Contractors claiming expenses can take up an awful lot of precious human resource time – time you’re no doubt paying for.

Increasing numbers of companies are relying on contractors and temporary staff, whether for ad hoc projects, to fill in for busy periods, or to add a level of expertise that doesn’t warrant hiring a full time equivalent staff member.

The good thing about hiring contractors is that cash flow can be easier to manage, and there does tend to be a little bit less paperwork.

Apart from one area.

Contractors claiming expenses – the risky area

When it comes to reconciling the process of contractors claiming expenses, all of your human resources’ time-saving can be undone.

The problem is that it’s just not safe to give contractors or temporary staff a company credit card. These are people you may only have met once – often not at all – before they start work. As they’re not being hired full time, you won’t have done the due diligence on them.

Cash slows everybody down

And, at the same time, petty cash or cash advances are an enormous hassle from everyone’s perspective. You have to send someone to the bank, withdraw the cash, and there may be forms to fill in for everyone involved. And then what happens after the cash has been handed over to the contractor? Coins and notes are impossible to track – it’s not like you can plant a GPS chip in every bank note!

It takes time to build up trust

Problems with company credit cards and cash alike are common to permanent staff as well as contractors. But the difference with permanent staff is that you know them well, and you know whether you can trust them. The other thing is that permanent staff know you, and they know that they can trust you. Permanent staff will frequently agree to pay for their own expenses upfront (which causes everyone a lot of work at the end of the month, but that’s another story). Contractors may be less willing to do so, and it can be harder to ask this of them, since you may not have built up such a solid relationship (yet) and they have their own contracts.

Trust is a huge part of the equation when it comes to contractors’ expenses.

In a way, you can never get rid of the issue of trust, and this is why most companies have exhaustive expense procedures. This means that contractors claiming expenses can take up a considerable amount of everyone’s time – as well as slow down the project or the work, if the contractor involved isn’t able to pay upfront, and you need to forward cash to them.

Luckily, however, there is another way to handle contractors expenses.

Soldo Business features multiple smart Mastercard cards linked to a smart account, with easy controls and effortless reports. You finally have a safe way to give company cards to your temporary staff and contractors.

Soldo Business Mastercard cards are different from other corporate credit or debit cards, because you retain control over everyone’s spending in real time, all the time.

You’ll control everything from an easy-to-use admin dashboard, seeing at a glance who is spending what, on what, where, and even why.

Stay in control from the comfort of your desk

The best part is – and here is where trust is taken out of the equation – you can set bespoke limits, budgets and spending rules to fit each user to perfection.

For example, if you have a contractor working on your company’s website, and you know that they will need to spend about £500 a month on resources to keep the project moving along for the next 4 months, you can set those parameters as rules on their card.

You may want to add another layer to the limits. If you know that none of their expense purchases should cost more than £200, you can say that they’re not allowed to spend more than that in any one transaction.

What’s more, you can even block cash withdrawals if you know they won’t need cash.

And, while you’re at it, why not block overseas transactions as well, if you know they won’t need to purchases goods or services from international suppliers.

Money makes the business go round

The results of having Soldo Business mean that your contractor is able to carry out their work smoothly, without having to bother you for cash, or a card every time they need to buy something.

Even if they do need to spend something over the budget, just do an instant money transfer via Soldo Business – it’s free of charge between users.

You know that they have enough to buy whatever’s needed for the project, so you can relax too.

Say goodbye to expense reports

The best part is that neither side of the business arrangement will have to waste anymore pointless hours on the tedium of contractors claiming expenses.

At the end of the month, Soldo Business generates accurate and richly-detailed expense reports in only a couple of clicks.

Soldo Business’ expense reports are compatible with all the major accounts management systems, from Xero to Quickbooks, Expensify and anything else in between.

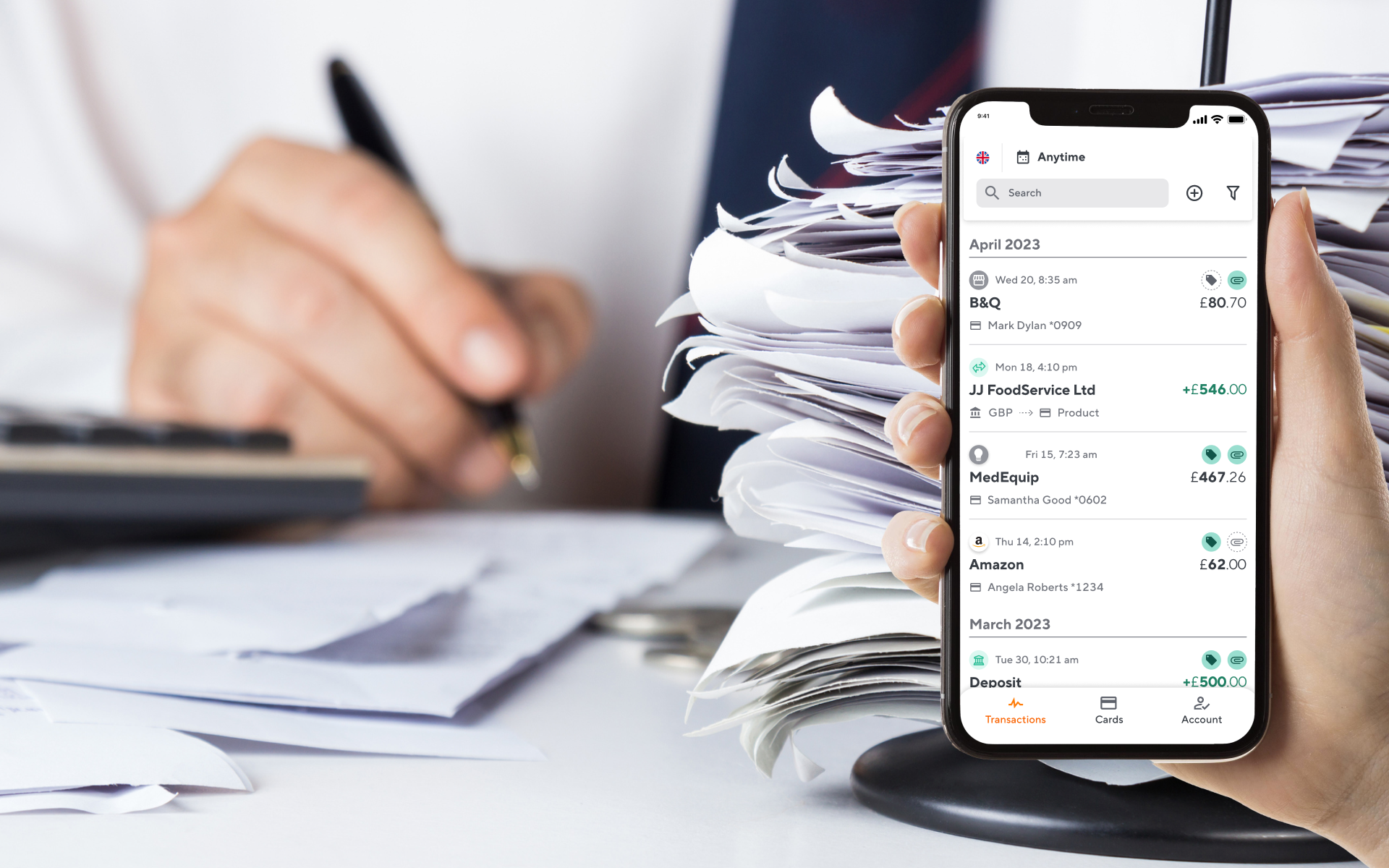

Your contractor can even download the Soldo Business app, which will help them stay on top of their spending.

But the Soldo Business app goes even further than that.

Your contractors contribute effortlessly to the reporting process

The app allows your contractors (and employees) to become active contributors to the expense reporting process, with minimal effort on anyone’s part.

As soon as they make a purchase, they can upload a photo of the receipt and attach it to the transaction using the app.

They can also add other notes, and select categories and tags which are defined by you in advance.

How does it work?

For example, if they spend £37 on stock images, they can add the following information to the transaction in the app:

- A photo of the receipt

- A note saying: “Images purchased for the About Us section of the website”

- Two tags: “Web Project” and “Web Media”

It will take them a matter of seconds.

Then, when you come to generating the report at the end of the month, all the information your contractor has entered will be right next to each transaction.

No more chasing crumpled receipts, or doing detective work about the reason for each mystery transaction.

If contractors claiming expenses have got your goat, click over to Soldo Business to find out how you could save money, time and stress.