slide 8 to 10 of 6

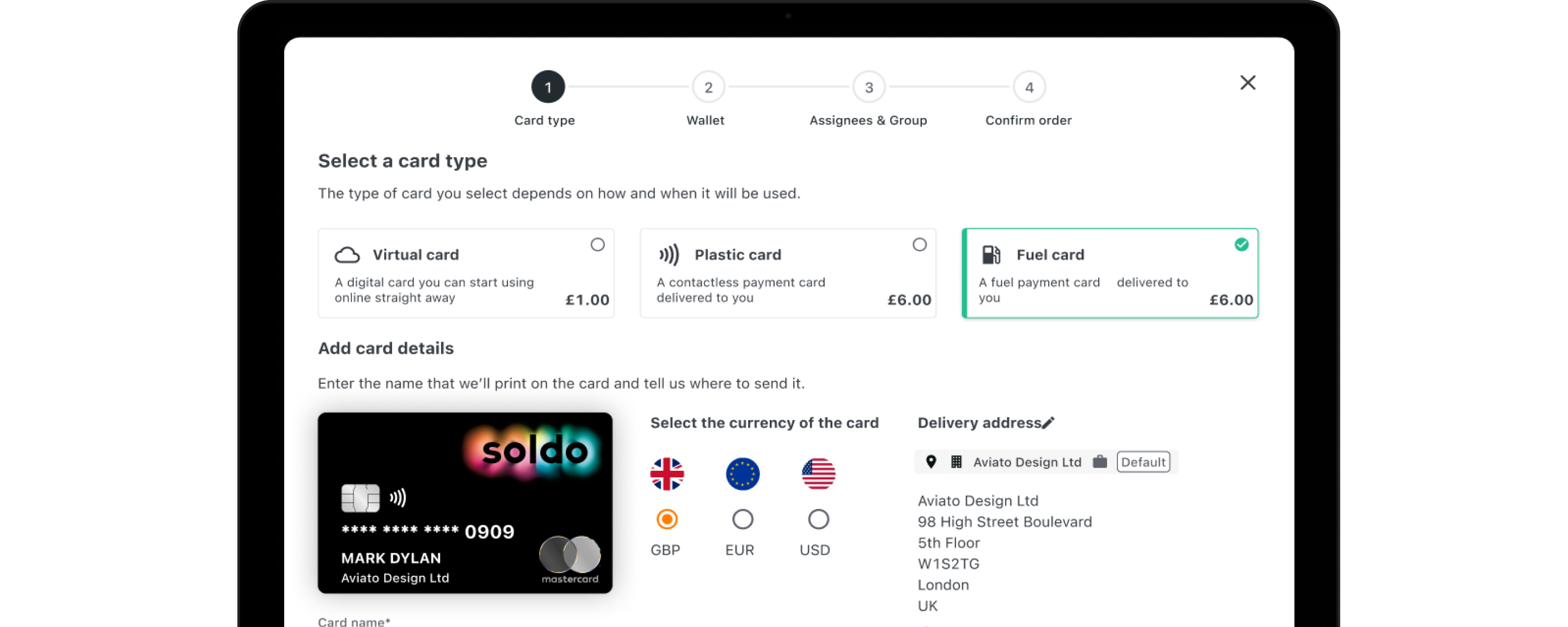

Soldo • 10 Nov 2022

Modern Expense Management For Diverse Fleets

Recent fuel cost increases, concerns about environmental impact, and digitisation of business processes mean that companies need new and better...

Soldo • 2 Mar 2021

What to consider when choosing a fuel card for your business

There’s a lot to think about when choosing a fuel card for your business. Whether you run a large fleet,...

Soldo • 16 Jun 2025

A comprehensive guide to fleet card management

Fuel cards are supposed to make life easier, but they can come with complications. To find out how you can...

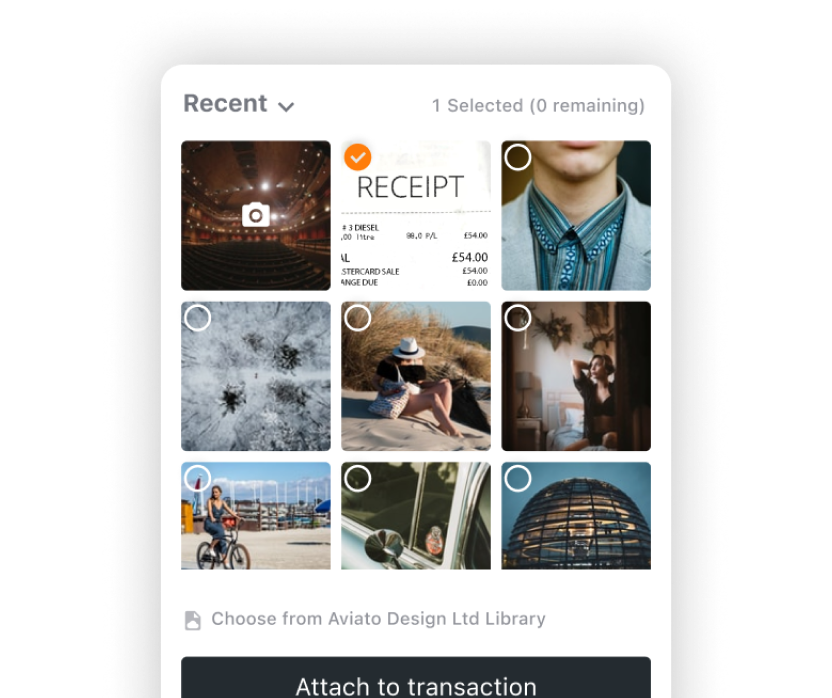

Soldo • 5 Oct 2021

How to get the most out of your mileage allowance

You might already know about approved mileage allowance payments, but if you’re owed some more, how do you get it?...

Soldo • 16 Nov 2021

Mileage calculation made easy

If you use a personal vehicle for work then you may be familiar with how crucial mileage calculation is. Read...

Soldo • 22 Mar 2022

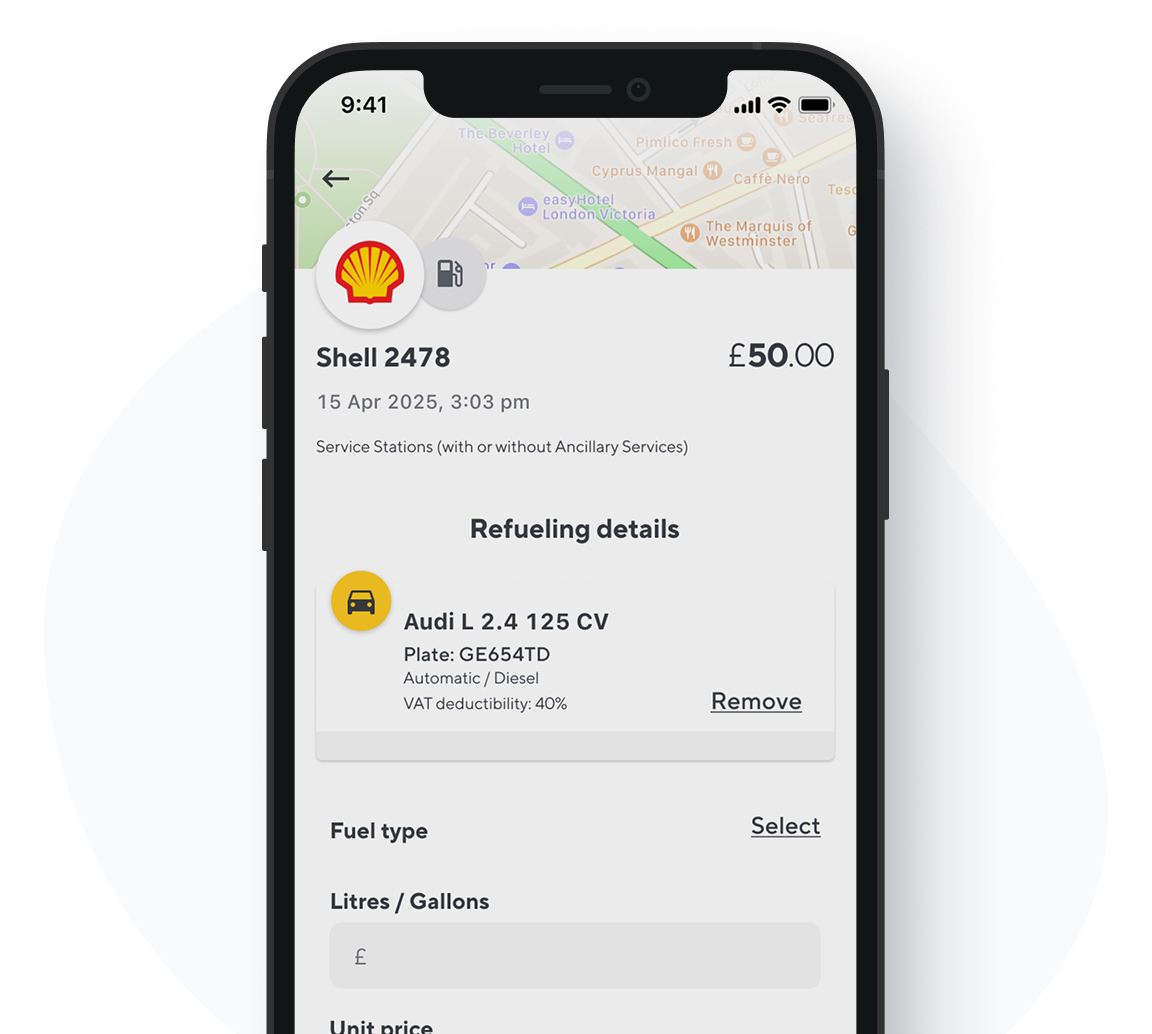

What petrol stations are near me? Discover what brands are in your area

A guide to petrol station distribution in the UK and how you can streamline your business’ fuel spend by giving...

Soldo • 10 Nov 2022

Modern Expense Management For Diverse Fleets

Recent fuel cost increases, concerns about environmental impact, and digitisation of business processes mean that companies need new and better...

Soldo • 2 Mar 2021

What to consider when choosing a fuel card for your business

There’s a lot to think about when choosing a fuel card for your business. Whether you run a large fleet,...

Soldo • 16 Jun 2025

A comprehensive guide to fleet card management

Fuel cards are supposed to make life easier, but they can come with complications. To find out how you can...

Soldo • 5 Oct 2021

How to get the most out of your mileage allowance

You might already know about approved mileage allowance payments, but if you’re owed some more, how do you get it?...

Soldo • 16 Nov 2021

Mileage calculation made easy

If you use a personal vehicle for work then you may be familiar with how crucial mileage calculation is. Read...

Soldo • 22 Mar 2022

What petrol stations are near me? Discover what brands are in your area

A guide to petrol station distribution in the UK and how you can streamline your business’ fuel spend by giving...

Soldo • 10 Nov 2022

Modern Expense Management For Diverse Fleets

Recent fuel cost increases, concerns about environmental impact, and digitisation of business processes mean that companies need new and better...

Soldo • 2 Mar 2021

What to consider when choosing a fuel card for your business

There’s a lot to think about when choosing a fuel card for your business. Whether you run a large fleet,...

Soldo • 16 Jun 2025

A comprehensive guide to fleet card management

Fuel cards are supposed to make life easier, but they can come with complications. To find out how you can...

Soldo • 5 Oct 2021

How to get the most out of your mileage allowance

You might already know about approved mileage allowance payments, but if you’re owed some more, how do you get it?...

Soldo • 16 Nov 2021

Mileage calculation made easy

If you use a personal vehicle for work then you may be familiar with how crucial mileage calculation is. Read...

Soldo • 22 Mar 2022

What petrol stations are near me? Discover what brands are in your area

A guide to petrol station distribution in the UK and how you can streamline your business’ fuel spend by giving...

Soldo • 10 Nov 2022

Modern Expense Management For Diverse Fleets

Recent fuel cost increases, concerns about environmental impact, and digitisation of business processes mean that companies need new and better...

Soldo • 2 Mar 2021

What to consider when choosing a fuel card for your business

There’s a lot to think about when choosing a fuel card for your business. Whether you run a large fleet,...