Nailing Cash Flow Management in Turbulent Times

Introduction

The Covid-19 pandemic is expected to cost businesses $1.1 trillion (about £900 billion) in lost revenue. With no clear idea of when we can expect the tide to start turning – and margins in many industries already narrower than they’ve ever been – having cash on hand is essential if your business is to weather the storm.

But how do you make sure you have healthy cash flow when bills are piling up and there’s less money than usual coming in?

In this comprehensive yet concise guide to cash flow management, we’ll walk you through:

– The key issues to consider when managing cash flow in times of crisis

– Tactics to build your cash reserves and unlock more working capital

– How to keep spending in check the smart way with finance automation

– How to plan ahead with confidence, despite the uncertain economic outlook

Chapter 1: How crises affect cash flow

Keeping positive cash flow is tough at the best of times. When we surveyed finance leaders about their greatest challenges, 72.1% agreed it was cash flow management. And business expert and author David Finkel calls it ‘one of the biggest obstacles’ to growing a business.

But if cash flow issues can spell trouble when things are going well – poor cash flow is a factor in 80% of business failures – their impact can be even more serious in times of crisis.

Crises, says Generation CFO’s Christopher Argent, have a two-fold effect: Firstly, ‘…there’s a sudden, immediate change to your incomings and outgoings. This happens whether the crisis is a global event such as the Coronavirus, or something on a smaller scale like flood damage to your premises or a key employee moving on.’

Typically, the crisis will impact your – and, possibly, other businesses’ – ability to trade. With no revenue coming in, it’s harder for everyone to pay bills and invest in growth, so liquidity dries up.

Chris Argent, Generation CFO’s Managing Director

That’s bad enough on its own. But what’s worse, says Argent, is the speed at which change can happen.

“With a continually evolving situation like the Coronavirus, for example, you need to be able to act as quickly as possible. But depending on your processes, ‘as quickly as possible’ can be painfully slow.

For example, you could email everyone telling them that, moving forward, a senior manager has to sign off on all credit card spending. But not everyone is going to see that email immediately. For all you know, a staff member could be buying £3,000 worth of stuff with the company credit card just as you’re pressing send… and there’s nothing you can do about that.”

The good news is that finance automation tools like Soldo can speed up your crisis response time significantly.

We’ll discuss what implementing these tools into your workflow can bring to the table in a minute. But, first, it’s worth taking a look at what you can do to give your cash flow a short-term boost.

Chapter 2: Increasing your working capital

While a crisis can dry up revenue faster than the sub-Saharan sun, not all is lost. There are other ways to keep your working capital on a reasonably even keel.

The three main areas worth looking at are your:

- Balance sheet

- Accounts receivable

- Accounts payable

Using your balance sheet to unlock working capital

McKinsey & Partners’ Ankur Agrawal, Kevin Carmody, Kevin Laczkowski, and Ishaan Seth argue that a crisis is the perfect opportunity to review and strengthen your balance sheet.

Selling off perishables, old stock, or equipment you no longer use can bring in a welcome cash injection. This helps ‘extend the company’s financial flexibility while keeping everyone focused on key metrics at a chaotic time.’

While you’re at it, it’s also worth looking at other aspects of your balance sheet.

What do your departmental and project budgets look like, for instance? And, more importantly, are you making the best use of your now more limited resources?

You won’t necessarily want to go overboard with belt-tightening. But it may be worth thinking about what you should prioritise and what you should put on the back burner.

It’s also worth looking at areas where you may be wasting money.

Case in point, 71% of businesses have at least one ‘orphaned’ software subscription – a subscription bought by someone who has since left the business and is no longer in use. Similarly, several departments may have duplicate subscriptions. These could be needlessly inflating your IT bill by as much as 30%.

Reviewing your accounts receivable

Businesses often work on the assumption their invoices will be paid on time. But research suggests 66% of invoices are paid late, and the average UK business has to wait 18 days or more after the due date to get their money.

With new revenue dwindling, these outstanding amounts can be the difference between going under and staying afloat. Which means it may be a good idea to ramp up your credit control efforts.

Your logical first port of call will probably be businesses you’ve classed as riskier, such as startups or organisations that are dependent on seasonal trade. Seeing as they may have a harder time adapting to economic uncertainty – and you may also have negotiated shorter payment terms because of their risk profile – this makes perfect sense.

That said, it’s also worth speaking to lower-risk debtors. Chances are, these businesses have higher value outstanding invoices. They’re also more likely to have healthier cash reserves. Which means they may be able to pay at shorter notice.

Of course, credit control conversations always have the potential for being difficult. So a time of crisis requires even more tact and caution.

Argent puts it this way:

“In a crisis, relationships are more important than ever. With something large-scale like the Coronavirus, everyone is in the same boat, so you need to be open, honest and willing to compromise.”

Negotiating terms on accounts payable

Just as you might be doubling down on collections, your creditors may also be knocking at your door. Which means you may have to renegotiate the terms on your accounts payable.

Here again, honesty, openness, and flexibility are key. ‘You need to be frank about your financial position and what you can and can’t handle,’ says Argent. ‘The trick is to work out a way you can receive enough so you can pay enough. It’s a fine balance.’

Chapter 3: Getting smart about spending

When McKinsey researched which companies were most resilient over the last 20 years, the common denominator was that they prepared earlier and acted sooner in times of crisis.

Case in point, by the time the 2008 recession hit, the most resilient companies had already started cutting costs in order to mitigate the damage: ‘By the first quarter of 2008, the resilient ones already had cut operating costs by 1% compared with the year before, even as their peers’ year-on-year costs were growing by a similar amount. The resilient maintained and expanded their cost lead as the recession moved toward its trough, improving their operating edge in seven out of the eight quarters during 2008 and 2009.’

Case in point, by the time the 2008 recession hit, the most resilient companies had already started cutting costs in order to mitigate the damage: ‘By the first quarter of 2008, the resilient ones already had cut operating costs by 1% compared with the year before, even as their peers’ year-on-year costs were growing by a similar amount. The resilient maintained and expanded their cost lead as the recession moved toward its trough, improving their operating edge in seven out of the eight quarters during 2008 and 2009.’

Clearly, cutting spending boosts your cash reserves and strengthens your financial position even as revenue goes down. That said, as tempting as it may be to cut deeply and liberally, that approach can backfire. For spending cuts to be effective, you need to think carefully.

McKinsey themselves acknowledge this, noting that, particularly in the context of the Coronavirus crisis:

“…across-the-board cost cuts can create more problems than they solve. For starters, there’s the risk of undercutting digitization efforts by underinvesting in mission-critical talent. There are also the wider social costs of layoffs, which companies are starting to feel in the form of backlash from communities, customers, politicians, and workers.”

Argent goes further: ‘Some spending is business-critical, whether you’re going through a crisis or not. You can’t furlough your finance staff, for example. Who’s going to manage cash flow and produce budgets and forecasts? You need to find your risk tolerance.’

Clearly, you need to strike a balance. And in order to do this, you need to:

- Get as close to your spending as possible

- Be more flexible with budgeting

Putting your spending under the microscope

Spend analysis can cut your procurement costs by as much as 57%. That’s significant in any economic climate, but even more so when you’re in the midst of navigating a crisis. If you know exactly where your money is going, you can:

Consider whether you’re making the best use of your resources

Consider whether you’re making the best use of your resources- Find areas where you could get away with making cuts

- Identify and eliminate waste

- Identify any surpluses and reallocate your resources accordingly

Because things are so fluid during a crisis, McKinsey recommends conducting spend analysis more often. So if you used to conduct spend analysis every quarter, it might be a good idea to start doing it every week. Or even every day, for areas that are material and volatile – your supply chain, for example. This will allow you to be more proactive and flexible.

The challenge is that, to be able to conduct effective spend analysis this frequently, you need access to accurate data. And, in a world where many businesses rely on manual processes and 73% mistrust their financial data, that’s easier said than done.

Making spend analysis simpler and more effective with finance automation

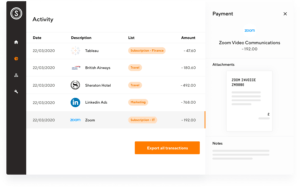

Finance automation tools like Soldo can make spend analysis easier by giving you access to accurate, to-the-minute data when you need it.

Instead of having to collect your data manually – by reconciling credit card statements or processing expense reports, for instance – every transaction is recorded automatically as it happens.

This means the prep work has been done for you: log on to the dashboard and you have a snapshot of your business’ financial health at any point in time which you can use as the basis for your analysis.

Soldo can also tag transactions by user, merchant, expense category, company card (a card that allows you to ring-fence team or project funds), or custom accounting or nominal codes.

The upshot is that you have unprecedented, real-time visibility into your spending which you can use to make better-informed financial decisions. This can be as simple as putting a stop to spending that’s outside your expense policy, to big-picture decisions about what to prioritise.

Let’s say you’re conducting a spend analysis into your marketing department’s budget. You notice a big chunk of it is being spent on SaaS subscriptions, and that some of them overlap – for instance, the team’s subscribed to Todoist, Trello, and Asana, all of which have broadly similar purposes.

Typically, the team would pay for the subscriptions with the departmental credit card, so you wouldn’t be able to find out how much they’ve spent until you went through the credit card statements. But if the team pays with a Soldo card, you can pick up the transactions immediately and have a discussion about what’s essential to the department’s operations and what can be cut.

Even better, you can reallocate some of that newly freed-up cash to areas of your business that are underfunded or higher priority.

Similarly, if you see that HR is buying too much stuff from Amazon, you can set limits either on their expense centre or individual cards. Amazon purchases are automatically blocked once they hit the limit, so you can set it and forget it until it’s time for the next review.

Being more flexible with budgeting

The benefits of real time visibility don’t stop at spending cuts. They also extend to budget planning.

In this regard, Argent argues that most businesses’ approach to budgeting is detrimental:

“Many businesses just assign a chunk of money to teams or projects periodically, which is really inefficient and encourages waste. You end up having conversations where people go “How much burn money do you have?” – they’re literally throwing cash away on stuff they don’t need just so they can justify getting the same amount next quarter, or next year.”

A better approach, particularly in a crisis, is to use zero-based budgeting. This allows you to allocate money on an as-needed basis, including, if necessary, diverting resources where there are surpluses or lower priorities.

Case in point, with most countries in lockdown because of the Covid-19 pandemic, T&E spend has plunged. On the other hand, web conferencing and collaboration software subscriptions are on the rise.

Case in point, with most countries in lockdown because of the Covid-19 pandemic, T&E spend has plunged. On the other hand, web conferencing and collaboration software subscriptions are on the rise.

With real-time visibility into your spending, you can identify these changes quickly and adjust your budgets on the fly to get more bang for your buck. So if there’s a shortfall in a business-critical R&D project’s budget, but sales has money left over – for instance because they’ve barely touched their T&E budget – you could redirect the surplus.

Soldo allows you to get as granular with your budgeting as you need to be. You can assign each team member a card with a set spending limit and restrict what they can or can’t buy with it.

At the other end of the spectrum, you can set up an expense centre and connect cards with a unique identifier instead of individual staff members’ names. The cards will only pull money from the expense centre they’re connected to. So you can set up an expense centre for a department’s overall budget, or for a specific project, even if it involves people from different departments working together. But because the cards aren’t named, anyone on the team can use them. This is unlike sharing cards that belong to only one name. These are not covered for fraud.

You can also set things up so that Soldo cards get topped up automatically – either at a fixed interval, or when the balance goes below a predetermined limit.

This gives you an unprecedented level of control over your spending and makes it easy to act at speed. Unlike sending emails informing staff about new spending policies, budget limits are immediate – as soon as someone goes over, they can’t make further purchases.

More relevant in times of crisis – particularly Covid-19 – all Soldo’s cards are also virtual. This means they can be accessed remotely and topped up immediately. These cards also connect to Soldo’s central cloudbased dashboard, so you can see what’s being spent on them in real time wherever you’re working from.

And because staff can upload receipts through the app, there’s no need to submit paperwork (which could be a Covid-19 infection risk), or go through the tedious, time-consuming process of reimbursing out-of-pocket expenses.

Chapter 4: Forecasting in times of crisis.. and why it’s important

It’s easy to get stuck in a loop of short-term thinking when you’re dealing with sudden, unexpected, even – dare we say it? – unprecedented events.

But forward planning is key, because it helps you adapt more quickly as the situation evolves so you come out the other side in a stronger position.

Of course, forecasting in the midst of great economic uncertainty can feel like trying to hit a moving target. Which is why it’s a good idea to plan for a number of different scenarios.

But how do you work out these scenarios? And what would the forecasting process look like for each of them?

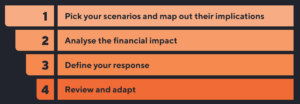

Deloitte’s Dwight Allen, Frank Friedman, and Carl Steidtmann suggest a four-step process:

Step 1: Setting the scene

Your choice of scenarios will depend on what you want to forecast.

Let’s say you’re trying to work out an operational budget for 2021. You could come up with two scenarios.

In scenario 1 – medical research is successful and a vaccine becomes widely available in September 2020.

In scenario 2 – the Covid-19 pandemic escalates and lockdown remains in force, so no travel or in-person meetings are possible until at least 2022.

Conversely, if you want to forecast revenue, you could explore scenarios here certain countries or industries recover quickly from the effect of the pandemic, while others have a hard time bouncing back.

Step 2: Counting the cost

With your scenarios in place, you’d try to estimate the potential financial impact on your business.

Covid-19’s effect on certain countries or industries, for instance, could have repercussions on your supply chain and, in turn, on your profit margin.

Similarly, an ongoing travel ban might have a positive effect on your T&E spend. But at the same time, it may hamper growth if you’re dependent on in-person meetings to grow.

Step 3: Putting a plan in place

You now know the potential financial impact each scenario could have on your business.

- What steps can you take to minimise that impact or neutralise it?

- And how much would each action cost the company?

These steps can act as a framework the leadership team can use to make business decisions moving forward. So, for instance, if no travel is going to be possible until at least 2022, you may need to invest in software and training to make sales demos remotely.

Step 4: Keeping forecasts under review

The accuracy of your forecasts depends on many factors. Some, like your data and processes, are within your control. But others – specifically, how things will actually play out compared to the scenarios you planned for – aren’t.

With this in mind, continuous monitoring is key.

You’ll need to track the situation closely to understand how you’re spending and the effect this could have on your ability to respond to changes down the line.

Chapter 5: Levelling up your forecasting capabilities… with finance automation

Just as real-time visibility helps you make better-informed decisions about spending and resource allocation, it also helps you make more accurate plans and forecasts. This is because, with access to real-time information, you can adjust the assumptions your forecasts are based on as circumstances change

Finance automation tools can also be connected to business intelligence and forecasting software through APIs. Putting your data through these platforms can help you get a clearer picture of the potential risks and opportunities a crisis creates for your business.

Chapter 6: Don’t take cash flow management for granted

Argent notes that good cash flow management is often an under-appreciated skill:

Business people tend to focus on profit and loss and assume that, as long as they’re in the black, it’s all good. The cash will come in. But the truth is that cash doesn’t always come in on time, so keeping the right flow of incomings and outgoings can be like walking a tightrope. The smallest crisis can upset everything.

The good news is that, while the balance may be fragile, you can restore it even when a crisis threatens to put everything into disarray.

In the short term, cleaning up your balance sheet, tactful negotiations around your accounts payable and receivable, and judicious spending cuts can beef up your cash reserves and unlock more working capital.

In the longer term, using financial automation tools can help you unlock better data and gain real-time visibility into your business’ financial health. This will allow you to be more flexible and respond to change at speed, so you can thrive no matter what the world economy – and the elements – throw at you.

Consider whether you’re making the best use of your resources

Consider whether you’re making the best use of your resources