We’re trusted by social care providers across the UK

In social care, standards can’t slip. But it’s difficult to maintain excellence when rising demand coincides with spiralling costs, limited funding, and a recruitment crisis. It feels like you’re juggling on a tightrope – one misstep and everything comes crashing down.

So, calm some of that chaos with Soldo. Simplify spending, from quick supermarket trips to monthly recruitment advertising. Put an end to petty cash and out-of-pocket expenses. Stop chasing receipts and speed up month-end.

Social care providers use Soldo to simplify spending

in the 1st month by one of our social care customers

saved by staff on the average expense claim

Rising demand, spiralling costs, limited funding, and a recruitment crisis. We get it. You’re walking on a tightrope and juggling 100 balls in the air. With Soldo, manual expense management doesn’t have to be one of them.

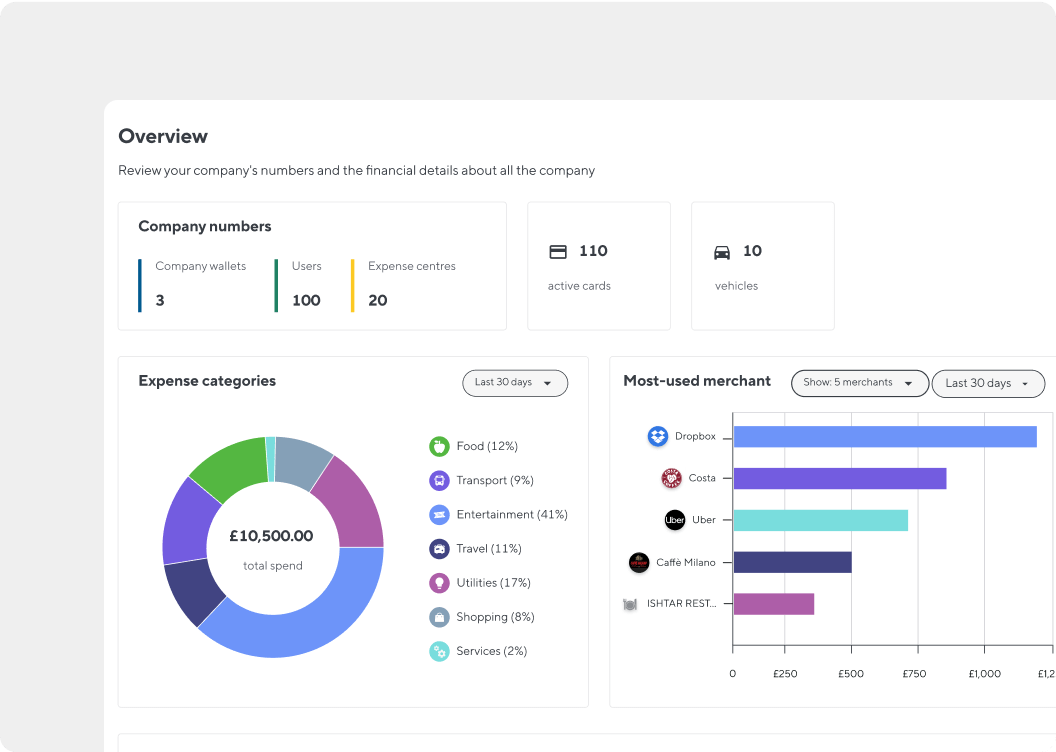

Soldo company cards let staff buy what they need, when they need it. Our platform gives you visibility and control of that spending – in real time. Staff won’t have to spend out-of-pocket, you won’t have to chase down receipts. And petty cash? A thing of the past.

Soldo tackles these areas head on – making expense management a little easier, while you take care of everyone else. We know you’re busy, so we’ve put together a quick guide that shows you how Soldo supports social care providers at a glance.