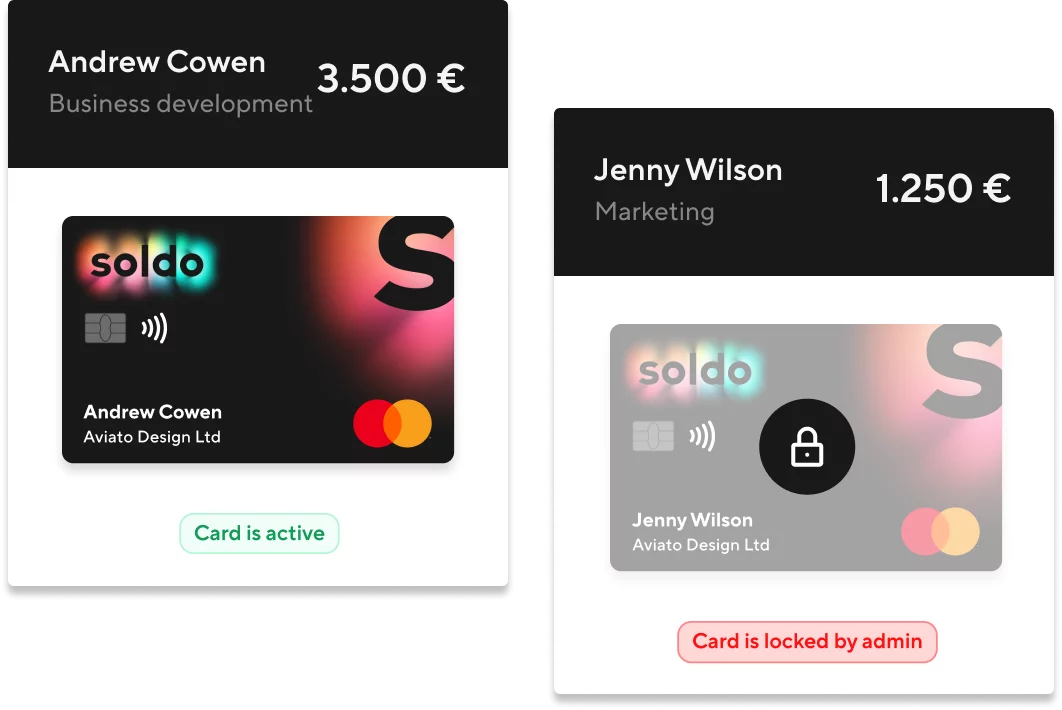

- Give cards to employees and teams to buy what they need.

- Set custom spending limits and rules for hands on cost control.

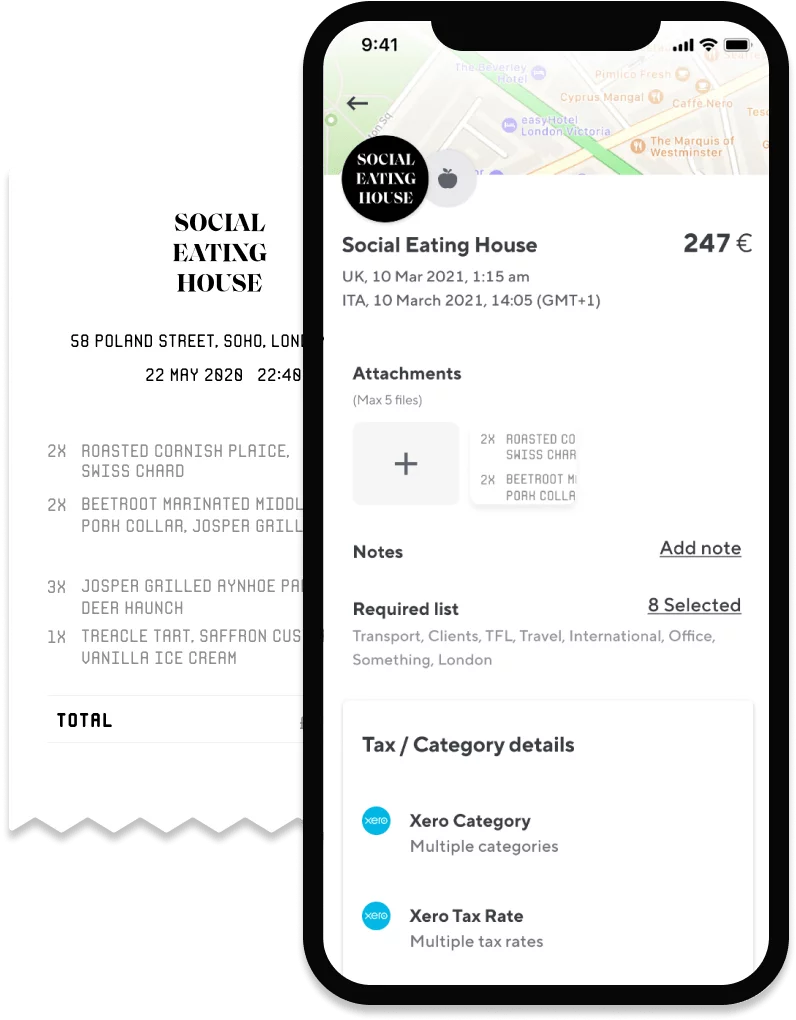

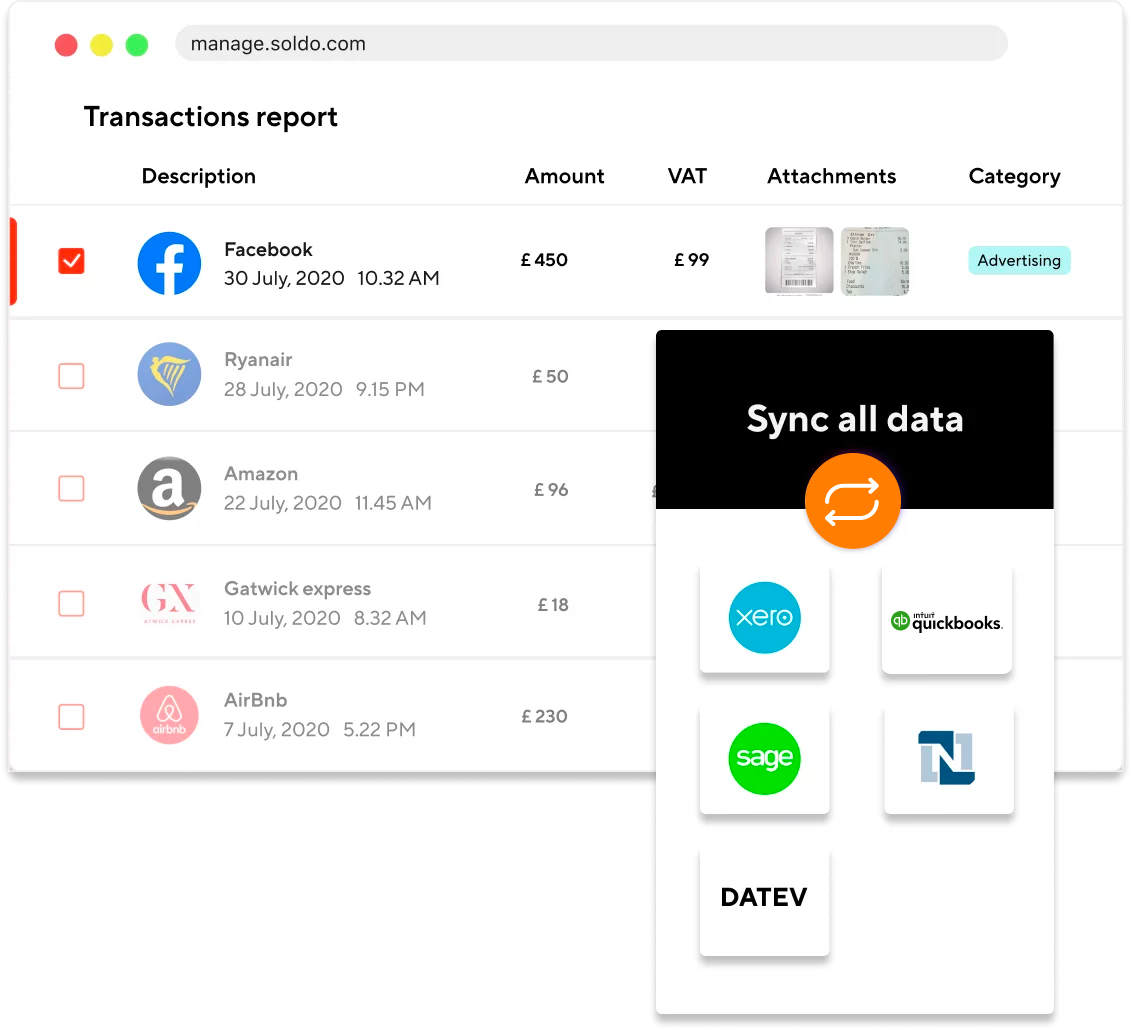

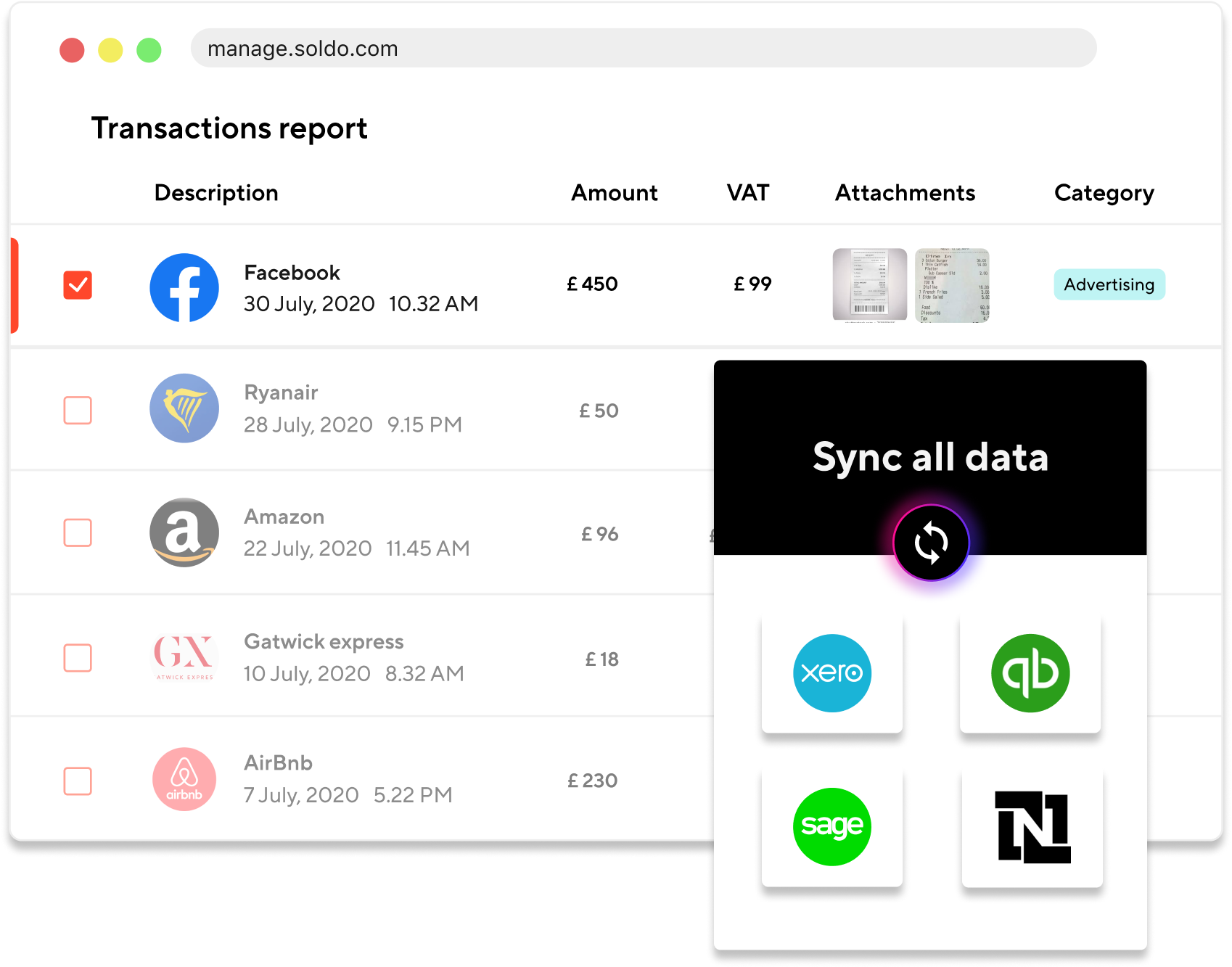

- Capture the receipt immediately the transaction is made for easy month end reconciliation.

It’s small business spending, as it should be.