The uncertainty of the UK economy has led to the pound’s value decreasing significantly against major currencies. In general, FX rates have been volatile.

Shortly after the announcement of the UK’s Growth Plan (also referred to as the mini-budget), the value of the pound to the dollar decreased from around 1.17 to 1.08 so that sterling had almost reached parity with the US currency – a 37-year low.

While the pound has made back some of these gains, off the back of Government u-turns, there is likely further FX rates volatility ahead. This will likely continue, as the markets remain unsure of the future direction of the UK economy.

Drops in the value of sterling create both opportunities and threats for UK-based businesses. Companies exporting overseas will likely see a greater demand for goods and services sold in their local currency. This is due to customers seeing these businesses as comparatively cheap.

However, if you have overseas suppliers, you risk paying more due to the deteriorating currency. This will eat into your margins and make it harder to predict future cash flows.

Follow our tips below to put a strategy in place to best manage unpredictable FX rates.

Forward contracts to manage FX rates

Buying forward contracts will give certainty to your rate of exchange by locking it in at a specified date in the future. This will protect you from adverse FX market movements. For example, this can be an agreement to purchase $200,000 at an agreed exchange rate today, accessible six months from now.

The exchange rate of forward contracts tends to be at a premium to today’s rates as the contract seller takes on the risk of worsening currency movements. Premiums are likely to be more significant the further into the future you are buying contacts.

Once you receive foreign currency from contracts, you can settle invoices in overseas currencies.

The certainty of forward contracts will support forecasts as you will know exactly how much overseas payment of supplies will cost you in sterling.

Forward contracts are purchased from financial institutions. But you should also review options from brokers as these may be more cost-efficient. Some providers offer added flexibility, allowing you to draw down a portion of funds if currency is needed early.

Consider different FX options

Foreign currency options require you to pay a fixed upfront cost, which gives you the right to buy currency at a set exchange rate in the future. The price paid varies based on several factors. Like what currency you take the option in (as well as the value of the transaction).

There is no obligation to exercise options. But you cannot reclaim the purchase fees if they are not used.

If you are uncertain of whether you will have an overseas currency value to settle in the future, options may be preferable to use over forward contracts. For example, there may be the possibility of expected costs for a project yet to take place that isn’t one hundred percent confirmed.

Alternatively, you may take out a foreign currency option as a hedge if you believe exchange rates will move more favourably in the future.

Open bank accounts in overseas currencies

If you make sales internationally, you should consider opening bank accounts in the currencies of overseas customers.

With this method, aim to match payments made in foreign currencies with foreign currency inflows received at the same time. This minimizes the administrative burden and cost of forward contracts and foreign currency options. It also reduces overall currency risk.

To make this worthwhile, you’ll need to generate enough overseas business with each currency type to open accounts.

Use expense management platforms for employee expenses

General employees in the business, outside of finance, are less likely to care about receiving the most competitive exchange rates or lowest fees when generating and claiming back business expenditures via their own personal bank cards. These cards tend to add around 3% of the value of the transaction on top of the conversion.

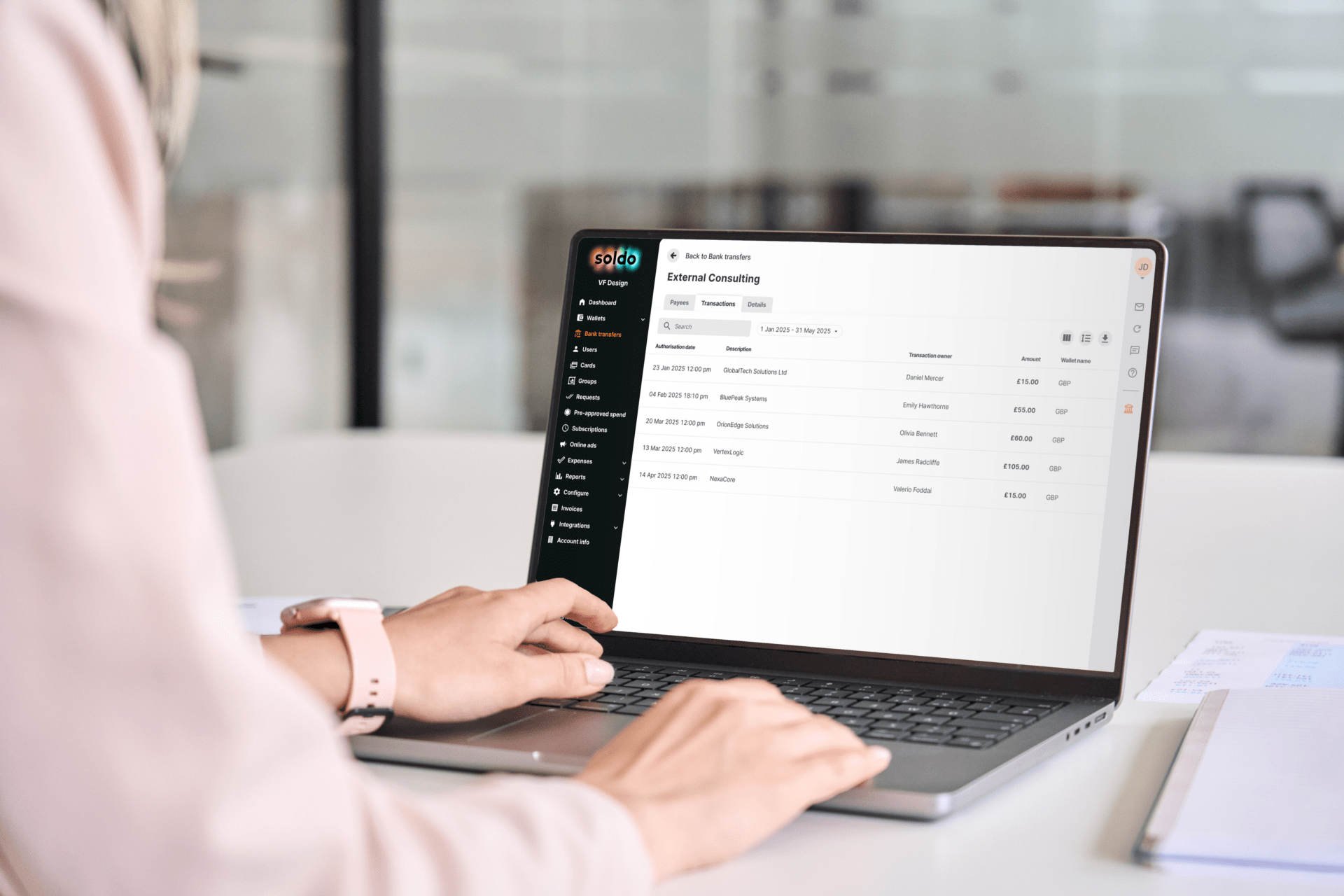

To minimise overpaying for overseas currencies, you should introduce an expense management solution and equip staff with prepaid cards. Platforms like Soldo allow you to issue cards in several currencies, including Euros and US Dollars. Exchange rates on cards are competitive, with added fees on overseas transactions being as low as 1%.

Incremental FX savings add up

On a day to day basis, savings made from applying an FX strategy may seem marginal. But in certain circumstances, they can add up over time to be significant.

Your FX strategy will differ based on the relative values of purchases and sales from and to overseas. So you should never stop tinkering. Revisit and iterate your approach. It’s unlikely that the volatility will stop (at least in the near term).