In partnership with Financial Director, a publication for finance professionals, our CEO Carlo Gualandri and Robin Owen, Senior Financial Director at AstraZeneca, discuss what steps you can take to get greater visibility of your spend data, providing the insights needed to drive growth.

⚙️ How to improve business decisions by harnessing automation

💾 Why legacy technology wasn’t built with the modern finance leader in mind

💳 How to control business spending

📊 How viable it is to have real-time visibility of data

📈 What growth opportunities are available to you

Robin Owen

Senior Finance Director at AstraZeneca

Robin Owen is the Senior Finance Director, Global Business Services and Global Procurement, at AstraZeneca, a role he has held for the last 5 years. AstraZeneca is a FTSE 100, global bio-pharmaceutical business with revenues of $25B and 50,000 employees. AstraZeneca’s purpose is to push the boundaries of science to deliver life-saving medicines

Carlo Gualandri

CEO & Founder at Soldo

Carlo has dedicated his career to building companies in regulated industries that are going through transformation. Before Soldo, he founded Gioco Digitale, a company that became the leader in online gaming in Italy and as founder of Matrix, launched Virgilio, the first web portal in Italy. He has also founded Active Advertising, the online advertising network and participated in the founding of Fineco, a leading digital bank.

Chris Jewers

Reporter at Contentive

Our host, Chris works across a number of financial professional publications including Accountancy Age. He is a qualified journalist having graduated from Kingston University with a Master’s in journalism, where he also received the NCTJ qualification. Prior to this, Chris worked as a project manager and also in marketing for a variety of different companies.

🔗 Webinar Links

Reinventing finance for a digital world

Information makes the world go round. It unlocks knowledge, which, in turn, unlocks new perspectives and new solutions to difficult problems.

Data is information. Data is the key to driving business growth.

But even the most digital-first, data-obsessed companies don’t have real-time insight into 100% of company spending. Did you know that Uber was spending $200k a year on balloons? Their CFO didn’t either.

You need the right tools to interpret spend data. Luckily, these tools exist and aren’t as unobtainable as you’d think.

Read on to find out how finance leaders are unlocking knowledge to drive business growth.

Your purpose has changed.

Robin highlights the difference between the role of the finance function before and now.

Before, it was mostly controlling people’s behaviours and numbers, and then trying to remove unexpected results. The more control you had, the heavier the finance function would become.

Of course, it’s still about control. Finance teams still have to follow regulations, sign off accounts, pay taxes and stick to commitments. But it’s much more about enabling the business by delivering incremental value through insights and impactful business decisions.

Plus, now you can achieve a higher level of control without being a burden on the finance function.

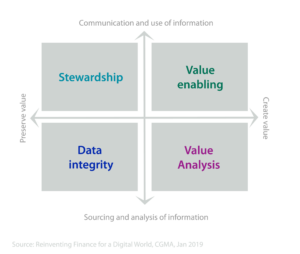

The finance function value matrix below, by Chartered Global Management Accountant, illustrates the purpose of finance teams. The Y axis represents what finance functions do, while the x-axis, represents why finance functions do it.

The value matrix overall represents the total value and role of the finance function:

So, the role has expanded greatly to include value-added activities. However, this doesn’t take away the finance team’s primary duty.

Finance teams are the custodians of the most important resources of the company: money. You make it available when needed, whilst keeping it under control.

But with great power comes great responsibility. Finance leaders therefore walk a tightrope between empowerment and control.

As a Finance leader, you have to start thinking about being agile and moving in ways that impact your business across the board.

The quality of your processes impacts your level of responsiveness.

You need to make sure everything happens at the right speed and in the right place and, more importantly, not lose track of a single pound or euro you spend.

But things move so fast, it can be hard to keep up. And you can’t exactly slow down your business just to make sure. The only solution is to speed up your processes.

By many accounts, one of the slowest things invented by humans is bureaucracy. Carlo suggests eliminating it.

If it’s unnecessary and excessively complicated, it shouldn’t exist. Employees should be able to use the money they need when they need it, instead of making requests to those one or two people who have the “power”. Centralisation leads to bottlenecks and long processes.

Finance teams can delegate, to each individual, the ability to use the money they are supposed to be using. No more no less.

Remember, we’re talking about bank accounts. We don’t want everyone to have complete access to your bank account.

When you give your employees access to a business bank account, you’re giving them the keys to the kingdom. You want to give them the freedom to use the money they need to use, but also don’t want to give them access to the underlying functionality of the bank account.

What if you could automate processes so nobody actually has that level of power? Well, it’s not as difficult a task as it sounds when you have computers on your side!

Computers obey a strict set of rules. Put one between the employee and the account, and you’ve achieved a new level of control and security.

Employees won’t be able to accidentally spend more because the ‘computer’ won’t let them.

Back office tech has changed, but business banking hasn’t budged a lot. Legacy systems hinder their rate of innovation and their accounts offer limited visibility. Even now that banks are investing in open innovation and forming strategic partnerships with fintech companies, these new ventures are in their infancy.

Overhauling legacy infrastructure is no cushy number, and that is their current mission.

On the other hand, there are disruptive fintech businesses targeting niches to deliver enhanced experiences and address specific needs.

Of course, banks are institutions that have been around for centuries, which means more people trust them. However, it is important to note that the fintechs offering services are also regulated by the FCA and other competing authorities.

Carlo shares a secret: it will be a balance of the two.

Banks will not disappear. Banks will innovate and improve in parallel and, together, banks and fintechs will lead the way towards new, seamless banking services that benefit you and your business.

Finance functions spend a lot of time closing the books and performing month-end activities.

As Carlo says, if aliens were to see this, they wouldn’t understand why we do this.

You have transactions that flow through systems and they need to be captured immediately.

Accurate real-time spend data would remove that laborious end-of-month activity.

Businesses need to take advantage of the increasing availability of data to improve reaction times, avoid unexpected results and bring value to the business.

Technology can enhance human output. You can’t replace humans with machines (in most cases) but you can augment their abilities.

There was a case study on chess. Long story short, the overall best player wasn’t the grand master, nor the super-computer. The best players were two guys with fairly standard laptops.

Humans and machines working together. So, it’s not about removing the people from the picture, but about removing repetitive work from the picture.

The key is human creativity and the ability to understand human behaviour, augmented by the technology we have at our disposal today.

Chris Jewers 00:00

Hello everyone and welcome to this FinancialDirector webinar, in association with Soldo. Today, we’ll be discussing how to unlock knowledge to create growth. My name’s Chris Jewers, from FinancialDirector, and I’m delighted to be joined by our two distinguished guests, Carlo Gualandri and Robin Owen. Carlo is the CEO and Founder of Soldo, he’s dedicated his career to building companies in regulated industries which are going through transformation. He also founded Gioco Digitale, a company that became the leader in online gaming in Italy, was the founder of Matrix, launched Virgilio, the first web portal in Italy, founded Active Advertising, the online advertising network and participated in the founding of Fineco, a leading digital bank.

00:43

Colin is joined by Robin, who is the Senior Financial Director of Global Business Services and Global Procurement at AstraZeneca, a role he has held for the last five years. AstraZeneca is a FTSE 100, global bio-pharmaceutical business with revenues of $25B and 50,000 employees.

01:12

Thank you both for joining us today and thank you to all our listeners for joining as well. Before we begin, I’d like to remind everybody to submit questions to our guests via the Q&A function on ON24

01:22

So to kick things off, I’d like to ask you both – What is the purpose of the modern finance function?

Robin Owen 01:27

It’s almost easier to start with what was the purpose of the old-fashioned finance function? It was very much about control, control of people’s behaviors, control of the numbers, and removing, sort of, variability and unexpected results.

01:49

I think the modern finance function is about… we still have, an element of control. So control is still very important, and lots of regulations need to be followed. Our accounts need to be signed off, we need to pay our taxes, and, you know, we need to deliver our commitments to our shareholders,

02:15

But much more so now, the finance function is about enabling the business, and it’s about delivering incremental value, through providing insight and impacting business decisions.

02:30

And we do that in many ways with our expertise, as finance professionals, with a unique view of data that the finance function gets. So, there’s usually no other functions in the business that see the full scale of the cost base of the business and can draw dots between A and B and Z. So we’re uniquely positioned as a function, to be able to bring insight through data inside the business, but backward looking and then more and more forward looking.

03:05

So what does the past tell us about the future, but also what are the plans for the future mean from a financial perspective and how can we impact the business bu having insight into that?

Carlo Gualandri 03:20

If I were to play the role of the business CEO instead of the CFO or the finance director, I would say, to me, finance is the custodian of the fuel that powers the engine of business and what the business does. It’s powered by money. And so you must have a proper control, but also availability when it needed, of what is needed to grow the business. And so the very first role I see is that of custodian of the most important resources of the company, i.e. money, and the company making it available when needed, but keeping that under control.

04:07

And then of course, there is the other half of it. If you spend one pound, it must be accounted for and must be accounted for in the proper way. In part, because of course it keeps the CEO out of jail, but more than that, because proper compliance is an ethical imperative. It’s a good company managed properly. There are no questions, no ways to cut corners on that and it is a very healthy thing for the business.

04:41

The fact that it’s properly managed at the compliance level that it gives you. And now I come to the third, big value that I see and role for the finance department. It gives you insight. Finance is usually the ultimate truth, the department, the function within a company that owns the truth in number and typically they own the ultimate number.

05:10

They are the priest of quantitative thinking. And the go-to function when you have to work on that. So, in a way that’s a very important thing for the business – looking forward, looking backward and governing what is nowadays an increasingly quick evolution of a business that can only be properly managed by having total grip on numbers, a total grip on cash and total confidence in the fact that compliance is executed at the highest style.

05:54

That to me is the world of finance that we have devoted our life to try to optimize.

Chris 06:06

Thanks very much both. We have a poll question for our audience now. And the question is based on what we were just talking about – Do you have a grip on spending across your organisation? There are three answers: Yes, I am confident that I am in control of spending; Somewhat, I have control, but I have to work hard to maintain it; No, I struggle to stay on top of spending. We’re going to give you 30 seconds or so to answer that if you could and and then we’ll move on to the next question.

06:33

[Pause to answer question].

07:22

So our next slide is about the spend imperative and how finance leaders walk a tightrope between empowerment and control. So Carlo?

Carlo 07:38

Yes, yes, absolutely. As we were discussing, the role of finance being the custodian of the money, custodian of the fuel. Finance is in the position of having, at the same time, to make sure everything can happen at the speed, in the moment, and in the place where it should happen otherwise the business is losing opportunities.

08:03

But nobody is getting them any slack, any discount on the level of control. So, in a way I need it now, but by all means I need it properly controlled by a master, and not lose track of any single pound that I’m going to spend. So I believe this is the tension and how to achieve one without compromising on the other is the real big challenge because nowadays nobody can really slow down the business just to make sure.

08:39

And nobody can accept not to be in full control.

Robin 08:45

Yeah. I think for me, it’s about establishing the boundaries that people operate within. We’re talking about mature business leaders, you know, people, we pay quite a lot of money to achieve their business outcomes. Part of their accountabilities is to control the amount of costs that they generate. Now as finance people, we might set the limits, and we might bracket those limits into certain types of costs, but actually we should expect business leaders to worry about what costs they’ve generating or what revenues they’re bringing in, as part of their accountabilities. It’s not that, you know, every decision comes back to finance – that you set boundaries, you have guidelines and you have processes that allow people to operate.

09:31

If they step outside of those then that’s obviously an issue, and that’s where higher levels of control need to come in. But in fact, to enable the business, you need to give people room to do what they need to do.

Carlo 09:45

I would say one of the trends clearly is that management in the past 50 years has been towards the flat organisation, where you empower more people, you eliminate a lot of levels. You eliminate a lot of bureaucracy so that the empowered manager is able to pick the decision there and in that moment, and be as fast as the business requires. The problem is when it comes to money, in many situations here there’s the tendency to go back to that angle, the old way, because it’s very difficult to delegate access to money without losing control.

10:24

I think there is the challenge – the business leader defines the strategic logic of the business and the cost structure is the first step, but the actual day to day, implementation of that happens in the organisation, not at the centre, not at the top.

10:43

And being able to use, the entire power of the organisation, delegating everybody, the ability to use the money they are supposed to be using, in the course of their business activities is one of the, of the big goals that we must set for ourselves in order to avoid centralisation. Every time you have centralisation you have bottlenecks, long processes and ultimately in the usual down the business or the business cites that the controls aren’t quick enough, but then you lose control.

Chris 11:23

And how important is it to remain agile, to find that function as an organisation?

Robin 11:30

Incredibly important and more so than ever. So, the pace of change, you know, the need to react, the need to gain competitive advantage all relies on the ability to be agile. I think often finance functions are thought of perhaps as one of the least agile functions in a business. But if we’re to enable success in the business and growth in the business, then we have to be agile and that agility covers lots of different bases. So agile thinking, but also, agile in terms of rolling out new pieces of insight or new systems or new processes. So it’s not just about thinking quickly and reacting quickly, it’s about moving fast in ways that impact broad spectrums of the business.

Chris 12:27

Correct. So on to our next topic then. The issue of traditional banking creating a knowledge gap. How is legacy technology holding finance leaders back?

Carlo 12:45

I would say it’s legacy technology as much as the big divide that exists between the world of business and the world of banking. Banking is a specific industry with specific rules. It’s a highly regulated business, with a long history, having been in a highly regulated industry in many different and very complex ways.

And that has created a world of banking that in order to fulfill the compliance requirements is only focusing on doing banking, but then the business speaks a different language. They need things to be done in a different way. So it’s not just a legacy system as an evolution of IT, that of course exists and especially exists in banks, not because banks are stupid in having legacy systems…

13:38

…but just because they were the first users of ID banking in insurance or, in a way what made that possible commercially in the first instance. So, in a way, they’re now paying the cost for that.

13:59

That’s an IT technology angle, but another angle is, the bank talks the language of banking and financial services and the business talks the language of business, and the language of the business is the relevant one and must be translated. Then there is a lot of work required to translate the logic of the business into the requirements of of the banking system.

14:26

I think this is a more fundamental inefficiency, even than the technology, legacy problem, because the real problem is you can translate one to the other only through a lot of people doing a lot of work in manual processes and that’s a big drag in the agility that we were talking about before.

Robin 14:52

Yeah. I think the flip side of that certainly is what we’ve experienced with the disruptive Fintech businesses, and even as a very large business ourselves, they’ve had very refreshing offerings, which haven’t been available from our big banking partners. So it’s there – the option now to take advantage of new technology and new offerings if you’re prepared to take a little bit of risk to ensure the results meet your requirements.

Carlo 15:28

Yes, it is an industry that’s now flourishing, based on the fact that this very closed market of a regulated industry such as financial services that’s been now more than 10 or 15 years ago – it has been opened up by the regulator with the explicit goal of fostering competition and fostering innovation in the segment.

15:57

So there is a lot more that can be done. There are a lot more players that have the right to be part of the financial services industry. We are one of those players. We abide by the same rules of the bank. We are not dragged down by legacy systems, just because we are a new board. So we can take advantage of the most advanced and most recent technologies of today. And that’s a huge, huge advantage. And we can think out of the box then, at the end of the day, you can sort of do two things – do the exact same thing that a bank was doing just a little cheaper or a little faster, or go after problems that no bank ever went after, that are big gaps, in the offering and in the portfolio of tools in the hands of the finance department.

16:51

We chose this second option of going after the things that today are just not automated through computers, not controlled by computers, we do a lot of optimising and making things possible.

The ecosystem is going to be a balance of the two. Banks will not disappear tomorrow, and should not. I think that it will plug gaps, the bank will get better and the competition will ultimately benefit the user in the most, the best possible way. This is usually when you have a market that is open and open to competition that creates innovation.

Chris 17:42

So we have our poll results and just under half of our attendees have answered. I have the results I’ll share with you now.

So to the question, do you have a grip on spending across the organisation?

44% of people actually say, yes, I’m confident I have control of spending.

Another 44% said somewhat, I have control but I have to work hard to maintain it. And only 12% said no, I struggle to stay on top of spending, which is a good sign.

18:07

So can you talk to these results?

Robin 18:11

So I can certainly talk to the middle bracket – I have control and it’s hard work. We don’t want our finance functions to be too heavy. Obviously historically, the more control you wanted to add, the more bureaucracy you had, the more people you had, and the heavier the finance function became both in terms of size, but also in terms of impact to the organisation.

18:36

So I certainly think that modern organisations are trying to have fairly light finance functions, but retain control, which leads into ‘I can control it, but it’s hard work.’

And that’s where I think the use of technology, appropriately designed controls and materiality, levels and delegations of authority come in. But you allow people to operate within a sort of a bracket, or a margin of control and therefore you can kind of lessen the control you need to do, whilst maintaining the overall results, but that can feel like hard work. So, I’m not surprised that 44% of people feel they have control, but it’s hard work.

19:26

And I applaud the 44% who just have control or it doesn’t seem like it is hard work

Carlo 19:35

Well, perhaps it’s not hard work or not painful for them. Now if you look at a total cost of ownership of the solution that gives you control – I would say you always have to also ask yourselves, am I trading control with speed and am I trading control by shifting the burden on somebody else. Because if I implement a very complex and air-tight spend management process, probably I have total control over every single thing which takes weeks, or I have total control because I’m just shifting the burden of paying for expenses to my employees.

20:19

So, I’m cool. problem is that every single employee and I’m messing up with the life, the financial life of every single employee, forcing them to use their own money, to foot the bill of the business. Is that right? Is that sustainable? Whatever it is, it’s not free. There is a cost associated, it’s just somebody else’s cost.

20:43

So probably all combination of things are appropriate, but it’s a question of how much work, how much cost, how much time it takes. And who are you shifting the cost to that you have to consider when you evaluate how satisfied you should be about your control scenario, your cost control, performance, and what you could do better for the benefit of the business, of the speed of the business, or even your employees.

And then of course, if you are not under control of your finances, well, that’s more important and urgent priority

Chris 21:34

And perhaps for those who have said they’re not in control, what steps should they be thinking of taking to get that under control?

Robin 21:42

So my first question would be, do the business leaders feel accountable for controlling the cost that they’re generating. If they don’t, well that’s very difficult to go from there to feeling in control. I would expect that to be a major gap for those for the 12%, that people don’t feel accountable. There are some organisations where every pound spent should be considered as personal money almost like people operate in a way in which everyone feels accountable for the costs that they generate, but particularly the leaders in that business – leaders of functions, leaders of departments and teams, need to feel accountable and I suppose that’s almost cultural, so it’s not easy to change or implement, but there has to be the objective to move from left in that survey over to the right. Alongside that again, it’s what margin do you want people to operate within, so setting clear guidelines, clear boundaries, and I suppose coming down hard on cases where there is a breach, whether it’s sorts of behaviours. etc. So I’m not expensing correctly or overspending or those sorts of things. Having a very low tolerance for those events, but allowing people to operate within particular boundaries again, I think that’s how you feel more in control without duplicating yourself 40 times.

Carlo 23:32

I totally agree on the concept that control, especially when it comes to money is really culture, or at least to start from a culture of control from an ethical standpoint when it comes to money. But having said that, there are a lot of operational challenges, so probably I would say if you don’t feel you’re in control, the very first thing at the operational level after having asked yourself is there a culture of control and the cultural of the company comes from the leadership, and then, informs the entire company. But on the operational level, I would say probably there is no single problem, there is no single lack of control. Every problem can be segmented and divided to be then conquered. So probably, your lack of control takes many forms, but which one of these is the actual, more critical, more important, most important among those so that you at least can understand and classify the priority that you should use to address these problems.

24:43

Very probably there are the usual, 80 20 scenarios where 20% of the cases where probably 80% of the money is being spent. And that’s the priority one that you should focus on addressing the problem.

Robin 25:04

Yeah. The thing I’d add to that is that as a finance function, there are different things we can do about it – so making results very visible, putting them in a format which makes it more obvious what the problem is. That’s almost step one.

Supporting our business counterparts to fix the problem is, step two. And then seeing the big picture. So, not just a problem in one function and one division, but seeing across, and recognising either trends or opportunities to move between the few is step three.

Chris 25:50

So we’ve touched on technology and that’s the next topic, specifically automation, which is very much focused on the finance function and how it provides lots of data to use. How can you harness this data to drive strategy and increase visibility?

Carlo 26:06

Well, automation is always an interesting aspect because you usually cannot say, I want to automate, it’s not the first step, the very first step is – I must understand.

Only when you have a complete map of the territory, a complete map of the processes and the organisation doing that, then you have a clear idea. That should be my very first step. Even if you perform all the older processes manually, but it’s a very deliberate and thought out and understood process. You are in a very good position because then once, you know fully, then you can start automating.

26:50

When you see something being done over and over again, and it’s actually the same thing being done, then you have the basis to start automating because one of the risky things is when you specify a software system, you must have a very clear set of specifications that are fully understood before you start. Like when you buy a house – making the changes during construction is very, very costly.

27:18

So you need to understand your processes. Then you will observe that the vast majority of the events can be automated so that you can then devote your resources, the most important resources that are your people, because replacing people with computers and cloud computing to do repetitive work is easy, so that you can devote your people to manage the exceptions, and usually the exceptions are where there is the most value in focusing your attention. The day-to-day, I have… I don’t know, 100, 1,000, 10,000… invoices to pay, all of them being paid on time, on the same day, with the right amount, but no problems in the recipient of the money.

28:12

Well, that’s a computer job. That’s automation. It’s when it breaks down that you need the intelligent software, flexible system that says, okay, up until here, it was automated. Now, here’s the flag, there is a problem where you bring in the human, the intelligence of a human to deal with the exceptions and overtime, probably a lot of these exceptions will end up being automated themselves because you understand them more clearly, and you can specify the way it can be automated.

28:44

I think it’s a sort of a never-ending cycle of continuous improvement and optimisation also because of the business change, so anything that’s been built up to now is not set in stone or something would change the world that will force you to re-evaluate when it will be top of mind while making sure everything is okay and then you go back to work on full auto-pilot.

Robin 29:10

Yeah. So, I agree with Carlo there. What is automation? It’s removing human intervention, so, touchless processing, lights-out counting, but the prerequisites to it, are very standard processes and if you go to get value out of the data, very clear cut rules and the standardisation of data sets.

29:40

A few years ago, everyone was talking about fuzzy logic and the fact that technology would fix all of our system incompatibilities. Actually, or certainly my experience of automation and advanced analytics, is that your data sets absolutely need to be aligned and following the same rules, in order for you to be able to derive insight and turn off manual intervention.

30:04

I do think once you take a few steps down that journey, though, the power of the data that comes out can be incredible. I’ll talk about an example we have internally at AstraZenea which was use of a deep process mining tool. So, we looked at how we pay our suppliers and this tool picks up all your SAP records and visualises it so it can follow a transaction through the process.

30:36

The amount of insight we got from that deep understanding of what was actually happening is incredible. And it was busting all the myths of – well, that didn’t happen because person X didn’t do that task. Actually you could see for any individual payment or masses running through different systems and processes exactly what was happening, you know, where things were developing lagtime, what problems could be fixed. So that’s not in itself automating, but it’s using technology to really deeply understand the process and see what’s happening across tens of thousands of invoices and payments.

Carlo 31:13

I would like also to offer another angle on the concept of automation, to connect to what we were discussing before. Automation can be an efficiency challenge, so we want to take people out of the equation, run processes, 24/7 lights out – making sure that there are no manual mistakes that there typically are with humans. All these things is efficiency. Processes cost less, less people. I can reuse people to do better jobs – everybody’s happy.

31:47

But it’s not only about efficiency. There is another angle specifically when a process touches money. When a process touches money, you raise again the issue of control. So, the problem is, if I were to say an employee has access to the bank account, I’m actually saying, I’m giving you the keys to the kingdom. There is not much that I can do once I’ve given access and control, to what can be done.

32:20

But if you automate processes that deal with money so that nobody actually has access to the underlying functionality of a bank account. For example, send money, any amount, to any recipient. But that is mediated by a process that is automated, in a way between any person and the bank account, there was a computer that is following a strict set of rules. So if you control the exceptions, the reality of what you have achieved is a much higher level of control. Instead of adding a process with a person at the very end, that logs into the banking system, and pays invoices, and they can actually pay anybody any amount, and possibly they will be caught. But if you have a system that basically, robotically pays invoices, the only way you can create that bank transfer to, say, my cousin, where we’re stealing a little bit of money out of the company is if I create my cousin as a supplier, and I create an entire paper trail of invoices to my cousin and all these signed by all the barriers, and departments, all the way, well, wait for it coming to the moment where you can touch the money.

33:45

So automations means removing the human from the equation also from a point of view of control. And that allows you to achieve a much higher level of security when you are talking about touching money. Because if I’m doing a refund and I’m to do a bank transfer of a few thousand, and in doing that, I log into a bank account that has a few million, the danger is just there – the security of that arrangement means that there must be somebody double checking what I’m doing, breathing on my neck and making sure that what it is and that, itself, is a lot of cost and much lower security than if there was a rigid set of automated rules managing that thing. In the case of exception, you open the safe, or you take out the login to the bank account, but only with the exception

Chris 34:40

And where is it important to still keep the human element?

Robin 34:49

So I guess, interaction with other humans in its simplest form. So what do we do in finance? We ensure that the data is accurate, we use the data to understand the business, we present the data to external stakeholders, our shareholders, our auditors. And then we use the data to impact and influence how the business is going to behave.

I suppose that that top section, and we’re talking about business partnering in its broad sense is something you can’t automate, or robotise and that’s a key area where it’s important to keep human to human interaction, and where finance will add value in the future. In 30 years’ time, then there’s a lot of automation, AI, robotics, big data, than there is today, it’s in the human to human interaction, to some extent it might still be in pattern spotting. So machines can spot patterns, yes, but what do they mean? So, the interpretation of the results of trend analysis and pattern spotting.

36:15

And I guess if we have a sort of digitally-enabled finance function, it’s also in what do you change next, to what are the significant, disruptive ideas that we as a finance function bring either to our own activities, or those of the business. And again, I don’t think those are the sorts of things we will automate, so that’s, that’s where I would come from. You know, what wouldn’t we look to apply automation to?

Carlo 36:45

Yeah. And I would say from experience, every time there is a screw up. Get a human connecting the dots, probably connecting disparate contributions to the problem coming from different departments, the angle of communicating with other humans in the organisation, properly escalating, establishing the responsibility, the size of the kind of problem getting out of the company. And understanding how to solve the problem by engaging third parties that could be suppliers, clients… And then there would need probably a lot of sensitivity on the way you do it, all the things for which we need people and smart people in handling the problem.

37:40

So the, the concept of automation is not taking out people to save on salaries. It’s to take out the stupid work from the life of people to help and make sure they focus on the rewarding and value-added activities that you must be doing.

Robin 37:59

Yeah. I’d add to that… I quite like the phrase ‘augmented humans’. So there was a case, I think that there’s lots of case studies in chess for some reason, but, certainly in this case study the most powerful chess player wasn’t the grandmaster, it wasn’t the supercomputer, it was actually two guys, with two fairly standard laptops. So, it was the human creativity and power to think about human behaviour, plus the augmentation of technology. And I think it’s to your point, Carlo, so, an example we’ve got at the moment, and again, it’s a disruptor, this isn’t how we do all our reporting…

38:40

…but we’re testing, piloting some natural language generation capability. So, you know, someone who owns a cost base doesn’t get a report that’s been written by humans, they get a report that’s been written by algorithms. And the human intervention, the part our analysts are playing is they are picking out the three or four things that really need a human touch to understand, that the algorithm can’t understand and they’re adding that in as the value added facts and insight.

39:17

So that I call that a version of the augmented human and it’s taking out the humdrum work of saying this number is bigger than that number. And it saying, okay, well, that number is bigger than that number, and that’s the biggest variance I’ve got, so why did that happen? And just writing down that reason rather than having to write down the same facts that you can get from a machine.

Chris 39:42

Before we move on to the last topic, I’d like to remind everyone that there’s the option to submit questions. So if you do have any questions, please submit them before we run out of time. And then, like I said, moving to the last topic.

39:55

We’ve touched on data, obviously very important and automation of fields on data. So to start with what’s the viability of real-time data and what it does?

Robin 40:11

So it’s an interesting concept. And Carlo and I were having a discussion before about month-end. So finance functions spent a lot of time closing the books or performing month-end activities. If you were an alien who landed on the planet, you would not see a reason to do that, really. You have, transactions that flow through systems, and to sum up what all those transactions mean at any point in time, shouldn’t really involve five days’ worth of work by hundreds, thousands of people depending on your organisation. So, I think that real-time data and by real-time there, daily would be real time in that example… but real-time accuracy of your transactions and data summed up in a single set of windows would remove that requirement at month end. And I think that is entirely possible in the medium term. I suppose the power of real-time data depends on your organisation, how quickly it can or needs to react to new data, so it’s probably does require a different level of real-time data.

41:38

I can certainly see the power of producing data more quickly and having it more available. and we have an example again, internally at AstraZeneca, with spend analytics, and seeing what’s been spent with our 25,000 suppliers. It used to be something that would have a lag of a month, a month and a half to it. Again, using the same sort of process mining technology, we can now see that daily and that’s useful and powerful. So, it’s real-time enough for us to make use of, it’s much better than waiting a month and a half for it. For us at this stage, that’s real time enough. And we can take advantage of that huge increase in the availability of information. Carlo, what are your thoughts?

Carlo 42:26

I was thinking that actually, there are like two sides to this and we think real time… I believe we think, two different, two different things at the same time. One is I believe probably the most, the most important is continuous processing of things. What we are used to handle today, and it’s part of that category of things we do not even call it problems, but facts of life. Then, as you said, an alien come to this planet will wonder why humans consider those things a fact of life, but of course, there is a reason. The reason is all the delays in processing of things. Because of that you can chunk them up, wait until you have enough and then process them all together.

43:24

That creates a certain rhythm, with ups and downs and spikes of work and much less work in other moments. If you were to be able, as a first step, to make a continuous processing of everything you do – that’s most of what you would perceive as real time. In reality, real time would be continuous with zero delay, zero latency. Now continuous, even if with a little bit of delay and latency would still be enormously better. And then you can, even once you have a continuous thing, gradually remove all the delays. So these invoices are issued and processed at T+ one. Tomorrow it can be issued and processed at T+ zero. But the real problem is it’s not there left waiting and then at the end of the month, well, the usual 10 days of, passion to close the month.

44:32

So I believe the whole concept is information system and human processes, but much more than that, processes that get automated by information systems and communication between these information systems should allow for streaming.

44:55

It’s like saying, instead of watching a movie on Netflix, I’m just watching the first ten minutes, and then tomorrow, ten minutes have arrived, and I’ll watch the other part of the movie. It’s not, it’s not what you would expect to see. So streaming and continuous processing of all the information that is possible if you automate, it is possible if you interconnect systems so that there are no delays when one station has finished elaborating its part, and then the next one can start doing the next phase of the job… is real time.

45:35

The other half of real time is, reducing progressively in the delays so it’s actually start timing. We are far from this, but I believe, that the big, big, thing, is not worrying because we don’t have it now, but deciding that we want to get there. We want to get there and it can be achieved. So, the moment you decide that thing is a problem is no longer acceptable to have the months as a concept, because it makes no sense anymore.

46:11

It used to make sense. Now it doesn’t make any sense anymore. So, let’s just decide that anything that is not continuous streaming and ultimately real time in the sense of instantaneous, is just not acceptable. Of course, it’s not that just because we decide it’s going to happen, but if we don’t challenge the status quo, it will never change.

And that’s a big change because it will affect everything, your organisation… think about how by adding peaks of work you have to define an organisation about the peaks and then have potentially a lot of disoptimisation, how having everything at the very last moment makes you vulnerable to delays or problems in the very last moment, because then you don’t have any time to recover. That week is the month for you. If anything happens in the week, like holidays – either you go on holiday or you close the month. But if you close the month, every single day, well, at the 15th of the month, you’ve closed the 15 days. At the 20th, the 20th and the 30th, the 30th.

47:22

Oh, by the way, that’s the end of the month. Okay. Stop. Take that number. Use it as the month while I continue, because the next day I’m already going on, on the following, on the following month. So, I think this is the goal and the real thing is believing you can do it because the entire industry should be challenged to provide that kind of service, in order to take the next step in the evolution of all the processes for finance, but also in general, managing the organisation.

Chris 47:57

And for those who have in fact achieved real-time visibility on their data, what benefits does it bring them?

Robin 48:04

So, there are certainly examples I’ve seen. I used to work at Jaguar Land Rover, and that business, the history, it was sold by Ford to Tata. At that point, Tata forced Jaguar Land Rover to stand on its own two feet from a cash perspective. So all of a sudden, under the giant of Ford, it had to monitor its own bank account and its own cash from a very challenging in that type of industry. But that company, at that point in time, they had to, they were forced to invest very heavily in, in cash processes and cash systems that allow them to manage the business from a cash perspective.

48:49

I guess that for me is a good example of, you know, a real value-add investment in achieving, depending on our definition of real time, but, a constant, a constancy to understanding the cash flows in the business. Whereas a lot of businesses don’t think like that either because they haven’t needed to in the past or they still don’t need to now. So, they manage their cash very differently and it’s an adjustment on their P&L rather than a metric they use to manage the cash by talking about big businesses, particularly. So, I think, another example that springs to mind… so, Cisco systems supposedly achieved a virtual close of its books, and by that, I guess that refers back to the conversation we were having about month end close.

49:43

And you could genuinely achieve a virtual close of your books, you know, without dedicating whatever, three….[obscured] resources in finance to closing the books over the course of a third of a month. That’s a huge peak. You have to employ all those people the whole year in order to achieve that peak activity, 12 times. So, I guess in that example, achieving, configuring your systems and processes as such, you could virtually close, and that would give you a lot more flexibility to employ people and give them roles, which aren’t defined by 12 peaks a year.

Carlo 50:27

If I switch to the business point of view, I would say the core value of this concept of real time, streaming low-latency immediacy, whatever we want to call it, is actionability. If you’re a business unit to take decisions, if you take decisions on yesterday’s data, a week from now, it’s already late to take the decision. If you can take a decision today on yesterday’s and today’s data, you’re in a much better position.

51:11

And then the crazy thing is it’s not even the end of it because the moment you achieved real time, you want to go and then start to predict the future. So you will extend that level of thinking into leading indicators and you will continue the search for continuous optimisation in having the best decision-making tools at your disposal.

So, the moment you knew exactly how I close the day today, and how my business is faring today, that means that I already have an incredible value in decision-making because I can, I can decide and steer the shape of the business.

51:56

But then I immediately realise that if I were to look at the leading indicators that one week ago would probably have given me a rough or even not so rough idea, what would have been the situation today. I wouldn have been able to move my decision-making moment, one week before, and that could be an incredible advantage in the business. So, I feel if we don’t do much of a month, yeah, of course, for compliance reasons, there’s still the month, there’s a logic. We do a continuous business most of the time we tend to have a sort of a rhythm of the business around the week just because in terms of what we do business spending, typically the weekend has a different pattern of usage than the weekdays.

52:49

So, that’s, I think, that we do. But we are pushing more and more to try to use, not just only today’s data to take the decision of today, but most of the time, any decision I take today will affect the results one or two months down the line. So the moment I realised this, I realised that not only I need the quality of the data, that real-time is giving me in order to do these decisions in the best way and as early as today, in this case, possible. But immediately after you achieve that, you start looking upward and say, okay, but what if now I’m looking at all the indicators that will tell me how I will close a month from now. And if I can take even a rough decision or I can start worrying about something that I see coming way before it’s in front of me, well I can, I can do a much better job of steering the company in the right direction.

53:59

It’s normal, it’s something we do. You always look at the next turn when you drive and the faster you drive, the more you want to see. Driving very fast, in the fog, it’s terrifying. You don’t know what’s in the next 10 meters, what will appear at the last moment and you will not be able to react to that. So, I think a business is always striving to increase its speed. And for the health of the business, this can be a very important tool in making the… let’s put it this way. In being able to achieve a higher speed, because you have a reaction time that is compatible with higher speeds, then this make the business more competitive.

Robin 54:49

Yeah, it’s interesting because you mentioned the forward-looking view, and we’re investing in quite a lot in predictive forecasting, which is different from real-time data. It’s more like automation, because there are armies of people focused on forecasting, and the first forecast we’ve been able to do is the mid-month forecast, so forecasting 15 days in advance.

55:12

So, there’ll be quarterly forecasts. And then for certain brands or countries, it might be the annual forecast that we can remove the heavy work with predictive modelling. And that for me is, I suppose, where the real benefits come, actually, because you can then focus on what could the outliers be, what events might occur that will influence this forecast.

55:37

What causes it to swing in one direction or another. And it’s much more value-added thinking that you can’t automate. You can run scenarios through automation, but I think that the real time will certainly be helpful, and in many businesses critical, but forward-looking, predictive forecasting personally would rate above, I guess, investment in real-time data personally, in the sort of business that I work in.

Carlo 56:05

Yeah. I would say it’s sort of one can’t really exist without the other. If you don’t take the data up to the 15th of the month. Yeah, it’s very difficult to have a model to predict your month’s end. So, in a way that the two go hand in hand, but I would say the real time for compliance is not as important, but the real time must be there for business decision-making. And once it’s there, it’s a big optimisation, even for compliance or processes in the finance department. So sort of, yeah, possibly if you will, just to optimise the processes, it would be less justifiable to the big investments, but the thing is it’s the basis for both.

Chris 56:53

Great. Well thank you. We haven’t actually had any questions as you covered the topics in such detail. So thank you to Carlo and Robin, and also thank you to all our listeners today. You can learn a lot more about the topics we’ve covered today by going to FinancialDirector – financialdirector.co.uk – where you will also find this webinar recording if you’d like to listen back to it after today.