Tracking project-based spending can feel like chasing shadows.

Freelancer invoices from dispersed departments. Ad hoc software subscriptions. Last-minute vendor wages.

Your business works better when its brightest minds work together to forge new paths forward. But how can creating a project budget help you maintain financial control without holding your team back from doing their most innovative work?

Controlling how, what, and where team members spend company funds is the surest way to bypass any chance of costly budget overruns or unplanned cashflow issues.

It also helps you get a clearer understanding of your business’s overall financial health. When your finance team has oversight over budget allocation and ROI, it becomes easier to keep every penny in line with your business’s most strategic goals.

In this blog, we’ll cover common reasons why budget management gets out of control and how financial management software helps people like you streamline oversight, reduce waste, and make smarter decisions.

Read more to learn how to control project-based spending.

5 reasons managing project-based spending adds to financial chaos

Your project expense policy isn’t in place

Maybe you’re a startup that’s sees formal spending policies as red tape (and the wrong ones can certainly hinder progress). Or maybe your team lacks the time or resources to put create a cross-departmental framework in place. Or maybe rapid growth made your small-team spending policy completely obsolete.

But an absent project-based spending policy can make overspending inevitable. Without a clear spending policy, spending limits and approvals become unnecessarily ambiguous.

Team members don’t know where the guardrails are. And Finance is forced to play catch up at the very end of a project lifecycle when it’s too late to course correct.

A clear project-based policy can be as simple as creating a shared document that clarifies:

- Why the policies exist

- Which payment platforms are approved

- How vendor selection works

- What per diem limits or contract thresholds apply

By outlining these details, team members know how to spend responsibly while supporting the company’s growth and goals.

Your approval workflows are undefined

Do your project leads and budget holders make decisions without the oversight of Finance? Do team members revert to “shadow spending,” using personal or team credit cards before your finance team can review or approve the spend? Do you find yourself justifying out-of-policy project expenses retroactively because the funds have already been spent?

Having a structured pre-approval workflow can help you stay in charge.

Start by:

- Using one centralised method to track the entire project lifecycle

- Capturing details like owner, purpose, estimated costs, and requested vendors

- Outlining what projected costs may be

- Including budget owners and teams leads into new budget requests.

These simple steps can help your finance team find problems before they turn into costs. They can also ensure policy compliance and help you get a better handle over your budgeting process without slowing anyone down.

Your spend limits are too restrictive or too flexible

Restrictive spend limits make it impractical for teams to act decisively. They won’t jump on new opportunities quickly because the company’s policy is unrealistically low. Or they might delay important purchases, causing a delay to submitting projects on time.

Overly flexible spend limits put your bottom line at risk. It’s not just a lack of visibility over where company spend goes. It’s a lack of control and structure that leads to better financial decisions. Ultimately, too much flexibility, forces your finance team to troubleshoot when there’s not much left to save.

To set spend limits that fit your business, ask the following questions:

- How do project lifecycles intersect with our current approvals process?

- How do smaller expenses impact overall project expenses?

- What are some common exceptions that require more urgent action?

- How do we accommodate for quick turnarounds when we have little-to-no notice?

With the perfect balance between control and agility, your finance team works in harmony with the rest of the business – allowing it to move fast, without losing financial oversight.

Your payment handling process is outdated

When teams aren’t aware of how much they’re spending, they end up spending more than they have in their budget.

Finance teams struggle too. Allocating resources becomes much harder when you’re not aware of how company funds are being used in real time. Without up-to-date oversight into project-spending, budget tracking becomes reactive instead of proactive – making it harder to spot risks before they escalate.

Excel-based tracking, email approvals, and other manual methods of tracking business-wide spending aren’t up to the task because they lack real-time visibility.

Financial management becomes a lot easier with the right tech. If you’re looking for management software, look for these features:

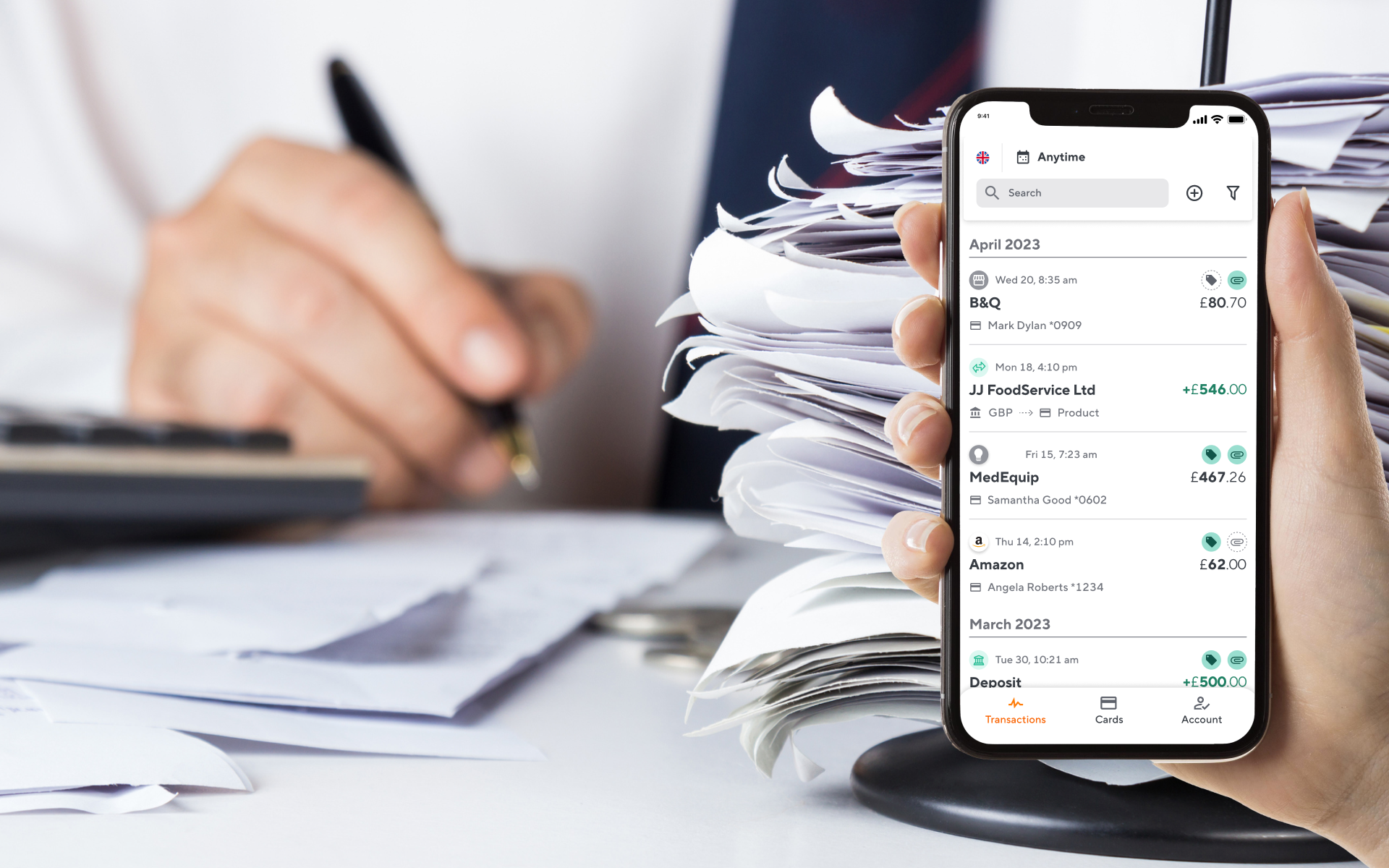

- On-the-go expense capture that allows team members to snap and upload receipts right after they make a purchase.

- Real-time spend tracking that allows budget holders to see how much they can spend, and where.

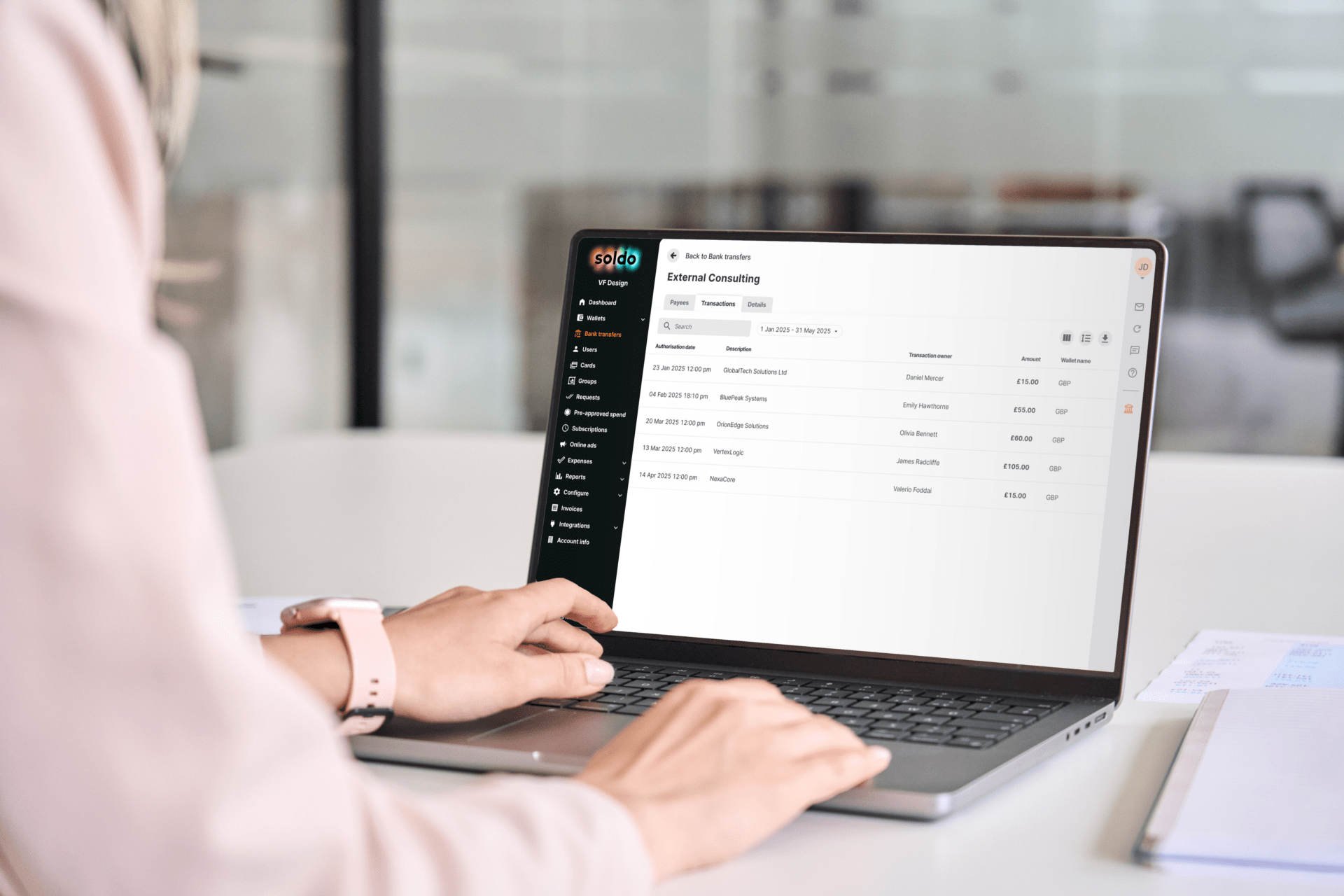

- A management platform that simplifies allocating resources to specific projects with pots or wallets

- Non-nominative cards that track costs by project, not just department or individual

- Automated policy enforcement that reduces the chances of errors or unauthorised spending in your budget management process.

Modernising how your team leads submit receipts can immediately save time, reduce errors, and improve compliance, all while streamlining your finance team’s workflow.

Your post-spend process is tracked at too high a level

When you review business wide spending after a project lifecycle ends, are you left with more questions than answers?

You might feel this way if teams spend within budget, but you aren’t able to link spend to project results or ROI. Context offers clarity. But if invoices, receipts, and transaction records are mismatched or missing entirely, the insight from your audit and close process become unusable.

If you’re looking for granularity into team spending, look for budget management software that offers:

- Team-level spend tracking

- Custom tags that categorise expense by client, cost centre, event, or campaign

- Note capture that allows team members to add qualitative context to every transaction

- Policy compliance to precisely narrow down where overspending happens

Modernising how your employees submit receipts can immediately save time, reduce errors, and improve compliance, all while streamlining your finance team’s workflow.

People like you use Soldo to bring control to project-based spending

Costs are unpredictable and variable. Innovation comes with risk. Speed increases scrutiny.

But you don’t have to accept the unpredictability of team spending without a contingency plan.

Finance can get the real-time visibility and flexible controls they need with the right management software and processes in place.

Because untracked project-based spending doesn’t just affect your balance sheet. It undermines decision-making, performance, and trust across the business. The longer it goes unchecked, the harder it becomes to fix.

You can set the foundations for controlled spending with prepaid budgets, real-time tracking, and smart policy enforcement. That way, even when project spending shifts or surprises emerge, you’re prepared, agile, and still in control.

People like you use solutions like Soldo to bring order to project-based spending. Using our advanced card controls, mobile app for on-the-go expense capture, and management platform, they are helping every team within their business collaborate more effectively.

There’s more to managing operational spend than just tracking project costs.

Learn how 25,000 businesses are using Soldo to streamline financial operations and drive smarter, faster decision-making.