When it comes to growing businesses, Darrell Cox has a lifetime of experience. Currently the CFO of Vena Solutions, he has a self-proclaimed specialty in ‘growth-stage businesses’, having worked in scale-ups in the hardware, software, and telecommunications industries.

Companies that are expanding fast consistently need to push limits and maximise opportunities in their markets. This means their CFOs have to ‘make decisions fast, and mistakes quickly’. On account of this, Darrell’s developed an agile planning methodology designed to raise the impact of his finance team.

He joined us on our podcast – The CFO Playbook – and shared four tips to help you implement an agile finance function in your business.

Develop iterative processes

Iterative processes help you get more timely feedback into what’s working and what’s not. This allows you to change direction when a particular strategy isn’t delivering, or to roll out effective processes across your department – or even the wider company.

One way that Darrell’s team at Vena Solutions does this is by running a full budget process every quarter, as opposed to only once a year. This allows them to make minor adjustments regularly, instead of major adjustments once a year.

As Darrell puts it: ‘You don’t want to wait a year to find out that a particular campaign was a bad idea.’

He sees the process of constantly monitoring results and making changes along the way as being vital to the success of a business.

‘The way you’re going to get the best possible product, the best possible outcome for your business in the long run, is by constantly adjusting.’

There’s always something to improve – and you want to be clear on what that is.

Always focus on long-term objectives

This process of constantly monitoring and adapting requires that you keep your long-term plans in sight. This will help you stay on track and achieve the goals you set for your company.

It will also allow you to anticipate any snags or difficulties that might be headed your way.

A great example of how this works at Vena Solutions is how they approach funding rounds:

‘We secure funding well before we need it, so that we’re never in a position where we need something, it’s always wanting.’

Keeping your eye on the longer-term plans while tweaking them, insulates your business against any difficulties that might arise down the road.

If you see the hurdles coming, you can get ready to jump.

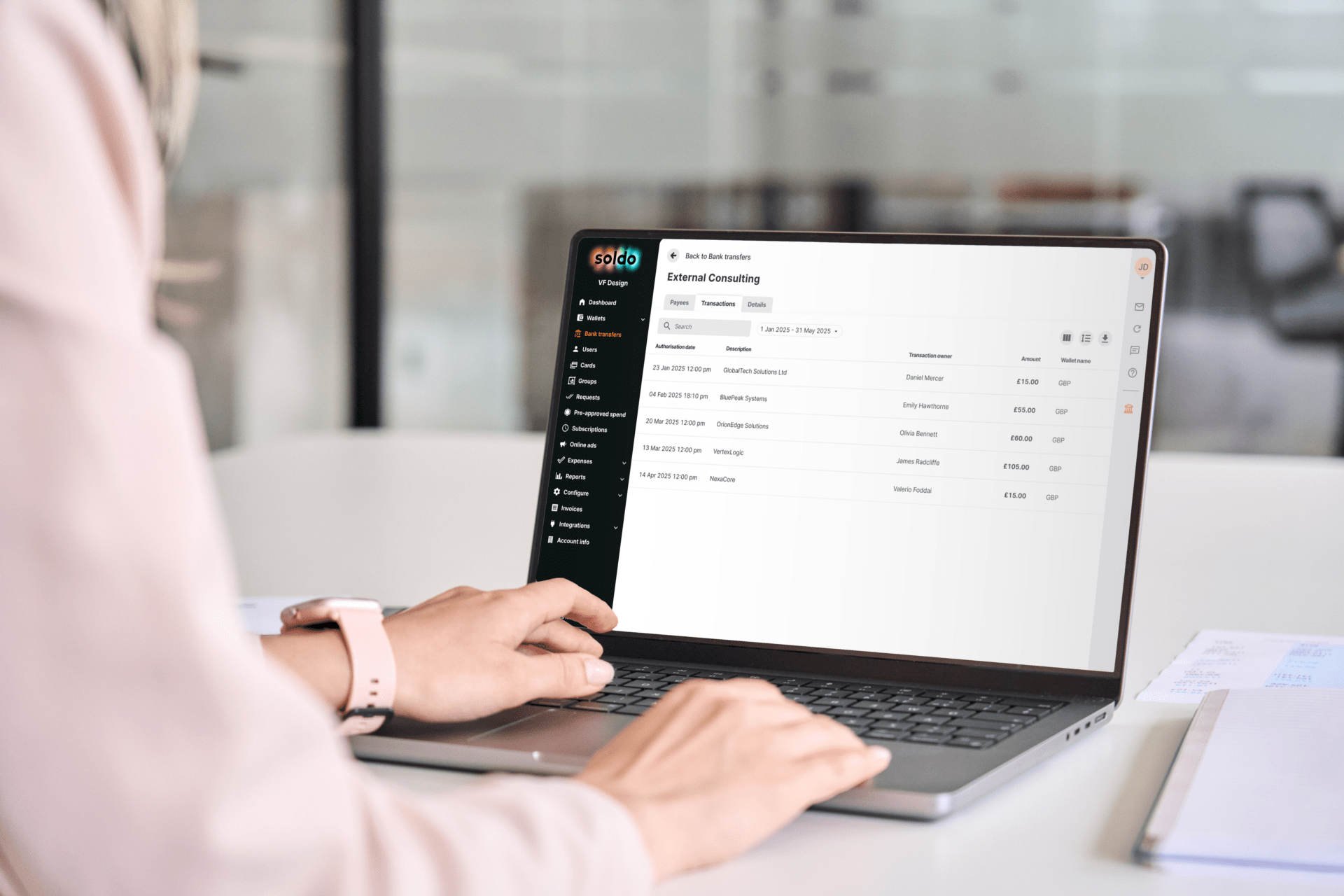

Implement the right technology

There’s more data within easy reach for businesses than ever before. And as you can imagine, business leaders now expect their finance business partners to be the people who interpret all this data.

But without the right tools by your side, you won’t be able to do that.

For Darrell, that toolset needs to include, at a minimum, good general ledger and payroll solutions. And as a CFO at a SaaS company specifically, he also prioritises oversight over the sales funnel – which he accomplishes by combining the power of Salesforce and HubSpot.

Finally, all of that data needs to be put together in one place. How and why does he do this?

‘I need to put all that data into a central database and that database needs to tie directly to my plans, my budget, my reporting. So I can do my reporting cycle. Think of it as a part of the management operating process for the business as a whole.’

At Vena Solutions, they use their own platform – which pulls data from your existing systems into a single database – for this purpose. As with other things in life, you can make more sense of what you know if you have a bird’s eye view of it.

Be human!

As a business advisor, you need to communicate with other stakeholders in the business on a regular basis. This is a given. And if your EQ is high enough, communication comes easy.

‘Some of the most successful finance leaders that I know are not only great with numbers, but they also know who they’re talking to, and what that person is concerned with.’

When dealing with stakeholders outside of finance, he recommends imagining what it’s like to be them. If you need to talk numbers, ask yourself what numbers are important to them.

But walking in someone’s shoes isn’t enough. To be more effective, Darrell says you should become a storyteller. ‘Don’t just slam down a bunch of numbers and say, “see”. Get to the point and describe why people should be interested to get them excited about it.’

A ‘show, don’t tell’ rule, but for business. You can’t go wrong with that.

Implementing an agile finance function to support growth

The business world is ever-changing, and being able to spot initiatives that are either working or not can give you the edge you need over your competition.

More importantly, being able to effectively communicate to the rest of the business, can maximise your impact as a leader – which is ultimately what will set you apart – and bring on better opportunities and brighter decisions.

Darren’s agile principles are a great starting point if you want to develop a more impactful finance team in your organisation. Either way, as a leader, you’ll do well to remember these tips.

Listen to the full conversation

Hear the full interview with Darrell Cox, and catch up on the latest episodes at CFOPlaybook.fm