As CFO of Soldo, I’m deeply invested in how finance leaders can drive productivity and sustainable growth, especially given today’s economic pressures. Our 2025 ‘Productivity at Work’ report underscores a critical, often underestimated factor: employee empowerment. I want to share my perspective on how empowering employees through progressive spend management can revolutionise the finance function and propel business success.

The CFO’s Mandate: From Gatekeeper to Growth Enabler

I know first-hand the pressure CFOs face to optimise financial processes and strategically contribute to business growth. Traditional, restrictive financial processes hinder productivity and limit opportunities. Our research reveals that 71% of finance teams recognise that slow processes prevent them from effectively supporting employees in pursuing new business opportunities. This needs to change, and it starts with us.

Empowering employees with controlled access to budgets is the key to transforming finance from a perceived “hurdle” to a “harbinger of growth”. By implementing solutions like Soldo, finance leaders can proactively manage spending, ensuring every decision aligns with business goals and policies.

Here’s how this shift directly benefits CFOs:

- Increased Agility: Empowered employees can respond faster to market opportunities and customer needs.

- Reduced Bottlenecks: Automating financial processes and granting direct budget access reduces administrative burdens and streamlines workflows.

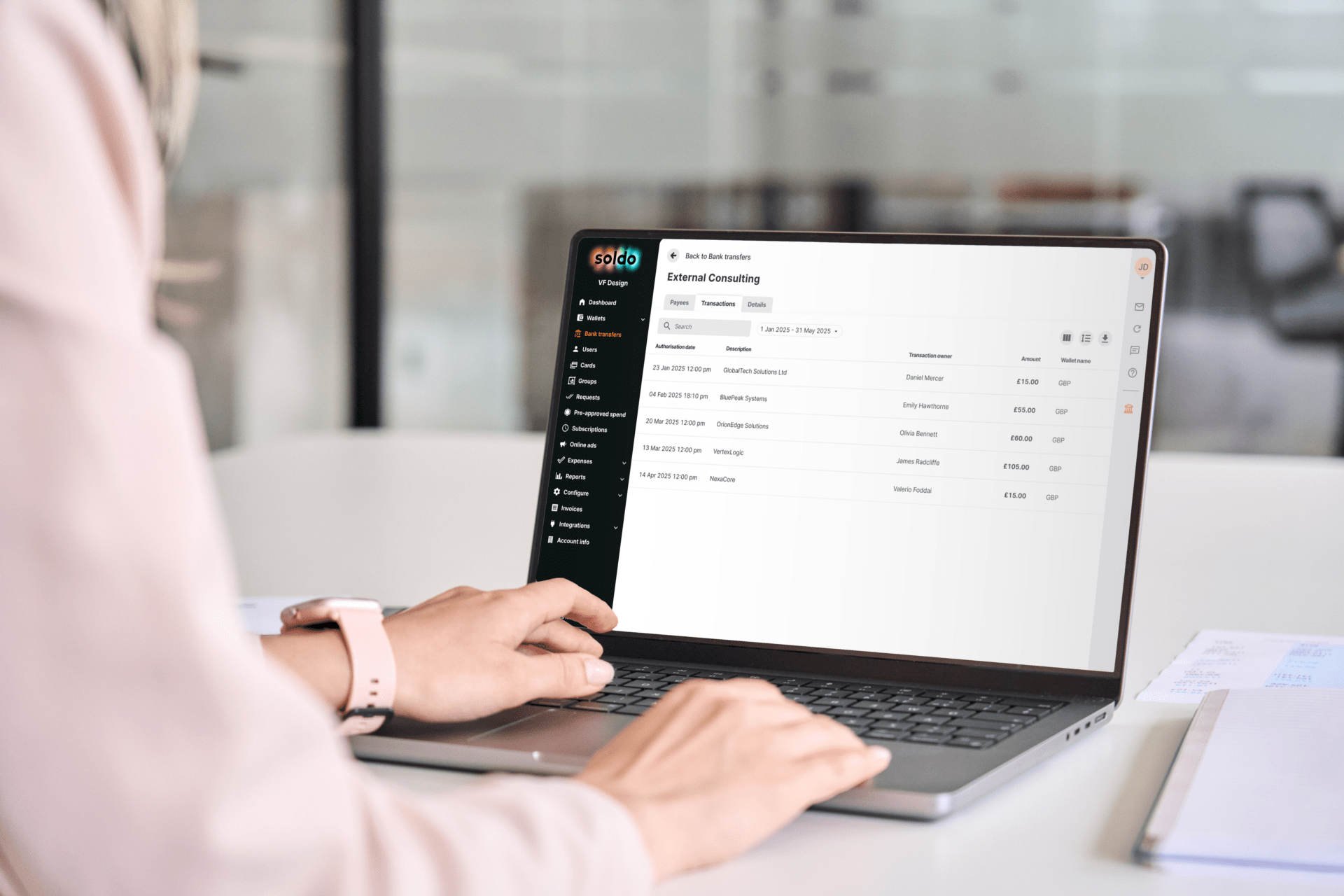

- Improved Financial Visibility: Real-time tracking of transactions and spending data enhances oversight and control. It allows acceleration of the closing the books process.

- Strategic Resource Allocation: Finance teams can focus on strategy rather than being bogged down in manual tasks.

- Enhanced ROI: Spot inefficiencies, eliminate waste, and accomplish more with the right tools. Soldo’s solutions have demonstrated a 358% ROI when used for over three years.

Key Considerations for CFOs: Delivering Productivity Through Empowerment

To truly empower employees and unlock unprecedented levels of productivity, CFOs must consider the following:

- Automate Financial Processes: to streamline workflows and dramatically reduce administrative tasks.

- Grant Controlled Budget Access: Provide employees with company and virtual cards, equipped with pre-set spending limits and crystal-clear spending policies.

- Optimise Workflows: Identify and decisively eliminate bottlenecks in financial processes to enable faster decision-making and more effective resource allocation.

- Provide Comprehensive Training and Support: Ensure employees thoroughly understand financial policies and have the necessary training to manage budgets responsibly and confidently.

- Foster a Culture of Trust and Transparency: Communicate openly and honestly about your commitment to empowerment, fostering a culture of mutual trust and transparency, this reduces.frictions between teams.

- Establish Regular Evaluation and Optimisation: Continuously monitor the effectiveness of your spend management processes and make adjustments as needed to maximise productivity and employee satisfaction.

By embracing a progressive approach to spend management and equipping employees with the tools and autonomy they need, CFOs can unlock significant productivity gains and build a more sustainable and prosperous future for their businesses.

As Monica Proothi, IBM Consulting’s Global Finance Transformation Leader, said on our March episode of The CFO Playbook, “The office of the CFO is really the decision-making arm. So it is setting that goal to enhance the speed and quality of decision making with real-time insights, with reusable and scalable assets and methods.” I couldn’t agree more.