This interview is part of prepaid cards for business provider Soldo’s Digital Disruptors series, which highlights the individuals changing the world with technology.

An interview with Will Farnell.

In 2001, Will joined the Office of Government Commerce as Head of Accounts – but since then life has looked up. He founded Farnell Clarke in 2007, and the business has been at the forefront of digital technology in accounting ever since. In 2016, the firm won no less than three awards at the British Accountancy Awards, including the award for Most Innovative Firm. He is the author of “The Digital Firm”, based on his experiences of building a cloud-based business, and speaks worldwide on digital transformation.

You talk about the Digital Practice. What does that actually mean?

I think most people would accept that ‘Digital’ has affected their lives, so we need to understand its effect on the business of accountancy, and that calls for a bit of a history lesson.

It’s an evolution that tracks the development of my firm, and goes back to 2007-9 and the emergence of what we referred to at the time as “online accountants”. By the end of 2009, we were what people would today refer to as a 100% Cloud practice.

But that digitisation came with three strategies, which different players have used in different ways:

There are practices which have used technology to develop a cost-leadership strategy: using technology to remove offices and face-to-face contact, drive out costs and compete on price

There’s a tech-first approach, best exemplified by Crunch, where a practice invests heavily in its own bespoke technologies to scale up delivery and reach more clients with a mixed tech/people offer

And there is what we did, leveraging technology where it meets the needs of the client experience and client services perspective. I hadn’t run an accountancy practice before, so I set the firm up on the basis of what I would want. The client services focus was key, and we use technology today to create better client experiences.

By 2011, the idea of cloud accounting had taken hold. Accounting and compliance technologies had started to come of age (witness, for example, Xero’s headway in the UK market), and the broader financial ecosystem was developing; with companies like GoCardless making automation and auditing much simpler across different types of transaction.

I hadn’t run an accountancy practice before, so I set the firm up on the basis of what I would want. The client services focus was key, and we use technology today to create better client experiences.

On a single ledger, everyone on an accounting team could have access to the same data from multiple clients, all with automation to minimise effort. That’s changed the accounting business model forever. Suddenly there was predictability, so innovative ideas like fixed fee services and menu-based pricing became workable options.

Time could be spent on high-value advisory services, or practices could extend into other business services.

That brings us to 2017 and the current phase of the Digital Practice. Leading practices have embedded technology, they’re operating in an optimised way, and they’re delivering efficiency to their clients. The question, then, is: what next?

That’s where we start to recognise that compliance activities will always be under cost pressure; and look at other things we can do to supplement our compliance income and develop deeper, richer and more profitable relationships with clients.

Few firms will have been on that journey since 2007. What is the Digital Practice today?

So, if you’re catching up, digitisation should make firms think about a number of things: the services they deliver, how they brand and market their offerings. It’s part of what’s going on more broadly in the marketplace outside of accountancy as well: technology is driving new consumer behaviours across society. Particular value is associated with speed, personalised advice, 24/7 access, visualisation and automation.

Alongside that is the idea that the younger generation is causing an increase in expectations both as clients and as staff who might want to work in an accountancy firm.

But technology is just the enabler. My definition of a digital firm is, therefore, a firm that utilizes a mix of digital technology and digitally aware staff to deliver a first-class service efficiently and effectively with maximum levels of automation. We shouldn’t focus on anything that doesn’t enhance the client experience.

I can hear traditionalists tearing their hair out, saying “You’re right about the price pressure on compliance activities, but we’ve always made our money on upselling our consultancy experience. And everything in the soul of technology suggests remoteness and never seeing the clients!”

That’s a mistake. It’s not about avoiding seeing clients. It’s actually about using technology to rebuild relationships. 25 years ago, accountants were like bank managers: they had relationships with clients that meant they got invited to birthdays, weddings and funerals.

But that changed because compliance got complicated. With Self Assessment, RTI, auto-enrolment, GDPR and now MTD, our focus shifted from having really great relationships to simply keeping our clients out of jail. And we made good money by doing it. The best thing about the accountancy industry is also the worst thing: gross recurring fees. Because our clients pay us money every single year, the bar has historically been low: if you didn’t screw up, you kept your clients.

Today, technology is giving us the time back to reinvest in those relationships. We can go to those birthdays, weddings and funerals; but we can also have the conversations with clients that will help us to understand what they want to achieve in their businesses and what keeps them awake at night.

In my view, to build those relationships, we have to own the end-to-end process. In our firm, we do daily bookkeeping for around 60% of our clients. We spent four minutes per day, per client, doing their bookkeeping. And that means we get to have a conversation with 60% of our clients every single week. We’re building those relationships every single day. And when my team understand how to listen and how to ask the right kind of questions, then we’re in a really great place to deliver value-added services to our clients, because we understand their challenges.

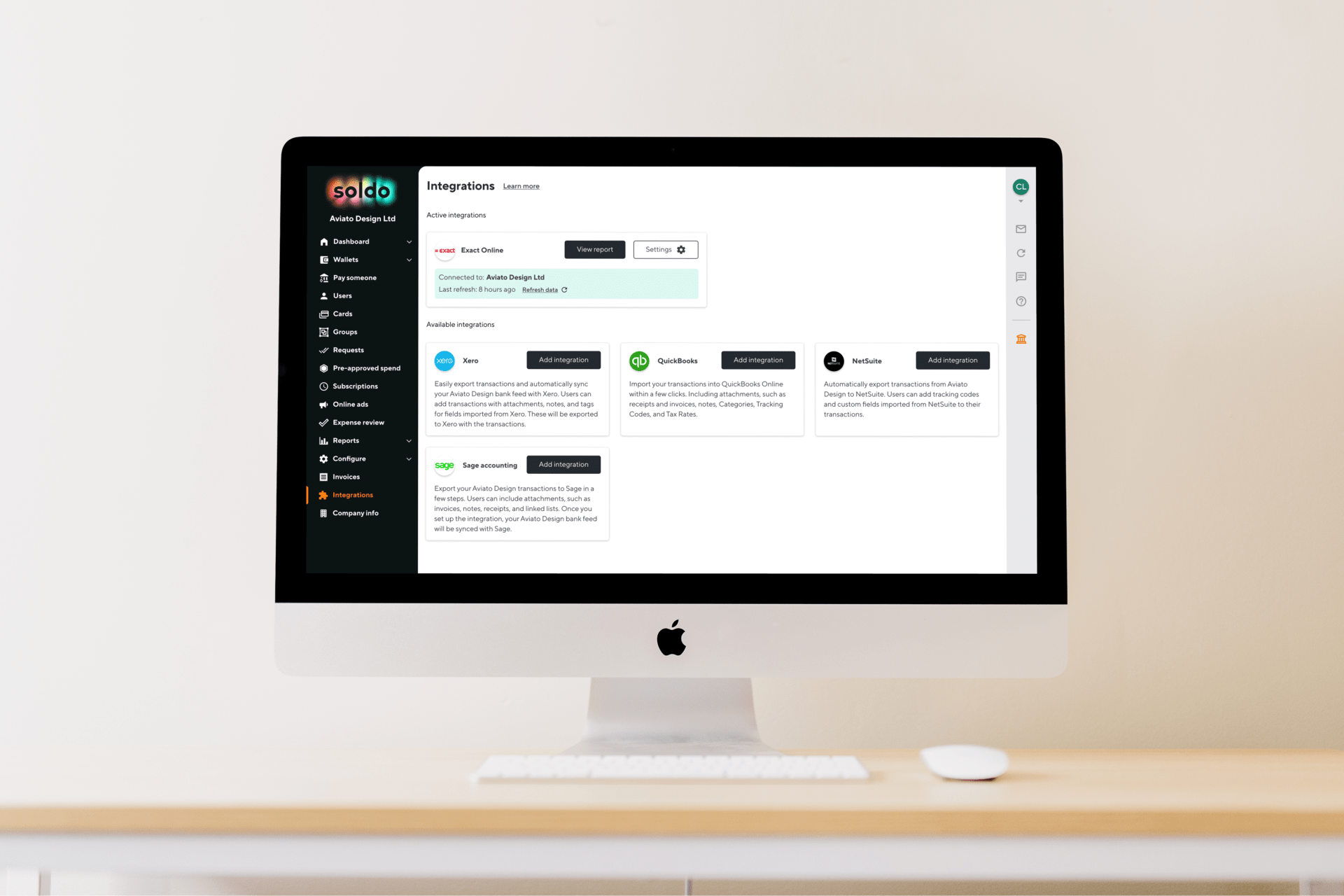

OK, so what is the technology stack for that end-to-end relationship? I’ve had a look at your website and you’ve got some complex integrations all connected up…

It is complex, and some accountants may want to buy in that expertise as they need it; but in layman’s terms, any firm has to handle three elements: input, process and output.

So if you’re doing the bookkeeping:

You’ve got to have the tools to collect data

Then process it in Xero, QuickBooks, Free Agent or whatever product you’re using as the processing engine

And then you’ve got to have something that creates the output. Yes, that’s your end-of-year compliance assets, but that can also mean dashboard reporting tools that will deliver new value to clients.

We’re building those relationships every single day. And when my team understand how to listen and how to ask the right kind of questions, then we’re in a really great place to deliver value-added services to our clients, because we understand their challenges.

But after that, there’s a raft of extension technologies we deploy to help clients get paid quicker or solve problems. So we use GoCardless for collecting direct debits, Stripe for collecting Card Payments, Chaser to improve Collections and of course Soldo for expenses which again increases the live data within our reach. And then beyond that, we’ve got products that manage HR, workflow, job management, time-sheeting and more – all of which allows us to become a digital solution provider and trusted advisor to the client. And instead of speaking to them once a year, we’re becoming a day-to-day part of their business and the management reporting that supports it.

So what does the future hold? Where is technology taking the accountancy practice?

There is ample potential for us to be proactive in flagging up useful information surfaced by the software. We’ll be able to point to defaulters or lengthening payment schedules or currency fluctuations. That’s the next stage of how we start to use the data.

We’ve spent a lot of time building a slick process that means we can turn client accounts round within four months of year-end, rather than nine, for example. Now we’ve done that, our team has the time to start looking at the data that we’ve always had but never really had the time to analyse.

Interestingly, technology innovation has plateaued slightly. We’re waiting for the next wave – mainstream AI and machine learning – which is not yet fully mature, and firms should use this period to maximise what they do with the tech they’ve already got.

MTD particularly is driving adoption, but too many firms are not changing their processes and workflows. They’re just replicating what they’ve always done on technology that is capable of far more. There’s a window of perhaps 18-24 months to get up to speed before the next wave of AI hits.

The technology is going to continue to improve and remove manual compliance work. So, as a profession. we fundamentally must look at how we go about building opportunities for other work. And that has to be done through building great relationships. Paradoxically, the successful digital firm will be a very human firm indeed.