Feeling the Cashflow Squeeze? We Have the Answer (Hint: It’s Not a Loan!)

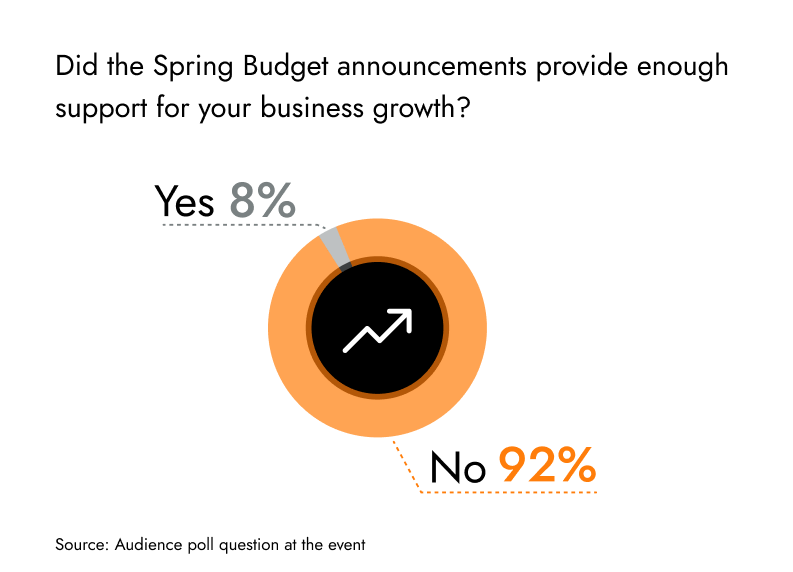

Managing your cash flow actively is the smart way to run and grow a sustainable and resilient company. In 2024, cash and financial debt management is more important than ever for SME business owners. With B2B payment terms extending to an average of 48 days and average delays of an additional 17 days*, effective cash flow management is the key to unlocking your business’ full potential and ensuring long-term success.

There is almost always a lag between receiving payment for the goods and services you have sold and paying for the inventory, services, and wages needed to produce them. This delay impacts your cash flow. To enhance short-term liquidity and efficiency of your business, it is essential to effectively manage your cash flow.

Effective cash flow management has 5 main levers:

- Forecast future cash flow to anticipate potential gaps between cash inflows and outflows. Cash flow forecasting is an essential tool to project your company’s financial health allowing you to budget, invest cash surpluses and understand if or when you may need additional financing.

- Optimise inventory levels to avoid tying up cash in excess inventory. Purchasing inventory represents a cash outlay and consequently, purchasing too much inventory which won’t be turned into cash flow in a timely manner can put an unnecessary strain on your finances.

- Negotiate favourable payment terms with suppliers to provide additional time to generate revenue before settling bills. Accounts receivable may constitute a large portion of your assets and how you manage them can have a big impact on your business’ financial health.

- Accelerate accounts receivable by promptly invoicing customers and following up on overdue payments. A large portion of overdue payments relate to buyers simply forgetting to pay. As such, sending reminders in advance of the due date is another important tool to ensure payment is received on a timely basis.

- Leverage short-term financing options from banks or from alternative financing providers to secure a safety net for cash flow fluctuations. This can help ensure that you can continue to run your business with peace of mind and overcome any hurdles or challenges you may face relating to long payment terms or delayed payments.

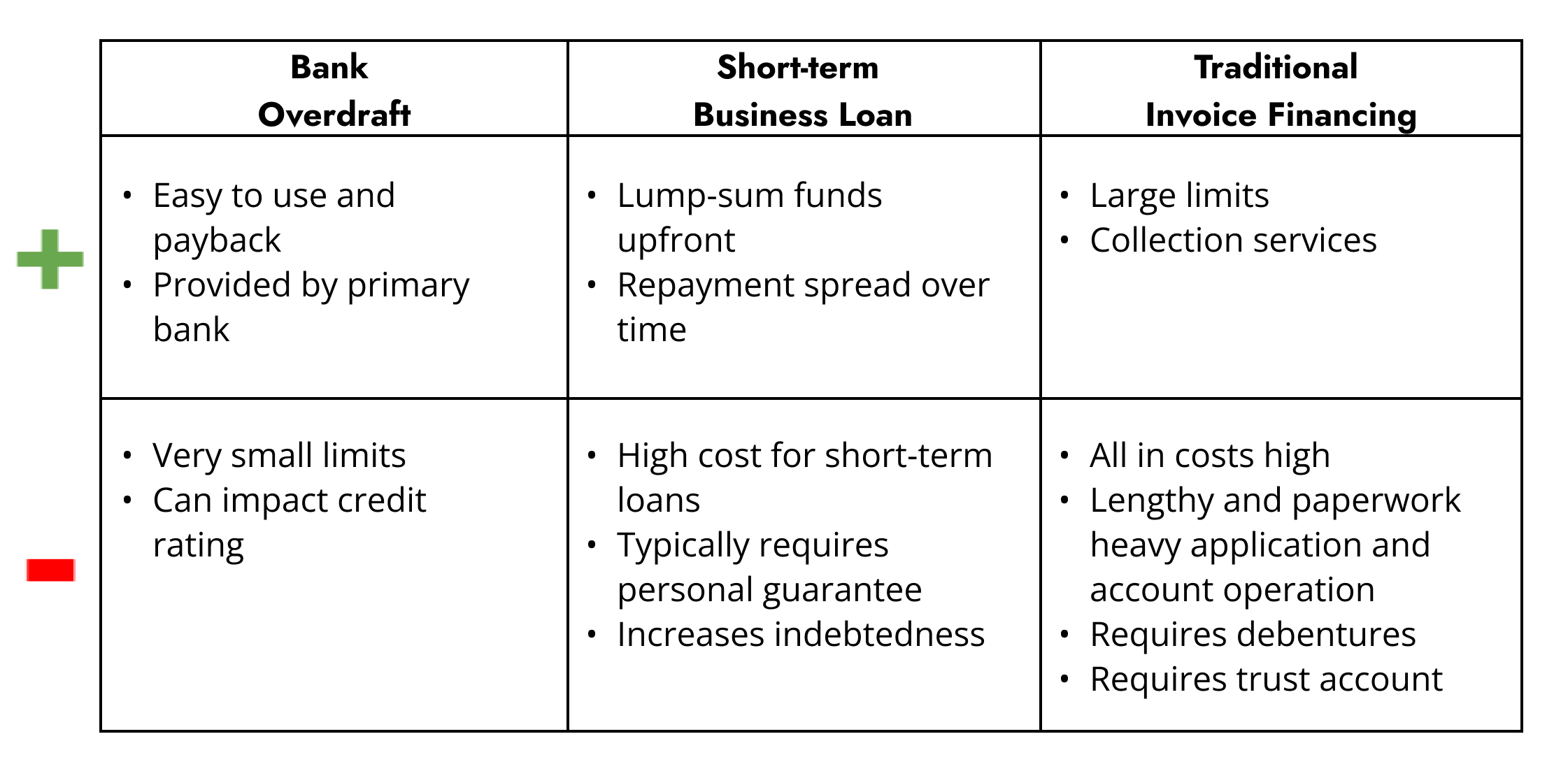

Traditional short-term financing options, including overdrafts, short-term loans and invoice factoring, often exacerbate the dilemma due to high costs, cumbersome and lengthy processes, and general inaccessibility to SMEs. Here’s an outline of the pros and cons of these traditional solutions:

Recognising these gaps, our trusted partner, TRIVER, introduces a revolutionary approach to SME cash flow financing. A strong cash flow not only ensures that operations continue smoothly but also provides the flexibility needed to navigate through uncertainties. With a TRIVER facility you can smooth your working capital simply by turning your unpaid client invoices into cash, when needed without taking on any additional debt. TRIVER differentiates in several dimensions:

- Fast: open a facility and advance invoices in minutes online

- Simple: no personal guarantee, no securities, no paperwork

- Discreet: invisible to your clients, not trust account

- Flexible: facility up to 20% of your annual turnover

- Fair: one simple daily fee per invoice you advance for the days you use

The partnership between Soldo and TRIVER represents the future of SME finances, empowering SMEs with the tools you need to run your business with peace of mind. Discover how TRIVER’s tailored solution can transform your financial management and secure the future of your business today*.

*Opening a TRIVER facility is subject to approval based on evaluation of the required information collected at application stage.