Everything you need to know about subsistence allowance and how Soldo can simplify your expense management

Tricky travel expenses

Employees can come across all sorts of expenses when they’re out on the road on business travel. From meals out to congestion charges, hotel rooms to laundry, the list of possible purchases is long. But which of these purchases can you get tax relief on? Do they qualify for subsistence allowance? And even more fundamental than that, what is this allowance and what are the rules surrounding it?

Read on for a run-down of everything you need to know about a subsistence allowance, as well as other relevant charges that could affect your business.

What is a subsistence allowance?

Also known as a meal allowance or per diem, a subsistence allowance is a certain amount of cash that an employee is given to pay for business-related expenses. As the word ‘subsist’ suggests, these charges usually apply to the products or services an employee needs to pay for during their daily life during the performance of their duties while they’re away from the office.

For example, an employee may be travelling away from their permanent workplace and need to buy food, pay for overnight accommodation, or entertain a client. These charges can be taken out of a subsistence allowance. This is well worth knowing, because if these transactions are designated as a business expense, you can get tax relief on them, thus saving your business money.

Other expense types require you to deduct and pay tax and national insurance on them. Any amount paid to an employee that exceeds the amount they paid for their expense must be taxed. The key point to remember is that a meal allowance only applies to costs incurred during the course of business. It absolutely cannot be applied to any personal uses.

For example, if an employee has to stay overnight in a hotel as part of their work, then whatever meals they purchase during this time comes under their meal allowance. However, if an employee has to travel away from their permanent workplace but return home for the night and have a meal out with their family, those expenses cannot fall under a subsistence allowance. That example may seem simple, but the line between business and personal can often blur, and it’s good to ensure you and your employees are on the same page as to which category an expense falls into.

Permanent vs temporary workplaces

Let’s highlight another important distinction related to subsistence allowance. This allowance is only valid on business journeys, and HMRC clarifies what does and doesn’t count as a business journey. For example, your trip from home to your permanent workplace is known as ‘ordinary commuting’ and does not count.

A business journey must require the employee to travel away from their permanent workplace, to what’s unsurprisingly known as a temporary workplace. For a workplace to count as temporary, an individual must work there for fewer than 24 months, and carry out less than 40% of their workload there.

If a trip fulfils this criteria, it counts as a business journey and subsistence allowance will be valid while they’re travelling to this location.

How to handle HMRC

Claiming tax relief on a subsistence allowance does come with a number of guidelines. HMRC publishes rules on allowable expenses and the conditions which must be met in order to do so.

Scale rate payments

One way of managing subsistence costs is to use a scale rate payment. These are fixed rates that apply to certain scenarios. For example, HMRC will offer benchmark rates for employees who need to pay for two meals during the course of a business day. This amount can be allocated to the employee without the need to tax it.

However, you must have a system in place to ensure that employees are only getting reimbursed these amounts when they have in fact incurred an expense. On top of this, HMRC do update their scale rates, so make sure you check your payments are up to date.

Alternatively, you can agree a bespoke scale rate payment with HMRC that’s specific to your business. This is a good way of establishing an increased scale rate, giving your employees greater freedom.

Mileage allowance

One type of travel expense that’s related to subsistence allowance is the Approved Mileage Allowance Payments (or AMAPs). Much like a meal allowance, this is a business charge that is exempt from taxation. It refers to the compensation an employee can receive for expenses incurred when using a private vehicle for business purposes. It must be stressed that these rates do not apply to company cars, and HMRC handle expenses for company cars in a different way.

These flat rates vary depending on vehicle type, and the current benchmarks are 45p per mile for the first 10,000 miles for vans and cars, and 25p per mile for any miles thereafter. For motorbikes, there is a single rate which is 24p, and for cyclists that figure is 20p. For further information and advice about AMAPs, read our mileage allowance guide here.

Fuel expenses

Another charge that travelling employees will inevitably be faced with is fuel costs. Although fuel is covered under AMAPs and you can’t claim tax relief on it separately, many businesses use fuel cards to manage the cost. These cards can be an effective way of tracking fuel-spend, especially if you have a large fleet.

One downside of fuel cards, however, is that many service providers’ cards can only be used at specific sites, so your drivers could waste time searching for particular stations. Thankfully, with a Soldo fuel card, you’re granted maximum flexibility.

Streamline with Soldo

Although we’ve touched on the legalities of subsistence allowance here, there is a wealth of guidance that it’s worth getting your head around so you know exactly where your business stands. This HMRC Employment Income Manual covers commuting, consuming, and everything in between, and it should tell you all you need to know about subsistence allowance.

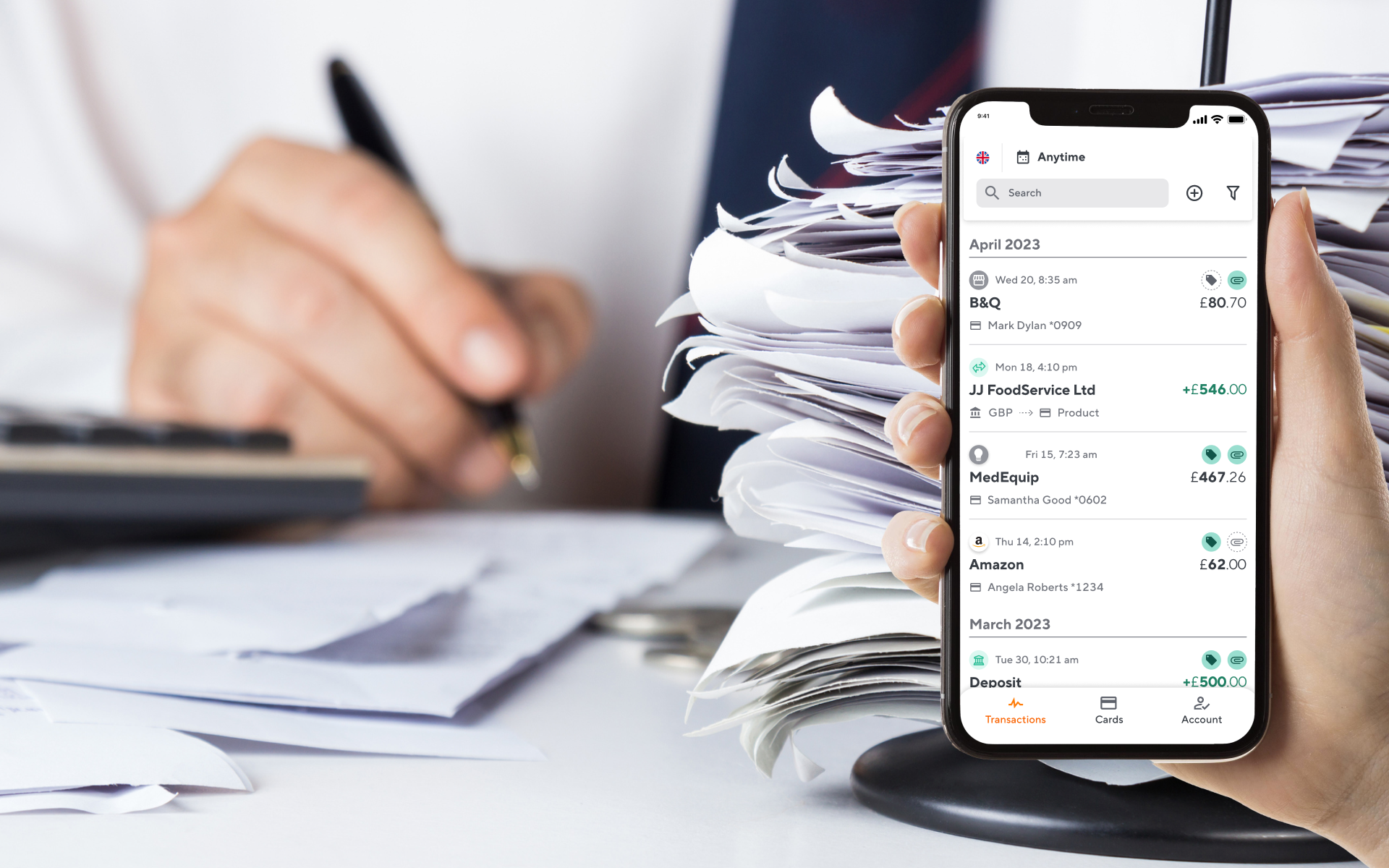

We may not be able to cover every aspect of tax law in one article, but what we can do is make your expense management process extremely simple. Soldo is a smart prepaid system that allows you to assign as many payment cards as you like to your employees.

These cards can be physical or virtual, and most importantly, they are completely customisable. You decide how much cash is on each card, how it can be spent, and when to turn a card on or off.

Every company must declare their business-category when they get started, so you can filter card payments through these categories, allowing employees to only spend on food and accommodation, for example.

This way, employees are empowered to make spend decisions and you always know how much is being spent and what it’s being spent on.

And with Soldo’s automated expense tracking, you can see every transaction as it happens in our console for mobile or desktop. Employees simply snap a photo of their receipt, add any necessary notes, and all the spend data from the purchase is stored in one place.

This makes it easier than ever to track your business finances and to analyse what changes can be made across your business to streamline spending even further.