How to maximise your chances of getting debt finance

Debt finance often isn’t the first choice of finance for growing companies.

A recent data point in Deloitte’s UK CFO Q4 2022 survey showed that bank borrowing and debt finance is the least attractive it’s been since the financial crisis. A large part of this is due to rising interest rates meaning that it is more expensive than at any time since 2009.

However, you shouldn’t write off debt finance as an option too quickly. It’s becoming harder to raise equity rounds at high valuations, and the changing market conditions mean that there is the possibility of raising “down rounds.” This is when the valuation on which you raise is at a lower value than the last equity funding round.

If you cannot raise finance at an increased valuation from the last round, you should consider debt financing. So you aren’t selling shares in your company too cheaply. This will also allow you to keep existing investors on side due to their capital holding its value on paper. And you can return to raise equity finance when the market conditions improve.

To maximise your chances of accessing debt finance, and at a favourable rate, read our tips below.

Fulfil filings at Companies House

Providing up-to-date filings at Companies House will provide lenders with clear statutory information on which to make credit decisions.

Filings should be completed for your annual accounts, confirmation statement, recent shareholder changes and amendments to articles of association.

Warnings on Companies House for late filings will raise potential red flags for lenders and could damage your chance of accessing facilities.

Have up to date management accounts ready

While statutory filed annual accounts are the gold standard due to needing to implement recognised accounting standards, they can be filed up to nine months after year-end.

This means there are many instances where you’ll have up-to-date filed annual accounts at Companies House. But which are viewed as too old to provide meaningful current information for lending decisions.

Therefore you should also have current management accounts ready to provide to lenders. While you may not prepare these formally, cloud accounting software makes it easy to generate instant monthly management accounts that can be exported into a PDF format.

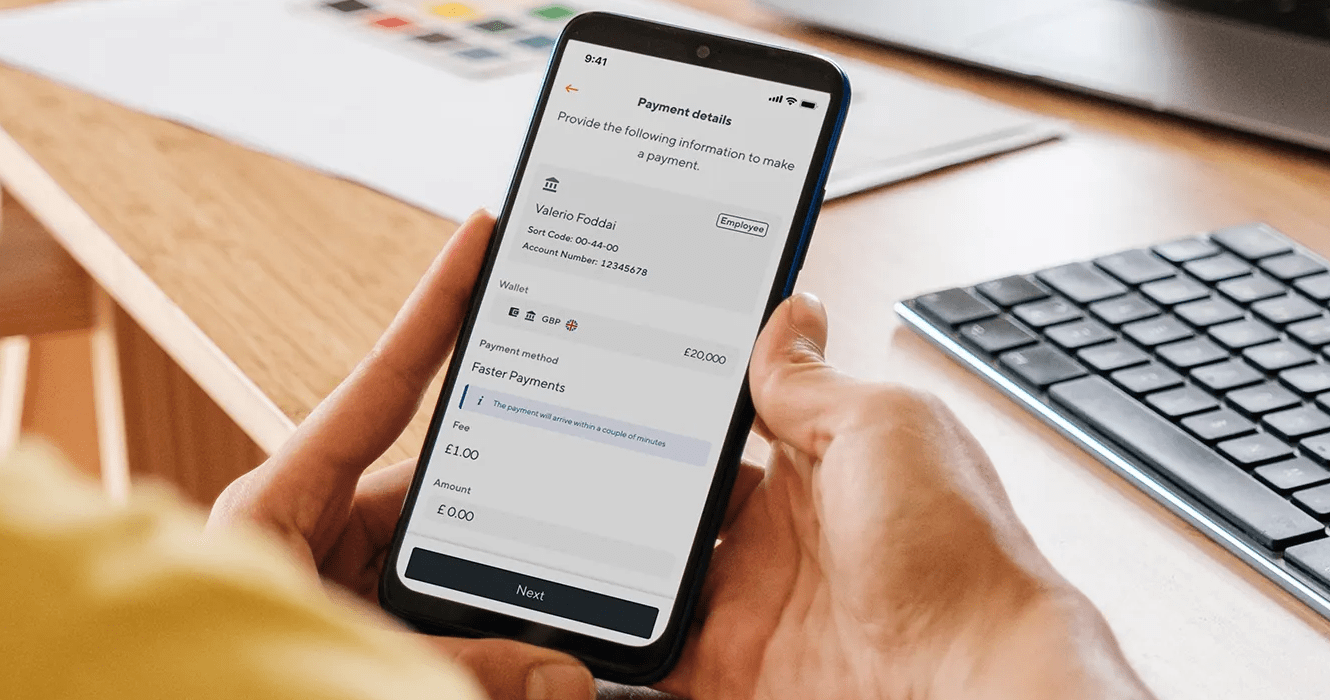

Accuracy of management accounts can also be enhanced by using spend management tools that will be updated with business spend in real-time. Rather than an out-of-pocket approach that manually needs to be updated on accounting software at month end with expense claims.

Provide recent bank statements

Most lenders require bank statements covering the last three months of activity.

Larger businesses are likely to have multiple accounts in different currencies. Downloading statements manually can be time-consuming, and you may mislabel files and send incomplete data.

Use Open Banking connectivity to seamlessly connect and download bank statements in one file per account. This will save time for you and lenders.

Consolidate debt and any outstanding loans

If you already have debt finance document any facilities, including monthly repayments, interest rates and duration.

Consider consolidating outstanding loans. This makes it easier for new lenders to understand your circumstances and get a clearer picture of affordability.

As well as simplifying your finances, consolidating debt can be a cheaper option than servicing several loans.

Create cash flow forecasts

Cash flow forecasts aren’t a pre-requisite to receiving debt finance. But they demonstrate to lenders that you take debt repayments seriously.

Forecasts should consider the value of the loan being sought and show monthly repayments too.

Cloud forecasting tools, such as Futrli, Float or Fathom, will streamline the production and maintenance of cash flow forecasts. And take up a fraction of the time from creating them on spreadsheets.

Monitor your credit score

Your credit score is hugely influential when it comes to accessing debt finance.

In advance of seeking funding monitor your company’s credit score to ensure it is as high as possible. Unfortunately, credit scores aren’t universal, but Experian and Equifax are two of the most widely used bureaus.

Negative elements that could affect your credit score include County Court Judgements (CCJs), late company filings, and not paying your suppliers on time.

These are all solvable issues but should be addressed in advance of debt applications.

Shop the market

Using online brokers is an efficient way to see the fullest view of the market. Funding Options, Capitalise and Swoop Funding, allow you to complete one application that will shop the whole market for you. These tools assess a range of different lenders and funding products.

This is fast and can unearth the cheapest and most relevant form of financing. Ensure you only work with brokers conducting soft credit searches, so your score is unaffected.

In the next post we’ll explore innovative and new forms of debt funding that may be suitable for your business. But which you may not have heard of before.

Visit our blog for more articles like this one or subscribe to get them direct to your inbox. Find out more about Soldo here.

Now’s the time to rethink expense management

Almost two-thirds (62%) of employees say reimbursement should be replaced with a system of company cards. Get your copy of The Cost of Business Crisis to find out more.