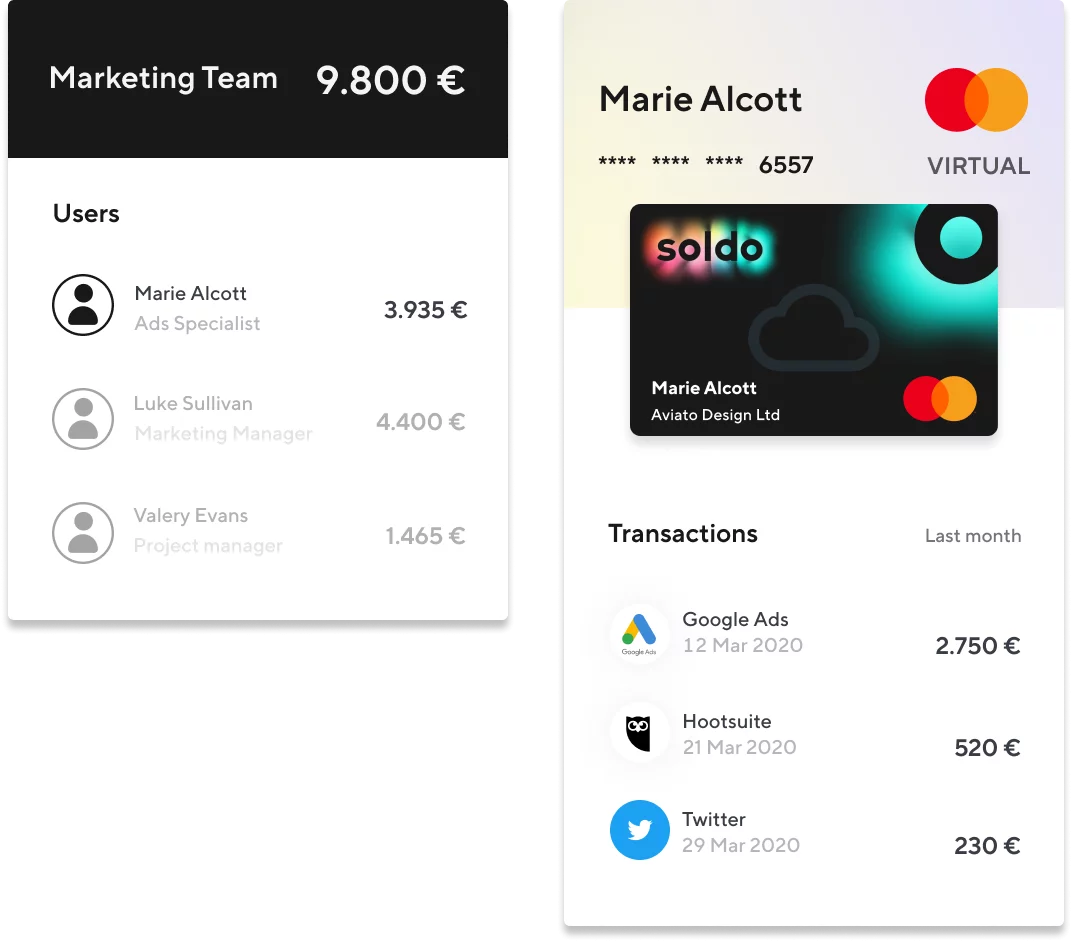

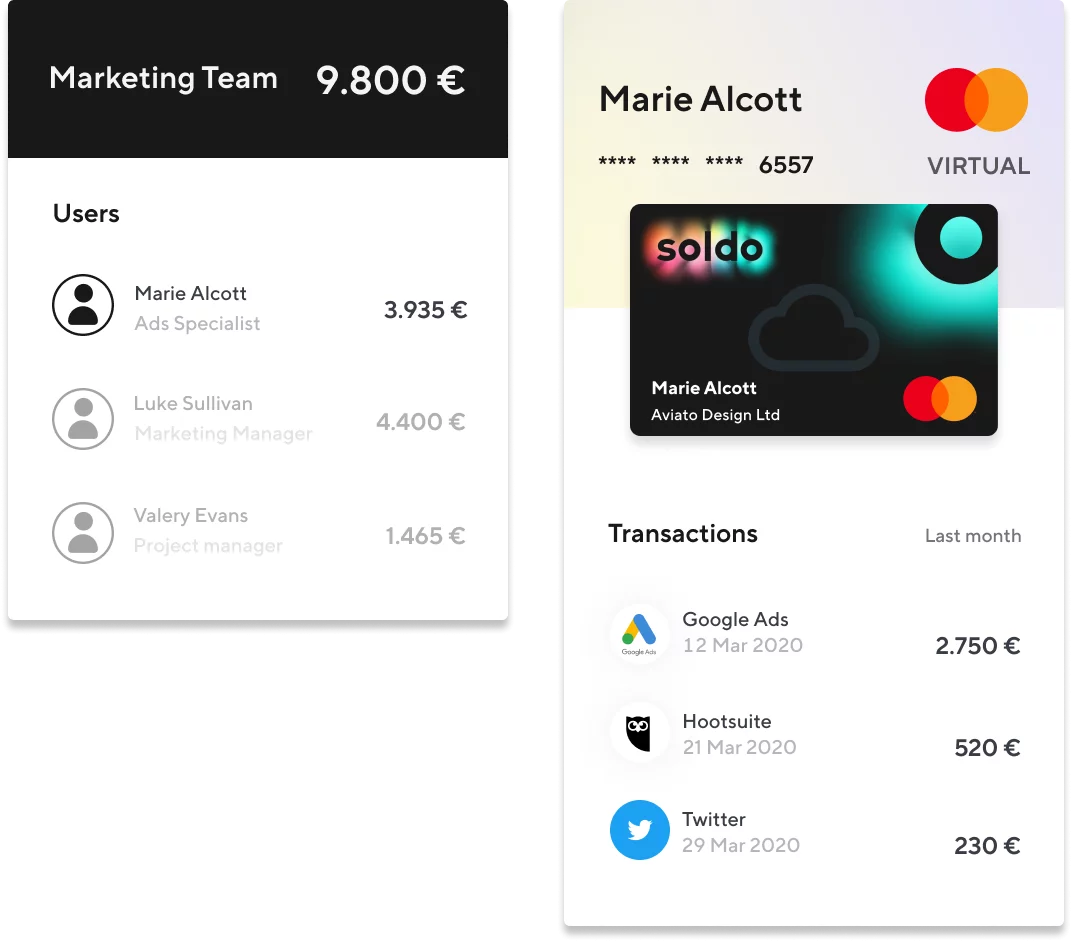

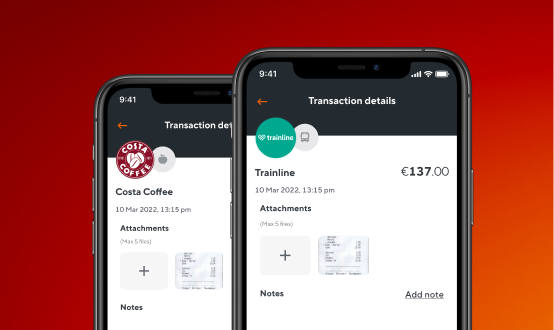

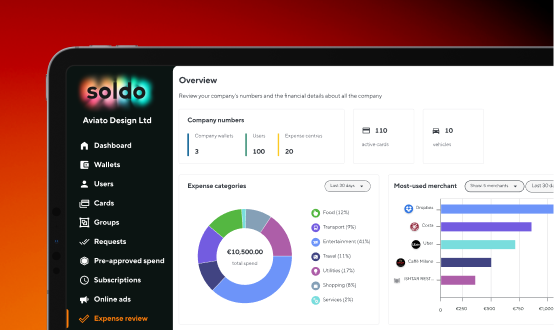

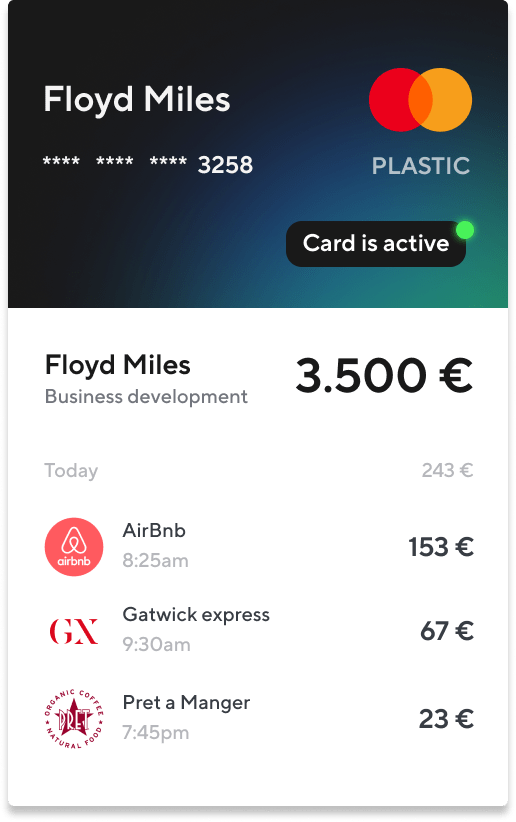

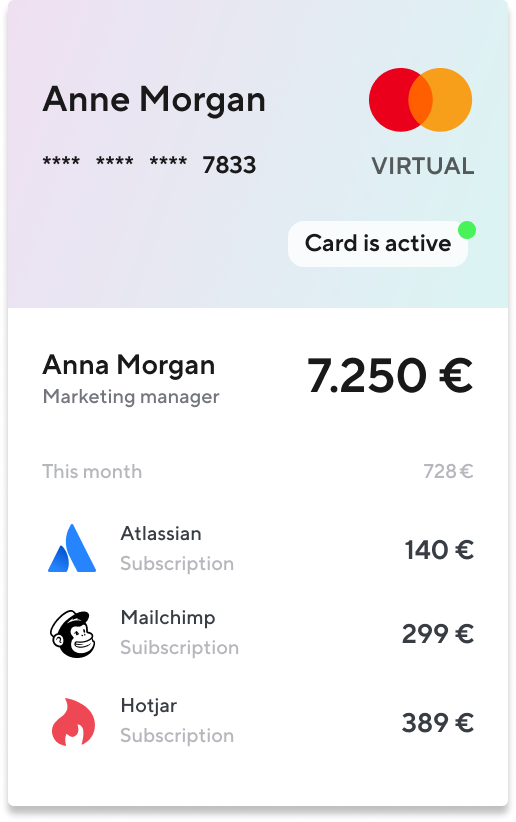

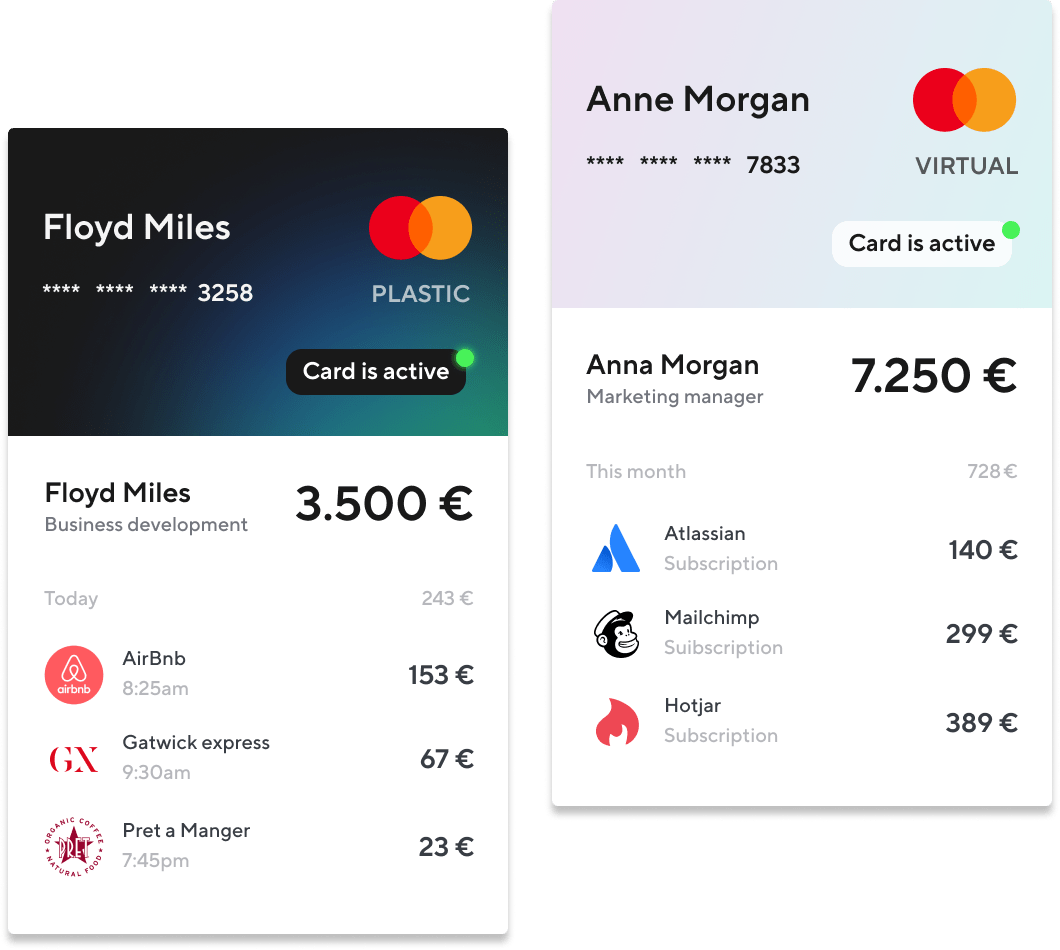

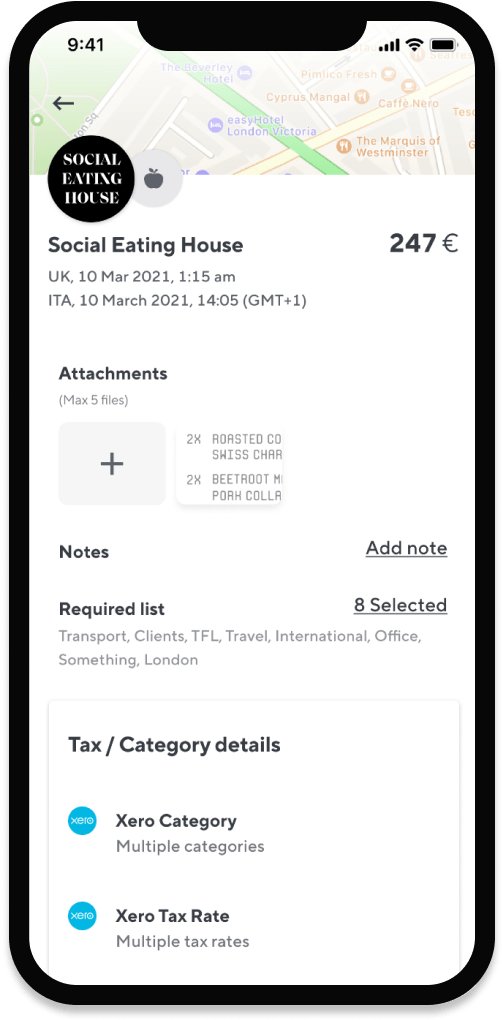

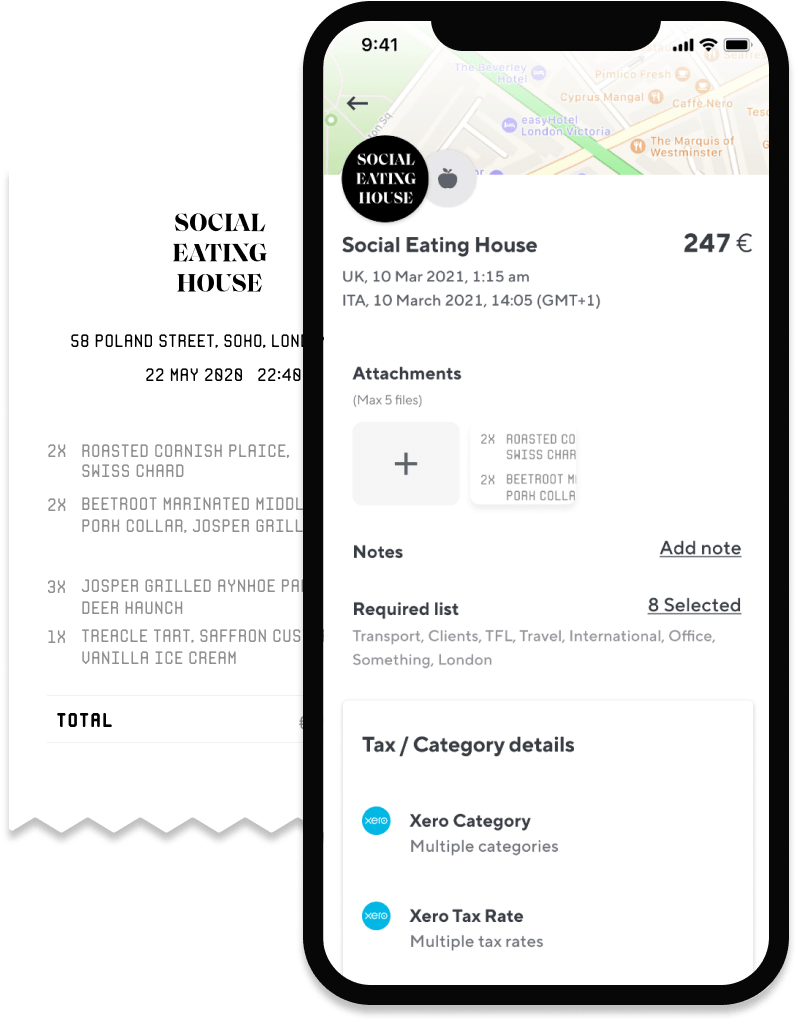

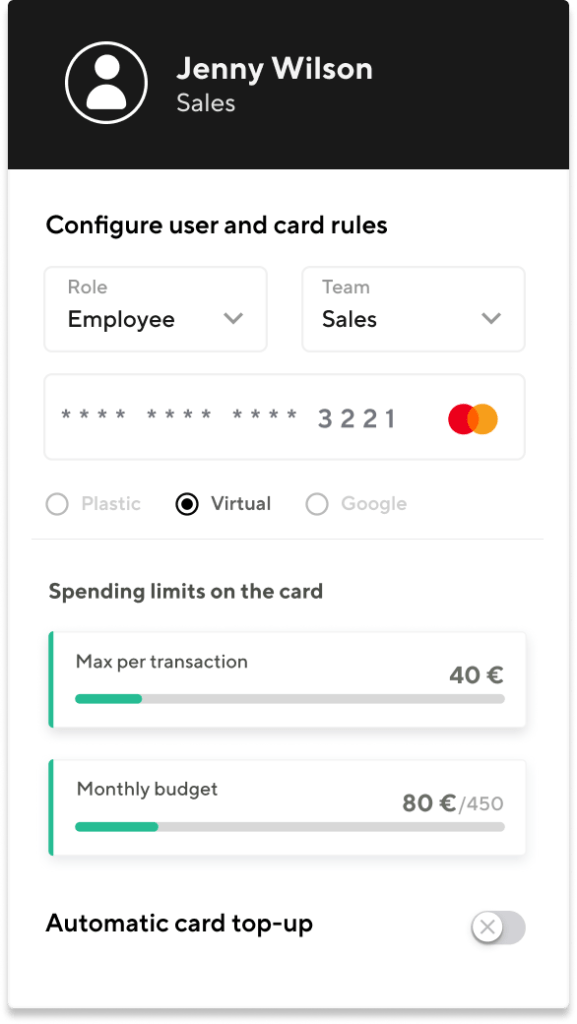

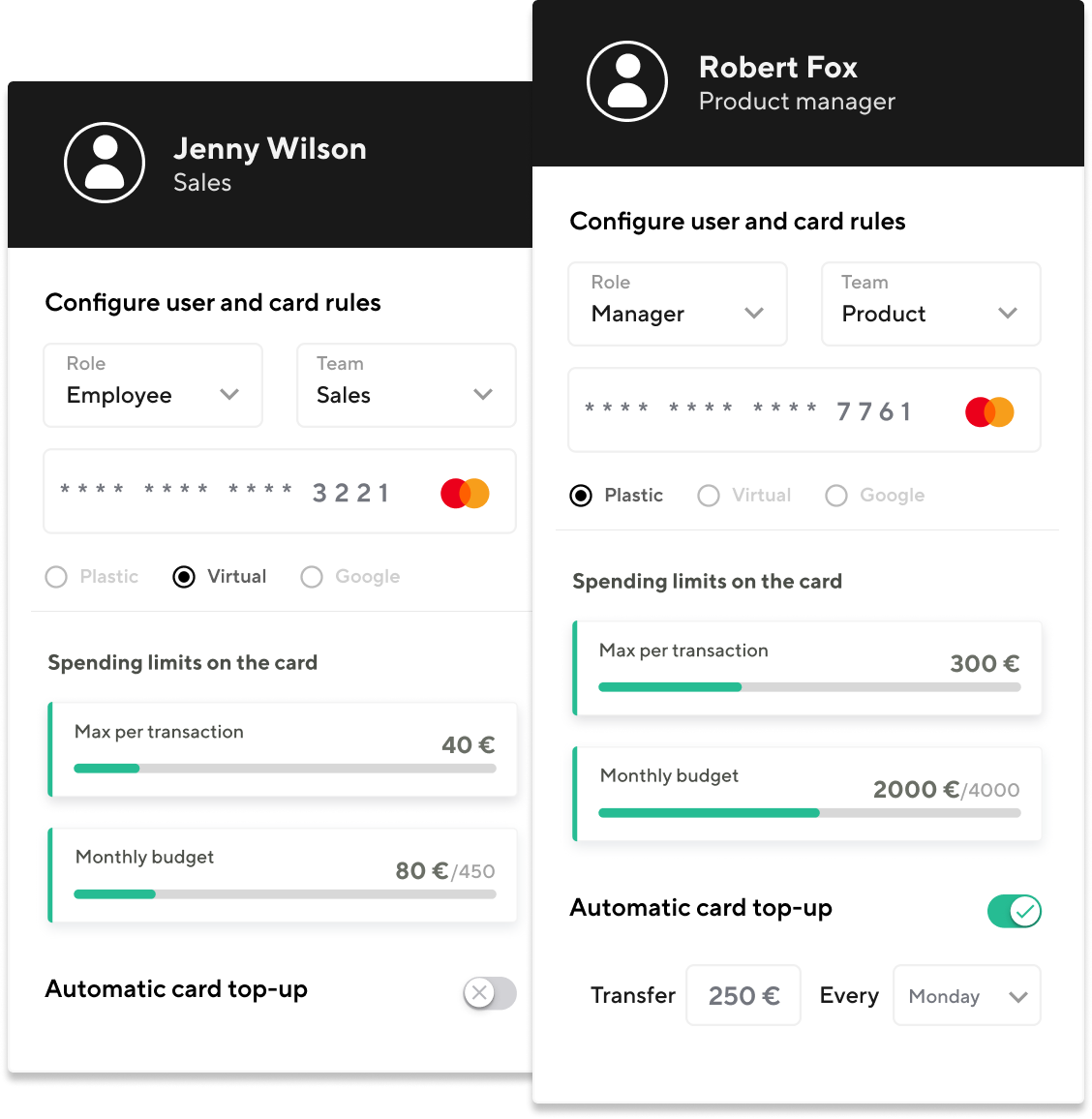

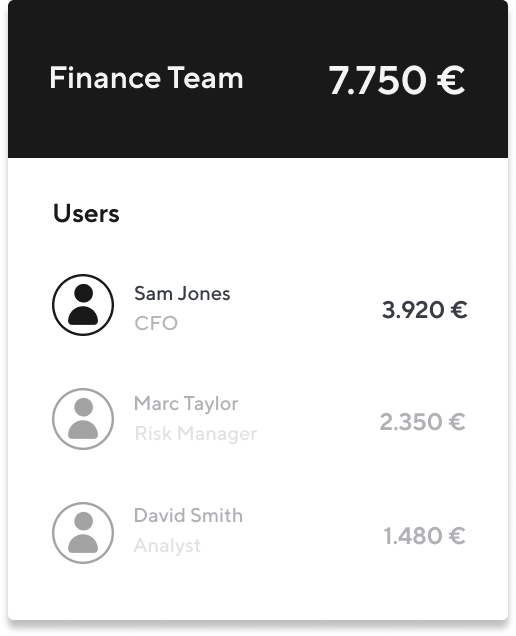

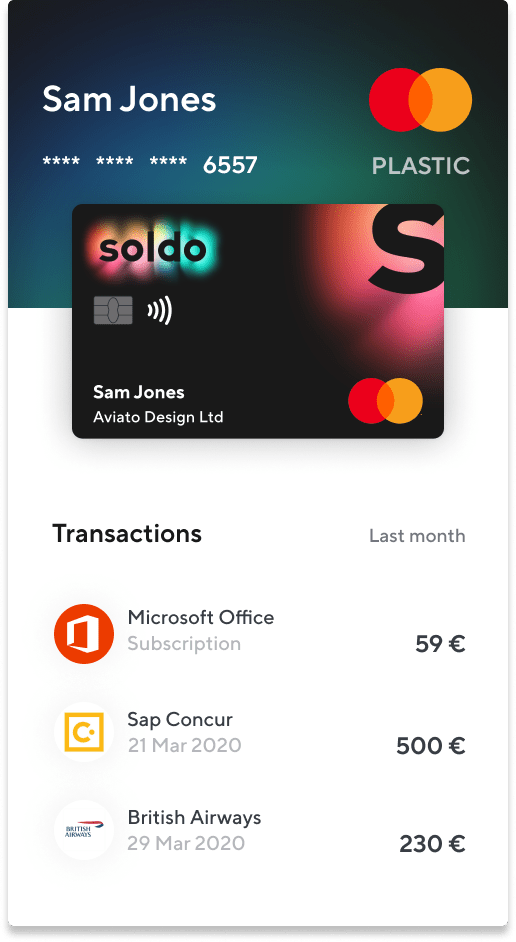

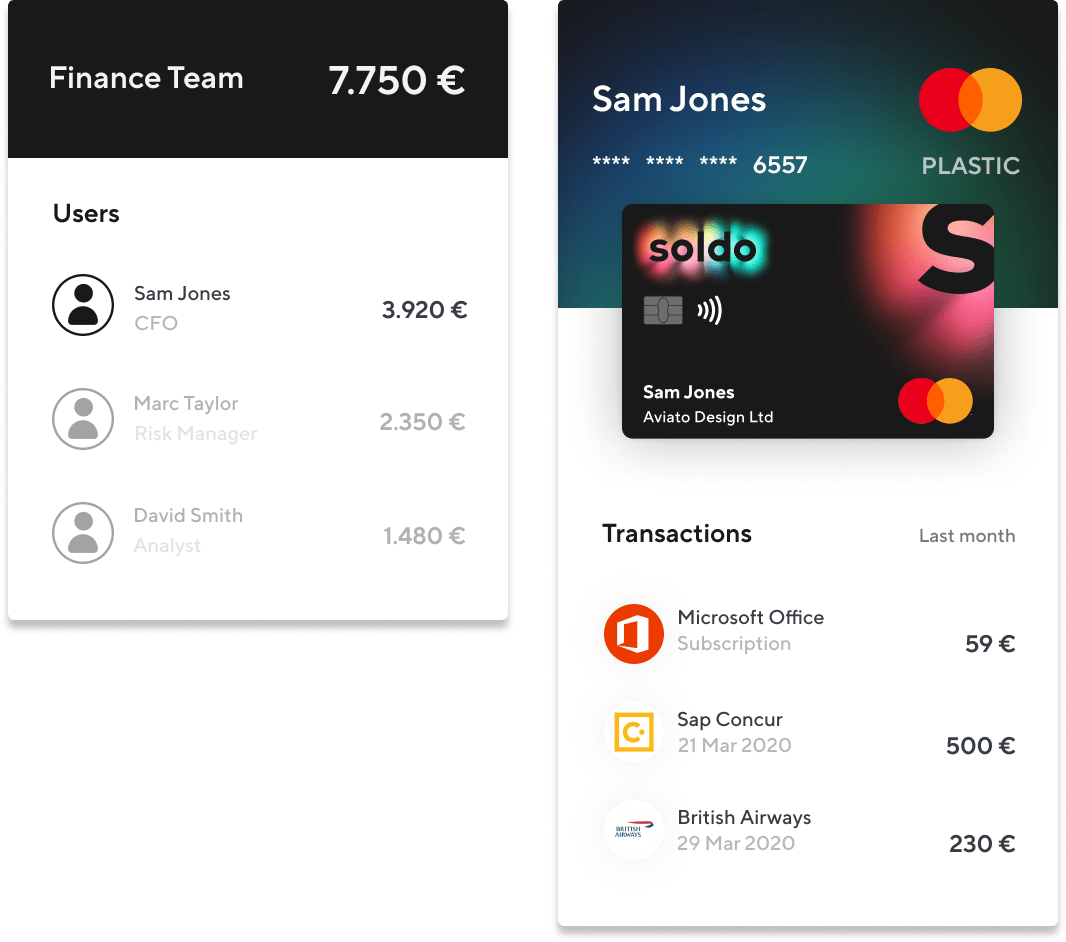

Simplify the payment process with an expense card for everyone who needs one. Use cards to pay for software subscriptions, office equipment, employee development, perks, and more. Employees will love the autonomy; you’ll love the accountability.

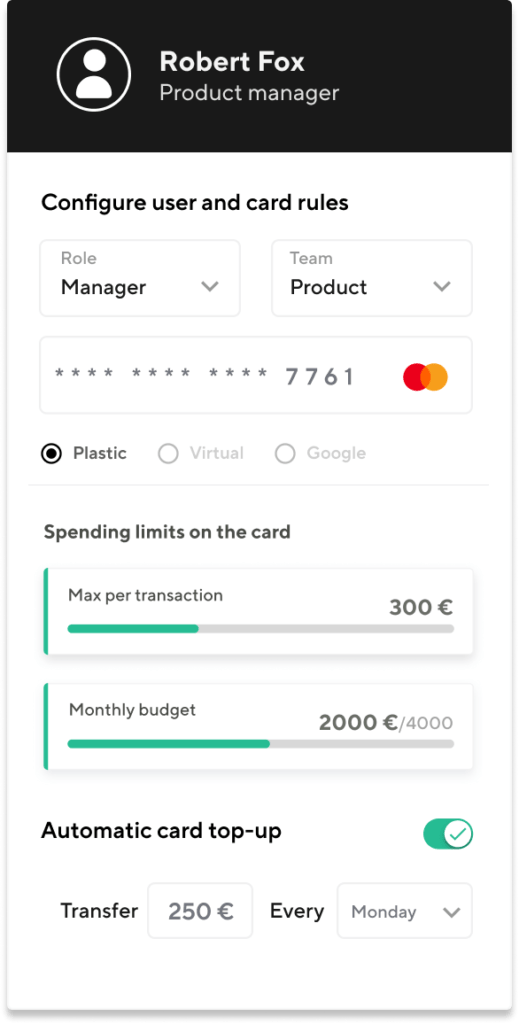

Soldo Premium: Combine brighter spending with advanced control

Get our step-up plan, designed for growing businesses. Take control and visibility to the next level with advanced tools to fit your unique requirements.