The four big expense challenges for social care providers (and how to overcome them)

The Social Care sector faces a laundry list of challenges. You’re navigating a staffing crisis, funding shortages, and ballooning demand. These are difficult times.

But challenges also present an opportunity. Crisis forces us to rethink how we operate. Right now, operational inefficiency is holding social care firms back. Reassessing your processes is a crucial first step in fixing the UK’s social care crisis.

A key pillar in providing more efficient care is expense management. Expenses and reimbursement are sometimes overlooked. But Soldo’s research has shown that they have a very real impact on productivity for social care providers.

The four expense challenges for Social Care

We commissioned Forrester Consulting to conduct a Total Economic Impact™ (TEI) study for Soldo. As part of their work, Forrester interviewed Soldo users (including a finance manager at a health and social care provider). The interviews uncovered four general expense challenges.

Time-consuming and complicated expense management

The expense process, as we know it, is a big time drain. For most social care providers, verifying expense claims and reimbursement is done via manual comparison.

Finance teams waste hours comparing expense claims to paper bank statements, checking compliance, and chasing missing receipts.

Care staff spend their own money on necessary work items (a big ask during a cost of living crisis). Reimbursement is manual and slow, with forms to be filled in and receipts to be accounted for.

Inefficient and manual monthly reporting

Any finance person will recognise this challenge immediately. Monthly reporting is tedious and time-consuming. And it’s remained unchanged for a long time.

Month-end involves creating, reviewing, and approving a monthly report in Excel. And then, you compare it to planned budgets and company spending. This process can swallow whole days of work per month.

Delays in distributing funds and cards

Budgets and plans can only do so much. Frequently, our best-laid plans can’t account for unexpected or urgent spending. That’s okay. It happens in any business.

The issue isn’t unplanned spending per se. It’s that adapting to unplanned spending is clumsy and slow. Topping up traditional bank cards can take two or three working days. That’s an anxious wait when employees need funds.

Withdrawing, counting, and distributing cash to employees is also time-consuming. Not to mention being prone to errors and theft.

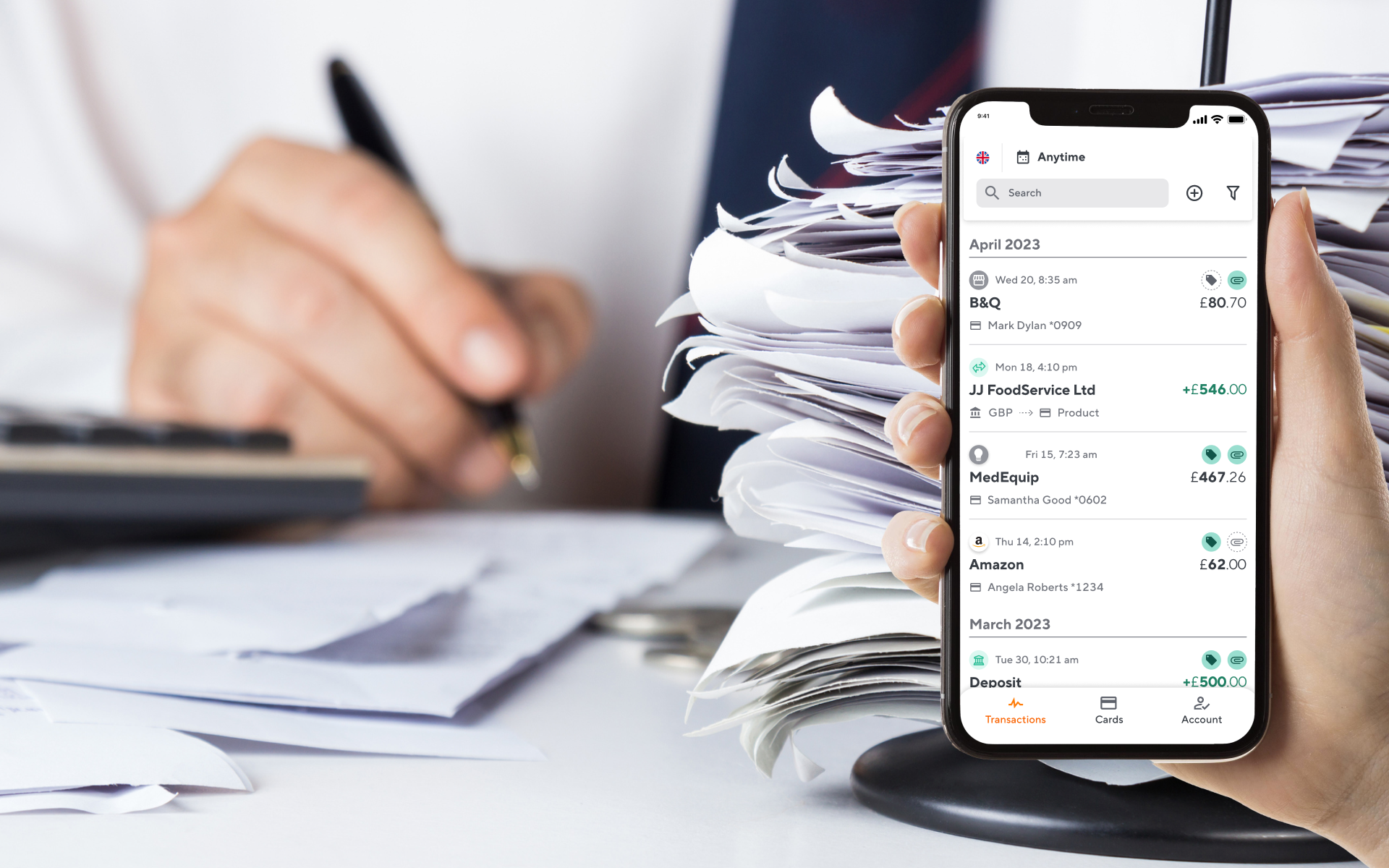

Lack of visibility and control over spend

Social care providers often don’t have any means of monitoring transactions in real-time. Traditionally, finance teams wait days (if not weeks) for access to bank statements. This slows down transaction reviews and spending analysis.

Doing everything in hindsight means resolving suspicious transactions takes too long. Or worse, it happens too late. By the time you get to the suspicious expense, the damage is done.

End inefficiency and get your time back

With the structural challenges facing the Social Care sector, the last thing you need are preventable problems. Expense management – and the four challenges that come with it – is a prime example.

It doesn’t need to be like this for finance teams. Soldo’s TEI study illustrates the significant impact an expense management platform has on efficiency.

The study showed that Soldo’s platform:

● Reduced the time a finance manager spent on a claim by 62%.

● Cut the time spent reviewing and approving a report by 80%.

● Lowered time spent reviewing budgets aligned with company spending by 50%.

And that’s just for finance teams. Non-finance employees saved over 50% of the time spent submitting expense claims; a reduction of 48 minutes per claim on average. Overall, employee time savings on expense management amounted to over £62,000.

A modern way to manage expenses

The way we spend money in our day-to-day lives has moved on a remarkable amount. And yet, company spending and expense management in Social Care has remained stubbornly old-fashioned.

What social care providers need is a modern, efficient way of making purchases and managing expenses. Employees – both carers and operational teams – can be given easy access to company money when they need it.

Whether that’s an impromptu purchase by a carer for a service user, or an online recruiting campaign for new care staff. Finance teams must have control, of course, but resources need to be deployed quickly.

It’s not a choice between control and efficiency. You can have both. Card limits can be adjusted to match the needs of each employee And once the spend is incurred, you verify expenses instantly. It’s all done in the expense management platform.

Automate and end admin

So much of the policy focus on UK Social Care fixates on ‘more’. More capacity, more carers, more service users. That isn’t wrong, but it’s not the whole story.

To do more, social care providers need to, counterintuitively, do less. Less admin, less manual processing, less waiting. Inefficiency is weighing you and your employees down at a crucial juncture.

Social care providers must strike a balance between providing adequate care and moving fast. It’s not easy – but expense management is an excellent place to start.

Soldo connects company cards to an expense management platform. This lets you distribute company money while staying in control of spending. An expense management platform isn’t a magic fix for the big challenges facing UK social care providers. But it’s certainly part of any long-term solution.

Expense management for social care

Get a clear view of spending in real-time and control all costs in one platform. From purchasing PPE to paying for staff training and building maintenance, Soldo lets you do it all, effortlessly.