Late payments just hit a two year high for small businesses in the UK, says new data

Late payments for small businesses hit a two-year high in September, according to new data published by Xero. Any increase in late payments is always concerning news for business leaders. But this is especially true in the current economic climate, where maintaining positive cashflow is such a delicate balancing act for SMEs across the country.

When your customers don’t pay invoices on time, it puts additional strain on your working capital and your cash position. With less cash flowing into the business, keeping your finances in good shape becomes a challenge.

So, what can you do to minimise the impact of late payments? And how can being in better control of your numbers help you spot potential debt issues before they arise? Read on for the answers to these and other questions including:

- What is the current state of late payments in the UK?

- What are the main causes of late payments?

- How can you prevent and manage late payments?

What is the current state of late payments in the UK?

According to Xero’s Small Business Index, small businesses waited an average of 30.6 days to be paid by their customers in September. This is the longest wait time in two years and the sixth month in a row that payment times lengthened. The rise in payment times left small businesses waiting an extra 8.2 days beyond agreed invoice payment terms – the highest late payment time since August 2020.

And that’s not the only sign of late payments becoming a growing issue for the UK’s small business owners.

A recent Federation of Small Businesses (FSB) study of 1,200 business owners found that close to one in three (30%) had seen late payment of invoices increase over the last three months. Another 8% had experienced other forms of poor payment practice and only 6% had formally agreed a change to their payment terms over that period.

This is a trend that’s adding to the existing pressure on UK small businesses. But what’s causing this jump in late payments? And what can you do to reduce the impact?

What are the main causes of late payments?

There are many reasons why your customers might not be paying your invoices on time. In an ideal world, getting paid should be a smooth and seamless process – especially in the digital age. But there are hurdles that can fall in the way of good payment practices.

For example:

- Their accounts payable team may have been instructed to delay payment

- Your customer may not have received your invoice at all

- You may have misquoted the purchase order number, or input other details incorrectly

- Bank details may be incorrect, or payment may have been refused by the bank

But by far the biggest reason for late payments will be the prevailing economic situation. The UK is already in recession, interest rates are increasing and costs are on the rise. And these challenging conditions mean your customers have less liquid cash to pay their bills.

Faced with this economic reality, what can you do to stay on top of late payments?

How you prevent and manage late payments?

With so many accounting tools, forecasting apps and credit control solutions available, staying in control of late payments should be a breeze. But if you want to get paid on time, it’s also important to know your customers and build trusted relationships that lead to better payment.

We’ve highlighted five ways to reduce your late payment worries:

1. Stay on top of your accounting

if you’re not up-to-date with your bookkeeping and bank reconciliation, you might not even know that payment is late. It’s also important to invoice on time, so you begin your payment terms as early as possible. A flexible cloud accounting package, like Xero, QuickBooks or Sage makes it easy to view your cashflow, accounts receivable and aged debtor reports.

Work closely with your accountant to talk through these numbers and look at your financial reporting at least once every month. These frequent chats with your adviser help you spot the slow payers and take action to get payment back on track ASAP.

2. Delegate your invoice chasing to an expert

If you’re currently managing the entire finance workload, it may be time to delegate this responsibility. Think about hiring an in-house finance manager for the business. Or see if your accountant offers an outsourced finance service, where they can manage the books and chase up the outstanding debts.

If you have the budget, there’s value in hiring a full-time or freelance credit-control professional. Someone to manage your accounts receivable, debt management and chasing of late or aged debt.

3. Get to know your customers

When you have a great relationship with your customers, this puts you top of mind when it comes to payment. If an invoice does miss the due date, it’s easier to chase up payment when you know a customer contact by name and have an existing rapport.

It’s also a good idea to track the financial health of customers – both before you take on new customers and regularly for your existing base. By checking a customer or prospect’s business credit score, you can make informed decisions about who to work with and what kind of payment terms to offer. You’re also more likely to spot a late payment problem on the horizon so you can get ahead of that risk before it becomes a threat.

4. Review your invoicing processes

It might be tough to hear but the problem doesn’t always sit with the customer. If you have messy or inconsistent invoicing procedures this can also lead to late payments.

Are you sending out invoices on time, without errors, to the right people? Are your company bank details up to date? Have you automated the sending out of recurring invoices, or are you reliant on someone remembering to press send on the invoice? Always follow up on the invoice to make sure it’s been received and that the email hasn’t ended up in someone’s junk folder.

5. Tighten up your payment terms

If you haven’t already, make sure you’ve agreed formal payment terms with every customer. These payment terms should set out when you expect to be paid (usually 14, 30, 60 or 90 days from the invoice date, depending on the benchmark for your sector).

Your terms should also set out your procedures for late payment and how much you’ll charge as a late-payment fee. This will generally be 8% of the invoice value – read HMRC’s guidance for charging interest on late commercial payments to find out more about this.

It’s also sensible to have an agreed process for when you contact a late-paying customer, and how the debt will be escalated if they don’t pay.

The value of great financial management

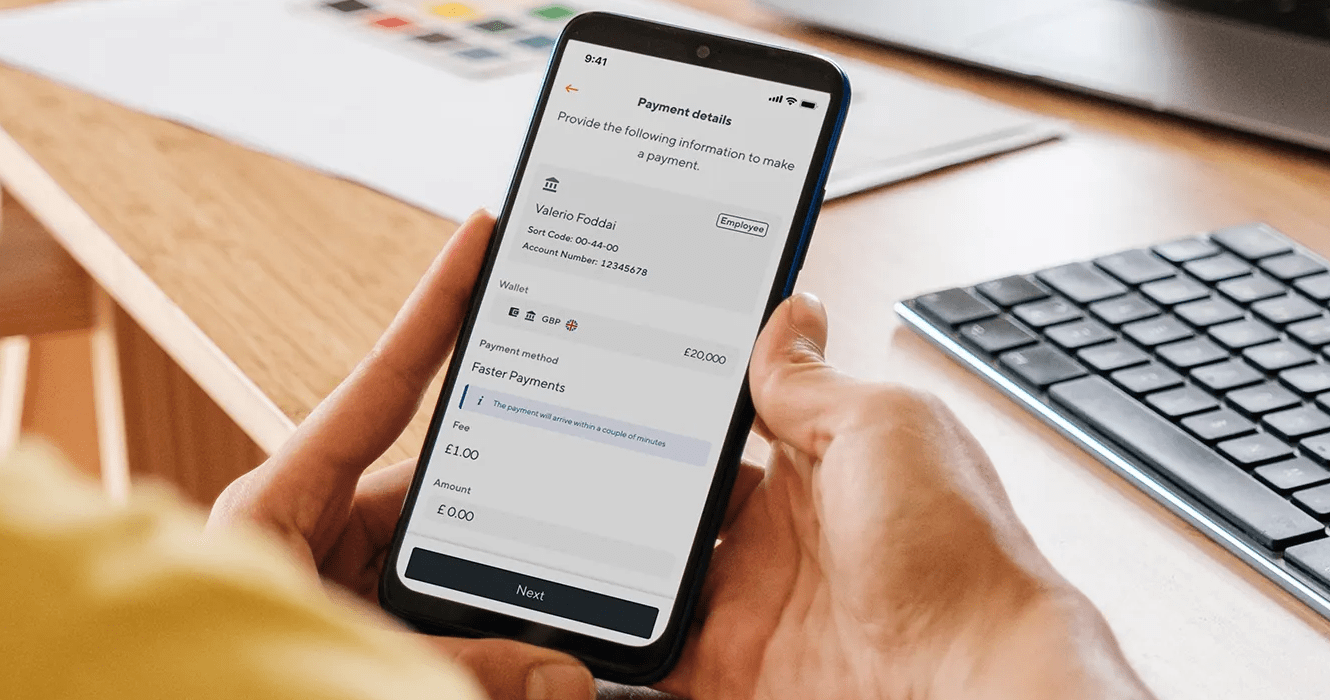

At Soldo, we know how important it is to stay in control of your company and employee expenses as well as your costs and cashflow. When it comes to late payments, the ideal mix is having the right accounting and finance tools, alongside a big focus on nurturing trusted customer relationships.

If you’re looking for more small business news and expert advice, subscribe to get all our latest blog posts, free resources for ambitious business owners straight to your inbox.