Digital banking for your business

More and more aspects of our lives are now being managed online. Whatever you may have done via traditional methods in the past, there is now almost certainly a digital alternative. However, when it comes to banking – particularly business banking – many people are wary of the security risks of going digital.

Provided that you haven’t been negligent, then banks are under an obligation to refund genuinely fraudulent transactions. However, it’s always better to be safe than sorry. While most banks and financial organisations take great pains to protect their systems, it’s essential as a customer to understand and to look for the technologies that offer maximum reassurance.

Identity checks

When you open a new account, banks will always want to verify your identity. This will usually involve providing copies or scans of documents such as your passport and recent utility bills. Increasingly it may also mean taking a selfie to compare with the photo ID or conducting a short video chat with a customer services representative.

If you are operating a digital business bank account online, make sure that you only permit access to trusted employees.

Authentication options

The days when we could rely on just a user ID and password to protect our online accounts are long gone. Any reputable banking organisation will now offer some additional means of verifying a new sign-on.

Most commonly, this involves two-factor authentication. After entering your password, you will need to enter a one-time code to complete the login. This may be sent to your phone via an SMS or be accessed using an authenticator app on a smartphone.

Other methods of authentication are also coming into play. This might be via a biometric identifier, such as a fingerprint, voice or retinal scan. There are also moves towards behavioural identifiers too – this is particularly of interest for mobile apps, where the software learns the unique way in which you use the screen and uses that to identify you. All of these are at relatively early stages in their development, but we’re likely to see them become more commonplace in future.

Of course, you still need a password, and you should make sure that this is something secure and not an obvious choice. Use a password manager app if you’re going to have trouble remembering it. Make sure that you also change passwords when a staff member moves on.

Card management

Although we’re talking about digital banking, we mustn’t forget that many transactions are now carried out in the traditional way with a credit or debit card, meaning if you lose your card or it’s stolen, that’s a problem.

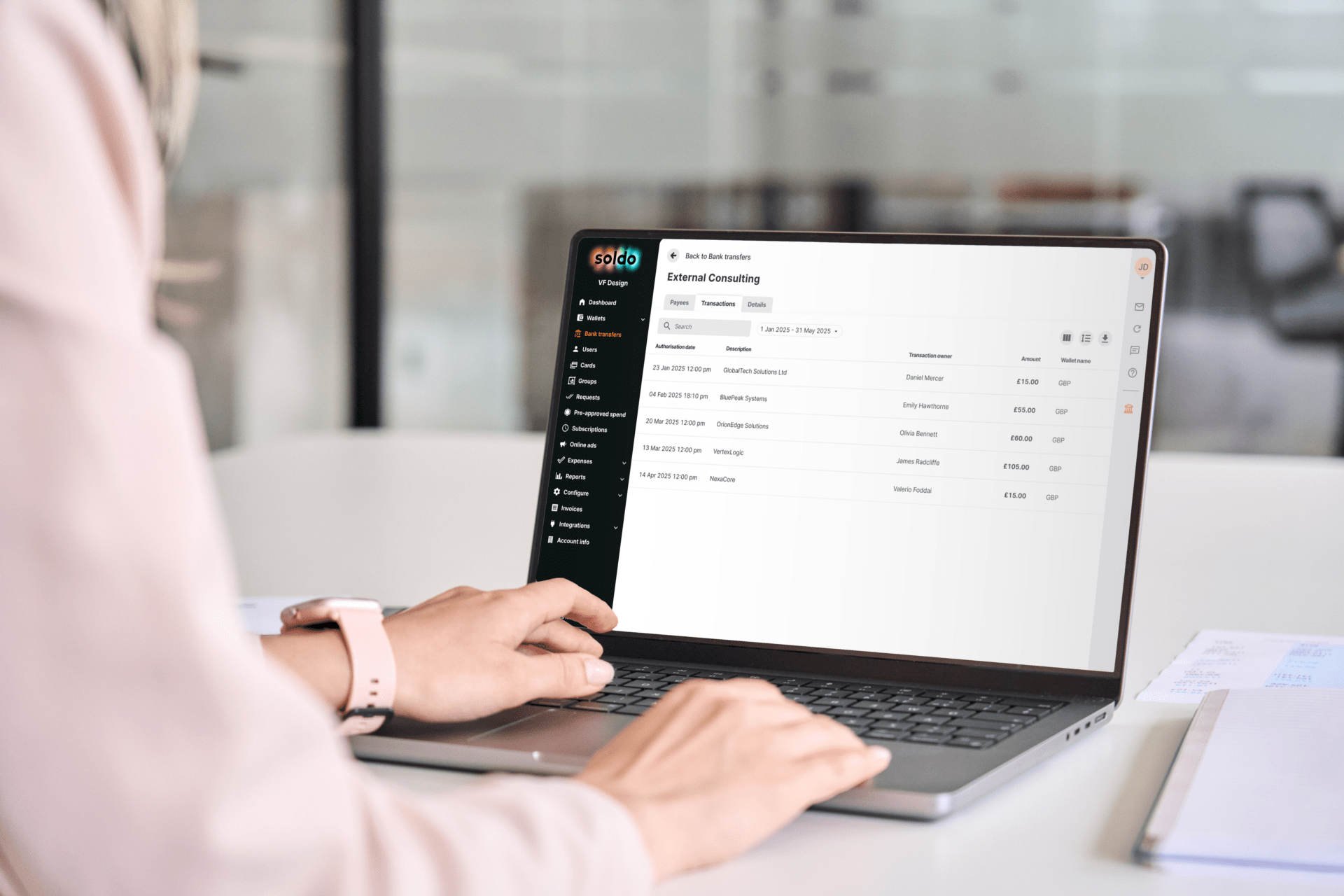

Many banks are now starting to offer the ability to lock your card via your banking app if you’ve misplaced it or won’t be using it for a while. This means that even if it falls into the wrong hands, it simply won’t work until it’s unlocked again. An extension of this is the ability to limit certain card functions. This might include blocking transactions over a certain amount, preventing ATM cash withdrawals or geofencing the card so that it can’t be used overseas in a similar fashion to the controls available on a Soldo contactless prepaid debit card.

All banks, even traditional ones, have algorithms that monitor your transactions and will challenge any unusual activity. While this may seem frustrating, it allows threats to be spotted and averted, so the added inconvenience of having to confirm a payment over the phone is worth the peace of mind.

You usually have the option to set alerts so that you get an email or text when a significant transaction takes place. This gives you added visibility of the account and can provide early warning of anything suspicious.

Automate business expenses with Soldo

Manage all your expenses on one platform

Phone safety

If you are using a digital banking app on your phone then, as with losing your card, there’s an added risk if you lose your phone. It is essential you always to lock the device with a PIN or biometric identifier, but it’s also worth looking out for digital accounts that allow you to block the app remotely and prevent it from being used if you misplace the handset.

If you’re using your phone for business, you may also want to look at installing remote management software that allows you to lock or wipe the device remotely if it should be lost or stolen.

Key messages

As mentioned, digital banking does carry some risks to it. It’s important to keep in mind the following points that we have discussed in order to help keep your business finances as safe and secure as possible:

- Only allow trusted staff to have access to your digital bank account

- Make sure the account has two-factor authentication

- Even with 2FA in use, make sure you choose secure passwords and change them when staff leave

- Use alerts to notify you of large transactions

- Ensure security software is up to date and consider using remote device management

- Beware of phishing emails

- Don’t use public Wi-Fi networks, or if you have to, use a VPN